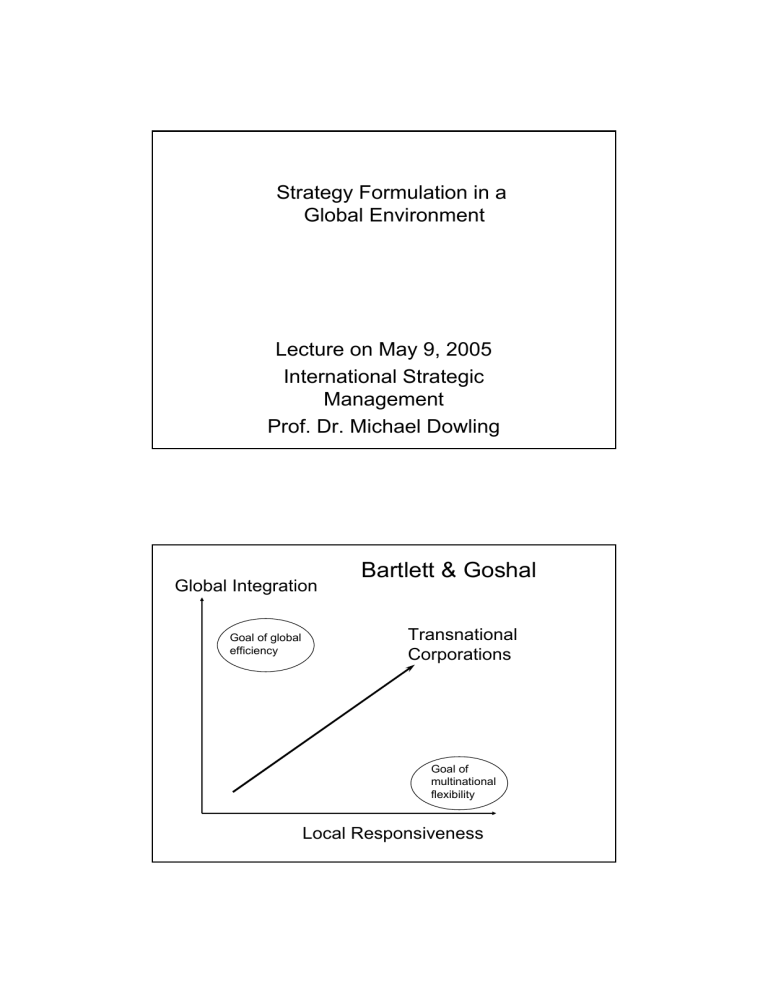

Bartlett & Goshal

Strategy Formulation in a

Global Environment

Lecture on May 9, 2005

International Strategic

Management

Prof. Dr. Michael Dowling

Global Integration

Goal of global efficiency

Bartlett & Goshal

Transnational

Corporations

Goal of multinational flexibility

Local Responsiveness

Global Efficiency

) Ratio of value of outputs to inputs

– increase value of outputs or

– lower value of inputs or

– both

Multinational Flexibility

) Ability to scan broad environment and detect changes that present new risks and opportunities

) Side bets to cover contingencies

Worldwide learning

) Internalization of international diversity creates potential for enhanced learning

) Organization must exploit potential!

– Develop mechanisms and organizations worldwide to sense customer needs and market opportunities

) Multinational

) International

) Global

) Transnational

Types

Multinational Strategy

) Focus on national differences

) Focus on revenues rather than cost

) Differentiation of products in response to customer preferences, industry characteristics, and government regulation

) Local resources to meet local needs

) Local autonomy

) Inability to exploit knowledge from other national units

– E.g. Unilever, Philips, Nestle

International Strategy

) Development of home innovations to develop competitive positions abroad

) Often involves attempt to transfer products, processes, or strategies from developed home market to less developed ones

) Weakness in both efficiency and flexibility

) E.g. in US - Kraft, Pfizer, P&G, GE

Global Strategy

) Emphasis on efficiency through global economies of scale

) Compromises on both flexibility and learning

) High transport costs and exchange rate risks

) Reduced learning through centralized

R&D

– E.g. Japan - Toyota, Canon, Komatsu,

Matushita

Transnational Strategy

) Both efficiency and flexibility important

) Costs and revenues must be managed simultaneously

) Innovation can be found in many parts of organization

) Capabilities and resources must be in part centralized and in part decentralized

) Complex!

Examples of a Transnational - Asea

Brown Boveri

) 1987 merger of Asea AB of Sweden and BBC Brown Boveri Ltd of

Switzerland

) world leader in power generation and transmission equipment

) also supplier of process automation, robotics, locomotives, pollution control equipment

) local organization - 1300 separate companies

– customer strategies

– regional results

– day to day management

– relationships with local government

) Business Areas - 65 global

– world-wide strategy and results

– R&D and product development

– purchasing coordination

– transfer of know-how

– acquisitions and divestments

Hout, Porter & Rudden

) Change industry by

– Exploiting economies of scale through global volume

– preempting competitor positions through large investments in innovation

– managing interdependently to achieve synergies

) No reliance on “world product”

Hamel & Prahalad

) Best defense is a good offense!

– Use cash flow at home to attack home markets of foreign competitors

good example - Goodyear´s counterattack on

Michelin in Europe

bad example - RCA with TVs in the US

Develop core business strategy

Internationalize the strategy

Yip - Developing a Total

Global Strategy

Core Business Strategy

Globalize the strategy

Country

A

Country

B

Country

C

Country

D

Country

E

Framework of Global Strategy Forces

Position and resources of business and parent company

Industry globalization drivers

• Market factors

• Cost factors

• Environmental factors

• Competitive factors

Appropriate setting for global strategy levers

• Major market participation

• Product standardization

• Activity concentration

• Uniform marketing

• Integrated competitive moves

Benefits/ costs of global strategy

Organization´s ability to implement a global strategy

Market Participation

) Multidomestic

– stand alone potential for profits

– patterns of investments accrue from local advantage

) Global

– potential for global benefits

– e.g. home market of competitor

– pattern developed for global advantage

Product Offering

) Multidomestic

– tailored to local needs

) Global

– standardized core product with minimum on local adaptation

Location of Value Added Activities

) Multidomestic

– value chain reproduced in each country

) Global

– value chain activities located in country with low cost for that activity

Marketing Approach

) Multidomestic

– tailored to each country

) Global

– uniform approach

Competitive Moves

) Multidomestic

– made specific to a country

) Global

– integrated across countries

Main Benefits of a Global Strategy

) Cost reduction

– economies of scale

– lower factor costs

– flexibility to seek lowest cost

– enhance bargaining power to reduce input costs

) Improved quality

– fewer products mean usually better quality control

– e.g. Toyota vs.. GM

) Enhanced Customer Preference

– better to establish brand name - e.g. Coca

Cola

) Increased competitive leverage

– more points for counterattack of competitors

Downside of Global Strategy

) Significant management costs for coordination, staff, etc.

) Product standardization may not satisfy all customers!

) Increase currency risks by activity concentration

) Integrated competition may lead to losses in particular countries

Ideal Strategy!

) Find a balance between level of strategy globalization and globalization potential of the industry

) Balance also depends on limitations of organization such as structure, culture, people, etc.

Globalization Potential of Industry versus

Globalization Strategy

High

National strategic disadvantage

Business D

Business C

Balanced global and national strategic advantage

Business B

Low

Business A

Low

Global strategic disadvantage

Globalization potential of industry High

Strategy Implementation in a

Global Environment

Early Research

) John Stopford, late 1960s

– 187 largest US-based MNCs

– number of products sold internationally (diversity)

– importance of international sales

) World wide companies adopt different organizational structures at different phases of development.

) End result often a “matrix” structure

Stopford and Well`s International Structural Stages Model

Worldwide

Product

Division Global Matrix

(or „Grid“)

Alternate Paths of Development

International

Division

Area

Division

Foreign Sales as a Percentage of Total Sales

Bartlett and Goshal:

Adapting to Administrative Heritage

) Every company is influenced by its development path

– history

– management culture

Organizational Configuration Models

(a) Decentralized Federation common to European multinational strategy

Mainly

Financial

Flows

(capital out; dividends back)

Loose, Simple Controls;

(strategic decisions decentralized)

(b) Coordinated Federation common to US international strategy

Mainly

Knowledge

Flows

(technology products, processes, systems)

Formal System Controls;

(planning, budgeting, replicating parent company administrative system)

(c) Centralized Hub

- common to Japanese global strategy

Mainly Flows of Goods

Tight, Simple Controls;

(key strategic decisions made centrally)

Solution: Building Organizational

Capabilities

) Formal structure not enough!

) MNC must develop multiple organizational capabilities:

– administrative systems

– communication systems

– interpersonal relationships

Integrated Network Model the Transnational Solution

Distributed, Specialized

Resources and Capabilities

Complex Process of Coordination and Cooperation in an Environment of Shared Decision Making

Large Flows of

Componets, Products,

Resorces, People, and Information among

Interdependent Units

The “Biological Model” of the

Transnational

) Anatomy

– line structures for formal relationships, but task forces and committees for additional decision making forums

) Physiology

– Information flows, including informal relationships

– Importance of meetings, trips, committee assignments

) Psychology

– corporate values and beliefs

– vision and mission

– behavior and public actions of senior management

– personnel policies, practices, systems

Problems with Matrix structures

) Positive Theory

– managers report both to area and functional supervisors

– multiple channels of communication

) Negative practice

– raised level of disagreement and conflict

– dual reporting led to confusion and conflict

– cultural differences heightened problems

International Cooperative Strategy

Typical Day for McKinsey Consultant –

David Ernst

) Gas pumped into his car is a product of an alliance between Royal/Dutch Shell and

Texaco

) Credit card to pay is co-branded with Shell and Mastercard

) Starbucks Coffee sold in airport through a JV with Marriott Corp.

) Airline he uses part of a group of several international carriers.

– „For most companies the basis of competition has shifted to groups of companies competing against groups of companies.“

Other Examples

) Oracle software has 15-16.000 alliances!

) IBM has announced $30 billion in alliances since May 1999 including Dell and Cisco Systems

) Average large company has 30 alliances

Types

) Networks

) Licenses

) Contracts, e.g. for R&D

) Joint Ventures

) Consortia

) Minority Investments

Loose

Tight

Reasons

) risk sharing

) scale economies

) access to markets

) access to technology

) converging markets

Why alliances can make more sense than acquisitions

(Business Week 10/99)

) Flexibility and informality promote efficiencies

) Access to new markets and technologies

)

)

Ability to create and disband projects easily

Multiple parties share risks and expenses

)

)

)

Partners can retail their independent brand identification

Working with partners possessing multiple skills can create major synergies

Rivals can often work harmoniously together

)

)

Alliances can take multifarious forms, from simple

R&D deals to huge projects

Ventures can accommodate dozens of participants

) Antitrust laws can shelter cooperative R&D activities

Goals

) Product goals

– Cost reductions

– Product range additions

) Knowledge goals

– transfer of capabilities

Risks - Giving away your future?

) skills

) jobs

) technology

Cost

) Complexity

) Uncertainty

) Difficulty in merging cultures

) Failure rate

– Andersen Consulting:

“61% of corporate partnerships are either outright failures or seen as ´limping´along.”

Management of Alliances

(Bartlett and Goshal)

) Choice of Partner

) Managing Boundaries

) Structure of Alliance

) Managing Knowledge Flows

Guideline for strong and lasting Alliances

) Compatibility and Responsibility

) Equal contributions

) Strong management

) Separate Culture

Management of Alliances

(Gomes-Casseres - HBS)

Global Logic of Alliances

Kenichi Ohmae

) Globalization makes them essential

– restatement of Triad power

) Dispersion of Technology

– no one company can be expert at everything

) Need to spread fixed costs

) Danger of building internally through equity

) Focus on ROS not ROA

Collborate with Competitors and Win

Hamel, Doz, Prahlad

) Based on research on 15 alliances

– four European-US

– two intra-European

– two European-Japan

– seven US-Japan

) In part in response to HBR article by

Robert Reich, “Joint Ventures with

Japan Give Away our Future”

Findings

) Alliances with Asian companies not always one sided

) Collaboration is a form of competition

) Harmony not the most important measure of success

) Cooperation has limits

) Japanese firms

– make major effort to learn from partners

) Western firms

– enter alliances to avoid investments, reduce risks

– many “alliances” just outsourcing

– e.g. Honda-Rover: Rover used Honda technology to avoid investments in design for new cars.

Conditions under which partners both can profit

) Strategic goals converge even as competitive goals diverge: e.g. Siecor

) Size and market power of partners is modest compared to industry leaders

) Each partner believes it can learn from other but still protect proprietary skills

Secure Defenses Important

) Defenses depends on type of skills

– danger of tranfer is greater when

easily transported (in drawings, etc)

workers can leave with knowledge

independent of cultural context

– Asian companies contribute complex process skills (hard to tranfer), Western companies often contribute technology

(easier to transfer).

) Written agreements important

– limited in scope

e.g. single technology rather than a whole group of technologies

time limit

– specific performance requirements

– careful control of gatekeepers of information (informal relationships)

) too much collegiality is dangerous!

Western managers and engineers too open.

Japanese managers more closed.

– “We don´t feel any need to reveal what we know. It is not an issue of pride for us. We are glad to sit and listen. If we´re patient we usually learn what we want to know.”

) physical separation sometimes important

Enhance learning capabilities

) Western companies must become more receptive to learning from partners

– Japanese executive

“Our Western partners approach us with the attitude of teachers. We are quite happy with this, because we have the attitudes of students”

) Top management must be committed to learning

) Lower level employees must be trained to be observant and learn.