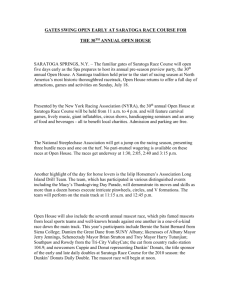

Economic Analysis of the Saratoga Race Course

advertisement