Capital Market Stakeholders Forum Investments and Securities

advertisement

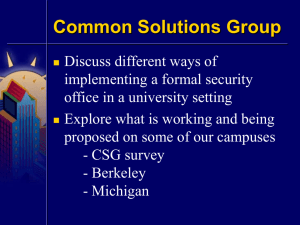

Capital Market Stakeholders Forum Investments and Securities Tribunal November 13, 2013 TEN YEARS OF SANITIZING THE CAPITAL MARKET AND BRINGING JUSTICE TO THE DOORSTEP OF THE PEOPLE By: Oscar N. Onyema, CEO Introduction I’m very pleased and honoured to be with you today to deliver the keynote speech at this important capital market stakeholders’ forum where so many representatives from the financial community with whom the Nigerian Stock Exchange (NSE) shares a common vision, for the growth and development of the Nigerian capital market are present. I would like to commend the Investment and Securities Tribunal (IST) on its ten (10) years of service to the capital market and the nation at large. The IST is an independent specialized judicial body established under Section 274 of the ISA 2007 and is vested with the responsibility of interpreting the Investment and Securities Act (ISA) 2007 and adjudicating disputes and controversies in all capital market transactions. The mission statement of the IST is to provide the efficient resolution of capital market disputes with fairness, flexibility and transparency. Where a violation is criminal in nature or has criminal elements, the Enforcement and Compliance department of the Securities and Exchange Commission (SEC) works closely with various enforcement agencies including the NSE to prosecute such criminal cases. The existence of the IST means that a member who is not satisfied with the decision of the SEC can appeal to the IST, Page 1 whose judgement thereafter is final. This helps to ensure a fair and independent process is observed when resolving capital market infractions, which is on par with developed markets. Our Role in Supporting the IST Legal Framework In this regard, the IST is a major component of the reform of the legal frame work for the capital market and pensions administration in Nigeria; with a view to evolving a more transparent, fair and secure financial sector that is responsive to the rule of law. This is a reform that is close to the heart of the NSE and over the past few years the Exchange has made great strides in its commitment to providing a world-class capital market experience, and to improving its service excellence. We have undertaken major reviews of our market and operations, and implemented innovations required to deliver a robust and efficient capital market. We have also successfully delivered on key strategic initiatives to create an African institution that competes effectively in the global market place. These initiatives are aimed at developing a more transparent, liquid and accessible market with a modern market structure to support the delivery of a wider range of investment products. More importantly, the initiatives are executed on the principles of (i) investor protection and (ii) stronger regulatory environment. Investor Protection to Strengthen the Capital Market Part XIV of the ISA 2007 requires the Nigerian Stock Exchange to establish and maintain an Investor Protection Fund (IPF). The NSE IPF provides investors a statutorily backed solution for reducing losses that might occur as a result of a major event suffered by a dealing member, or by fraud or breach of fiduciary responsibility by a dealing member. In September 2012, the Exchange inaugurated the Board of Trustees of the IPF in line with the provisions of the ISA, and has since developed rules to govern the operation and efficient management of the fund in line with global best practices. It is the intention of the Board to get the Rules approved by the SEC before the end of the year. In line with the IST’s goal to resolve outstanding investors’ claims, the Board of the IPF intends to commence payment of compensation to aggrieved investors before the end of 2013 and is currently working to ensure a clear and transparent process in settling outstanding requests. Although the IPF is setup to safeguard investors within the context of the NSE’s powers, the IST is critical to the entire enforcement process of the Nigerian capital market. In the ten (10) years that the IST has been operational, it is said to have adjudicated on about two hundred and fifty-six (256) cases with monetary claims of over three hundred and fifty (350) billion naira. Page 2 Apart from the federal government’s yearly budgetary allocations, the IST currently has no other source of funding, and has made it clear that this is inadequate and also hampers on the agency’s ability to deliver on its statutory mandate. From the point of view of the NSE, the importance of the IST cannot be disputed. It is an institution that is critical to the mission to build and retain the confidence of investors for the growth and stability of our capital market and the Nigerian economy. Stronger regulatory environment A strong regulatory environment is essential to protecting investors against infractions and enhancing investor confidence in the market. Consequently, the Exchange remains committed to developing and enforcing a strong regulatory environment. To this end, the Exchange ensures that it has clear and enforceable rules, as well as a zero tolerance policy on all infractions. In support of this initiative, the Exchange recently launched a new age trading platform called the XGEN. The new trading platform is based on a number of leading technologies, including NASDAQ OMX’s X-Stream matching engine, and the NSE’s flexible and robust X-GEN Market Database. The platform is clearly now among the most advanced in the world. X-gen directly supports a more robust regulatory and legal framework by allowing for stronger technology based surveillance and monitoring capabilities of the broker dealer community in real time. Furthermore, the system encourages less human interaction thereby reducing human error and provides for better audit trail. By implementing such initiatives, as well as engaging investors, our listed companies, market operators, the regulator, and prospective issuers who had lost faith in the capital market are now returning to the market and we are beginning to witness a sense of optimism from all market stakeholders. To illustrate this point, the NSE All Share Index (ASI) was up approximately 35% in 2012, and has returned 34% as at the end of October 2013. This highlights the fact that people are starting to see the value of investing in Nigeria and confirms that we are all moving in the right direction. To put these figures in perspective, we should take a global view, and look at other developed and emerging markets. In the same period ending October 2013, the DJIA posted a 19% gain, the NASDAQ Composite recorded a 30% increase, and the FTSE 100, a 14% bump. As it relates to regional competitors, the Nairobi Stock Exchange ASI is up an impressive 41%, the FTSE/JSE ASI returned 16%, and the EGX 100, a modest 8%. While we view our recent market performance as a sign of the return of Nigeria’s capital market’s vibrancy, we still have a relatively long road ahead of us, and investor protection and confidence are key drivers to continued market sustainability. Delivery of timely and judicious resolution to disputes is an important piece and the IST is a critical driver to this. In addition, the Exchange believes in Page 3 maintaining relationships with the various regulators in the financial ecosystem as well as developing new partnerships with other regulatory bodies, both foreign and domestic, as this will ultimately allow us to learn and share best practices for market sustainability. Accordingly, we are in great support of the work the IST has accomplished over the last decade. With a strong regulatory environment and a world-class level of service and excellence, Nigeria’s capital market will be able to compete effectively with other frontier and emerging markets around the globe. Conclusion In conclusion, while we view the IST’s progress to date as considerable and a sign of efficient management, we believe that there is still room for growth and improvement. To enable the market to sustain (and increase) the momentum it has recently experienced, the successful implementation of the IST’s long-term strategic goals must remain a priority. These goals according to Dr. Chianakwalam include; 1. Obtaining better funding for the IST 2. Ultimately improving the Nigerian capital market Thus, if we are to continue to build upon the strengths of the Nigerian capital market and ensure a truly fair and orderly market, then we must continue to do so benchmarking against the global perspective, realizing that Nigeria is a true force in the global financial marketplace. As the Nigerian capital market moves towards becoming more globally competitive, the Exchange is in full support of the IST’s goal to enhance the investor experience in Nigeria. Accordingly, the bourse is adopting the highest level of corporate governance principles, and our zero tolerance policy will remain a primary philosophy for discharging our front line regulatory responsibilities to our market. The NSE is passionate about protecting investors and as such strongly supports the mission of the tribunal. We commend the board of the IST on its drive and passion aimed at strengthening the justice delivery in the Nigerian capital market. Thank You Page 4