MARKETBEAT

OFFICE SNAPSHOT

DALLAS-FORT WORTH, TX

Q1 2015

A Cushman & Wakefield Research Publication

ECONOMIC OVERVIEW

The Texas economy continues to grow, but

some metros are beginning to experience a

deceleration, especially those where energyrelated jobs make up a large percentage of

employment. The Texas Workforce

Commission reported in March that the Dallas-Fort Worth (DFW)

labor market grew 3.6% by adding 115,800 nonagricultural jobs over

the last 12 months (317 net jobs per day). First quarter job growth

was mixed with the largest gains in the leisure & hospitality, trade,

transportation & utilities, and information sectors. The largest

decrease occurred in the construction & mining sector, falling 4.7%,

followed by professional & business services. The DFW labor market

is slowly tightening with unemployment at 4.0%, the lowest level since

April 2008 and well below the U.S. rate of 5.5%.

OUTLOOK

Overall market fundamentals continue to remain strong in DFW. The

metro area has enjoyed healthy growth for several years, however

uncertainty surrounding the price of crude oil and long-term interest

rates are creating some headwind. Depressed crude oil prices are not

expected to significantly impact the area’s real estate market at this

point, as the local economy is diversified enough to weather any

short-term shocks. However, companies that support those in the

energy industry, especially small and mid-sized firms, face an unknown

future, and that is beginning to affect leasing activity within those

sectors.

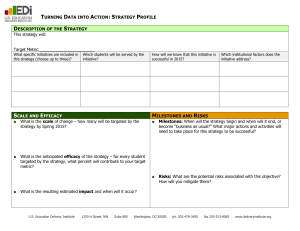

STATS ON THE GO

Q1 2015

Y-O-Y

CHANGE

17.8%

16.6%

-1.2pp

$20.73

$21.50

3.7%

3,998,424

2,877,634

-28.0%

Overall Vacancy

Net absorption remained relatively strong throughout Q1 as tenants

occupied spaces leased in late 2014. Direct net absorption reached

nearly 1.2 million square feet (msf), comparable to Q1’14 totals.

Major tenants occupying space included State Farm, Nationstar

Mortgage, SoftLayer, Richards Group, and Hilti.

Leasing activity dropped 28% to 2.9 msf compared to this period last

year with class A transactions accounting for 45% of the total

compared to 54% in 2014. Major leases signed included GE Capital,

NEC Corp, CEC Entertainment (Chuck E. Cheese), Huckabee, Top

Golf, and Travelocity.

Direct Asking Rents (psf/yr)

YTD Leasing Activity (sf)

$22.00

25.0%

$21.50

20.0%

$21.00

15.0%

$20.50

10.0%

$20.00

5.0%

$19.50

Full-service asking rental rates across all classes were $21.64 per

square foot (psf), an increase of 4.5% from Q1 2014. Class A asking

rents were at an all-time high of $26.63 psf, rising 4.9% over the last

year.

Available sublease space grew to 1.4 msf with Wingspan,

CompuCom, and Carlson subleasing nearly 0.5msf. Construction

completions totaled 831,000 sf with State Farm’s first office tower at

CityLine accounting for over half of that total. An additional 8.8 msf is

currently under construction, 43% of which is pre-leased.

$19.00

0.0%

2010

2011

2012

DIRECT GROSS RENTAL RATE

2013

2014

OVERALL OCCUPIER ACTIVITY

20.0

15.0

For more information, contact:

Ryan Tharp, Director of Research

+(1) 972 663 9649

ryan.tharp@cushwake.com

15.0

3.0

15.9

3.5

13.9

5.0

2.9

0.6

-5.0

12.3

1.6

0.0

13.0

5.0

2011

2012

2013

2014

Q1 15

-0.4

msf

Over 4.3 msf of investment office properties traded hands with a

total value of over $635 million in Q1. Two of the most prominent

transactions were the sale of the Allstate Insurance building to Select

Income REIT for $104.4 million ($236 psf) and Park Place on Turtle

Creek to Piedmont for $46.6 million ($256 psf).

Q1 15

DIRECT VACANCY RATE

10.0

INVESTOR FOCUS

12 MONTH

FORECAST

DIRECT RENTAL VS. VACANCY RATES

psf/yr

OCCUPIER FOCUS

Cushman & Wakefield of Texas, Inc.

2101 Cedar Springs Road, Suite 900

Dallas, TX 75201

www.cushmanwakefield.com/knowledge

Q1 2014

2010

LEASING ACTIVITY

ABSORPTION

The market terms and definitions in this report are based on NAIOP standards. No

warranty or representation, express or implied, is made to the accuracy or completeness

of the information contained herein, and same is submitted subject to errors, omissions,

change of price, rental or other conditions, withdrawal without notice, and to any special

listing conditions imposed by our principals.

© 2015 Cushman & Wakefield, Inc. All rights reserved.

1

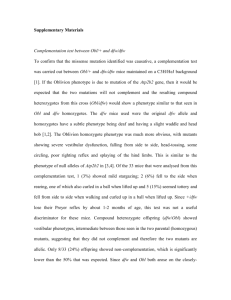

DALLAS-FORT WORTH, TX

SUBMARKET

INVENTORY

OVERALL

VACANCY

RATE

DIRECT

VACANCY

RATE

YTD LEASING

ACTIVITY

UNDER

CONSTRUCTION

YTD

CONSTRUCTION

COMPLETIONS

YTD DIRECT

NET ABSORPTION

YTD OVERALL

NET ABSORPTION

OVERALL WTD. AVG

ALL CLASSES GROSS

RENTAL RATE*

DALLAS CBD

26,651,220

21.8%

21.6%

281,248

454,500

0

258,337

258,337

$22.51

DIRECT WTD.

AVG.

CLASS A GROSS

RENTAL RATE*

$25.33

North Central

12,012,020

21.6%

19.6%

169,359

0

208,383

6,952

-231,629

$22.96

$ 26.49

Preston Center

3,425,870

9.6%

9.2%

27,094

190,000

0

(21,844)

(21,844)

$34.61

$37.65

Uptown/Turtle

Creek

10,369,899

12.9%

12.2%

116,013

802,000

0

(19,761)

(69,143)

$31.00

$34.31

9,575,400

22.8%

22.3%

87,305

0

0

26,832

26,832

$14.62

$19.91

556,534

6.1%

6.1%

11,974

0

0

9,285

9,285

$14.53

N/A

18,180,082

23.3%

23.2%

319,067

0

0

21,244

24,975

$18.41

$ 24.76

3,084,526

30.7%

30.6%

34,617

0

0

(25,888)

(25,888)

$14.88

$ 16.96

Las Colinas

29,032,439

15.6%

15.3%

574,248

631,220

164,784

297,666

297,666

$22.20

$ 25.20

Far North Dallas

17,614,529

14.8%

14.3%

206,908

0

0

(40,052)

(75,408)

$21.44

$ 27.46

Far North Central

17,523,342

13.7%

13.4%

580,408

2,219,084

458,000

465,889

453,310

$20.04

$ 23.49

Mid Cities

7,862,479

19.8%

18.4%

112,580

0

0

-825

(48,407)

$20.90

$ 28.50

Arlington

6,026,417

13.8%

12.5%

82,943

0

0

7,993

5,288

$17.52

$ 20.82

Far North

Stemmons

3,788,818

6.6%

6.6%

18,947

230,964

0

(18,586)

(18,586)

$16.15

$ 20.80

490,374

19.2%

19.2%

5,512

0

0

1,499

1,499

$14.94

$ 21.70

1,207,051

8.4%

8.4%

7,187

0

0

600

600

$17.83

$ 34.30

16,845,743

15.9%

12.5%

63,817

3,952,041

0

91,646

(121,624)

$28.46

$ 32.67

DALLAS SUBURBS

157,595,523

16.9%

16.1%

2,417,979

8,025,309

831,167

802,650

206,926

$21.29

$26.76

DALLAS TOTAL

184,246,743

17.6%

16.9%

2,699,227

8,479,809

831,167

1,060,987

465,263

$21.51

$26.44

11,658,902

10.1%

10.1%

135,475

0

0

90,615

90,615

$27.43

$29.66

East Fort Worth

2,291,748

6.1%

6.1%

11,393

0

0

(12,770)

(12,770)

$15.20

N/A

North Fort Worth

3,854,046

15.3%

15.3%

10,000

357,214

0

46,407

46,407

$19.88

$ 24.81

South Fort Worth

2,834,151

2.0%

2.0%

10,396

0

0

0

0

$19.00

N/A

West Fort Worth

2,939,731

4.3%

4.3%

11,143

0

0

289

289

$21.50

$ 24.90

FW SUBURBS

11,919,676

7.6%

7.6%

42,932

357,214

0

33,926

33,926

$19.34

$24.38

FORT WORTH

TOTAL

DFW TOTAL

23,578,578

8.9%

8.9%

178,407

357,214

0

124,541

124,541

$23.74

$28.70

207,825,321

16.6%

16.0%

2,877,634

8,837,023

831,167

1,185,528

589,804

$21.64

$26.65

Stemmons Freeway

Oak Cliff

LBJ Freeway

Northeast Dallas

Southwest Dallas

East I-30 Corridor

Legacy Frisco

FW CBD

* RENTAL RATES REFLECT ASKING $PSF/YEAR

Cushman & Wakefield of Texas, Inc.

2101 Cedar Springs Road, Suite 900

Dallas, TX 75201

www.cushmanwakefield.com/knowledge

For more information, contact:

Ryan Tharp, Director of Research

+(1) 972 663 9649

ryan.tharp@cushwake.com

The market terms and definitions in this report are based on NAIOP standards. No

warranty or representation, express or implied, is made to the accuracy or completeness

of the information contained herein, and same is submitted subject to errors, omissions,

change of price, rental or other conditions, withdrawal without notice, and to any special

listing conditions imposed by our principals.

© 2015 Cushman & Wakefield, Inc. All rights reserved.

2

MARKET HIGHLIGHTS

SIGNIFICANT 2015 LEASE TRANSACTIONS

SUBMARKET

TENANT

BUILDING CLASS

Riverside Commons

Las Colinas/DFW

Freeport

GE Capital

A

148,270

Royal Ridge Center V

Las Colinas/DFW

Freeport

NEC Corporation of America

B

119,610

Granite Tower

LBJ Freeway

CenseoHealth

A

65,516

Westway One

Las Colinas/DFW

Freeport

CEC Entertainment (Chuck E.

Cheese)

B

55,260

Burnett Plaza

Fort Worth CBD

Huckabee

A

44,580

Richardson Office Center

Farn North Central

Avnet

B

36,560

Northpark Central

North Central

Expressway

Top Golf

A

36,220

Comerica Bank Tower

Dallas CBD

Bickel & Brewer

A

35,580

SIGNIFICANT 2015 SALE TRANSACTIONS

SUBMARKET

BUYER

PURCHASE PRICE / $PSF

Allstate Insurance Building

Las Colinas/DFW

Freeport

Select Income REIT

$104,435,200/$236

443,450

Park Place on Turtle Creek

Turtle Creek/ Uptown

Piedmont

$46,600,000/$256

182,000

3131 McKinney

Turtle Creek/ Uptown

Invesco

$39,000,000/$257

151,740

Citymark

Turtle Creek/ Uptown

Bradford

$38,900,000/$169

229,800

6000 Connection Drive

Las Colinas/DFW

Freeport

Gramercy

$36,419,245/$125

292,500

3900 North Dallas Parkway

Legacy/Frisco

Cinemark Holdings

$26,200,000/$217

120,750

Richardson Commons – Building 1

Far North Central

Gladstone

$24,700,000/$160

154,380

The Offices at Valley Ranch

Las Colinas/DFW

Freeport

Select Income REIT

$22,657,080/$239

95,000

Willow Bend Center

Legacy/Frisco

CFT Developments

$20,750,000/$169

123,000

SIGNIFICANT 2015 CONSTRUCTION

COMPLETIONS

CityLine 3

SUBMARKET

MAJOR TENANT

COMPLETION DATE

Far North Central

State Farm

Q1 2015

458,000/100%

2801 North Central Expressway

Turtle Creek/ Uptown

Richards Group

Q1 2015

250,000/100%

8840 Cypress Waters Boulevard

Las Colinas/DFW

Freeport

Speculative

Q1 2015

165,000/25%

The Shops at Park Lane

North Central

Speculative

Q1 2015

122,000/0%

Preston Hollow Village

Legacy/Frisco

Conifer Health Solutions

Q1 2015

65,800/24%

SIGNIFICANT PROJECTS UNDER

CONSTRUCTION

Toyota Motor Corp.

SUBMARKET

MAJOR TENANT

COMPLETION DATE

Legacy/Frisco

Toyota

Q4 2016

1,787,000/100%

State Farm Build-to-Suit (3 buildings)

Far North Central

State Farm

Q2 2015

1,628,000/100%

McKinney @ Olive

Turtle Creek/Uptown

Gardere Wynne Sewell

Q3 2016

530,000/46%

Raytheon Build-to-Suit

Far North Central

Raytheon

Q4 2015

489,000/100%

KPMG Plaza at Hall Arts

Dallas CBD

KPMG

Q2 2015

454,500/59%

3200 Hackberry (Cypress Waters)

Las Colinas/DFW

Freeport

7-Eleven

Q4 2015

325,000/100%

Granite Park V

Legacy/Frisco

Speculative

Q4 2015

306,200/17%

Cushman & Wakefield of Texas, Inc.

2101 Cedar Springs Road, Suite 900

Dallas, TX 75201

www.cushmanwakefield.com/knowledge

For more information, contact:

Ryan Tharp, Director of Research

+(1) 972 663 9649

ryan.tharp@cushwake.com

SQUARE FEET

SQUARE FEET

BUILDING SQUARE FEET

(% LEASED)

BUILDING SQUARE FEET

(% LEASED)

The market terms and definitions in this report are based on NAIOP standards. No

warranty or representation, express or implied, is made to the accuracy or completeness

of the information contained herein, and same is submitted subject to errors, omissions,

change of price, rental or other conditions, withdrawal without notice, and to any special

listing conditions imposed by our principals.

© 2015 Cushman & Wakefield, Inc. All rights reserved.

3