1 / an introduction to the real estate business

advertisement

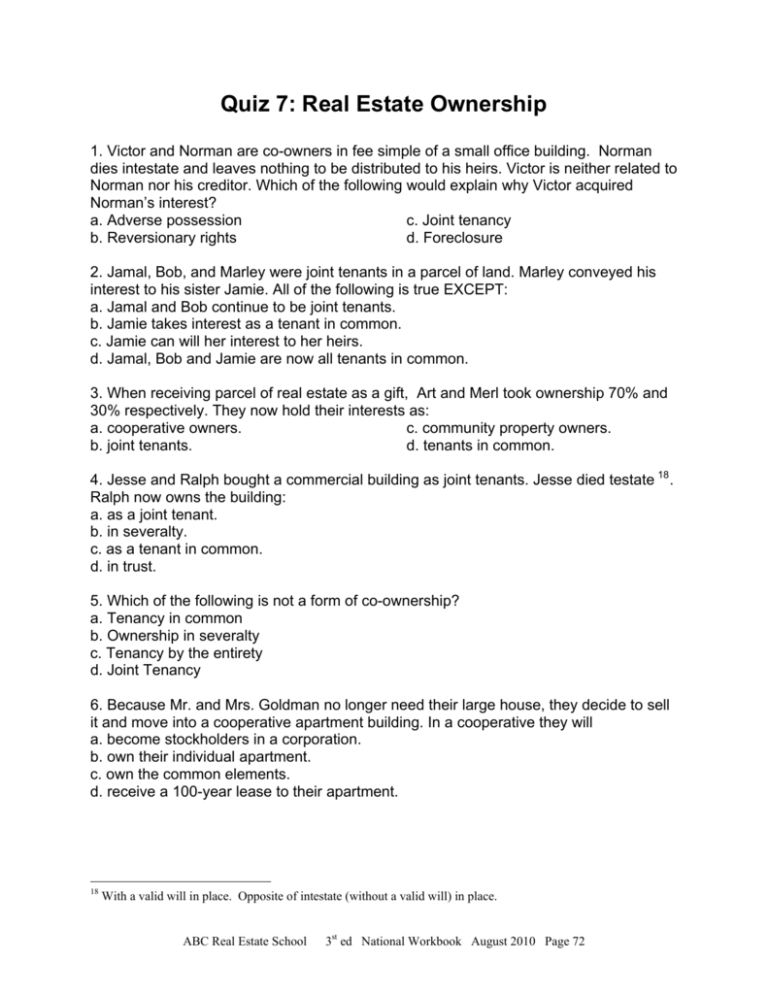

Quiz 7: Real Estate Ownership 1. Victor and Norman are co-owners in fee simple of a small office building. Norman dies intestate and leaves nothing to be distributed to his heirs. Victor is neither related to Norman nor his creditor. Which of the following would explain why Victor acquired Norman’s interest? a. Adverse possession c. Joint tenancy b. Reversionary rights d. Foreclosure 2. Jamal, Bob, and Marley were joint tenants in a parcel of land. Marley conveyed his interest to his sister Jamie. All of the following is true EXCEPT: a. Jamal and Bob continue to be joint tenants. b. Jamie takes interest as a tenant in common. c. Jamie can will her interest to her heirs. d. Jamal, Bob and Jamie are now all tenants in common. 3. When receiving parcel of real estate as a gift, Art and Merl took ownership 70% and 30% respectively. They now hold their interests as: a. cooperative owners. c. community property owners. d. tenants in common. b. joint tenants. 4. Jesse and Ralph bought a commercial building as joint tenants. Jesse died testate 18 . Ralph now owns the building: a. as a joint tenant. b. in severalty. c. as a tenant in common. d. in trust. 5. Which of the following is not a form of co-ownership? a. Tenancy in common b. Ownership in severalty c. Tenancy by the entirety d. Joint Tenancy 6. Because Mr. and Mrs. Goldman no longer need their large house, they decide to sell it and move into a cooperative apartment building. In a cooperative they will a. become stockholders in a corporation. b. own their individual apartment. c. own the common elements. d. receive a 100-year lease to their apartment. 18 With a valid will in place. Opposite of intestate (without a valid will) in place. ABC Real Estate School 3st ed National Workbook August 2010 Page 72 7. A plan where people share ownership or rental costs of a vacation home is a: c. condominium. a. leasehold. b. time-share. d. cooperative . 8. The difference between a deeded time-share a leased time-share is a. One type is forever and one type is ‘time determined’. b. Only one is arranged as interval ownership. c. A deed indicates ownership and a lease is a rental. d. Only a deeded time-share requires financing. 9. Jessica lives in an apartment building where the land and structures are owned by a corporation; with one mortgage loan securing the entire property. She owns stock in the corporation and has a lease to her apartment. This type of ownership is called a a. condominium. c. time-share. b. planned unit development. d. cooperative. 10. Kenny and Cindy a owned an apartment building. They shared their profits and losses on the venture equally, but they did not have any written partnership agreement. One day, Cindy died of a heart attack. If, after her death, Kenny continued to only own the same undivided interest in the real estate as he did before, then a. they were joint tenants. b. they were tenants in common. c. they were stockholders in their own corporation. d. Cindy died intestate. 11. Todd, who lives in a community property state, is divorcing his wife of 3 years. Which of the following is considered community property? a. A home purchased by Todd and his wife. b. An investment property purchased by Todd’s wife using Todd’s income. c. Property inherited by Todd while he was married. d. All of the answers are community property. 12. Under the community property laws of the state in which the couple live, all of the following apply to John and Mary Dunford EXCEPT a. Each may also own separate property. b. Mary may not convey community property without John’s consent. c. John may also own community property with a person other than Mary. d. Neither may encumber community property without the other’s consent. 13. To create joint tenancy in the ownership of real estate, there must be unities of a. grantees, ownership, claim of right, and possession. b. title, interest, encumbrance, and survivorship. c. possession, time, interest, and title. d. ownership, possession, heirs, and title. ABC Real Estate School 3st ed National Workbook August 2010 Page 73 14. The owner of a condominium unit learns that a neighbor has failed to pay his real estate taxes. If this neighbor does not pay the taxes a. a lien can be filed against the condominium, including all of the units. b. a lien can be filed against the neighbor's unit and his percentage of the common elements. c. a lien can be filed only against the common areas of the condominium. d. the taxing authority can order the condominium to be dissolved. 15. A person who owns one unit in a multiunit structure together with a specified undivided interest in the common elements would own a a. cooperative. c. condominium. b. share in a real estate investment trust d. time-share. (REIT). 16. For a property to be held in tenancy by the entirety which of the following is required? a. The cotenants must be husband and wife. b. The cotenants must be siblings. c. Upon the death of a cotenant, the deceased’s interest must pass to his or her heirs. d. Upon the death of a cotenant, the deceased’s interest must not pass to his or her spouse. 17. All of the following are true in defining a corporation as a legal entity, EXCEPT a. Stockholders have a direct ownership interest in the real estate. b. It is managed by a Board of Directors. c. It continues to exist until formally dissolved. d. Profits are taxed on two levels: as corporation profit and as dividends to stockholders. 18. A joint tenancy with right of survivorship may be created a. automatically if the property is distributed to the surviving children. b. by presumption if another form of ownership is not described. c. by deed or will. d. automatically if a deed is signed by both spouses. 19 All of the following is true about a condominium is EXCEPT? a. A declaration must be filed before any units may be sold. b. Each unit owner has a fractional undivided interest in the common elements. c. Each owner receives a separate real estate tax statement. d. Each owner has a proprietary lease with the association for his or her own unit. 20. In a limited partnership a. The owners are all personally liable for any legal actions and debts the company may face. b. all the partners participate in running the business. c. the general partners run the business and the limited partners have less authority. d. General partners have limited liability. ABC Real Estate School 3st ed National Workbook August 2010 Page 74 21. Ripley and Rick are joint tenants. Rick sells his interest to Freddy. What now is the relationship of Ripley and Freddy? a. They are joint tenants. b. They are tenants in common. c. There is no relationship because Rick cannot sell to Freddie. d. Ripley owns a 2/3 interest and Freddy owns a 1/3 interest. 22. Which of the following is true of condominium ownership? a. It cannot be mortgaged. b. The corporation pays the real estate taxes. c. The ownership cannot be willed. d. The limited common elements cannot be sold separately. 23. Tenancy with survivorship means a. the tenancy interest will be inherited. b. the tenancy interest will pass to the surviving tenants upon the death of one. c. the tenant's heirs are survivors. d. this is not a legal tenancy. 24. How does a cooperative obtain the funds necessary to cover ongoing operating expenses and mortgage payments? a. By charging rent b. By selling common elements c. By collecting regular assessments from shareholders d. By charging special assessments 25. When a corporation or trust uses pooled capital of multiple investors to purchase and manage income property or mortgage loans, the investment is called a: a. subdivision. b. time share. c. Real Estate Investment Trust (REIT). d. group investment. ABC Real Estate School 3st ed National Workbook August 2010 Page 75 Quiz 7: Real Estate Ownership Answers 1. c. Upon death in a joint tenancy, all remaining interests do not pass to the heirs or according to the will, but to the surviving joint tenant. 2. d. When a joint tenant conveys his or her interest in the jointly held property, the unities of time and title are destroyed, but the remaining right of the joint tenants are unaffected. The new owner takes interest as a tenant in common. 3. d. Unlike joint tenants, tenants in common do not need to hold equal ownership interests. 4. b. Joint tenancy can be used when there are multiple owners. Under joint tenancy, the ‘right of survivorship’ ownership remains with the surviving joint tenants as long as there is more than one tenant. In this case, there is only one surviving tenant, so Ralph now owns the property in severalty. 5. b. When there is one sole property owner, this is known as ownership in severalty. 6. a. In a cooperative, a corporation holds title to the land and building and offers shares of stock. 7. b. A time-share is a plan in which persons share ownership or rental costs of a vacation home, especially a condominium; entitling each participant to use the residence for a specified time each year.. 8. c. Deeded interest is an ownership interest. A leased interest is evidenced by a rental agreement. 9. d. In a cooperative, a corporation holds title to the property and offers stock shares to the residents, who then receive a proprietary lease to the apartment. 10. b. Under tenancy in common, when a co-owner dies, the tenant’s undivided interest passes according to the will. 11. d. Any real and personal property acquired by either spouse during the marriage becomes community property. 12. c. Community property laws are based on husband and wife being the only parties and merging into one entity. 13. c. The interests of possession, time, interest, and title must all be present for a joint tenancy to be created. 14. b. Real estate taxes are assessed and collected on each unit as an individual property. Failure to pay taxes may result in a lien against the neighbor’s unit. 15. c. A person who holds a fee simple title to a unit and a specified share of the undivided interest in the common elements, would own a condominium. 16. a. The term entirety establishes that the owners are considered one indivisible unit and one legal person. 17. a. Stock is personal property, so shareholders do not have direct ownership interest in the real estate owned by a corporation. 18. c. A joint tenancy can be created only by the intentional act of conveying a deed or giving the property by will, not implied or created by operation of law. 19. d. In a condominium, each owner has fee simple title to the unit. Owners of cooperatives have proprietory leases. 20. c. In a limited partnership, the limited partners are not legally permitted to participate, and each can be held liable for losses only to the extent of his/her investment. 21. b. If a joint tenant sells his/her interest in the jointly held property, the unities of time and title are destroyed. The new owner, Freddy, becomes a tenant-in-common with Ripley. 22. d. Although an individual unit owner owns the common elements as a tenantin-common, state laws usually provide that unit owners do not have the same right to partition that other tenants-in-common have. 23. b. Tenancy with survivorship, joint tenancy, means that the entire ownership remains with the surviving joint tenant. 24. c. Funds for the budget are assessed to individual shareholders, generally in the form of monthly fees. 25. c. A real estate investment trust (REIT) is an investment in income property and/or mortgage loans made by a group of investors. ABC Real Estate School 3st ed National Workbook August 2010 Page 76