Income Reward – meeting your income needs

Secure Advantage+

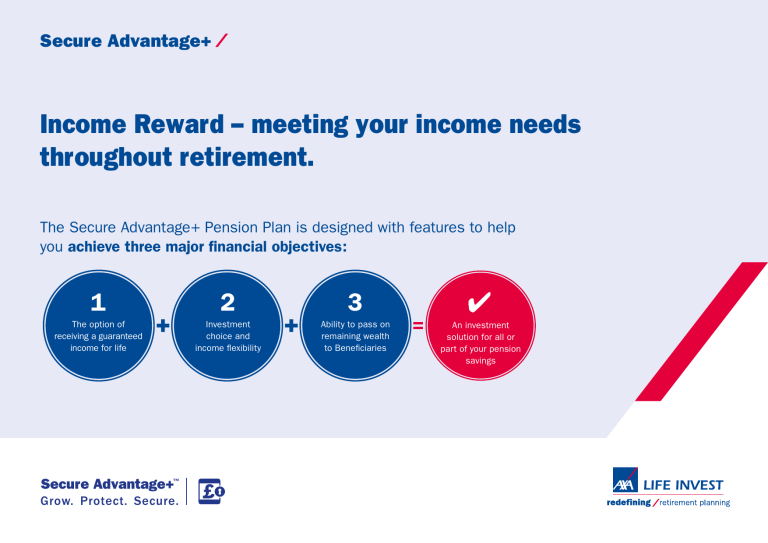

Income Reward – meeting your income needs throughout retirement.

The Secure Advantage+ Pension Plan is designed with features to help you achieve three major financial objectives:

Grow. Protect. Secure.

An AXA Life Europe product

1

Secure Advantage+

™

Grow. Protect. Secure.

An AXA Life Europe product

2

Lifetime

Investment choice and

Income income flexibility

3

Ability to pass on remaining wealth to Beneficiaries

An investment solution for all or part of your pension savings

Secure Advantage+

™

Grow. Protect. Secure.

An AXA Life Europe product

Lifetime

Income

Secure Advantage+

™

Grow. Protect. Secure.

An AXA Life Europe product

Secure Advantage+

™

Grow. Protect. Secure.

An AXA Life Europe product

Protected

Capital

Secure Advantage+

™

Grow. Protect. Secure.

An AXA Life Europe product

Protected

Capital

Income Reward – meeting your income needs throughout retirement

This example is based on a customer aged 55 who invests in the Plan on a Single Life basis and starts taking an income at age 65.

The Income Reward option is chosen. The Income Reward is added for every year income is not taken from the Plan. So, as income is delayed for 10 years, we will pay the Income Reward for the first 10 years that income is taken from the Plan.

The percentage rates shown below are a percentage of your Income Base, which is a notional amount we use to work out your Guaranteed Income Payments. It is different from the Plan Value. If you were to request any payments out of your Plan other than Guaranteed Income Payments (e.g a lump sum such as a Tax-Free Lump

Sum, any payment(s) in respect of Adviser Charges, tax charges or any Income Withdrawal(s)), we would use the Plan Value to work out the amount of the payment(s).

Any such payments from a Fund linked to a Lifetime Income Benefit would proportionately reduce the Income Base and any future Guaranteed Income Payments.

The Plan Value can be locked-in as the new Income Base on any

Plan anniversary 1

Total 6.25% of the Income Base for the first 10 years

2.5% Income

Reward each year

Income need curve

Optional additional Income/ lump sum withdrawals from funds invested outside of the

Lifetime Income Benefit 3

On death, any remaining Plan

Value can be paid to any

Beneficiary as a lump sum and/or used to provide a

Beneficiary’s

Pension.

3.75% 2 Guaranteed Income Payments each year.

55

Investment

Lock-In

Approaching retirement

Accumulating savings

65 Age

“Active” retirement higher income needs

75

“Passive” retirement reducing income needs

“Later” retirement income needs rising to cover healthcare costs

1 On a Plan anniversary, if the Fund Value is higher than both the amount invested and the previous Income Base, the growth is ‘locked-in’ and the Income Base increases. This means that future Guaranteed Income

Payments will increase too.

2 The 3.75% rate is based on starting to take income at age 65. The Guaranteed Income Rate that applies depends on your age (or if the Joint Life option is chosen, the age of the younger of you and your spouse/ civil partner) at the date you start to take income. The full list of rates is available from your financial adviser. You must be aged at least 55 to start taking income from the Plan.

3 Lump sums and Income Withdrawals can be taken at any time from the Income Start Date (minimum age 55).

Comparing the Secure Advantage+ Pension Plan with other ways of creating an income for your retirement

Conventional

Lifetime

Annuity

Choose how much income to take?

Flexibility to change your mind?

✘ ✘

Potential for investment growth?

Secure income as long as you live?

✘ ✔

Guaranteed

Death

Benefit?

✔

If a Guaranteed

Payment Period is chosen

Income

Drawdown

Secure

Advantage+

(with the optional

Lifetime Income

Benefit)

✔

✔

✔

✔

✔

✔

✘

✔

✘

✔

This table does not compare all aspects of these retirement income options. It is not meant to give advice and you should ask your financial adviser about whether this Plan, or any other retirement product, is suitable for your needs.

Important information

While a lifetime income is guaranteed from the Lifetime Income Benefit feature of this

Plan, the Plan Value is not guaranteed and it can go up and down depending on the performance of your investments. If all or part of the Plan is transferred you may get back less than you invested. We deduct a charge for providing the Plan and the

Lifetime Income Benefit, which will affect the growth potential of your Plan.

The guarantees provided under this Plan are provided only by AXA Life Invest. If we were to become insolvent, the guaranteed features of the Plan would be affected. You can read more about this in this Plan’s Key

Features Document .

What to do next

This document is intended to be an introduction to the Secure Advantage+

Pension Plan. It is not a full and complete description of the features, risks and charges associated with this Plan.

We would recommend that you speak to your financial adviser if you would like more information. They will be able to tell you more about the Plan, other retirement income options available and whether this Plan is suitable for your needs. Your adviser will also be able to give you a Personal Illustration and a copy of this Plan’s Key Features

Document , which you should read before making a decision to invest in this Plan.

The Secure Advantage+ range of plans is underwritten by AXA Life Europe Limited. AXA Life Europe Limited, trading as AXA Life Invest, is authorised by the Central Bank of Ireland, and is subject to limited regulation by the Financial Conduct Authority and Prudential Regulation Authority. Details about the extent of our regulation by the Financial Conduct Authority and Prudential Regulation Authority are available from us on request. Registered in Ireland under number 410727. Head office: 3 rd Floor, Guild House, Guild Street, IFSC, Dublin 1, Ireland. Member of the AXA Group.

15/05_UKV52_INCOME1