Oil Buyer’s

BRIEF Guide

Diesel Profit Drops as Indonesian Mines Close

By Ann Koh and Fitri Wulandari

The ripples from Indonesia’s ban on mineral-ore exports are reaching energy markets,

as shuttered mines and idle trucks crimp demand for diesel.

Profit from making the fuel in Singapore this year will be the lowest since 2011, Wood

Mackenzie Ltd. says. Indonesia, Asia’s biggest importer of the fuel, will buy 20 percent less amid the contraction in mining following the ban in January, according to the

Edinburgh-based consultant.

Indonesia’s ban, designed to stimulate the domestic ore-processing industry, is having

unintended consequences across the region. Weakening demand for diesel is coming at

a time when China is exporting more fuel as its economy expands at the slowest pace in

a quarter century.

“Less miners, less work going on, less trucks, so the diesel consumption would also be

less,” Gavin Wendt, the founding director of MineLife Pty, a commodities researcher in

Sydney, said May 23. “Mining accounts for a considerable portion of diesel consumption.”

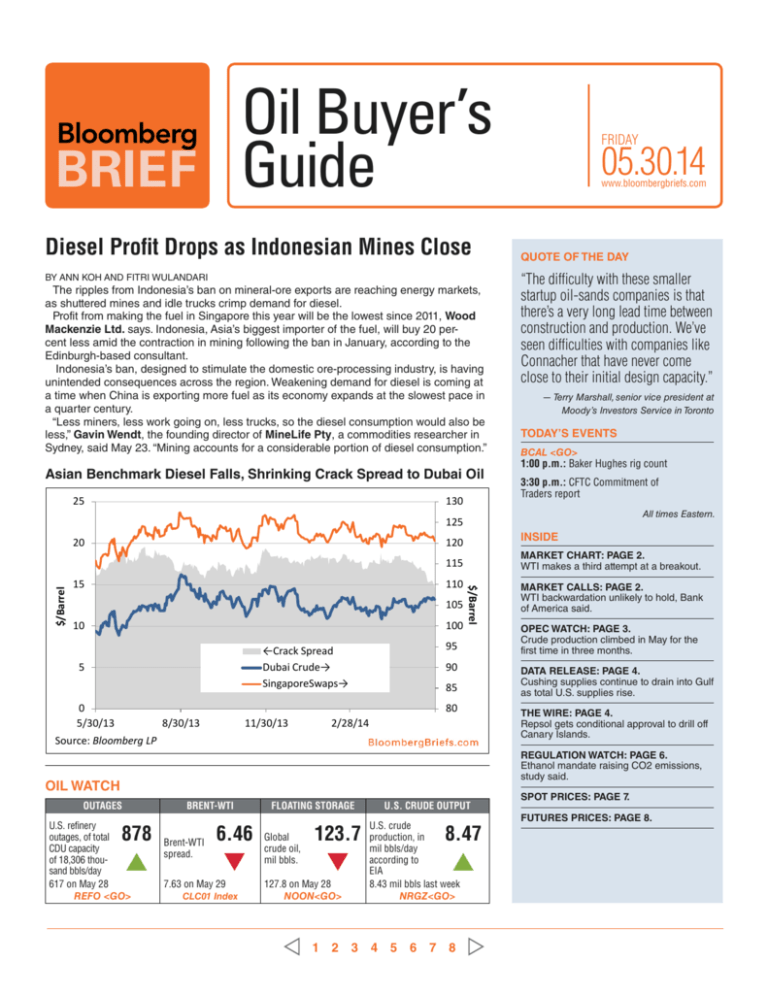

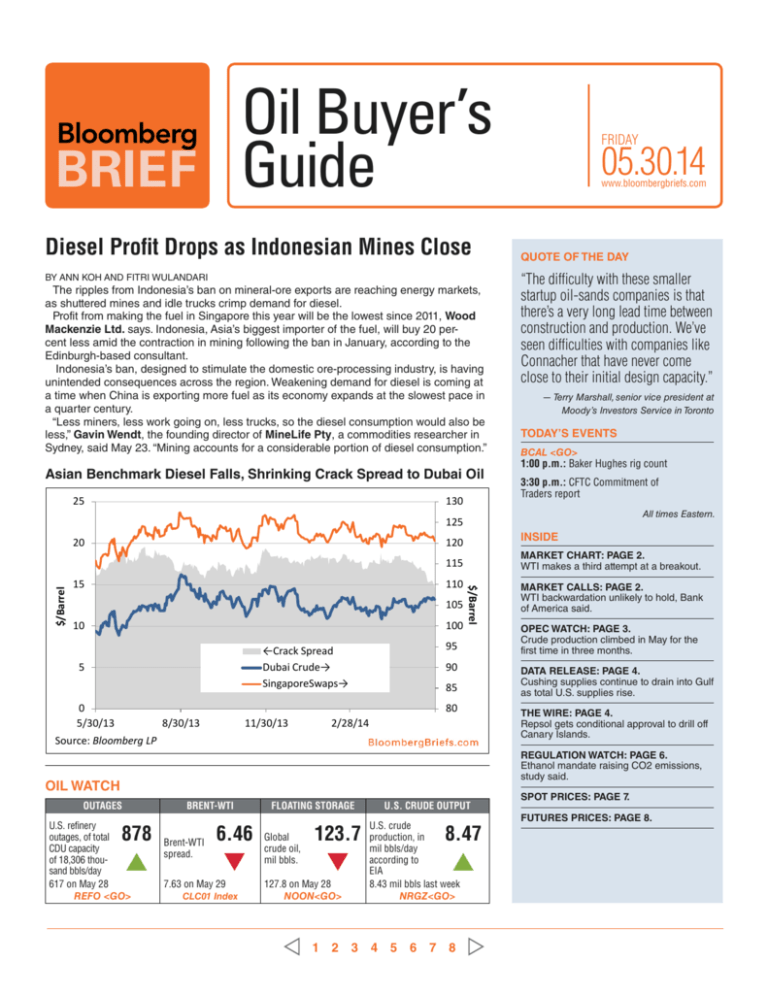

Asian Benchmark Diesel Falls, Shrinking Crack Spread to Dubai Oil

25

130

Friday

05.30.14

www.bloombergbriefs.com

Quote of the Day

“The difficulty with these smaller

startup oil-sands companies is that

there’s a very long lead time between

construction and production. We’ve

seen difficulties with companies like

Connacher that have never come

close to their initial design capacity.”

— Terry Marshall, senior vice president at

Moody’s Investors Service in Toronto

Today’s Events

BCAL <GO>

1:00 p.m.: Baker Hughes rig count

3:30 p.m.: CFTC Commitment of

Traders report

All times Eastern.

125

20

Inside

120

market chart: Page 2.

WTI makes a third attempt at a breakout.

15

110

105

10

100

←Crack Spread

Dubai Crude→

SingaporeSwaps→

5

0

5/30/13

$/Barrel

$/Barrel

115

95

90

85

80

8/30/13

Source:

Bloomberg

Source:

Bloomberg

LP

11/30/13

2/28/14

LP

Brent-WTI

U.S. refinery

outages, of total

CDU capacity

of 18,306 thousand bbls/day

617 on May 28

REFO <GO>

878

▲

OPEC WATCH: Page 3.

Crude production climbed in May for the

first time in three months.

DATA RELEASE: Page 4.

Cushing supplies continue to drain into Gulf

as total U.S. supplies rise.

The Wire: Page 4.

Repsol gets conditional approval to drill off

Canary Islands.

Regulation watch: Page 6.

Ethanol mandate raising CO2 emissions,

study said.

Oil Watch

Outages

MARKET CALLS: Page 2.

WTI backwardation unlikely to hold, Bank

of America said.

Brent-WTI

spread.

6.46

▼

7.63 on May 29

CLC01 Index

Floating Storage

Global

crude oil,

mil bbls.

123.7

▼

127.8 on May 28

NOON<GO>

u.s. crude output

U.S. crude

production, in

mil bbls/day

according to

EIA

8.43 mil bbls last week

nrgz<GO>

8.47

▲

1 2 3 4 5 6 7 8 SPOT PRICES: Page 7.

FUTURES PRICES: Page 8.

05.30.14 www.bloombergbriefs.com

Bloomberg Brief | Oil Buyer’s Guide

2

Refinery News

Exxon Mobil’s 502,500 barrel per day

refinery in Baton Rouge, Louisiana will

perform maintenance on a fluid catalytic cracking unit beginning in January,

■■

according to a person familiar with the

project. The work will last six weeks, the

person said.

— Lynn Doan

Current and Planned Refinery Outages

Thousands of Barrels Per Day

6,000

Exxon Mobil’s Torrance refinery in

southern California reported two hours

of unplanned flaring, according to South

Coast Air Quality Management District.

The refinery is conducting maintenance

with no expected impact to production,

Exxon spokeswoman Gesuina Paras said.

■■

— Lucia Kassai

Total Outages

U.S. Outages

5,000

Flint Hills received approval from

the U.S. EPA and Texas Commission on

Environmental Quality for a $600 million

project that will allow it to process more

domestic crude oil on the West side of its

Corpus Christi refinery.

■■

Russia Outages

Total (Projected)

4,000

U.S. (Projected)

Russia (Projected)

3,000

— Christine Harvey

Chennai Petroleum plans to shut a

crude unit and some secondary units at

its 9.5 million metric ton per year refinery

in southern India for a month for annual

maintenance sometime in the fourth quarter, Managing Director A.S. Basu said.

2,000

■■

1,000

0

Apr

May

Source: Bloomberg LP

Jun

Jul

Aug

— Debjit Chakraborty

Sep

Market Calls

WTI oil backwardation is unlikely to

hold in the second half of the year on

supply, according to Bank of America

Corp. “The ongoing ramp up in U.S.

crude output in 2H14 could reverse recent inventory draws,” the bank said in an

e-mailed report.

■■

Crude Oil Buyers Stage Third Attempt at Upside Breakout

CL1 Comdty (Generic 1st 'CL' Future)

— Grant Smith

Volatility may rebound if Brent backwardation flattens, undermining the

market’s appeal to investors and causing

a price drop, according to Petromatrix

GmbH, a consultant in Zug, Switzerland.

■■

— Grant Smith

Bloomberg Survey of

Oil Analysts and Traders

Source: Bloomberg LP

Buyers recently made their third attempt to break through WTI’s $104 a barrel level. The higher

low established in early May at the $99 level increases the odds for an upside breakout. However, the pattern can’t be considered bullish until there is at least one close above the $104

resistance level.

The BLOOMBERG PROFESSIONAL service, BLOOMBERG Data and BLOOMBERG Order Management Systems (the “Services”) are owned and distributed locally by Bloomberg Finance L.P. (“BFLP”) and its subsidiaries in all jurisdictions other than Argentina, Bermuda, China, India, Japan and Korea (the

“BLP Countries”). BFLP is a wholly-owned subsidiary of Bloomberg L.P. (“BLP”). BLP provides BFLP with all global marketing and operational support and service for the Services and distributes the Services either directly or through a non-BFLP subsidiary in the BLP Countries. The Services include electronic

trading and order-routing services, which are available only to sophisticated institutional investors and only where necessary legal clearances have been obtained. BFLP, BLP and their affiliates do not provide investment advice or guarantee the accuracy of prices or information in the Services. Nothing

on the Services shall constitute an offering of financial instruments by BFLP, BLP or their affiliates. BLOOMBERG, BLOOMBERG PROFESSIONAL, BLOOMBERG MARKET, BLOOMBERG NEWS, BLOOMBERG ANYWHERE, BLOOMBERG TRADEBOOK, BLOOMBERG BONDTRADER, BLOOMBERG

TELEVISION, BLOOMBERG RADIO, BLOOMBERG PRESS and BLOOMBERG.COM are trademarks and service marks of BFLP, a Delaware limited partnership, or its subsidiaries.

Bloomberg ®Charts

Rise

12

Neutral

5

Fall

19

1 - 1

— Greg Bender, CMT, Bloomberg Tradebook; See disclaimer: http://bit.ly/1iDPev0

1 2 3 4 5 6 7 8 The survey, conducted each Thursday, asks for an

assessment of whether crude oil futures are likely

to rise, fall, or remain neutral in the coming week.

05.30.14 www.bloombergbriefs.com

OPEC Watch Bloomberg Brief | Oil Buyer’s Guide

3

mark shenk, bloomberg news

May Crude Output Advances From Three-Year Low in Survey

OPEC crude production climbed in

May for the first time in three months, led

by gains in Angola and Saudi Arabia, a

Bloomberg survey showed.

Output from the 12-member Organization of Petroleum Exporting Countries

rose by 75,000 barrels a day to an average of 29.988 million, according to the

survey of oil companies, producers and

analysts. Last month’s total was revised

50,000 barrels a day higher to 29.913 million because of changes to the Saudi Arabian and United Arab Emirates estimates.

Members increased production as the

International Energy Agency projected

further increases will be needed to meet

demand during the second half of the

year. The IEA said in a May 15 report that

OPEC will need to provide an average of

30.7 million barrels a day in the last six

months of 2014.

“There’s still room for OPEC production

to increase further,” said Sarah Emerson, managing principal of ESAI Energy

Inc. in Wakefield, Massachusetts. “Both

the IEA and OPEC said this month that

Angola Leads Production Growth

Libyan Output Shrinks to 0.6 Percent of OPEC Oil

2600

10,000

5.6%

3.7% 0.6%

Saudi Arabia

8.2%

1.8%

2400

9,000

←Saudi Arabia Output

Angola Output→

2200

2000

8,000

1800

7,500

1600

7,000

6,500

Thousands of Barrels/Day

Thousands of Barrels/Day

9,500

8,500

there’s a need for additional barrels.”

Angolan output increased by 140,000

barrels a day to 1.68 million, the biggest

gain for any member in May. Production

climbed because of the end of maintenance at the Greater Plutonio offshore

field operated by BP Plc.

Saudi Arabia, the group’s biggest

producer, bolstered output by 70,000

barrels a day to 9.67 million, the first gain

this year. The country pumped 10 million

barrels a day in September, the most in

monthly data going back to 1989.

2.4%

2013

2014

Angolan production rose more than 9 percent from April. Saudi Arabia

increased its output by almost 1 percent.

Kuwait

U.A.E.

6.5%

Iran

Qatar

9.2%

32.2%

Nigeria

Angola

Algeria

9.0%

Libya

Venezuela

1400

2012

Source: Bloomberg LP

Iraq

9.7%

11.0%

Ecuador

Source: Bloomberg LP

Libyan output fell by 35,000 barrels a day to 180,000, the lowest level

since September 2011.

Production Rises Overall as Iran, Nigeria Lead Declines in Output

Producer

ticker

Total OPEC

Saudi Arabia

Iraq

Kuwait

U.A.E.

Venezuela

Iran

Nigeria

Angola

Algeria

Libya

Qatar

Ecuador

Total OPEC, ex-Iraq

OPCRTOTL Index

OPCRSAUD Index

OPCRIRAQ Index

OPCRKUWA Index

OPCRUAE Index

OPCRVENZ Index

OPCRIRAN Index

OPCRNIGE Index

OPCRANGO Index

OPCRALGE Index

OPCRLIBY Index

OPCRQATR Index

OPCRECDR Index

OPCREXIQ Index

May output,

April output,

thous. barrels/day thous. barrels/day

29,988

29,913

9,670

9,600

3,300

3,250

2,920

2,920

2,700

2,700

2,460

2,450

2,750

2,840

1,950

2,020

1,680

1,540

1,100

1,120

180

215

725

700

553

558

26,688

26,663

change,

thous. barrels/day

75

70

50

0

0

10

-90

-70

140

-20

-35

25

-5

25

Source: Bloomberg, LP

1 2 3 4 5 6 7 8 percent

change

0.25%

0.73%

1.54%

0.00%

0.00%

0.41%

-3.17%

-3.47%

9.09%

-1.79%

-16.28%

3.57%

-0.90%

0.09%

capacity,

Thous. barrels/day

36,581

12,500

3,650

2,900

3,275

3,000

2,900

2,400

1,870

1,200

1,550

780

556

32,931

05.30.14 www.bloombergbriefs.com

Bloomberg Brief | Oil Buyer’s Guide

4

The Wire

Markets

Cushing Supplies Drain Into Gulf as Total U.S. Crude Stocks Rise

West Texas Intermediate headed for its

first monthly advance since February as

crude inventories shrank at the delivery point

for New York contracts. Brent was steady in

London, poised for a second monthly gain

amid separatist violence in Ukraine.

■■

450,000

400,000

350,000

Thous Barrels

300,000

The Japan OTC Exchange plans to

open its trading platform for oil-product and

crude-swap contracts on June 24, according to a statement. The exchange plans to

offer TOCOM swaps for crude, gasoline,

kerosene and gasoil, and RIM swaps for

gasoline, kerosene, gasoil, A-grade fuel oil

and low-sulfur A-grade fuel oil.

■■

40,000

250,000

30,000

200,000

150,000

20,000

100,000

10,000

50,000

— Tsuyoshi Inajima and Emi Urabe

0

2004

2006

Source: Bloomberg LP, DOE

Supply Disruptions

■■ Nigerian rebels have called off “incessant

attacks on gas and oil pipelines, erroneously

or mischievously attributed to oil thieves” from

today, the Movement for Emancipation of Niger Delta (MEND) said in an e-mailed statement. MEND has also asked the Nigerian

government to pardon members who have

been convicted, drop charges and release

“MEND fighters still in detention facilities.”

0

2008

— Jeremy van Loon

— Cecile Gutscher and Rebecca Penty

■■

2012

2014

— Lananh Nguyen and Grant Smith

Total SA will cut 150 jobs at its Joslyn

oil-sands mine as costs escalate and the

company and its partner Suncor Energy

Inc. look for ways to make the project

more profitable. “We just need to find

ways to go further in cost effectiveness,”

Andre Goffart, the president of Total SA’s

Canadian business, said on a conference

call today. Oil sands miners, including Imperial Oil Ltd., have struggled with rising

costs in northern Alberta because of labor

shortages and distance from equipment

suppliers. Imperial last year boosted the

cost of its Kearl project by 18 percent. Total and partner Suncor last year canceled

their Voyageur upgrader because of rising

costs. The partners in October announced

they would go ahead with a C$13.5 billion

($12.5 billion) Fort Hills venture that will

produce 180,000 barrels a day within 12

months of startup in 2017.

Producers

2010

Stockpiles at Cushing, Oklahoma, the biggest U.S. oil-storage hub, dropped by 1.53 million

barrels last week to the lowest level since November 2008, according to the Energy Information Administration. Supplies nationwide expanded by 1.66 million, compared with a 500,000

barrel gain estimated in a Bloomberg News survey.

Canadian oil-sands producers, after

being denied funding last year as energy

prices fell, are regaining access to lenders

as demand for speculative-grade debt

surges with central banks suppressing

borrowing rates. Debt issuance and loans

to junk energy companies from lenders

ranging from Third Avenue Management LLC to Credit Suisse Group AG

has surged 74 percent this year to $8.9

billion from the year-ago period, according

to data compiled by Bloomberg. Calgarybased Sunshine Oilsands Ltd., which

failed to renew a credit line last year, is

marketing $325 million of bonds. BlackPearl Resources Inc. expanded a loan in

April, 10 months after market conditions

forced it to abandon financing. “Centralbank policy is pushing investors further

down the credit curve,” said Nicholas

Leach, who manages about C$2.5 billion

($2.3 billion) in Toronto at CIBC Asset

Management Inc. “In this environment,

there are lots of investors willing to take

on that kind of risk.”

— Grant Smith

50,000

Cushing Supplies→

Thous Barrels

— Lananh Nguyen and Grant Smith

60,000

←Total U.S. Crude Supply

■■

1 2 3 4 5 6 7 8 Repsol SA won government approval

to start a $10 billion oil drilling project off

Spain’s Canary Islands, signaling success

in its 12-year campaign to start exploration near the Atlantic archipelago. Spain’s

environment ministry yesterday cleared

the plan with conditions, Deputy Minister

Federico Ramos said in a briefing. The

decision follows a reconfirmation in 2012

of an exploration license first awarded

in 2001 and later tied up in court battles.

The decision advances plans by Spain’s

largest oil company to hunt for fields in an

area geologists estimate may be able to

supply about 10 percent of national demand. Several hurdles remain for Repsol.

The Supreme Court is set to rule June 10

on a challenge to its exploration permit.

■■

— Todd White

Petroceltic International is on track

for its largest monthly share decline since

June 2013 after well results yielded no

commercial hydrocarbons. Two formations in Shakrok-1 well in Kurdistan on the

■■

continued on next page

05.30.14 www.bloombergbriefs.com

Bloomberg Brief | Oil Buyer’s Guide

5

the wire…

continued from previous page

Shakrok license didn’t flow hydrocarbons

to the surface in the final two drill stem

tests. Romanian exploration well Muridava-1 failed to encounter commercial

hydrocarbons and South Dikirnis-1 exploration well in Egypt is water-bearing.

— Benjamin Dow

Oleo e Gas Participacoes SA, the

oil startup that triggered Eike Batista’s

financial collapse, will emerge as a viable producer once creditors approve a

recovery plan at a meeting scheduled

for next week, Chief Executive Officer

Paulo Narcelio said. OGpar, as the Rio

de Janeiro-based company is known, will

eliminate most of its debt and recover

financing capacity as it generates about

$500 million in sales this year, enough

to sustain operations, Narcelio said in an

interview at the company’s headquarters.

OGpar expects to produce an average

16,000 barrels a day for 12 months after

connecting two extra wells to its Tubarao

Martelo deposit by July, he said.

European Natural Gas Prices

KEY PRICES

Change

Time of

Last Price From

Open Last Trade

NBP prompt (GB pence/Therm)

42.65

0.15

8:15:28 AM

41.50

0.20

8:16:41 AM

61.00

0.25

6:52:31 AM

TTF Dutch Gas (EUR/MWh)

18.35

0.15

8:08:58 AM

18.68

-0.05

8:14:37 AM

24.45

0.00

7:38:40 AM

Ticker

Day Ahead

Jun 14

Win 14/15

NBPGDAHD Index

NBPG1MON Index

NBPGS1 Index

Day Ahead

Jun 14

2015

TTFGDAHD Index

TTFG1MON Index

TTFGCY1 Index

■■

— Juan Pablo Spinetto

Legal

Mexican authorities issued an arrest warrant for Amado Yanez, the chief

executive officer of Oceanografia SA, the

oil services provider seized by the government after Citigroup Inc.’s local unit

alleged a $400 million loan fraud. Yanez

was accused of participation in crimes

including violations of the country’s creditinstitutions law. Mexico took control of

Oceanografia in February, putting it under

the supervision of the Finance Ministry,

after Citigroup said it lost $400 million on

loans that were granted to the company

based on fraudulent invoices. Mexican authorities are probing why Citigroup’s local

unit boosted the size and length of loans

to the company in the months leading up

to the discovery of the fraud, the nation’s

chief banking regulator said.

■■

— Ben Bain, Nacha Cattan and

Dakin Campbell

Asia/Pacific Gas

China’s effort to catch up with the U.S.

in developing shale gas is coming at a

big cost: It’s spending four times as much

developing some fields, according to a

■■

Trade

Source

Fair Value

EGFI

EGFI

EGFI

41.50

60.87

ICAS

SPEC

EGFI

18.68

24.45

European Natural Gas Supply and Demand

indicator

GIE Total EU Gas Storage (MCM)

GIE Total EU Gas Storage (% Full)

Yesterday UK gas demand (MCM)

Day Ahead UK forecast gas demand (MCM)

Ticker

GIEDSTTL Index

GIEDFTTL Index

UGASDEMD Index

UGASFD1D Index

Value

50,681.68

64.55

211.27

184.52

1-Day Change

-291.31

-0.37

0.00

-4.89

U.S. Natural Gas Prices

Henry Hub Prices ($/

MMBtu)

Spot price

JUL 14

AUG 14

SEP 14

Ticker

Last Price

NGUSHHUB Index

NG1 Comdty

NG2 Comdty

NG3 Comdty

4.62

4.55

4.53

4.49

Change

From Open

--0.01

-0.01

-0.01

Time of

Last Trade

-8:06:20 AM

8:06:20 AM

8:06:20 AM

U.S. Natural Gas Supply and Demand

Indicator

Change In Total Gas Storage

Total Gas Demand

Ticker

MMcf/d

NAGSTSTO Index

NAGSTOTC Index

15,081.00

58,597.00

Change From

Previous Day

800.00

-4,483.00

Global LPG Pricing Data

Indicator

Mont Belvieu LST Propane

Mont Belvieu Non-LST Ethane

Naphtha fob Singapore

Ticker

LPGSMBPP Index

LPGSMBPE Index

NAPHSINF Index

new report. Holding the world’s biggest

potential reserves of natural gas in shale

rock, China will spend billions of dollars in

trying to close a gap with the shale leader,

which is about a decade ahead in developing the energy resource, according to a

study by Bloomberg New Energy Finance released Tuesday. China’s leaders

have mandated national targets for their

1 2 3 4 5 6 7 8 Last Price

105.25

29.13

104.56

Change

0.00

0.00

-0.25

producers such as state-owned China

Petroleum & Chemical Corp., known as

Sinopec. “For the government, shale is

one of the highest priorities, and Sinopec

is looking to distinguish itself by making

gains in shale,” Xiaolei Cao, an analyst at

Bloomberg New Energy Finance, said.

— Benjamin Haas

05.30.14 www.bloombergbriefs.com

regulation watch Bloomberg Brief | Oil Buyer’s Guide

6

Andrew Childers, Bloomberg BNA

Lower Ethanol Mandate in 2014 Would Reduce Carbon Emissions, Report Says

The Environmental Protection Agency’s

proposed reduction in the amount of ethanol that must be blended into the gasoline

supply in 2014 would cut greenhouse gas

emissions as much as taking 580,000

cars off the road for a year, the Environmental Working Group said in a report.

The annual renewable fuel standard

requirement to blend ethanol into the

gasoline supply has increased greenhouse gas emissions as more uncultivated land is cleared to grow feedstocks,

according to the May 29 report, “Ethanol’s

Broken Promise: Using Less Corn Ethanol

Reduces Greenhouse Gas Emissions.”

Lowering the ethanol blending mandate in

2014 would reduce greenhouse gas emissions by 3 million tons of carbon dioxide,

the report said.

The EPA issued a proposed rule Nov.

29, 2013, to reduce the 2014 renewable

fuel standard from the 18.15 billion gallons

required by the Energy Independence and

Security Act to 15.21 billion gallons.

In addition to reducing requirements for

petroleum refiners and importers to blend

Key Finding: Reducing the

2014 ethanol blending

requirement by 1.39 billion

gallons would reduce carbon

dioxide emissions by

3 million tons.

advanced biofuels such as cellulosic ethanol, the proposed rule would require 1.39

billion gallons less corn-based ethanol

than set out in the statute. The EPA has

said it plans to finalize the renewable fuel

standard rule in June.

The report said the blending mandate

has driven up commodity prices for corn

and soybeans, which creates incentives

for farmers to convert additional uncultivated land for crop production.

Ethanol production now consumes

40 percent of the U.S. corn crop, a 6

percent increase from 2000 to 2013, the

report said.

Between 2008 and 2011, 23 million

acres of grassland, shrub and wetlands

were converted to crop production. Of

that, 8 million acres were converted to

grow corn, increasing greenhouse gas

emissions by 60 million to 162 million tons

of carbon dioxide annually.

The Renewable Fuels Association

disputed the report’s conclusions, arguing

that it overstates how much uncultivated

land must be cleared to provide the necessary ethanol feedstocks. “Today’s Environmental Working Group report relies

upon overblown and disputed assumptions of land use change, making ethanol from corn appear to be worse than

gasoline,” Bob Dinneen, president and

chief executive officer of the Renewable

Fuels Association, said in a statement.

“That’s simply preposterous, particularly

when contrasted with the ever-rising

greenhouse gas emissions from tar sands

and fracking.”

IS THIS

YOUR COPY?

While we are grateful that our readers place a high value on our publication, unlawful duplication

and distribution undermines our efforts to bring you proprietary news and information that you

expect from the Brief.

We understand that every so often, an article or two of interest will be copied and passed on to a colleague.

However, routine copying or forwarding of our newsletters for distribution to others is a blatant, actionable

violation of our copyright.

Please contact Annie Gustavson for additional information about our Enterprise Program and we’d be happy to

help ensure your subscriptions are set up correctly and you continue to receive the best information available.

Annie Gustavson

+1-212-617-0544

agustavson@bloomberg.net

GET THE WORLD. IN BRIEF

BLOOMBERGBRIEFS.COM

1 2 3 4 5 6 7 8 BRIEF

05.30.14 www.bloombergbriefs.com

7

Bloomberg Brief | Oil Buyer’s Guide

SPOT PRICES

BENCHMARKS Prices as of end of day in New York

AMERICAS

PRICE

Bloomberg USGC Sour Index

Light Louisiana Sweet (LLS)

Mars Blend

WTI Cushing

West Texas Sour (WTS)

Bakken

West Canadian Select

Edmonton Syncrude Sweet

Gasoline New York 87

Gasoline U.S. Gulf 87

Gasoline LA 85.5 CARBOB

Jet Fuel No. 54 NY

Jet Fuel No. 54 U.S. Gulf

Diesel ULS NY

Diesel ULS U.S. Gulf

Diesel LS CARB LA

Heating Oil No. 2 NY

Heating Oil No. 2 U.S. Gulf

Fuel Oil NY Cargo 1.0% Low Pour

Fuel Oil U.S. Gulf Coast 3.0%

100.38

105.93

101.58

103.58

97.08

97.97

85.33

102.47

288.36

282.08

318.58

288.77

284.49

291.90

288.74

296.99

284.40

280.15

97.63

92.63

ASIA PACIFIC

PRICE

Crude Tapis (Bloomberg)

Crude Dubai Fateh

C&F Japan Naphtha

115.56

106.64

958.50

EUROPE

PRICE

Dated BFOE

Daily BWAVE

95 RON - ARA - FOB barge

MTBE ARA FOB barge

Jet Fuel NW Europe CIF cargo

Jet Fuel W Med FOB

Gasoil ARA FOB barge

Gasoil NW Europe CIF cargo

Gasoil W Med CIF cargo

Diesel ULS ARA FOB barge

Diesel W Med CIF cargo

Fuel Oil ARA FOB barge 3.5%

Fuel Oil W Med FOB cargo 3.5%

Fuel Oil ARA FOB cargo 1%

Fuel Oil NWE FOB cargo 1%

Fuel Oil W Med CIF cargo 1%

111.07

109.87

1021.50

1096.00

964.75

944.75

902.00

911.25

906.00

912.50

920.25

578.50

581.50

636.00

631.00

656.00

May 29, 2014

1 DAY

DIFFERENTIALS

SPREAD TO

CHANGE

-0.07

-3.20 WTI

0.86

2.35 WTI

0.16

-2.00 WTI

0.86

0.00 NYMEX

0.81

-6.50 WTI

-1.89

-4.75 WTI

-1.39

-18.00 WTI

-1.89

-0.25 WTI

0.77

-13.00 NYMEX

3.77

-17.50 NYMEX

4.27

19.00 NYMEX

-0.67

-3.13 NYMEX

-1.93

-7.50 NYMEX

-1.16

0.00 NYMEX

-1.05

-3.25 NYMEX

-1.55

5.00 NYMEX

-1.04

-7.50 NYMEX

-1.41

-11.75 NYMEX

0.00

0.25

1 DAY

DIFFERENTIALS

SPREAD TO

CHANGE

-0.14

-0.19

3.43 BRENT

-2.50

1 DAY

CHANGE

0.11

-0.23

-0.50

-0.40

-8.75

-8.75

-8.75

-8.75

-8.75

-7.25

-7.25

-1.75

-1.75

-8.00

-8.00

-8.00

Source: Bloomberg LP

For live prices on Bloomberg enter BOIL<GO> 4<GO>

PRICE SPREADS

PRICES ARE EXPRESSED IN USD PER BARREL

USD/BBL

Brent Crude, Gulf Coast 321 Crack Spread

20

15

10

5

0

(5)

May-13

Aug-13

Nov-13

Feb-14

LLS Crude, Gulf Coast 321 Crack Spread

USD/BBL

20

15

10

5

0

May-13

Nov-13

Feb-14

Brent Crude, WTI Crude

USD/BBL

140

130

120

110

100

90

80

70

60

Aug-13

USD/BBL

Spread ( R)

Brent Front Month (L)

WTI Front Month (L)

M

1 2 3 4 5 6 7 8 J

J

A

S

O

N

D

J

F M

A M

J

27

23

19

15

11

7

3

-1

-5

05.30.14 www.bloombergbriefs.com

Bloomberg Brief | Oil Buyer’s Guide

8

Futures

FUTURES BASED SWAPS

Prices as of 7:30 a.m. N.Y. Time

Period

Bal Mo

JUN 14

JUL 14

AUG 14

SEP 14

OCT 14

Bal Mo/JUN 14

JUN 14/JUL 14

JUL 14/AUG 14

AUG 14/SEP 14

SEP 14/OCT 14

Bal Qt

Q3 14

Q4 14

Q1 15

Bal Yr

Cal 15

WTI

103.14

102.92

102.06

101.01

100.00

98.94

0.22

0.86

1.05

1.01

1.06

103.03

101.02

98.02

95.42

100.40

92.79

Period

Bal Mo

JUN 14

JUL 14

AUG 14

SEP 14

OCT 14

Bal Mo/JUN 14

JUN 14/JUL 14

JUL 14/AUG 14

AUG 14/SEP 14

SEP 14/OCT 14

Bal Qt

Q3 14

Q4 14

Q1 15

Bal Yr

Cal 15

BRNT

109.70

109.27

108.55

107.86

107.33

106.84

0.43

0.72

0.69

0.53

0.49

109.48

107.91

106.37

105.03

107.72

103.28

WTI

BRNT

-6.56

-6.34

-6.50

-6.85

-7.33

-7.90

-0.22

0.16

0.35

0.48

0.57

-6.45

-6.89

-8.34

-9.61

-7.32

-10.49

NYRBWTI NYRBBR

22.95

22.42

21.77

20.89

14.91

13.94

0.53

0.65

0.88

5.98

0.97

22.68

19.19

13.71

17.66

18.01

18.56

16.39

16.08

15.28

14.04

7.59

6.03

0.31

0.80

1.24

6.45

1.56

16.23

12.30

5.37

8.05

10.69

8.07

Source: Bloomberg LP

SWAP CURVES

May 30, 2014

ULSD

ULSD WTI ULSD BRNT

291.01

291.07

291.43

291.84

292.12

292.29

-0.06

-0.36

-0.41

-0.28

-0.17

291.04

291.80

292.32

290.48

291.80

286.31

NYRB

ULSD

9.20

7.37

3.41

-1.60

-18.51

-23.53

1.83

3.96

5.01

16.91

5.02

8.28

-5.57

-26.28

-21.23

-9.87

-21.19

19.08

19.33

20.34

21.56

22.69

23.82

-0.25

-1.01

-1.22

-1.13

-1.13

19.20

21.53

24.75

26.58

22.16

27.46

HSGO

899.25

899.87

901.12

902.50

903.16

902.12

-0.62

-1.25

-1.38

-0.66

1.04

899.56

902.26

899.64

887.11

900.60

878.77

12.52

12.98

13.85

14.72

15.36

15.92

-0.46

-0.87

-0.87

-0.64

-0.56

12.75

14.64

16.41

16.97

14.83

16.97

HSGO BRNT

11.00

11.52

12.40

13.28

13.90

14.25

-0.52

-0.88

-0.88

-0.62

-0.35

11.26

13.20

14.39

14.04

13.16

14.68

NYRB

300.20

298.43

294.83

290.23

273.61

268.76

1.77

3.60

4.60

16.62

4.85

299.32

286.23

266.04

269.25

281.93

265.12

HSGO

ULSD

3.61

3.48

3.44

3.41

3.48

3.98

0.13

0.04

0.03

-0.07

-0.50

3.55

3.44

4.80

6.97

3.98

5.47

WTI

110

Today

100

Month Ago

90

80

70

May 14

May 18

WTI-Brent

-7

-11

-15

-19

May 14

May 16

HO-WTI

35

30

25

20

May 14

May 16

RB-WTI

30

25

20

15

10

May 14

May 16

May 18

For live prices on Bloomberg enter CFVL<GO> 96<GO>

Bloomberg Brief Oil Buyer’s Guide

Bloomberg Brief Jennifer Rossa

Executive Editor jrossa@bloomberg.net

+1-212-617-8074

Managing Editor, Stuart Wallace

Global Energy Markets swallace6@bloomberg.net

+44-20-7673-2388

Managing Editor, Tim Coulter

Energy and Commodities tcoulter@bloomberg.net

+44-20-7330-7901

Oil Buyer’s Guide Deirdre Fretz

Editor dfretz@bloomberg.net

212-617-5166

Data Editor: Joseph Aboussleman

U.S. Crude Oil jaboussleman@bloomberg.net

+1-609-279-4281

Data Editor: Paul Batchler

Canadian Crude pbatchler@bloomberg.net

+1-609-279-4128

Data Editor: Andrew Stewart

Natural Gas anstewart@bloomberg.net

+1-609-279-4258

Newsletter Nick Ferris

Business Manager nferris2@bloomberg.net

+1-212-617-6975

Advertising Adrienne Bills

abills1@bloomberg.net

+1-212-617-6073

Reprints & Lori Husted

Permissions lori.husted@theygsgroup.com

+1-717-505-9701

To subscribe via the Bloomberg Terminal type BRIEF <GO> or on the web at www.bloombergbriefs.com. To contact

the editors: dfretz@bloomberg.net. This newsletter and its contents may not be forwarded or redistributed without the

prior consent of Bloomberg. Please contact our reprints and permissions group listed above for more information. ©

2014 Bloomberg LP. All rights reserved.

1 2 3 4 5 6 7 8