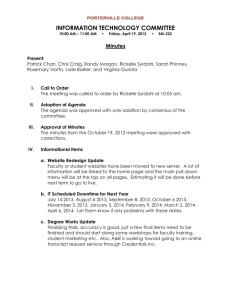

Cash Flow from Assets

advertisement

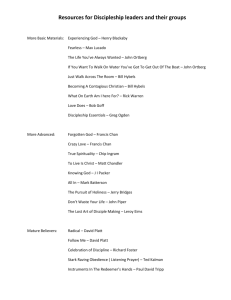

Chapter 2 & 3 Working with Financial Statements Konan Chan Financial Management, Spring 2016 Topics Covered Balance sheet & working capital Income vs. cash flow Cash flow from assets Statement of cash flow Du Pont identity Financial Management Konan Chan 2 Key Concepts and Skills Review the basic formats of B/S, I/S Know the difference between accounting income and cash flow Determine a firm’s cash flow from its financial statements Understand sources and uses of cash Compute and interpret the DuPont Identity Financial Management Konan Chan 3 Balance Sheet & Working Capital Financial Management Konan Chan 4 Cash inflows and outflows B/S right-hand side: source of cash B/S left-hand side: uses of cash Cash inflow: increase of right-hand side accounts Cash outflow: increase of left-hand side accounts Financial Management Konan Chan 5 The Income Statement Net Sales COGS Other Expenses Selling, G&A expenses Depreciation expense EBIT (Earnings Before Interests & Taxes) Net interest expense Taxable Income Income Taxes Net Income Financial Management Konan Chan 26,935 10,754 392 10,526 1,082 4,181 152 4,029 1,367 2,662 6 Profits (Income) vs. Cash Flows “Profits” record income and expenses at the time of sales, not when the cash exchanges actually occur Accounting income subtract depreciation (a non-cash expense) ignore cash expenditures on new capital (the expense is capitalized) do not consider changes in working capital Financial Management Konan Chan 7 Cash Flow from Assets Cash flow from assets = Cash flow to creditors + Cash flow to stockholders Also called “free cash flow” Cash flow from assets = Operating cash flow – Net capital spending – Changes in net working capital Financial Management Konan Chan 8 Free Cash Flow Operating cash flow EBIT + Depreciation - Taxes Net capital spending Ending FA – Beginning FA + Depreciation Changes in net working capital (NWC) Ending NWC – Beginning NWC Cash flow to creditors Interest paid – Net new borrowing Cash flow to stockholders Dividend paid – Net new equity raised Financial Management Konan Chan 9 The Statement of Cash Flows Reconciles the income statement with changes in the balance sheet from the beginning to the end of the year Inflows: net income, depreciation, decrease in asset item, or increase in liability item Outflows: increase in asset item, or decrease in liability item, dividend paid Financial Management Konan Chan 10 Parts of Statement of Cash Flows Cash flows from operations net income, depreciation change in working capital Cash flows from investments purchases and sales of long-term real assets and investments (marketable securities) Cash flows from financing issuances and payments of debt issue and repurchase stock dividend paid Financial Management Konan Chan 11 The DuPont Identity ROE Net Income Equity NI Sales TA ROE Sales TA E Profit Margin Asset Use Leverage Equity multiplier Measures the firm’s financial leverage EM = TA/E = (E + D)/E = 1+D/E Financial Management Konan Chan 12 Du Pont Identity ROE = Profit margin * Asset turnover * Leverage Du Pont system: breaks up ROE into components ROE Net Income Assets ROA * Leverage ratio * Assets Equity Operating performance + Financing decision Leverage can increase ROE Further break ROA into components Net Income Sales * Assets Sales Operating efficiency + Asset use efficiency ROA Financial Management Konan Chan 13 Financial Management Konan Chan 14 Du Pont Analysis (Example) Profit margin Asset turnover Debt/Asset • Coca - 2004 22.07% 70.11% 49.13% Coca - 2005 21.09% 78.51% 44.42% Pepsi-2004 14.39% 104.55% 51.68% Pepsi-2005 12.52% 102.63% 55.08% What are the ROEs? Leverage – Leverage ROE Financial Management Assets 1 1 Equity Equity / Assets 1 debt ratio Coca - 2004 1.97 30.42% Coca - 2005 Pepsi-2004 1.80 2.07 29.79% 31.15% Konan Chan Pepsi-2005 2.23 28.62% 15 Google vs. Yahoo Financial Management Konan Chan 16 Ethics Issues Why is manipulation of financial statements not only unethical and illegal, but also bad for stockholders? Financial Management Konan Chan 17 Quick Quiz What is the difference between accounting income and cash flow? How do we determine a firm’s cash flows? What are the equations and where do we find the information? How do you determine sources and uses of cash? What is Du Pont Identity and how to use this equation? Financial Management Konan Chan 18