corporate strategy in turbulent environments

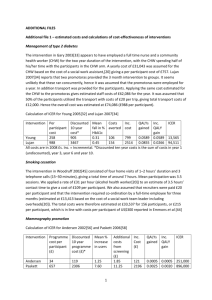

advertisement