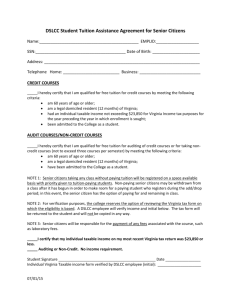

VA form 760 Instructions - Longwood University Computer Science

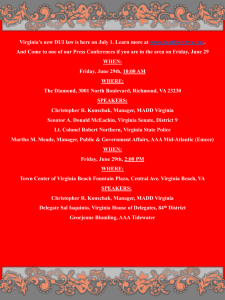

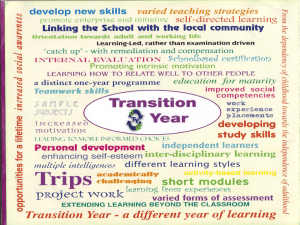

advertisement