Interstate Taxation and the Commerce Clause

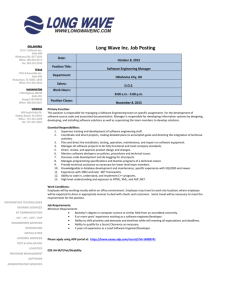

advertisement

Interstate Taxation and the Commerce Clause The issue: What limitations does the Commerce Clause (and, to a lesser extent, the Due Process Clause) place on how states can tax interstate businesses? Introduction Cases It is always poular tax strategy to shift the tax-burden as much as possible to out-ofstate residents and corporations. Legislators would much prefer to tax non-voters than voters. Unsuprisingly, however, the Constitution imposes limitations on the ability of states to shift tax burdens to out-ofstate corporations. Quill Corp. v North Dakota (1992) Commonwealth Edison v Montana (1981) Oklahoma Tax Comm'n v Jefferson Lines (1995) Since the 1977 case of Complete Auto Transit v Brady, the Court has used a four-part test to evaluate the constitutionality of taxes burdening out-of-state interests (see test in left column). THE FOUR-PRONG TEST OF COMPLETE AUTO TRANSIT v BRADY (1977): 1. Does the activity taxed have a In Commonwealth Edison v Montana (1981), substantial nexus with the taxing the Court considered the constitutionality of a 30% severence tax that Montana--America's state? "Saudi Arabia" of low sulfur coal--imposed on removed coal. Most of the coal came from 2. Is the tax fairly apportioned? federally owned land. About 90% of the coal 3. Does the tax discriminate against was for shipment out of state. The Court's interstate commerce? primary focus was on the fourth prong of the Complete Auto Transit test, requiring that the 4. Is the tax fairly related to state show the tax is "fairly related" to services the state provides the services the state provides the taxpayer. The taxpayer? Court, noting certain state benefits received by Commonwealth Edison, found the test met. Three dissenters argued that the Commerce Clause was violated whenever Questions states asked interstate commerce to bear more than their fair share of the tax burden-1. What taxing strategies might a state adopt for which this tax, they believed, did. an out-of-state corporation's assets that are in the state only temporarily--for example, airplanes In Quill Corporation v North Dakota (1992), the Court looked at a North Dakota "use" tax that fly into a state twice a day or an out-of-state applied to sales by out-of-state corporations professional sports team that may play a few games in the state? What prong of the (primarily catalog companies such as L. L. Complete Auto Transit test would be most Bean and Land's End) to North Dakota important to analysis of these questions? residents. Quill Corporation raised several 2. Does the Commonwealth Edison case give a constitutional objections to the tax. Although the Court found Quill's mailing catalogs into a state was sufficient to satisfy the "minimum contacts" test for due process purposes, it was NOT sufficient to satisfy the "substantial nexus" requirement of Complete Auto Transit. The Court noted that Quill had no physical presence in North Dakota--no salespersons, no outlets, no warehouse, no office. In dissent, Justice White argued that it was silly to make a state's ability to tax depend upon whether or not a corporation has one travelling salesperson in the state, but the majority saw advantages in a bright line "physical presence" test. greenlight to state severence taxes, no matter what the rate might be? Could Montana have imposes a 60% severence tax? What if a state had a monopoly on a critical resource? 3. What would be an example of a tax that unconstitutionally discriminates against out-ofstate corporations? Consider Boston Stock Exchange v State Tax Comm'n (1977), in which the Supreme Court struck down a New York law that imposes a tax on the delivery of corporate shares that varied in rate depending upon whether or not the shares were bought on a New York stock exchange ( the rate was twice as high for stocks bought on non-New York exchanges). 4. What business incentives are created by the Quill holding that a use tax cannot be imposed on sales to residents by an out-of-state Oklahoma Tax Comm'n v Jefferson Lines corporation lacking a physical presence in the (1995) focused on the "fair apportionment" taxing state? prong of the Complete Auto Transit 5. Is Congress free after Quill to authorize state test. Oklahoma imposed a sales tax on Jefferson Lines for the full cost of every bus use taxes? Is it likely to do so? What ticket sold in Oklahoma, regardless of where constitutional limitations, if any, would apply to state laws taxing internet sales from out-of-states the trip ticketed started or ended. Jefferson corporations? Lines argued that the Commerce Clause 6. Who has the better argument in Oklahoma prohibited Oklahoma from imposing a sales tax on that portion of the ticket reflecting the Tax Comm'n v Jefferson, the majority or the dissent? Why? Could a state impose a tax on cost of miles travelled outside of Oklahoma. The Court disagreed, viewing that travel by bus within that state, even when the ticket was purchased (and fully taxed) out-ofsale of the ticket as "a discrete event state? facilitated at the point of sale." In dissent, Justices Breyer and O'Connor argued that Oklahoma must apportion its tax to the percentage of miles of the trip on Oklahoma roads.