Oil Buyer’s

BRIEF Guide

Showa Shell Boosts Use of South American Oil

Wednesday

03.26.14

www.bloombergbriefs.com

Quote of the Day

“The notion that they were going to

somehow cooperate with each other

in an oil investment is difficult at

best right now.”

By Tsuyoshi Inajima

Toa Oil, a unit of Japan’s Showa Shell, has boosted its use of South American crude

as the grades are cheaper than Middle Eastern oil, Yasuyuki Shishido, chief of the

company’s corporate planning office, said in an interview today.

South American crude, mainly from Ecuador, accounted for about 25 percent of the

feedstock processed at the company’s Keihin refinery in 2013, up from less than 20

percent the year before, Shishido said. The company plans to maintain the same level of

South American crude use in 2014, Shishido said.

The company processed about 88,600 barrels of crude a day in 2013. South American

crude is used by the Keihin refinery’s 27,000 barrel per day coker, which allows the facility

to produce less low-value residual fuel oil and more high-value light products such as

gasoline and diesel.

— Occidental Petroleum Corp.’s Chief

Executive Officer Steve Chazen on efforts to

sell a stake in its Middle East business to a

consortium made up of Oman, the United

Arab Emirates and Qatar.

Today’s Events

BCAL <GO>

All day: Howard Weil Energy Conference,

New Orleans. Presenters include Canadian

Natural Resources, Pioneer Energy Services,

Whiting Petroleum Corp.

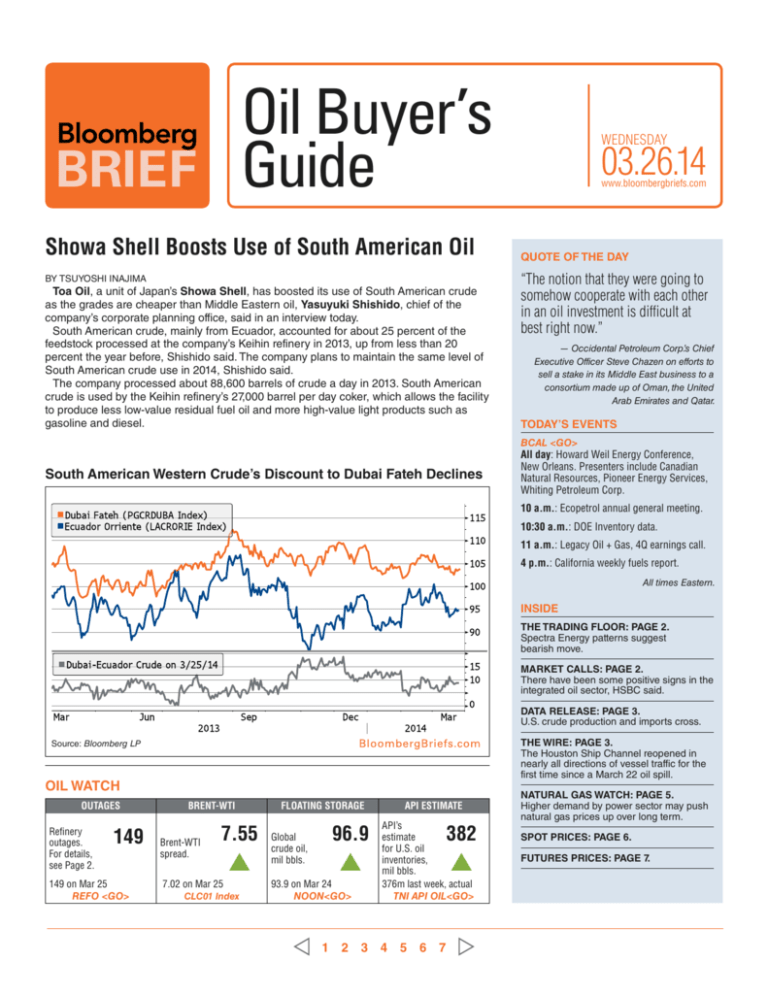

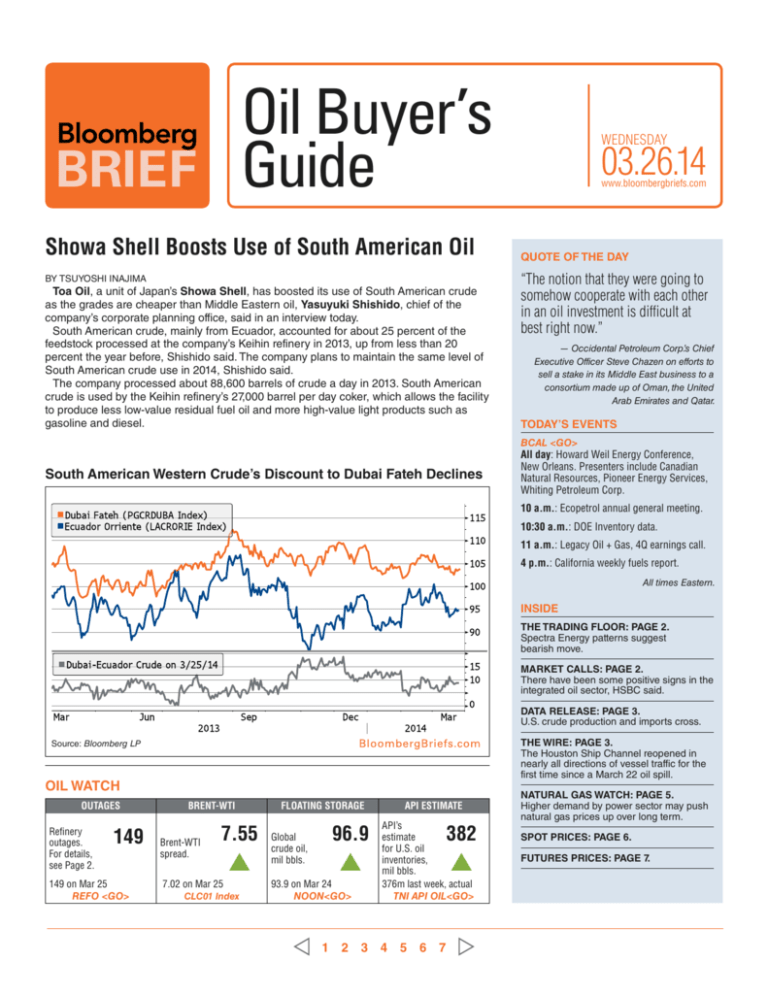

PGCRDUBA Index (Bloomberg Arabian Gulf Dubai Fateh Crude Oil Spot Price)

LACRORIE Index (Bloomberg Latin American Oriente Crude Oil Spot Price)

Dubai-Ecuador Crude

South American Western Crude’s Discount to Dubai Fateh Declines

10 a.m.: Ecopetrol annual general meeting.

10:30 a.m.: DOE Inventory data.

11 a.m.: Legacy Oil + Gas, 4Q earnings call.

4 p.m.: California weekly fuels report.

All times Eastern.

Inside

The Trading Floor: Page 2.

Spectra Energy patterns suggest

bearish move.

MARKET CALLS: Page 2.

There have been some positive signs in the

integrated oil sector, HSBC said.

DATA RELEASE: Page 3.

U.S. crude production and imports cross.

Source: Bloomberg LP

The BLOOMBERG PROFESSIONAL service, BLOOMBERG Data and BLOOMBERG Order Management Systems (the “Services”) are owned and distributed locally by Bloomberg Finance L.P. (“BFLP”) and its subsidiaries in all jurisdictions other than Argentina, Bermuda, China, India, Japan and Korea (the

“BLP Countries”). BFLP is a wholly-owned subsidiary of Bloomberg L.P. (“BLP”). BLP provides BFLP with all global marketing and operational support and service for the Services and distributes the Services either directly or through a non-BFLP subsidiary in the BLP Countries. The Services include electronic

trading and order-routing services, which are available only to sophisticated institutional investors and only where necessary legal clearances have been obtained. BFLP, BLP and their affiliates do not provide investment advice or guarantee the accuracy of prices or information in the Services. Nothing

on the Services shall constitute an offering of financial instruments by BFLP, BLP or their affiliates. BLOOMBERG, BLOOMBERG PROFESSIONAL, BLOOMBERG MARKET, BLOOMBERG NEWS, BLOOMBERG ANYWHERE, BLOOMBERG TRADEBOOK, BLOOMBERG BONDTRADER, BLOOMBERG

TELEVISION, BLOOMBERG RADIO, BLOOMBERG PRESS and BLOOMBERG.COM are trademarks and service marks of BFLP, a Delaware limited partnership, or its subsidiaries.

Oil Watch

Bloomberg ®Charts

Outages

Refinery

outages.

For details,

see Page 2.

149

149 on Mar 25

REFO <GO>

1 -1

Brent-WTI

Brent-WTI

spread.

7.55

▲

7.02 on Mar 25

CLC01 Index

Floating Storage

Global

crude oil,

mil bbls.

96.9

▲

93.9 on Mar 24

NOON<GO>

API Estimate

API’s

estimate

for U.S. oil

inventories,

mil bbls.

376m last week, actual

tNI API OIL<GO>

382

▲

1 2 3 4 5 6 7 The Wire: Page 3.

The Houston Ship Channel reopened in

nearly all directions of vessel traffic for the

first time since a March 22 oil spill.

Natural gas watch: Page 5.

Higher demand by power sector may push

natural gas prices up over long term.

SPOT PRICES: Page 6.

FUTURES PRICES: Page 7.

03.26.14 www.bloombergbriefs.com

Bloomberg Brief | Oil Buyer’s Guide

The Trading Floor

Market Calls

SEP US Equity (Spectra Energy Partners LP)

There have been some positive

signs in the integrated oil sector,

even as full-year results and strategy

updates remain mixed, HSBC said in

a note. The bank said there have been

no fundamental changes in investor

sentiment as a whole and that the

market remains wary of free cash flow

and growth opportunities; however,

any immediate signs that counter this

view are rewarded very quickly. Recent

positive news has mainly come in

the form of lower capex guidance,

including for Total and Statoil, and

improved cash flow guidance, including for BP and Chevron, HSBC said.

Some of the market’s skepticism

about the integrated oil sector can be

attributed to the fall in crude prices in

2008 and 2009, even though balance

sheets are in a better state now, the

bank said.

Spectra Energy Patterns Suggest Bearish Trend

■■

Source: Bloomberg LP

Spectra Energy’s Bollinger bandwidth reached a new low (shown by the red horizontal trendline.)

Both the Bollinger Percent B and RSI lines break an upward slanting trendline indicating potential

downward

move. Look for a break of the 23.6 percent Fibonacci line which matches up to prior highs1 - 1

Bloomberg

®Charts

and lows, as well as a break of the lowest Fibonacci fan level to confirm the bearish trend.

The BLOOMBERG PROFESSIONAL service, BLOOMBERG Data and BLOOMBERG Order Management Systems (the “Services”) are owned and distributed locally by Bloomberg Finance L.P. (“BFLP”) and its subsidiaries in all jurisdictions other than Argentina, Bermuda, China, India, Japan and Korea (the

“BLP Countries”). BFLP is a wholly-owned subsidiary of Bloomberg L.P. (“BLP”). BLP provides BFLP with all global marketing and operational support and service for the Services and distributes the Services either directly or through a non-BFLP subsidiary in the BLP Countries. The Services include electronic

trading and order-routing services, which are available only to sophisticated institutional investors and only where necessary legal clearances have been obtained. BFLP, BLP and their affiliates do not provide investment advice or guarantee the accuracy of prices or information in the Services. Nothing

on the Services shall constitute an offering of financial instruments by BFLP, BLP or their affiliates. BLOOMBERG, BLOOMBERG PROFESSIONAL, BLOOMBERG MARKET, BLOOMBERG NEWS, BLOOMBERG ANYWHERE, BLOOMBERG TRADEBOOK, BLOOMBERG BONDTRADER, BLOOMBERG

TELEVISION, BLOOMBERG RADIO, BLOOMBERG PRESS and BLOOMBERG.COM are trademarks and service marks of BFLP, a Delaware limited partnership, or its subsidiaries.

— Teresa Chan

Selected Refinery Outages

REFO <GO>

JX Nippon Oil & Energy refinery in Japan said most of its units will be “mothballed” as of March 31.

Company

LOCATION

2

REASON

START OF

OUTAGE

PROJECTED

END DATE

Toa Keihin

Refinery Japan

Japan

No. 3 CDU of 70,000 b/d to shut in

spring for maintenance.

Qtr 2,

2014

Qtr 2, 2014

JX Nippon Oil & Energy Corp Muroran

Japan

Most units, including No. 2 CDU of

180,000 b/d, are to be mothballed.

31-Mar-14

NA

Citgo Corpus Christi

TX Refinery (PADD 3)

Corpus Christi,

Texas

Refinery reported a shutdown of A

sulfur train after breach of reactor shell,

a filing to the state shows.

24-Mar-14

8-Mar-13

Neste Porvoo

Refinery Finland

Finland

Refinery is conducting maintenance,

the company said March 25.

24-Mar-14

30-Mar-14

— James Cone

Urals differentials in northwest Europe are expected to drop due to higher loadings, JBC said in an e-mailed

report. “Increase in cargoes loading in

the north is strongly expected to cool

Urals NWE and send it to a deeper

and steady discount to the tighter

Mediterranean market,” JBC said. The

total volume of Urals supplied to the

market is in line with higher Russian

refinery maintenance, JBC said, noting

that the Mediterranean market is still

missing sizable amounts of mediumsour crude from Iran, Syria and northern Iraq given frequent outages along

the Kirkuk-Ceyhan pipeline.

■■

— Sherry Su

Source: Bloomberg

Bloomberg Brief Oil Buyer’s Guide

Bloomberg Brief Ted Merz

Executive Editor tmerz@bloomberg.net

+1-212-617-2309

Managing Editor, Stuart Wallace

Global Energy Markets swallace6@bloomberg.net

+44-20-7673-2388

Managing Editor, Tim Coulter

Energy and Commodities tcoulter@bloomberg.net

+44-20-7330-7901

Oil Buyer’s Guide Deirdre Fretz

Editor dfretz@bloomberg.net

212-617-5166

Data Editor: Joseph Aboussleman

U.S. Crude Oil jaboussleman@bloomberg.net

+1-609-279-4281

Data Editor: Paul Batchler

Canadian Crude pbatchler@bloomberg.net

+1-609-279-4128

Data Editor: Andrew Stewart

Natural Gas anstewart@bloomberg.net

+1-609-279-4258

Newsletter Nick Ferris

Business Manager nferris2@bloomberg.net

+1-212-617-6975

Advertising Adrienne Bills

+1-212-769-0480

Reprints & Lori Husted

Permissions lori.husted@theygsgroup.com

+1-717-505-9701

To subscribe via the Bloomberg Terminal type BRIEF <GO> or on the web at www.bloombergbriefs.com. To contact

the editors: jresnickault@bloomberg.net. This newsletter and its contents may not be forwarded or redistributed

without the prior consent of Bloomberg. Please contact our reprints and permissions group listed above for more

information. © 2014 Bloomberg LP. All rights reserved.

1 2 3 4 5 6 7 03.26.14 www.bloombergbriefs.com

Bloomberg Brief | Oil Buyer’s Guide

3

The Wire

DWOPUSA Index (DOE USA Crude Oil Production Data)

DOCRTOTL Index (DOE Crude Oil US Import Data/Total)

Policy

Rising U.S. Oil Production Fuels Congressional Debate

“America can and should be an energy

superpower,” Senator Mary Landrieu,

chairman of the Energy and Natural

Resources Committee, said yesterday at

her first hearing as head of the panel. A

House Energy and Commerce Committee panel also took up the issue of U.S.

energy exports including liquefied natural

gas yesterday and the House Foreign

Affairs Committee will hold a hearing on

the subject today. Some lawmakers are

skeptical about stepped up overseas

sales. “Unlimited LNG exports would

have serious impacts on consumers and

manufacturers,” Representative Henry

Waxman, a California Democrat, said

at the House hearing. “Foreign policy

arguments in favor of energy exports are

gaining momentum on Capitol Hill,” Whitney Stanco, a Washington-based energy

policy analyst at Guggenheim Securities

LLC, said in a note to investors. “Nevertheless, it remains unlikely that Congress

will coalesce around a plan on LNG

exports and highly unlikely that Congress

will act on crude exports in the near term.”

Congress remains split on the issue, said

Michael Webber of the University of Texas.

Lawmakers from energy-consuming states

are more likely to oppose exports out of

concerns it will drive up prices. There are

also divisions among businesses. Crude

oil exports are backed by producers such

as Exxon Mobil Corp. and ConocoPhillips that say it would encourage more

U.S. drilling, increase government revenue

and create thousands of jobs. Four

U.S.-based oil refiners recently formed a

coalition to fight increased crude exports.

They say overseas sales would raise

U.S. gasoline prices. America’s Energy

Advantage, a coalition that includes Dow

Chemical Co., Eastman Chemical Co.

and Alcoa Inc., said the conditional approval Monday of the Jordan Cove LNG

terminal in Oregon was a “grievous error”

that could raise domestic prices.

■■

— Jim Snyder and Brian Wingfield

Supply Disruptions

The Houston Ship Channel reopened

in nearly all directions of vessel traffic for

the first time since a March 22 oil spill.

The Coast Guard planned to shut down

■■

Source: Bloomberg

The BLOOMBERG PROFESSIONAL service, BLOOMBERG Data and BLOOMBERG Order Management Systems (the “Services”) are owned and distributed locally by Bloomberg Finance L.P. (“BFLP”) and its subsidiaries in all jurisdictions other than Argentina, Bermuda, China, India, Japan and Korea (the

“BLP Countries”). BFLP is a wholly-owned subsidiary of Bloomberg L.P. (“BLP”). BLP provides BFLP with all global marketing and operational support and service for the Services and distributes the Services either directly or through a non-BFLP subsidiary in the BLP Countries. The Services include electronic

trading and order-routing services, which are available only to sophisticated institutional investors and only where necessary legal clearances have been obtained. BFLP, BLP and their affiliates do not provide investment advice or guarantee the accuracy of prices or information in the Services. Nothing

on the Services shall constitute an offering of financial instruments by BFLP, BLP or their affiliates. BLOOMBERG, BLOOMBERG PROFESSIONAL, BLOOMBERG MARKET, BLOOMBERG NEWS, BLOOMBERG ANYWHERE, BLOOMBERG TRADEBOOK, BLOOMBERG BONDTRADER, BLOOMBERG

TELEVISION, BLOOMBERG RADIO, BLOOMBERG PRESS and BLOOMBERG.COM are trademarks and service marks of BFLP, a Delaware limited partnership, or its subsidiaries.

In November, the U.S. produced more oil than it imported for the first time since 1995, fueling a

debate on current restrictions to oil and gas exports. See story, left.

Bloomberg ®Charts

1 -1

— Jim Snyder and Brian Wingfield

the channel at about sunset last night and

resume movements at daylight today, Petty Officer Eric Coleman said. As of 5:30

p.m. local time yesterday, 50 vessels were

waiting to come into the Houston Ship

Channel and 30 were waiting to leave,

Petty Officer Matthew Schofield said by

telephone. Three tankers were waiting

to enter Galveston-Texas City and three

were waiting to leave; 19 barges were in

the queue at Pelican Cut; three barges

were at Barbours Cut; seven barges were

at Bayport; and 35 barges were at Bolivar.

— Barbara Powell and Dan Murtaugh

Colonial Pipeline Co., which operates

the largest oil products pipeline system

in the U.S., shut a segment that can

carry 885,000 barrels a day of fuel to the

Northeast for repairs. The leg, known as

Line 3, was taken out of service yesterday

after work crews investigated “an anomaly” in Virginia and began a repair plan,

the Alpharetta, Georgia-based company

said in an e-mailed statement. The line,

part of Colonial’s larger system that ships

gasoline, diesel and other fuels to the

Northeast from Gulf Coast refiners, was

expected to be shut “through the night,”

■■

1 2 3 4 5 6 7 and Colonial had updated shipping schedules to reflect the outage. The shutdown

threatens to trap product supplies in the

Gulf Coast, a region already facing transport challenges after a fuel-oil spill closed

the Houston Ship Channel for three days.

— Lynn Doan

Exploration

Brazil will look to auction oil exploration

licenses by mid-2015, following three bidding rounds last year, as the South American country seeks to reverse a decline in

crude output and stoke economic growth.

The government hasn’t set a date or decided whether to offer ultra-deep fields in

the so-called pre-salt area, Oil Secretary

Marco Antonio Almeida said.

■■

— Rodrigo Orihuela

BG and Woodside together won four

offshore blocks in a Myanmar auction, the

nation’s energy ministry said on its website. Shell won three exploration blocks.

Eni and Reliance Industries won two

blocks each. Statoil-Conoco and Roc

Oil-Tap Oil partnerships each won one

■■

continued on next page

03.26.14 www.bloombergbriefs.com

Bloomberg Brief | Oil Buyer’s Guide

4

the wire…

continued from previous page

block. Myanmar received a total of 64 bids

for 30 offshore oil blocks.

— Kyaw Thu and Rakteem Katakey

Exxon Mobil Corp. is negotiating

to bring OAO Rosneft into oil and gas

licenses in Iraq’s Kurdistan region, according to people familiar with the talks.

Rosneft is still considering the proposal,

part of a global alliance between the

largest U.S. and Russian oil companies,

and a deal isn’t guaranteed. Exxon signed

six production sharing contracts covering

more than 848,000 acres in Kurdistan in

October 2011, according to the company’s

2013 annual report. Exxon began a seismic survey on four of six blocks in 2013

and has begun drilling one well, according

to the report.

■■

— Stephen Bierman and Brian Swint

Mergers & Acquisitions

Seadrill Ltd. plans to resume acquisitions and rig building by early 2016 when

the market for deep-water rigs is expected

to improve, Chief Financial Officer Rune

Magnus Lundetrae said yesterday in an

interview in New Orleans.

■■

— David Wethe

Legal

Cleopatra Shipping Agency Ltd., the

operator of the bulk carrier that collided

with a barge carrying oil in the Houston

Ship Channel, was on probation for a

2011 federal pollution violation. Cleopatra

Shipping operates the Summer Wind, a

585-foot Liberian flag vessel owned by

Sea Galaxy Marine SA, Greg Beuerman, a spokesman for the U.S. Coast

Guard Joint Information Center, said in a

telephone interview yesterday. Cleopatra,

based in Pireas, Greece, pleaded guilty

in September 2012 to violating the Act

to Prevent Pollution from Ships. It was

ordered to pay a $300,000 fine and serve

a three-year term of probation requiring

implementation of an environmental compliance program. Both Cleopatra Shipping

and Kirby Inland Marine LP, owner of

the barge carrying fuel oil, were sued

by commercial and sport fishermen on

Monday. The fisherman claimed damages

from the March 22 oil spill.

■■

— Harry R. Weber and Dan Murtaugh

European Natural Gas Prices

KEY PRICES

Change

Time of

Last Price From

Open Last Trade

NBP prompt (GB pence/Therm)

54.50

-0.50

8:16:38 AM

54.10

-0.15

8:13:25 AM

54.30

0.02

8:02:11 AM

TTF Dutch Gas (EUR/MWh)

22.15

0.10

8:22:05 AM

22.02

0.02

8:05:42 AM

24.55

0.05

8:15:17 AM

Ticker

Day Ahead

Apr 14

Sum 14

NBPGDAHD Index

NBPG1MON Index

NBPGS1 Index

Day Ahead

Apr 14

2015

TTFGDAHD Index

TTFG1MON Index

TTFGCY1 Index

Trade

Source

Fair Value

ICAS

ICAS

EGFI

54.22

54.20

ICAS

EGFI

ICAS

22.09

24.53

European Natural Gas Supply and Demand

indicator

GIE Total EU Gas Storage (MCM)

GIE Total EU Gas Storage (% Full)

Yesterday UK gas demand (MCM)

Dayahead UK forecast gas demand (MCM)

Ticker

GIEDSTTL Index

GIEDFTTL Index

UGASDEMD Index

UGASFD1D Index

Value

50,681.68

64.55

247.76

270.85

1-Day Change

-291.31

-0.37

0.00

1.74

U.S. Natural Gas Prices

Henry Hub Prices ($/

MMBtu)

Spot price

APR 14

MAY 14

JUN 14

Ticker

Last Price

NGUSHHUB Index

NG1 Comdty

NG2 Comdty

NG3 Comdty

4.50

4.40

4.39

4.42

Change

From Open

-0.01

0.00

0.00

Time of

Last Trade

-8:14:26 AM

8:14:31 AM

8:13:54 AM

U.S. Natural Gas Supply and Demand

Indicator

Change In Total Gas Storage

Total Gas Demand

Ticker

MMcf/d

NAGSTSTO Index

NAGSTOTC Index

-13,642.00

91,053.00

Change From

Previous Day

-1,872.00

453.00

Global LPG Pricing Data

Indicator

Mont Belvieu LST Propane

Mont Belvieu Non-LST Ethane

Naphtha fob Singapore

Ticker

LPGSMBPP Index

LPGSMBPE Index

NAPHSINF Index

EMEA Gas

Ukraine began talks on importing

natural gas from the European Union via

Slovakia, in an effort to decrease reliance

on supplies from Russia. Representatives

from Ukrtransgas AC and Eustream AS,

the Ukrainian and Slovakian pipeline operators, met with European Commission

■■

1 2 3 4 5 6 7 Last Price

103.75

28.75

100.97

Change

1.75

0.62

-0.38

officials in Brussels yesterday to discuss

technical aspects of trying to reverse the

flow of gas through Slovakia’s pipeline,

EC spokeswoman Sabine Berger and

Eustream spokesman Vahram Chuguryan

said. Ukraine currently exports the fuel to

Slovakia.

— Ladka Bauerova and Ewa Krukowska

03.26.14 www.bloombergbriefs.com

natural gas watch Bloomberg Brief | Oil Buyer’s Guide

5

Naureen S. Malik, Bloomberg news

Winter’s Higher Natural Gas Costs Hint at Future as Power Generation Shifts

Demand for gas, used to heat half of

U.S. households and generate 27 percent

of the nation’s power, reached records

from New York to Los Angeles in January,

sending regional prices to all-time highs.

“The market is basically looking at this

situation as a weather anomaly,” said

Angie Storozynski, a New York-based

utility analyst with Macquarie Capital

USA Inc. “They aren’t pricing in the

tightness of power generation supply

sources. A number of these plants won’t

be around soon.”

A record number of coal units, 86 generators accounting for 10,308 megawatts

of capacity, were mothballed in 2012,

while the 79 plants slated for shutdown in

2015 account for another 11,993 megawatts, said M. Tyson Brown, an analyst

with the EIA, who based the estimate on

data collected from power producers.

Power from coal-fired plants will account for about 40 percent U.S. electric-

“Rolling blackouts would be

more of the norm because of

the aggravated fuel supply.”

– Roshan Bains, director of utilities power

and gas at Fitch Ratings in New York on

increasing U.S. use of natural gas

ity generation this year, down from 44

percent in 2009, EIA estimates show.

Gas will supply 27 percent, up from 23

percent five years ago.

As many as 13 nuclear reactors may be

mothballed or retired early because of

public opposition to extending licenses,

high costs, poor performance or tough

market conditions, according to IRR

Energy data released March 19 in a BNP

Paribas SA conference call. The plants

account for about 11 percent of U.S.

nuclear capacity, EIA data show.

While coal and nuclear plants close,

gas-fired generating capacity will increase

to about 410,000 megawatts by 2016, up

10 percent from 2012, accounting for 35

percent to 40 percent of total U.S. capacity, according to Roshan Bains, director

of utilities power and gas at Fitch Ratings

in New York.

“As you rely more on natural gas, or one

fuel, you will see more and more spikes in

power prices,” Bains said. “Rolling blackouts would be more of the norm because

of the aggravated fuel supply.”

Spot gas at the Transco Zone 6 hub

serving New York rose to a record $135

per million Btu Jan. 21 on the IntercontinentalExchange. Prices have averaged

$18.24 so far in 2014, more than double

a year ago and the most for the time of

year in data compiled by Bloomberg going

back to 2002.

e

r

a

how ing?

o

d

e

w

m or e

,

e

e

t to s

n

a

w

u

o yo

what d the brief?

less in w we can makeaonutrto you.

ev

ho

tell us ters more rel

:

t

tions to

e

s

l

e

s

g

g

w

u

ne

and s

030

ments ll +1-212-617-9

m

o

c

r

u

nd yo rg.net, or ca

e

s

e

s

a

e

ple

bloomb

@

f

e

i

r

b

b

1 2 3 4 5 6 7 BRIEF

03.26.14 www.bloombergbriefs.com

6

Bloomberg Brief | Oil Buyer’s Guide

SPOT PRICES

BENCHMARKS Prices as of end of day in New York

AMERICAS

Bloomberg USGC Sour Index

Light Louisiana Sweet (LLS)

Mars Blend

WTI Cushing

West Texas Sour (WTS)

Bakken

West Canadian Select

Edmonton Syncrude Sweet

Gasoline New York 87

Gasoline U.S. Gulf 87

Gasoline LA 85.5 CARBOB

Jet Fuel No. 54 NY

Jet Fuel No. 54 U.S. Gulf

Diesel ULS NY

Diesel ULS U.S. Gulf

Diesel LS CARB LA

Heating Oil No. 2 NY

Heating Oil No. 2 U.S. Gulf

Fuel Oil NY Cargo 1.0% Low Pour

Fuel Oil U.S. Gulf Coast 3.0%

ASIA PACIFIC

Crude Tapis (Bloomberg)

Crude Dubai Fateh

C&F Japan Naphtha

PRICE

96.41

102.54

97.94

99.54

93.54

97.10

79.53

100.83

266.78

265.65

290.78

295.65

284.15

292.65

288.15

290.65

285.15

274.65

99.63

88.38

PRICE

112.65

103.65

927.38

EUROPE

PRICE

Dated BFOE

Daily BWAVE

95 RON - ARA - FOB barge

MTBE ARA FOB barge

Jet Fuel NW Europe CIF cargo

Jet Fuel W Med FOB

Gasoil ARA FOB barge

Gasoil NW Europe CIF cargo

Gasoil W Med CIF cargo

Diesel ULS ARA FOB barge

Diesel W Med CIF cargo

Fuel Oil ARA FOB barge 3.5%

Fuel Oil W Med FOB cargo 3.5%

Fuel Oil ARA FOB cargo 1%

Fuel Oil NWE FOB cargo 1%

Fuel Oil W Med CIF cargo 1%

106.59

106.94

962.00

1132.00

954.50

928.50

894.00

901.00

900.00

913.50

925.25

571.50

568.50

641.50

625.50

647.50

March 25, 2014

1 DAY

DIFFERENTIALS

SPREAD TO

CHANGE

-0.34

-3.13 WTI

0.19

3.00 WTI

-0.36

-1.60 WTI

-0.56

0.00 NYMEX

0.94

-6.00 WTI

0.14

-3.00 WTI

0.18

-19.00 WTI

0.18

2.00 WTI

-4.56

-21.50 NYMEX

-1.44

-22.63 NYMEX

-1.18

2.50 NYMEX

-0.01

3.50 NYMEX

1.99

-8.00 NYMEX

0.49

0.50 NYMEX

0.99

-4.00 NYMEX

0.99

-1.50 NYMEX

0.74

-7.00 NYMEX

-0.01

-17.50 NYMEX

0.25

0.25

1 DAY

DIFFERENTIALS

SPREAD TO

CHANGE

0.26

0.32

3.29 BRENT

7.38

1 DAY

CHANGE

0.26

-0.22

27.00

28.00

-4.75

-4.75

-4.25

-4.25

-4.25

-3.75

-3.75

-1.75

-1.75

-6.50

-6.50

-6.50

Source: Bloomberg LP

For live prices on Bloomberg enter BOIL<GO> 4<GO>

PRICE SPREADS

PRICES ARE EXPRESSED IN USD PER BARREL

USD/BBL

Brent Crude, Gulf Coast 321 Crack Spread

20

15

10

5

0

(5)

Mar-13

USD/BBL

20

Jun-13

Sep-13

Dec-13

Mar-14

LLS Crude, Gulf Coast 321 Crack Spread

15

10

5

0

Mar-13

USD/BBL

140

130

120

110

100

90

80

70

60

1 2 3 4 5 6 7 Jun-13

Sep-13

Dec-13

Brent Crude, WTI Crude

Mar-14

USD/BBL

Spread ( R)

Brent Front Month (L)

WTI Front Month (L)

M

A M

J

J

A

S

O

N

D

J

F M

27

23

19

15

11

7

3

-1

-5

03.26.14 www.bloombergbriefs.com

Bloomberg Brief | Oil Buyer’s Guide

Futures

FUTURES BASED SWAPS

Prices as of 7:30 a.m. N.Y. Time

99.45

99.27

98.53

97.71

96.78

95.87

107.07

107.00

106.77

106.38

105.89

105.32

WTI

BRNT

-7.62

-7.73

-8.24

-8.67

-9.11

-9.45

0.18

0.74

0.82

0.93

0.91

0.07

0.23

0.39

0.49

0.57

Bal Qt

Q2 14

Q3 14

Q4 14

99.45

98.50

95.90

93.39

Bal Yr

Cal 15

96.28

88.68

Period

Bal Mo

APR 14

MAY 14

JUN 14

JUL 14

AUG 14

WTI

Bal Mo/APR 14

APR 14/MAY 14

MAY 14/JUN 14

JUN 14/JUL 14

JUL 14/AUG 14

Period

Bal Mo

APR 14

MAY 14

JUN 14

JUL 14

AUG 14

BRNT

SWAP CURVES

March 26, 2014

NYHO

NYHOWTI

NYHOBR

NYRB

292.67

292.48

292.06

291.88

291.78

291.67

23.47

23.58

24.14

24.88

25.77

26.63

15.85

15.84

15.90

16.21

16.66

17.18

289.40

289.17

287.15

284.51

281.46

277.70

0.11

0.51

0.43

0.44

0.34

0.19

0.42

0.18

0.10

0.11

-0.11

-0.56

-0.74

-0.89

-0.86

0.01

-0.06

-0.31

-0.45

-0.52

0.23

2.02

2.64

3.05

3.76

107.07

106.71

105.36

104.00

-7.62

-8.21

-9.46

-10.61

292.67

292.14

291.66

290.88

23.47

24.20

26.60

28.78

15.85

15.98

17.14

18.17

289.40

286.94

274.14

257.26

105.53

101.30

-9.25

-12.61

291.67

283.07

26.22

30.20

16.97

17.59

274.44

258.00

NYRBWTI NYRBBR

RBHO

ICEGO

GO BRNT

HOGO

110

Month Ago

90

80

70

Mar 14

Mar 18

WTI-Brent

-7

-11

-15

-19

Mar 14

35

14.48

14.45

13.84

13.12

12.32

11.31

-3.27

-3.31

-4.91

-7.37

-10.31

-13.97

899.50

899.50

899.07

898.33

897.48

896.58

13.67

13.74

13.91

14.20

14.57

15.02

Bal Mo/APR 14

APR 14/MAY 14

MAY 14/JUN 14

JUN 14/JUL 14

JUL 14/AUG 14

-0.09

0.11

0.29

0.35

0.67

0.03

0.61

0.72

0.80

1.01

0.04

1.60

2.46

2.94

3.66

0.00

0.43

0.74

0.85

0.90

-0.07

-0.17

-0.29

-0.37

-0.45

0.29

-0.06

-0.17 30

-0.19

Bal Qt

Q2 14

Q3 14

Q4 14

22.10

22.02

19.24

14.66

14.48

13.80

9.78

4.05

-3.27

-5.20

-17.52

-33.62

899.50

898.97

896.48

891.80

13.67

13.95

14.98

15.70

5.20

4.84 20

5.16

15

5.87

Bal Yr

Cal 15

Source: Bloomberg LP

18.99

19.68

9.74

7.06

-17.23

-25.06

896.12

871.66

14.76

15.70

5.28

4.49

1 2 3 4 5 6 7 Today

100

22.10

22.19

22.08

21.79

21.44

20.77

For live prices on Bloomberg enter CFVL<GO> 96<GO>

WTI

Mar 16

HO-WTI

5.20

5.01

30

4.72

4.78

25

4.95

5.14

20

Mar 14

0.19

Mar 16

RB-WTI

25

10

Mar 14

Mar 16

Mar 18

7

Economics

China Brief

London (free brief)

Economics Europe

Economics Asia

Mergers

Hedge Funds Europe

Hedge Funds

Municipal Market

Financial Regulation

Private Equity

Leveraged Finance

Structured Notes

Technical Strategies

Clean Energy & Carbon

Healthcare Finance

Oil Buyer’s Guide

Bankruptcy & Restructuring