Shareholder Information

advertisement

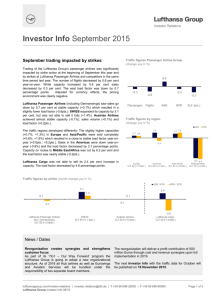

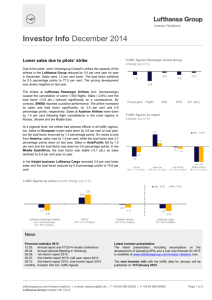

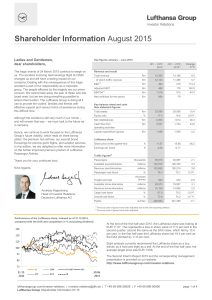

Shareholder Information Investor Relations November 2010 Ladies and gentlemen, dear shareholders, ­ Lufthansa has flown through the financial and economic crisis ­successfully. After a gratifying third quarter the Group was able to report a very respectable result for the first nine months of 2010 and increase its earnings forecast for the full year. After the effort it took to stabilise our business during the financial and economic crisis, we are now back on our course of profitable growth. Recent months have also seen further important decisions taken for the Group’s future development. In September the Supervisory Board appointed Christoph Franz as the next Chairman of the Executive Board and CEO with effect from 1 January 2011. Carsten Spohr was appointed to the Executive Board of Deutsche Lufthansa AG; he will also chair the Lufthansa German Airlines Board. At the same meeting the Supervisory Board approved the order for 48 aircraft as part of the ongoing programme to moder­nise the fleet. Today’s Shareholder Info gives you an overview of current developments and the outlook for Lufthansa. Furthermore, we present a brief portrait of Lufthansa Cargo and comments on the dividend policy and corporate responsibility. If you are interested in more detailed information, please visit our website at i lufthansa.com/ investor-relations. We would also be delighted to hear your views on our business – our contact details can be found on the back cover. Key figures January to September 2010 Jan. – Sept. 2010 Revenue and result €m 20,193 16,162 24.9 of which traffic revenue €m 16,445 12,589 30.6 Operating result €m 612 226 170.8 EBIT €m 957 208 360.1 Net profit/loss for the period €m 524 31 €m 29,501 27,281 8.1 Key balance sheet and cash flow statement figures Total assets Equity ratio % 25.1 22.5 2.6 pts Net indebtedness €m 1,521 1,908 – 20.3 Cash flow from operating activities €m 2,425 1,438 68.6 Capital expenditure (gross) €m 1,760 1,777 – 1.0 Share price at the quarter-end € 13.49 12.11 11.4 Earnings per share € 1.14 0.07 thousands 67,869 55,635 22.0 % 79.7 78.0 1.7 pts thousand tonnes 1,468 1,231 19.3 The Lufthansa share Traffic figures 2) Passengers Freight and mail Cargo load factor Frank Hülsmann, Head of Investor Relations, Deutsche Lufthansa AG Change in % Total revenue Passenger load factor Kind regards, Jan. – Sept. 2009 1) % 68.0 58.1 9.9 pts Available tonne-kilometres millions 28,780 25,907 11.1 Revenue tonne-kilometres millions 21,479 17,994 19.4 % 74.6 69.5 5.1 pts number 763,170 638,492 19.5 Overall load factor Flights Last year’s figures have been restated in line with measurement changes under IAS 39. Lufthansa Group without Germanwings. 1) 2) Performance of the Lufthansa share, indexed as of 31.12.2009, After falling in the second quarter of 2010, the stock markets compared with the DAX and competitors r­ allied again in the third quarter. The DAX climbed to 6,229 points (+4.4 per cent) on 30 September 2010. The Lufthansa share was 1,4140 lifted even more strongly by the sustained pace of the sales and earnings recovery, finishing the quarter at EUR 13.49. It was one of 1,3130 the strongest performers in the DAX in the third quarter, posting 1,2120 an increase of 14.8 per cent since the beginning of the year. On an 1,1110 industry comparison the Lufthansa share also outperformed many 1,0100 competitors. A large majority of equities analysts continue to rate Lufthansa as a buy. Their average target price at the end of 0,9 90 September was EUR 15.20 and expectations were adjusted 0,8 80 upwards again following publication of the quarterly results. Cur70 rent analysts’ opinions and more information about the Lufthansa 0,7 31.12. share are available on our website. 2009 DAX Lufthansa Shareholder Information November 2010 Lufthansa British Airways Air France 30.9. 2010 benefited particularly well from resurgent demand, reporting another record result. Lufthansa Technik and Lufthansa Systems confirmed their role as late-cycle segments with slight falls in revenue, but nevertheless presented good results. LSG Sky Chefs also benefited from the resurgent premium business. The structural measures taken by all Group companies to safeguard earnings and the restructuring of the new companies are being pursued unchanged. Outlook Business development After a turbulent start to the year 2010, Lufthansa was increasingly able to match the performance of prior years over the following months. The global economic recovery, the business segments’ strong positioning in their markets, the increased use of potential synergies in the airline group and ongoing cost-cutting measures all had a positive effect on the Group’s revenue and income. Strong growth rates were reported particulary in freight traffic and international passenger traffic over the reporting period, with traffic revenue here rising sharply. By contrast, revenue in European ­traffic con­tinues to lag behind as a result of structural shifts in ­passengers’ booking patterns. Despite varying levels of activity in the business segments, the ­success to date and current stable developments in demand have altogether led us to the conclusion that our expectations for earnings development in 2010 can be revised upwards. We are therefore now assuming an increase in revenue, which should be well above last year’s, even after adjusting for the effects of consolidation. By continuing to focus on attaining our cost targets we expect the operating result for the current financial year to exceed the EUR 800m mark. If the economy develops as forecast and the course of business is not undermined by a disproportionate increase in fuel prices or other unforeseeable factors, it can generally be assumed from a current perspective that the result will continue to develop positively in 2011, too. The extent to which the planned air traffic tax will lead to a downturn in demand remains difficult to predict, however. The volatility of the remaining variables remains high, and the current forecast is therefore subject to the usual risks for the industry. The Passenger Airline Group reported particulary an operating profit for the first nine months overall. It was nevertheless still lower than last year’s due to the non-recurring effects from the first half of the year and negative earnings contributions from the newly consolidated companies bmi and Austrian Airlines. Lufthansa Cargo In the course of the operating recovery we are now also expecting 2010 to deliver a net profit for the period and positive earnings per share. These are subject to diverse influences, however, and therefore cannot be quantified more closely at present. We nevertheless assume from today’s perspective that the conditions for paying a dividend for the financial year 2010 will be met. Revenue and operating result by business segment (Jan. – Sept. 2010) Operating result and net profit / loss for the period in €m (Jan. – Sept.) Revenue Change ­compared with previous year in €m in % Passagenger Airline Group Operating Change result ­compared with previous year in €m in % 1,085 15,460 28.3 218 Logistics 2,014 45.0 230 MRO 2,983 – 0.8 211 438 – 2.9 12 0 1,674 5.5 50 – 5.7 IT Services Catering 1,578 954 – 8.8 691 – 7.9 524 226 31 2006 2007 Operating result Lufthansa Shareholder Information November 2010 612 529 414 2008 Net profit / loss for the period 2009 2010 Portrait of a business segment: Lufthansa Cargo Leading European freight airline Lufthansa Cargo is the ­Lufthansa Group’s main provider for the logistics business as well as one of the largest cargo airlines in the world. In addition to the standard segment and the express segment, a special segment for the transport of temperature-sensitive products, live animals, airmail and particularly valuable goods rounds off the company’s broad range of services. Lufthansa Cargo’s strategic goal is to lead the industry in terms of profitability, quality and growth. In a fluctuating economic environment Lufthansa Cargo has held its ground very successfully. Since the end of 2009 freight traffic has rebounded from the crisis faster than expected. Above all it has been the resurgent German export economy that has driven the recovery at Lufthansa Cargo. Furthermore, consistent cost management contributed to a positive earnings performance. The operating profit for the first nine months of 2010 came to EUR 230m, which represents the best result in the company’s ­history. The different production platforms at Lufthansa Cargo are one important success factor. In addition to its own MD-11 fleet it uses belly capacities in Lufthansa’s passenger aircraft as well as the capacities of its joint ventures Jade Cargo International in China and AeroLogic GmbH in Leipzig. Since July 2010 Lufthansa Cargo has also been marketing the freight capacities of Austrian Airlines. In Austria the new subsidiary of Austrian Airlines and ­Lufthansa Cargo, Austrian Lufthansa Cargo GmbH, is responsible for the continued development of Vienna as an additional hub. Overall, this enables Lufthansa Cargo to benefit from its worldwide network, which links 330 destinations in more than 100 countries via hubs in Frankfurt, Munich, Leipzig/Halle and Vienna. Lufthansa Cargo is expanding its route network in specific areas in order to exploit market potential. The focus is on the Asia/Pacific traffic region, which is one of the company’s engines of growth. The last four MD-11 aircraft parked during the economic crisis are also being reactivated to cover the additional routes. They will be available again by the end of the year. Outlook Lufthansa Cargo In view of the very positive economic momentum Lufthansa Cargo is optimistic and expects to improve revenue even further in the traditionally strong fourth quarter. ­Considerable seasonal demand is forecast, above all from Asian markets. The rapid growth rates seen this year will increasingly taper off, however, due to the base effect caused by last year’s slump in demand. The growing AeroLogic fleet and the MD-11 ­aircraft brought back into service ahead of schedule by Lufthansa Cargo will provide much greater capacities for the pre-Christmas increase in demand. Sales performance in cargo tonne-kilometres in millions (Jan. – Sept.) 5,966 6,214 6,285 5,298 6,504 2006 2007 2008 2009 2010 Lufthansa Cargo therefore continues to expect a significant increase in revenue for the full year 2010 and will maintain its strict cost management. After the crisis-induced loss sustained last year, the company is confident of generating an operating profit in the fourth quarter of 2010 as well and adding to the result already achieved. Lufthansa Shareholder Information November 2010 Questions & Answers Responsibility Will Lufthansa be distributing a dividend for this year? In view of the expected earnings development for the current financial year we are assuming as of today that the conditions defined in our dividend policy for making a distribution will be met. Analysis of transport modes: air traffic is compelling A recently published study has shown that it is above all the intelligent networking of road, rail and air as modes of transport that ensures ­efficient, sustainable mobility. The Air Traffic for Germany initiative, which combines DFS Deutsche Flugsicherung GmbH, Flughafen München GmbH, Fraport AG and Deutsche Lufthansa AG under the aegis of the German Federal Ministry of Transport, Building and Urban Development (BMVBS), asked an independent group of experienced authors (the research and advisory company INFRAS Zurich and the Fraunhofer Institute for Systems and Innovation Research) to carry out a study of transport modes. The analysis includes aspects such as infrastructure costs, accident and environmental costs, operating and user-time costs. Today, the German economy already benefits from a transport system in which road, rail, sea and air transport complement one another well. In passenger traffic, for instance, Lufthansa only accounts for 15 per cent of the competition with railways. Due to the system concepts there are differences between the individual modes of transport. Air transport is the only mode of transport to cover most of its own costs itself, with a figure of 95 per cent. The corollary is that air transport only receives four per cent of total transport subsidies (rail accounts for 52 per cent and road for 24 per cent). If one looks at the costs of the individual transport modes, air transport is well ahead from distances of 400 to 500 km onwards and for longer European routes there is effectively no alternative. The full transport study can be viewed at i initiative-luftverkehr.de. You can find more information about how we deal with our corporate responsibility on our website at i lufthansa.com/­verantwortung. What is the dividend policy at Lufthansa? Our dividend policy is primarily aimed at achieving continuity in the dividend ratio. Dividend payments largely depend on two financial indicators: the operating result and the net profit for the year. The distribution is primarily based on the operating result: in the past we have paid out 30 to 40 per cent of this result to our share­holders. This is nevertheless subject to the condition that ­Lufthansa’s net profit for the year, as shown in the consolidated and individual financial statements for the parent company, allow a dividend to be paid. Why does Lufthansa not distribute the same dividend per share every year? Our dividend policy reflects the cyclical nature of our business. In good years we give shareholders a share of our success with ­correspondingly high dividends. The very good 2008 financial year, for instance, resulted in a dividend payment of EUR 1.25 per share. In poor years, however, the substance of the Company must not be weakened. This means that for these years no dividends are paid out to the detriment of the equity base. For the crisis year 2009 for example, no dividend was paid. Contact Financial calendar Your contacts at Investor Relations: 7March2011Release of Annual Report 2010 1 3May 2011 Annual General Meeting, Berlin 5May 2011Release of Interim Report January to March 2011 The next Shareholder Information will be published in August 2011. J. Honig G. Schleussner J. Hildenbrock If you have any questions please do not hesitate to ­contact us by telephone +49 69-696 28010, or via email at investor.relations@dlh.de. Address Deutsche Lufthansa AG Investor Relations Lufthansa Aviation Center LAC Airportring 60546 Frankfurt am Main Germany Disclaimer in respect of forward-looking statements Information published in the Shareholder Information with regard to the future development of the Lufthansa Group and its subsidiaries consists purely of f­orecasts and assessments and not of definitive historical facts. Its purpose is exclusively informational identified by the use of such cautionary terms as “believe”, “expect”, “forecast”, “intend”, “project”, “plan”, “estimate” or “intend”. These forward-looking statements are based on all discernible information, facts and expectations available at the time. They can, therefore, only claim validity up to the date of their publication. Since forward-looking statements are by their nature subject to uncertainties and imponderable risk factors – such as changes in underlying economic conditions – and rest on assumptions that may not or divergently occur, it is possible that the Group’s actual results and development may differ materially from those implied by the forecasts. Lufthansa makes a point of checking and updating the information it publishes. It cannot, however, assume any obligation to adapt forward-looking ­statements to accommodate events or developments that may occur at some later date. Accordingly, it neither expressly nor conclusively accepts liability, nor gives any guarantee, for the actuality, accuracy and completeness of this data and information. Lufthansa Shareholder Information November 2010