France Telecom First half 2012 Financial Report

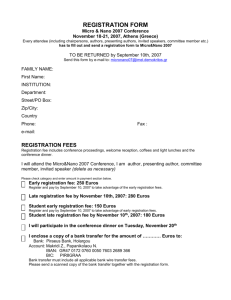

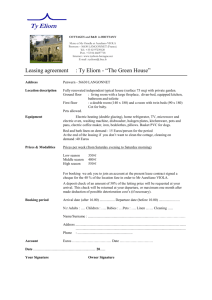

advertisement