Answers to Text Questions and Problems in Chapter 12

advertisement

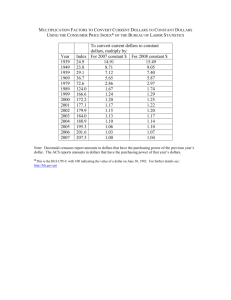

Answers to Text Questions and Problems in Chapter 12 Answers to Review Questions 1. A dollar can be traded either for 100 yen or 10 pesos, so 100 yen = 10 pesos. The yen-peso exchange rate can be expressed either as 10 yen per peso (= 100/10), or as 0.1 pesos per yen (= 10/100). 2. The nominal exchange rate is the rate at which two currencies can be traded for each other. The real exchange rate is the rate at which foreign and domestic goods can be traded for each other; more precisely, the real exchange rate is the price of the average domestic good or service relative to the price of the average foreign good or service, when prices are expressed in terms of a common currency. A formula for the real exchange rate is eP/Pf, where e is the nominal exchange rate, P is the domestic price level, and Pf is the foreign price level. As the formula shows, an increase in the nominal exchange rate e also tends to increase the real exchange rate. The real exchange rate tells us how expensive domestic goods and services are relative to foreign goods and services, and thus it is the type of exchange rate most directly relevant to a country’s ability to export. 3. Crude oil: yes, this is a standardized product with transportation costs that are low relative to its value. Fresh milk: probably not, as possible spoilage increases the cost of transporting it long distances. Taxi rides: no, not traded internationally. 4. Canadian households supply dollars to obtain foreign currencies, which they need to buy foreign goods, services, and assets. Likewise, foreigners demand dollars in exchange for their own currencies in order to buy Canadian goods, services, and assets. 5. An easing of monetary policy lowers the real interest rate, which makes domestic financial assets less attractive to financial investors. Foreigners demand less domestic currency (they don’t want to buy as many domestic assets), so the value of the exchange rate falls (depreciation). Depreciation makes domestic goods and services cheaper relative to foreign goods and services, promoting net exports. The increase in net exports raises aggregate demand, strengthening the effect of the easier monetary policy on output and employment. In general, under flexible exchange rates, changes in the exchange rate reinforce the effects of tightening or easing of monetary policy. 6. An overvalued exchange rate is a fixed exchange rate whose official value exceeds its fundamental value, as determined by supply and demand in the foreign exchange market. Ways to respond to overvaluation include devaluation, imposing restrictions on trade and capital flows, using international reserves to buy back the excess supply of domestic currency, and tightening monetary policy in order to increase the fundamental value of the exchange rate. Devaluation, or more generally, changing the value of the exchange rate whenever the fundamental value changes, amounts to having a flexible exchange rate. Imposing restrictions on trade and capital flows is bad for economic efficiency and growth. Using international reserves only works until the central bank’s reserves run out, after which the exchange rate may undergo a speculative attack. Using monetary policy to eliminate overvaluation may be the best approach, but it has the disadvantage that if monetary policy is used to support the fixed exchange rate, it is no longer available for stabilizing output and employment. Copyright © 2009 McGraw-Hill Ryerson Limited 1 7. As discussed in question 5, under a flexible exchange-rate system, the movement of the exchange rate tends to strengthen the ability of monetary policy to stabilize output. For example, a tight monetary policy raises the real interest rate and makes domestic assets more attractive to financial investors. The resulting increase in the demand for the domestic currency causes an appreciation, which makes it more difficult for domestic producers to export. The decline in net exports reinforces the negative impact of the tight monetary policy on output. In contrast, under fixed exchange rates, monetary policy must be used to keep the fundamental of the exchange rate near the official value, and thus it is no longer available to use for stabilization purposes. Fixed exchange rates are more predictable than flexible exchange rates in the short run, as flexible exchange rates vary from moment to moment with shifts in supply and demand in the foreign exchange market. However, fixed exchange rates are subject to periodic speculative attacks, which can result in a large change in their value. So in the long run, the value of an exchange rate that is currently fixed may be no more predictable than the value of a flexible exchange rate. Answers to Problems 1. From Table 12.1, 0.500 pounds equal one dollar, and 99.50 yen equal one dollar. Therefore 0.500 pounds equal 99.50 yen. Dividing both sides by 99.50, we find that 0.005025 pounds equal one yen, so the exchange rate is 0.005025 pounds/yen. Alternatively, dividing both sides by 0.500, we find an exchange rate of 199.00 yen/pound. (We can get the same result by taking the reciprocal of 0.005025.) If the pound appreciates 10% against the dollar, then 0.500 pounds buys 1.10 dollars. So the pound-dollar exchange rate is now 0.500/1.10 or 0.4545 pounds to the dollar. Setting 0.4545 pounds equal to 99.50 yen, we find the exchange rate to be 0.4545/99.50 = 0.004568 pounds/yen, or 99.50/0.4545 = 218.92 yen/pound. 2. In dollars, the British automobile costs £20,000 × $2/£ or $40,000. The price of the U.S. car relative to the British car is thus $26,000/$40,000 = 0.65; that is, the U.S. car is cheaper. From the British perspective, the value of the U.S. car in pounds is 26,000/2 = £13,000. The price of the British car relative to the U.S. car is £20,000/£13,000 = 1.538 (which, by the way, equals 1/0.65). So, either way we calculate it, we find that the British car is more expensive and the U.S. car is more competitively priced. 3. One blue was worth two reds both last year and this year, so there has been no change in the nominal exchange rate, which is 2 red/blue. The real exchange rate is eP/Pf. Treating Blueland as the home country, last year we had e = 2 red/blue, P = 100, and Pf = 100, so the real exchange rate was 2 × 100/100 = 2.0. This year we have e = 2 red/blue, P = 110, and Pf = 105, so the real exchange rate is 2 × 110/105 = 2.095. Blueland’s real exchange rate has appreciated about 4.75 percent since last year. The increase in Blueland’s real exchange rate makes its exports more expensive relative to Redland’s, which should hurt Blueland’s exports. 4a. If the nominal exchange rate is 100 yen per dollar, the price of Japanese cars in dollars is 2,500,000/100 or $25,000, and the price of Canadian cars in yen is 20,000 × 100 or 2,000,000 yen. Canadian car sales to Japan are 10,000 – 0.001(2,000,000) = 8000, and Japanese car sales to Canada are 30,000 – 0.2(25,000) = 25,000, so net exports to Japan equal 8000 – 25,000 or –17,000 cars. The real exchange rate from the perspective of Canada is the dollar price of a Canadian car divided by the dollar price of a Japanese car, or 20,000/25,000 = 0.8. b. If the yen depreciates (the dollar appreciates) to 125 yen/dollar, then the price of Japanese cars in dollars is 2,500,000/125 = $20,000, and the price of Canadian cars in yen is 20,000 × 125 = 2,500,000 yen. Canadian car sales to Japan are 10,000 – 0.001(2,500,000) = 7500, and Japanese sales to Canada are 30,000 – 0.2 × 20,000 = 26,000. So Canadian net exports to Japan have fallen to 7500 – 26,000 = –18,500 cars. The real exchange rate from the perspective of Canada is the dollar price of a Canadian car divided by the dollar price of a Japanese car, or 20,000/20,000 = 1.0. So we conclude that an increase in the Copyright © 2009 McGraw-Hill Ryerson Limited 2 Canadian real exchange rate, from 0.8 to 1.0, is associated with a decline in Canadian net exports, from – 17,000 to –18,500. 5a. Since gold should cost the same in both locations, we have $1050/ounce = 8400 pesos/ounce 1 dollar = 8 pesos So the exchange rate is 8 pesos/dollar. b. Now we have $1050/ounce = 12,600 pesos/ounce, so 1 dollar = 12 pesos, that is, the exchange rate has changed to 12 pesos/dollar. This example illustrates that the country with high inflation (Mexico) will have an exchange rate depreciation, while the country with low inflation (the U.S.) will have an exchange rate appreciation. c. From part b, based on comparing the price of gold in the U.S. and Mexico, the exchange rate is 12 pesos/dollar. If crude oil costs $70/barrel in the U.S., it should cost 70 × 12 = 840 pesos/barrel in Mexico. d. According to the law of one price: Price of gold in U.S. dollars = (U.S. dollars/Canadian dollar) × (Price of gold in Canadian dollars) $1050/ounce = 0.95 × Price of gold in Canadian dollars Price of gold in Canadian dollars = $1050/0.95 = 1105.26 Canadian dollars/ounce 6a. Canadian assets become less attractive, so the demand for dollars falls. The dollar depreciates. b. The demand for Canadian goods (software) falls, so the demand for dollars falls. The dollar depreciates. c. Financial investors switch funds from Canadian assets to East Asian assets, so they demand fewer dollars (or supply more). The dollar depreciates. d. As Canadians are dissuaded from buying imported automobiles, they supply fewer dollars to the foreign exchange market. The dollar appreciates. e. Financial investors would anticipate that the Bank of Canada will lower interest rates, making Canadian financial assets less attractive. The demand for dollars falls and the dollar depreciates. This effect may be offset to some degree by the impending recession itself, which would be expected to lower the Canadian demand for imports and hence reduce the supply of dollars, putting upward pressure on the dollar. f. The demand for foreign goods rises, so the supply of dollars rises. The dollar depreciates. 7a. Set quantities demand and supplied equal: 30,000 – 8000e = 25,000 + 12,000e 5000 = 20,000e e = 0.25 dollars/shekel b. The official value of the shekel, 0.30 dollars, exceeds the fundamental value, 0.25 dollars, so the shekel is overvalued. At 0.30 dollars/shekel, the demand for shekels is 30,000 – 8000(0.30) = 27,600, and the supply of shekels is 25,000 + 12,000(0.30) = 28,600. The balance-of-payments deficit equals shekels supplied less shekels demanded, equal to 28,600 – 27,600 = 1000 shekels. The government will have to use 1000 shekels’ worth of reserves (equal to 1000 × 0.30 = $300) each period to buy up the excess supply of shekels in the foreign exchange market. Hence the country’s international reserves will decline over time. c. If the shekel is fixed at 0.20 dollars, less than the fundamental value of 0.25 dollars, the shekel is undervalued. With an undervalued currency, the country will have a balance of payments surplus, equal to the demand for shekels minus the supply of shekels. The demand for shekels at an exchange rate of 0.20 dollars/shekel is 30,000 – 8000(0.20) = 28,400, and the supply of shekels is 25,000 + 12,000(0.20) = 27,400, so the balance of payments surplus is 28,400 – 27,400 = 1000. The country must print 1000 shekels per period and use these to acquire foreign currencies being offered on the foreign exchange market. Thus the country’s international reserves will grow over time. Copyright © 2009 McGraw-Hill Ryerson Limited 3 8a. If the real interest rate in Eastland is higher than the real interest rate in Westland, financial investors in Westland will want to buy Eastland assets, and hence will demand eastmarks. The demand equation shows that, the greater the difference between the real returns in Eastland and Westland, the higher the demand for eastmarks. Similarly, if the return in Eastland is greater than the return in Westland, financial investors in Eastland will not be eager to buy Westland’s financial assets, and thus will not supply so many eastmarks to the foreign exchange market. The supply equation implies that, the greater the difference between the real returns in Eastland and Westland, the fewer eastmarks will be supplied to the foreign exchange market. b. If the real interest rates are equal, the last term drops out of both the supply and demand equations. Setting demand equal to supply we can find the fundamental value of the eastmark: 25,000 – 5000e = 18,500 + 8000e 6500 = 13,000e e = 0.5 westmarks/eastmark c. Now rE – rW = 0.10 – 0.12 = –0.02. Setting demand equal to supply we have 25,000 – 5000e + 50,000(–0.02) = 18,500 + 8000e – 50,000(–0.02) 24,000 – 5000e = 19,500 + 8000e 4500 = 13,000e e = 0.346 westmarks/eastmark So the increase in Westland’s real interest rate has caused the fundamental value of the eastmark to decline, relative to the westmark. d. The depreciation of the eastmark makes Eastland’s goods cheaper abroad, and makes imports from Westland more expensive. So the depreciation should raise Eastland’s net exports and hence its aggregate demand. e. To restore the fundamental value of the eastmark to 0.5 westmarks/eastmark, Eastland will have to match the real interest rate increase in Westmark, setting rE = 0.12. If the difference in real interest rates is zero, then the same calculation as in part b shows that e = 0.5. However, the higher real interest rate in Eastland will depress aggregate demand and output. f. Because of the fixed exchange rate, Eastland was forced to match Westland’s monetary tightening, whether or not it was an appropriate move for Eastland’s domestic economy. This illustrates the point that maintaining a fixed exchange rate eliminates a country’s ability to use monetary policy independently to stabilize its domestic economy. 9a. The following table shows the real exchange rate. b. Year Price level for China Price level for the United States 1997 1998 1999 2000 2001 2002 2003 2004 2005 100.0 99.20 97.81 98.20 98.91 98.16 99.30 103.17 105.03 100.00 101.55 103.77 107.27 110.29 112.05 114.62 117.68 121.65 Exchange rate: U.S. dollars per yuan 0.12 0.12 0.12 0.12 0.12 0.12 0.12 0.12 0.12 Real exchange rate 0.12 0.117 0.113 0.110 0.108 0.105 0.104 0.105 0.104 China’s real exchange rate depreciated over the 1997-2005 period. Copyright © 2009 McGraw-Hill Ryerson Limited 4 c. If the 1997 real exchange rate was an equilibrium exchange rate, then the change in relative inflation rates indicates that the yuan was overvalued in 2005. d. The real depreciation in the yuan would be predicted to lead to higher net exports for China and increased official foreign exchange reserves. e. The CPI includes only consumer goods, including imports, while the GDP deflator includes all goods produced domestically. Sample Homework Assignment 1. a. b. c. Coconuts grown in Papua New Guinea are priced at 2 kina per kilogram. Comparable coconuts grown in Hawaii are priced at $2.60 per kilogram. One kina trades for 0.8 U.S. dollars in the foreign exchange market. Find the real exchange rate for a kilogram of coconuts from the perspective of the United States. Find the real exchange rate for coconuts from the perspective of Papua New Guinea. Which country’s coconuts are priced more competitively? 2. a. b. c. d. How would each of the following be likely to affect the value of currency in the country Omicron? Omicron stocks are perceived as being less risky assets. Omicron consumers increase their spending on imported goods. The central bank in Omicron reports that it is undertaking policies to prevent inflation. The government of Omicron places quotas on imported goods. 3. The demand for and supply of Somali Shillings in the foreign exchange market are given below. The nominal exchange rate is expressed as Canadian dollars per Somali Shilling. Demand: 10,000 – 2e Supply: 500 + 2e What is the fundamental value of the Somali Shilling? If the Somali Shilling is fixed at 3000, is it overvalued or undervalued? What will happen to Somali international reserves over time if it maintains the fixed exchange rate? If Somalia undergoes a speculative attack, what will happen to its international reserves? a. b. c. d. Multiple Choice Quiz 1. a. b. c. d. e. The rate at which two currencies can be traded for each other is called the nominal exchange rate. real exchange rate. nominal trade rate. real trade rate. real currency rate. 2. a. b. A decline in the value of a currency relative to other currencies is called inflation. deflation. Copyright © 2009 McGraw-Hill Ryerson Limited 5 c. d. e. disinflation. appreciation. depreciation. 3. a. b. c. d. e. The market on which currencies of various nations are traded for one another is called the currency exchange market. world money market. foreign-exchange market. flexible-exchange market. international exchange market. 4. a. b. c. d. e. The price of the average domestic good or service relative to the price of the average foreign good or service when prices are expressed in a common currency is the nominal exchange rate. real exchange rate. comparative exchange rate. relative exchange rate. price exchange rate. 5. a. b. c. d. e. Net exports will tend to be high when real exports are low. nominal exchange rates are high. real exchange rates are high. real exchange rates are low. real imports are high. 6. a. b. c. d. e. If transportation costs are relatively low, the price of an internationally traded commodity must be the same in all locations. This is a statement of purchasing power parity. the principle of constant price. the law of one price. comparative advantage. the benefits of international trade. 7. a. b. c. d. e. Which of the following will increase the supply of dollars? An increase in the preference for Canadian goods. A decrease in Canadian real GDP. A decrease in the real interest rate on Japanese assets. An increase in Canadian real GDP. An increase in the real interest rate on Mexican assets. 8. a. b. c. d. e. Which of the following will not increase the demand for dollars? An increase in the preference for Canadian goods. An increase in real GDP abroad. An increase in the real interest rate on Canadian assets. A decrease in Canadian GDP. A decrease in the real interest rate on foreign assets. 9. A reduction in the official value of a currency is called Copyright © 2009 McGraw-Hill Ryerson Limited 6 a. b. c. d. e. appreciation. depreciation. devaluation. revaluation. deflation. 10. a. b. c. d. e. A massive selling of domestic-currency assets by financial investors is called a(n) overvaluation. market correction. speculative attack. devaluation. depreciation. Problems/Short Answer 1. a. b. c. 2. a. b. c. Wheat grown in New Zealand is priced at 17 New Zealand dollars (NZ$) per bushel. Comparable wheat grown in Canada is priced at $8.60 per bushel. One New Zealand dollar trades for 6.8 Canadian dollars in the foreign exchange market. Find the real exchange rate for a bushel of wheat from the perspective of Canada. Find the real exchange rate for a bushel of wheat from the perspective of New Zealand. Which country’s wheat is priced more competitively? The demand for and supply of Thai baht in the foreign exchange market are given below. The nominal exchange rate is expressed as Canadian dollars per Thai baht. Demand: 1000 – 12e Supply: 50 + 14e What is the fundamental value of the Thai baht? If the Thai baht is fixed at 30, is it overvalued or undervalued? What will happen to Thai international reserves over time if it maintains the fixed exchange rate? Answer Key to Extra Questions in Instructor’s Manual Sample Homework Assignment 1a. (0.8)(2.60)/2 = 1.04. b. (1/0.8)(2)/2.6 = 0.96. c. Papua New Guinea’s. 2a. b. c. d. Increase. Decrease. Increase. Increase. 3a. b. c. d. 2375. Overvalued. Somali reserves will decline. To maintain the fixed exchange rate, the central bank will have to spend more international reserves. Multiple Choice Copyright © 2009 McGraw-Hill Ryerson Limited 7 1. 2. 3. 4. 5. 6. 7. 8. 9. 10. a e c b d c d d c c Problems/Short Answer 1a. (6.8)(8.6)/17 = 3.44. b. (1/6.8)(17)/8.6 = 0.30. c. New Zealand’s. 2a. 36.54. b. Undervalued. c. Thai reserves will increase. Copyright © 2009 McGraw-Hill Ryerson Limited 8