Syllabus

advertisement

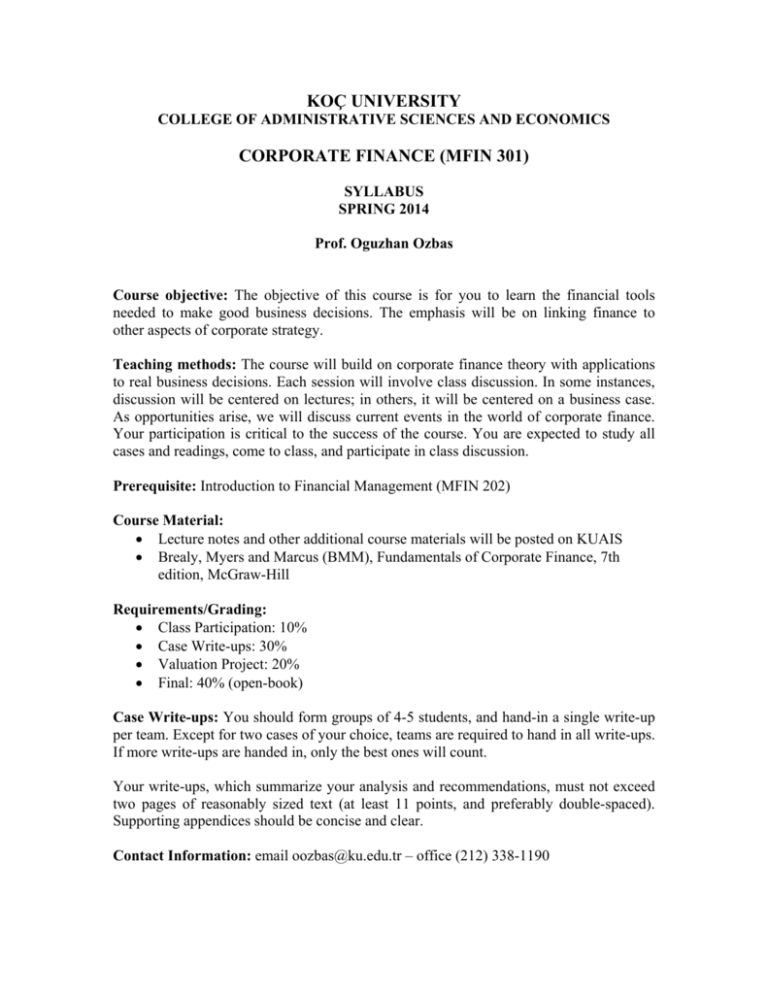

KOÇ UNIVERSITY COLLEGE OF ADMINISTRATIVE SCIENCES AND ECONOMICS CORPORATE FINANCE (MFIN 301) SYLLABUS SPRING 2014 Prof. Oguzhan Ozbas Course objective: The objective of this course is for you to learn the financial tools needed to make good business decisions. The emphasis will be on linking finance to other aspects of corporate strategy. Teaching methods: The course will build on corporate finance theory with applications to real business decisions. Each session will involve class discussion. In some instances, discussion will be centered on lectures; in others, it will be centered on a business case. As opportunities arise, we will discuss current events in the world of corporate finance. Your participation is critical to the success of the course. You are expected to study all cases and readings, come to class, and participate in class discussion. Prerequisite: Introduction to Financial Management (MFIN 202) Course Material: Lecture notes and other additional course materials will be posted on KUAIS Brealy, Myers and Marcus (BMM), Fundamentals of Corporate Finance, 7th edition, McGraw-Hill Requirements/Grading: Class Participation: 10% Case Write-ups: 30% Valuation Project: 20% Final: 40% (open-book) Case Write-ups: You should form groups of 4-5 students, and hand-in a single write-up per team. Except for two cases of your choice, teams are required to hand in all write-ups. If more write-ups are handed in, only the best ones will count. Your write-ups, which summarize your analysis and recommendations, must not exceed two pages of reasonably sized text (at least 11 points, and preferably double-spaced). Supporting appendices should be concise and clear. Contact Information: email oozbas@ku.edu.tr – office (212) 338-1190 Institute Policy regarding Academic Integrity: The following is from the Teaching Guide, Koç University College of Administrative Sciences and Economics: “Honesty and trust are important to all of us as individuals. Students and faculty adhere to the following principles of academic honesty at Koç University: Individual accountability for all individual work, written or oral: Copying from others or providing answers and information, written or oral, to others is cheating. Proper acknowledgment of original author: Copying from another student’s paper or from another text without written acknowledgment is plagiarism. Study of group project activity is effective and authorized teamwork: Unauthorized help from another person or having someone else write one’s paper or assignment is collusion. Cheating, plagiarism, and collusion are serious offenses resulting in an F grade and disciplinary action.” SCHEDULE Part I: Financing Objective: The aim of this part of the course is to develop a framework to think about how firms finance their operations and how this interacts with overall corporate strategy. Session #1 – Monday, February 3 Introduction For background, you may want to read again: o BMM, Chapter 3: “Accounting and Finance” o BMM, Chapter 4: “Measuring Corporate Performance” Session #2 – Wednesday, February 5 Case Study: Butler Lumber Company (Session I) Reading: BMM, Chapter 18: “Long-Term Financial Planning” Session #3 – Monday, February 10 Case Study: Butler Lumber Company (Session II) Session #4 – Wednesday, February 12 Case Study: Butler Lumber Company (Session III) Session #5 – Monday, February 17 Lecture: Capital Structure Session #6 – Wednesday, February 19 Lecture: Capital Structure (continued) Session #7 – Monday, February 24 Lecture: Capital Structure (continued) Session #8 – Wednesday, February 26 Case Study: UST Inc. (Session I) Session #9 – Monday, March 3 Case Study: UST Inc. (Session II) Session #10 – Wednesday, March 5 Case Study: Massey-Ferguson, 1980 (Session I) Session #11 – Monday, March 10 Case Study: Massey-Ferguson, 1980 (Session II) Wednesday, March 12 – No class Session #12 – Monday, March 17 Lecture: Capital Structure: Informational and Dynamic Considerations Session #13 – Wednesday, March 19 Lecture: Capital Structure: Informational and Dynamic Considerations (continued) Session #14 – Monday, March 24 Case Study: MCI Communications Corp., 1983 Session #15 – Wednesday, March 26 Lecture: Risk Management Reading: Froot, Scharfstein and Stein, “A Framework for Risk Management,” Harvard Business Review, 1994 PART II: Valuation and Investment Objective: The aim of this part of the course is to develop tools to evaluate real investment opportunities, such as building a new plant or acquiring another company. Session #16 – Monday, March 31 Lecture: Free Cash Flows Session #17 – Wednesday, April 2 Case Study: Sky Television versus British Satellite Broadcasting Monday, April 7 – Spring Break Wednesday, April 9 – Spring Break Session #18 – Monday, April 14 Lecture: WACC Session #19 – Wednesday, April 16 Lecture: APV Reading: Luehrman, “Using APV: A Better Tool for Valuing Operations,” Harvard Business Review, 1997 Session #20 – Monday, April 21 Case Study: Dixon Corporation: The Collinsville Plant (Session I) Wednesday, April 23 – National Sovereignty and Children’s Day Session #21 – Monday, April 28 Case Study: Dixon Corporation: The Collinsville Plant (Session II) Session #22 – Wednesday, April 30 Case Study: Dixon Corporation: The Collinsville Plant (Session III) Session #23 – Monday, May 5 Lecture: Valuing a Company Session #24 – Wednesday, May 7 Case Study: The Southland Corporation (A) Session #25 – Monday, May 12 Case Study: Radio One, Inc. Session #26 – Wednesday, May 14 Sample Final Exam VALUATION PROJECT: Friday, May 16 FINAL EXAM: University scheduled day and time