Chapter 13 Laugher Curve Some Basics about Inflation The

advertisement

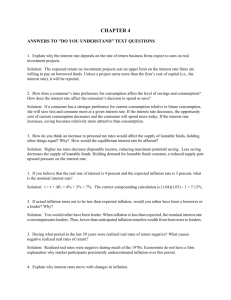

Laugher Curve Chapter 13 Part 1 Inflation Equation of exchange Economics is the only field in which two people can share a Nobel Prize for saying opposing things. Specifically, Gunnar Myrdahl and Friedrich S. Hayek shared one. Some Basics about Inflation The Distributional Effects of Inflation • Inflation is a continuous rise in the price level. • It is measured using a price index. • There are individual winners and losers in an inflation. • On average, winners and losers balance out. 1 The Distributional Effects of Inflation The Distributional Effects of Inflation • The winners are those who can raise their prices or wages and still keep their jobs or sell their goods. • Unexpected inflation redistributes income from lenders to borrowers. • The losers in an inflation are those who cannot raise their wages or prices. Expectations of Inflation • Expectations play a key role in the inflationary process. – Rational expectations are the expectations that the economists' model predicts. – Adaptive expectations are those based, in some way, on what has been in the past. – Extrapolative expectations are those that assume a trend will continue. • People who do not expect inflation and who are tied to fixed nominal contracts are likely lose in an inflation. Productivity, Inflation, and Wages • Changes in productivity and changes in wages determine whether inflation may be coming. • There will be no inflationary pressures if wages and productivity increase at the same rate. 2 Productivity, Inflation, and Wages • The basic rule of thumb: Inflation = Nominal wage increases – Productivity growth Deflation • Deflation is the opposite of inflation and is associated with a number of problems in the economy. • Deflation – a sustained fall in the price level. Deflation Theories of Inflation • Deflation places a limit on how low the Fed can push the real interest rate. • Deflation is often associated with large falls in stock and real estate prices. • The two theories of inflation are the quantity theory and the institutional theory. – The quantity theory emphasizes the connection between money and inflation. – The institutional theory emphasizes market structure and price-setting institutions and inflation. 3 The Quantity Theory of Money and Inflation • The quantity theory of money is summarized by the sentence: • Inflation is always and everywhere a monetary phenomenon. The Equation of Exchange • Equation of exchange – the quantity of money times velocity of money equals price level times the quantity of real goods sold. MV = PQ z M = Quantity of money z V = velocity of money z P = price level z Q = real output z PQ = the economy’s nominal output The Equation of Exchange Velocity Is Constant • Velocity of money – the number of times per year, on average, a dollar goes around to generate a dollar’s worth of income. • The first assumption of the quantity theory is that velocity is constant. • Its rate is determined by the economy’s institutional structure. Velocity = Nominal GDP Money supply 4 Velocity Is Constant • If velocity remains constant, the quantity theory can be used to predict how much nominal GDP will grow. • Nominal GDP will grow by the same percent as the money supply grows. Real Output Is Independent of the Money Supply • The second assumption of the quantity theory is that real output (Q) is independent of the money supply. • Q is autonomous – real output is determined by forces outside those in the quantity theory. Real Output Is Independent of the Money Supply Examples of Money's Role in Inflation • The quantity theory of money says that the price level varies in response to changes in the quantity of money. • The quantity theory lost favor in the late 1980s and early 1990s. • The formerly stable relationships between measurements of money and inflation appeared to break down. • With both V and Q unaffected by changes in M, the only thing that can change is P. %∆M ⇒ %∆P 5 • The relationship between money and inflation broke down because: – Technological changes and changing regulations in financial institutions. – Increasing global interdependence of financial markets. U.S. Price Level and Money Relative to Real Income Price level and money relative to real income (1960 = 1) Examples of Money's Role in Inflation 6 5 Price level 4 Money 3 2 1 0 1960 • The empirical evidence that supports the quantity theory of money is most convincing in Brazil and Chile. Inflation and Money Growth Annual percent change in inflation (%) Inflation and Money Growth 1965 1970 1975 1980 1985 1990 1995 2000 2005 100 90 Argentina 80 70 60 Nicaragua Poland 50 Chile 40 Zaire 30 20 Indonesia 10 U.S. 0 0 10 20 30 40 50 60 70 80 90 Annual percent change in the money supply (%) 100 6 The Inflation Tax The Inflation Tax • Central banks in nations such as Argentina and Chile are not a politically independent as in developed countries. • Their central banks sometimes increase the money supply to keep the economy running. • The increase in money supply is caused by the government deficit. • The central bank must buy the government bonds or the government will default. The Inflation Tax The Inflation Tax • Financing the deficit by expansionary monetary policy causes inflation. • The inflation works as a kind of tax on individuals, and is often called an inflation tax. • It is an implicit tax on the holders of cash and the holders of any obligations specified in nominal terms. 7 The Inflation Tax Policy Implications of the Quantity Theory • Central banks have to make a monetary policy choice: • Supporters of the quantity theory oppose an activist monetary policy. – Ignite inflation by bailing out their governments with an expansionary monetary policy. – Do nothing and risk recession or even a breakdown of the entire economy. – Monetary policy is powerful, but unpredictable in the short run. – Because of its unpredictability, monetary policy should not be used to control the level of output in an economy. Policy Implications of the Quantity Theory Policy Implications of the Quantity Theory • Quantity theorists favor a monetary policy set by rules not by discretionary monetary policy. • Many central banks use monetary regimes or feedback rules. • A monetary rule takes money supply decisions out of the hands of politicians. – New Zealand has a legally mandated monetary rule based on inflation. – The Fed does not have strict rules governing money supply, but it works hard to establish credibility that it is serious about fighting inflation. 8