Do Non-monetary Prices Target the Poor? Evidence from a Field

advertisement

Do Non-monetary Prices Target the Poor? Evidence

from a Field Experiment in India

Bridget Hoffmann∗

Northwestern University

November 24, 2014

Abstract

This paper uses a field experiment in India to study the targeting of health products

to the poor, using monetary prices and non-monetary prices (time costs) to allocate

the good. I model household demand for a health product at monetary prices and at

non-monetary prices. The model illustrates that monetary prices screen out the poor

and that it is theoretically ambiguous whether non-monetary prices screen out the rich

or the poor due to opposing income and substitution effects. Therefore, whether nonmonetary prices target the poor better than monetary prices is an empirical question.

In order to generate estimates for demand at monetary prices and at non-monetary

prices, I conducted a field experiment in India in which I elicited respondents’ willingness to pay (WTP) for a water purifier in Rupees and in working hours. I find that

a 10% increase in daily household income implies a 2.0% increase in monetary WTP.

In contrast, a 10% increase in daily household income implies a 0.5% decrease in nonmonetary WTP. Comparing across price types, non-monetary WTP falls 2.3% relative

to monetary WTP for a 10% increase in daily household income. Using demand curves

estimated from the WTP data, I evaluate the problem of a principal with a fixed budget whose objective is to increase take-up of the health product, in particular by those

with greatest need. In this case, the principal targets the poor because the poor are

less likely to own a water purifier at baseline and are more likely to report episodes

of water borne illness. Despite better targeting achieved by non-monetary prices, the

principal optimally chooses a monetary price for a large range of parameters.

∗

BridgetHoffmann2014@u.northwestern.edu, Northwestern University, Department of Economics, 2001

Sheridan Road, Evanston, IL 60208. I would like to thank Treb Allen, Lori Beaman, Matthias Doepke,

Seema Jayachandran, Cynthia Kinnan, Lee Lockwood, Ofer Cohen, Joel Gamoran, Juan D. Prada, and

seminar participants at Northwestern University for their helpful comments and their contributions to the

paper. I would like to thank the Russell Sage Foundation, the Buffett Center at Northwestern University,

and Northwestern University TGS for generous funding. All errors are my own.

1

1

Introduction

In developing countries, many health products have large private and social benefits but

very low take-up at the market price, particularly among the poor.1 Governments and Non

Governmental Organizations (NGOs) use price subsidies to increase take-up,2 but monetary

price subsidies do not select those with the highest returns (Cohen and Dupas, 2010; Kremer

and Miguel, 2007; and Ashraf et al. 2010). The poor often have the greatest benefit from

health products, but are screened out even at subsidized prices, because they lack the cash,

savings, or credit to purchase (Tarozzi et al., 2014; Dupas and Robinson, 2013; Devoto et

al., 2012). Therefore, organizations face a trade-off between higher monetary price subsidies

(at higher cost) and excluding the poor.

An alternative method of allocating health products is non-monetary prices (time costs),

often called “self-selection” mechanisms. Non-monetary prices may target the poor better

than monetary prices because selection occurs on willingness to pay in time rather than

money. If the time spent to purchase the product is productive, non-monetary prices may

allow organizations to recover partial product costs without screening out the poor.

This paper studies two methods of targeting health products to the poor, monetary prices

and non-monetary prices, using data from a field experiment in India. I develop a model of

household demand for a health product at monetary prices and at non-monetary prices that

illustrates three features of demand. First, I show that for any monetary price rich demand

exceeds poor demand, implying that the poor are underrepresented among demanders. Second, the model demonstrates that non-monetary prices may not result in greater demand

among the poor than the rich due to opposing income and substitution effects. When the

utility function is concave, a higher wage implies a greater loss of consumption for each hour

of work forgone to pay the non-monetary price, but also implies a lower marginal utility of

consumption. These opposing effects imply that whether the utility cost of the non-monetary

price is increasing in the wage is theoretically ambiguous. Third, regardless of whether the

utility cost of the non-monetary price is increasing in the wage, the model illustrates that,

relative to the rich, the utility cost of a monetary price is greater than the utility cost of

a non-monetary price for the poor. This implies that non-monetary prices target the poor

1

For high price sensitivity for health products, see J-PAL (2011), Berry, Fischer, and Guiteras (2012),

Dupas (2014a), Dupas (2014b), and Miguel and Kremer (2004). For large private and social benefits of health

products, see Miguel and Kremer (2004), Arnold and Colford (2007), Baird et al. (2011), and Thomas et al

(2006).

2

Information campaigns are an alternative to subsidies but have little effect on price sensitivity (Kremer

and Miguel, 2007; Dupas, 2009; Meredith et al., 2013).

2

better than monetary prices.

To empirically test whether non-monetary prices target health products to the poor better

than monetary prices, I conducted a field experiment in Hyderabad, India using the TATA

Swach Smart water purifier.3 The experiment included nearly 800 households in seventeen

slum neighborhoods of Hyderabad. At baseline, 70% of households did not own a water

purifier and 41% of households reported that at least one household member suffered from

an illness perceived to be caused by the drinking water during the last rainy season.

I used the Becker-DeGroot-Marshak (BDM) mechanism (Becker, DeGroot, Marshak,

1964) to elicit respondents’ willingness to pay (WTP) for a TATA Swach Smart water purifier

at monetary prices (rupees) and at non-monetary prices (hours sorting seeds by type). The

BDM mechanism is similar to a second-price auction in which the second-price is an unknown,

randomly drawn price. The respondent states her maximum willingness to pay for a good

and then a price is randomly drawn from a distribution of possible prices. If the price is

less than or equal to the respondent’s WTP, she purchases the good at the randomly drawn

price. If the price is above the respondent’s WTP, she cannot purchase the good.

I analyze the distribution of WTP for each price type across income levels. I find that

monetary WTP is increasing in income. A 10% increase in household daily labor income

implies a 2.0% increase in monetary WTP. For all monetary prices, rich demand exceeds poor

demand and the fraction of total demand that is poor falls as the monetary price rises. I can

reject equality of the rich and poor monetary demand curves. Household income is negatively

correlated with non-monetary WTP. A 10% increase in daily household income implies a 0.5%

decrease in non-monetary WTP, but I cannot reject that the rich and poor demand curves

are the same for non-monetary prices. In a pooled sample of households’ monetary WTP and

non-monetary WTP, I use household fixed effects to control for households’ fixed valuation

of the water purifier. Focusing on the differential effect of income on WTP by price type,

I find that non-monetary WTP falls relative to monetary WTP as income rises. Therefore,

non-monetary prices target the poor better than monetary prices (a larger fraction of total

demand is poor) even though non-monetary demand is similar across income levels.

Next, I evaluate non-monetary prices as a policy to target health products to the poor.4

3

The TATA Swach Smart water purifier follows US EPA guidelines and is economical in terms of both

the initial cost (retail price of 999 Rs) and the cost per liter relative to similar water purifiers.

4

Self-selection mechanisms are widely useful as a method of targeting the poor. For example, the National

Rural Employment Guarantee Scheme (NREGS/NREGA) is a targeted poverty alleviation program in India

that covers 11% of the world’s population (Niehaus and Sukhtankar, 2013). Although the purpose of NREGA

is to transfer resources to the rural poor, all households are eligible for NREGA benefits. The program relies

on poorer households self-selecting into the program while richer households self-select out of the program

3

I model the problem of a principal with a fixed budget who can choose either a monetary

price or a non-monetary price to allocate the health product. The principal’s objective is to

increase take-up of the health product, in particular by those with the greatest need. In this

case, the principal targets the poor because the poor are more likely to report episodes of

water borne illness and are less likely to own a water purifier at baseline.

I evaluate the principal’s problem in three steps. First, I use the experimental WTP

data to estimate the total demand and the poor demand curve for each price type. Second,

I find the optimal monetary price from the set of monetary prices, and I find the optimal

non-monetary price from the set of non-monetary prices. Third, I compare the value of the

objective using the optimal monetary price and optimal non-monetary price to determine

the optimal price.

The optimal price depends on the need of the poor relative to the rich. In the case that

the principal does not target the poor because there is no difference in need across income

levels, the principal simply chooses the price type with a lower net cost per unit at the

optimal prices. As the relative weight on the poor increases, the principal places increasing

weight on the difference in targeting achieved by the price types at the optimal prices. In

the case that the rich have no need for the health product, the principal only values health

goods distributed to the poor, and the principal compares the difference in the net cost per

unit to the difference in targeting achieved by the price types at the optimal monetary price

and the optimal non-monetary price.

I show that a non-monetary price is optimal only when the principal places much greater

weight on the poor than on total take-up. When the productivity of the non-monetary

price is 50 Rs per hour, the principal prefers a monetary price to a non-monetary price if

the rich have a relative weight of at least 0.136 (relative to the poor’s weight of 1). As

the productivity of the non-monetary price (hours worked in exchange for the health good)

increases the subsidy is effectively less costly and the non-monetary price is preferred to the

monetary price for a larger range of parameters. When the principal weighs the allocation

to the rich and poor according to the fraction of diarrhea episodes, the principal prefers the

monetary price to the non-monetary price until the non-monetary price has a productivity

of 85 Rs per hour.

Three recent experiments study the effectiveness of self-selection mechanisms in targeting

resources in developing counties. Alatas et al. (2013) provides evidence that an ordeal

combined with an asset test leads to a much poorer group of beneficiaries for Indonesia’s

because of the manual labor requirements.

4

Conditional Cash Transfer Program than a universal asset-based enrollment system. Ma,

Sylvia, Boswell, and Rozelle (2013) and Dupas, Hoffmann, Kremer, and Zwane (2013) study

the effectiveness of self-selection mechanisms in selecting those most likely to use the goods

for health purposes. Ma, Sylvia, Boswell, and Rozelle (2013) use distance from a student’s

home to the county seat, where a voucher can be redeemed, as an ordeal mechanism in the

distribution of eyeglasses to students in rural China. In western Kenya, Dupas, Hoffmann,

Kremer, and Zwane (2013) use a voucher for water treatment solution that can be redeemed

at a market center as a “micro-ordeal”. The micro-ordeal varies by whether households can

redeem the voucher in the market center nearest to their home. Both experiments find that

the ordeal reduces program costs without screening out a substantial number of people who

would have used the health product if given for free.

This paper builds on the previous results that non-monetary prices can improve targeting

and lower program costs. The WTP data used in this paper provide a much finer measure

of non-monetary WTP, which allows me to determine the optimal non-monetary price as

a function of the principal’s budget, the need of the poor relative to the rich, and the

productivity of the non-monetary price.

The remainder of the paper is organized as follows. In section 2, I model household

demand at monetary prices and non-monetary prices. The experimental design is described

in section 3. In section 4, I investigate the distribution of willingness to pay. In section 5, I

model the problem of a principal with a fixed budget dedicated to distributing preventative

health products. I evaluate the principal’s problem using estimated demand functions for

monetary and non-monetary prices and discuss the optimal pricing policy. In section 6,

I perform robustness checks, specifically concerning the distribution of willingness to pay.

Section 7 concludes.

2

Household Model

This section describes a simple model of a household’s decision whether or not to purchase

a water purifier through the subsidy program either for a monetary price, PM , or for a

non-monetary (time) price, PN M . PN M is denominated in hours.

Households have quasi-linear utility U = u(ci ) + αi 1[di = 1] with a common, increasing,

and strictly concave utility function over consumption goods. Households receive additional

utility αi from ownership of a water purifier which captures the household specific utility

received from a water purifier in the form of better health and increased earnings due to

5

reduced incidence of illness. d is an indicator variable for purchase of the water purifier.

Households earn income from labor at an exogenously determined wage, wi ∈ {wp , wr }

with wp < wr . There is no disutility of labor so all households choose to work the maximum

number of hours, h̄.

Household i maximizes its utility subject to its budget constraint, ci + 1[di = 1]·PM ≤ wi h̄

for a monetary price and ci ≤ wi ∗ (h̄ − 1[di = 1] · PN M ) for a non-monetary price. Household

i purchases a water purifier if the additional utility received from a water purifier exceeds

the loss in utility from reduced consumption. This creates a cut-off level of α for each wage

level, j, and price type, k, denoted αkj such that a household will purchase a water purifier if

its value of α exceeds the cut-off value and will not purchase otherwise. The cut-off level of

α for households facing a monetary price is given by u(wi h̄) − u wi h̄ − PM and the cut-off

level of α for households facing a non-monetary price is given by u(wi h̄) − u wi ∗ (h̄ − PN M ) .

Suppose that αi is distributed uniformly among households with each wage. Without loss

of generality, assume that the support of α is [0,1].

The following proposition shows that demand among the rich exceeds demand among

the poor for any monetary price.

Proposition 1. For the set of monetary prices, PM , such that Dr (PM ) > 0 and Dp (PM ) < 1

the proportion of households that purchase a water purifier among those with the high wage

is greater than the proportion of households that purchase a water purifier among those with

the low wage: Dr (PM ) > Dp (PM ).

p

p

r

and Dp (PM ) = 1 − αM

Proof. Since Dr (PM ) = 1 − αM

, the result holds since αM

=

r

by concavity of the utility function

u(wp h̄) − u(wp h̄ − PM ) > u(wr h̄) − u(wr h̄ − PM ) = αM

for consumption. Strict concavity of u implies that for every λ ∈ (0, 1) and for every pair

0 ≤ x < x0, u(x0) + u(x) < u(λx + (1 − λ)x0) + u(λx0 + (1 − λ)x). The result follows by

PM

, x = wp h̄ − PM , and x0 = wr h̄.

choosing λ = wr h̄−w

p h̄+PM

The conditions Dr (PM ) > 0 and Dp (PM ) < 1 are needed to rule out boundary cases in

which no households or all households demand a water purifier at price PM .

Intuitively, households with the higher wage have a lower marginal utility of consumption

and suffer a smaller disutility of forgone consumption when they purchase a water purifier

at a monetary price.

The following corollary extends the result above to consider changes in demand in response to a monetary price change. The difference in demand at the lower monetary price

and at the higher monetary price is decreasing in the wage.

6

Proposition 1 implies that for any monetary price, demand is lower among the poor

p (P )

M

is always less than one-half. The above

than among the rich so the targeting ratio, DD(P

M)

proposition holds for all monetary price levels, showing the potential for non-monetary prices

to target the poor more effectively than monetary prices.

When considering demand at a non-monetary price, it is not necessarily true that for

a given value of α, households with a higher wage, and higher opportunity cost of time,

have lower demand. The classical literature on ordeal mechanisms has assumed that time

costs are more costly in utility terms for the rich (Barzel, 1974; Nichols, Smolensky, and

Tideman, 1971; Nichols and Zeckhauser, 1982; and Besley and Coate, 1992). For example,

when the utility function for consumption is linear, the utility cost of the non-monetary

price is proportional to the wage and demand is decreasing in the wage. However, when the

utility function is concave, the utility cost of a non-monetary price is not proportional to the

wage. There are two opposing effects of a higher wage: (1) the substitution effect: a higher

wage results in greater loss of consumption utility from forgoing an hour of work to pay

the non-monetary price since each hour of work can buy relatively more consumption; (2)

the income effect: a higher wage implies higher consumption, and therefore, lower marginal

utility of consumption, leading to a smaller utility loss from forgoing an hour of work to pay

the non-monetary price. Non-monetary prices are most effective in targeting the poor when

the substitution effect outweighs the income effect, and the marginal utility of consumption

does not decrease too rapidly as consumption rises in the relevant range.

The following proposition shows the conditions under which non-monetary prices will

result in greater demand among the poor than among the rich.

Proposition 2. Define v(w, PN M ) = u(w(h̄ − PN M )). If v satisfies increasing differences in

w and −PN M , then for the set of non-monetary prices, PN M , such that Dr (PN M ) < 1 and

Dp (PN M ) > 0 demand among the poor is greater than demand among the rich: Dp (PN M ) >

Dr (PN M ).

p

Proof. Demand for the poor is given by Dp (PN M ) = 1 − αN

M and demand for the rich is

r

r

given by D (PN M ) = 1 − αN M . The result holds if v satisfies increasing differences in w and

−PN M because this implies u(wr h̄) − u(wr (h̄ − PN M )) > u(wp h̄) − u(wp (h̄ − PN M )).

The conditions Dr (PN M ) < 1 and Dp (PN M ) > 0 are needed to rule out boundary cases

in which all households or no households demand the water purifier at price PN M .

For utility functions, such as CRRA with relative risk parameter γ ∈ (0, 1), which satisfy

the requirements above, the utility cost of the non-monetary price is increasing in the wage

7

and demand at the non-monetary price is decreasing in the wage. In this case the targetp (P

NM )

is always greater than one-half and increases as the non-monetary price

ing ratio, DD(P

NM )

increases.

Even if non-monetary prices do not result in greater demand among the poor than among

the rich, there is still scope for non-monetary prices to better target the poor than monetary

prices. The following proposition shows that the targeting ratio is always greater for a nonmonetary price than for a monetary price. This follows directly from the propositions above

but also holds under weaker conditions.

Proposition 3. For PM and PN M such that Dp (PM ) > 0 and Dr (PN M ) > 0, the targeting ratio for a non-monetary price is greater than the targeting ratio for the corresponding

p (P

p (P )

NM )

M

monetary price: DD(P

> DD(P

.

NM )

M)

p (P

Dp (PM )

p

p

p

NM )

r

]

> [1 − αM

] ∗ [1 −

>

implies

that

[1

−

α

]

∗

[1

−

α

]

+

[1

−

α

Proof. DD(P

M

N

M

M

)

D(P

)

NM

M

p

r

αN M ]+[[1−αN

M ] . Normalize wp = 1 so the poor are indifferent between paying a monetary

r

r

price or a non-monetary price of equal magnitude. Then [1 − αM

] > [1 − αN

M ] since wr > 1

and u0(·) > 0.

The boundary conditions Dp (PM ) > 0 and Dr (PN M ) > 0 ensure that demand is positive

for both the poor and the rich at both the monetary price and non-monetary price. The

proposition above shows that non-monetary prices will result in better targeting of the poor

than monetary prices.

This simple model illustrates that monetary prices screen out the poor and that the

targeting ratio for monetary prices is always less than the fraction of the population that

is poor. While the targeting ratio for non-monetary prices may be greater or less than the

fraction of the population that is poor, it always exceeds the targeting ratio of monetary

prices.

3

Experimental Design

The experiment was conducted in Hyderabad, Telangana from June 26, 2013 to July 18,

2013. Seventeen slums were randomly selected from a list of nearly 1,400 slums provided by

the Greater Hyderabad Municipality. The list was restricted to slums with a population of at

least 100 households.5 Door-to-door surveying was conducted from Monday to Friday, with

5

This excluded 5 slums with missing population data and 323 slums with fewer than 100 households.

Thirteen slums selected from the list were skipped because they could not be located (6 slums) or because

the neighborhood was located but did not contain a low-income, residential area (7 slums).

8

the survey team visiting a new slum neighborhood each day. Households were surveyed if an

adult (age 20 years or above) household member was available and the household contained

more than one person.6 On average, 47 households completed the main survey in each slum

with the number depending on the weather and surveyor absences.

Since the primary objective of the experiment was to study targeting of health investment

goods to the very poor, households in the top and bottom quartiles of the income distribution

were overrepresented in the sample. Eligibility for the main survey was determined by a presurvey that consisted of 6 questions about household asset ownership and one categorical

income question.7 1,233 potential respondents completed the pre-survey. Of these, 804

respondents were determined to be eligible for the main survey, and 798 completed the full

survey.

The main survey included sections covering income and assets, savings and credit, household expenditure, and education. An additional section asked questions regarding water

source, water treatment, and water borne illnesses. A detailed section collected information about all household members’ labor market activities.8 Table 1 presents household and

respondent summary statistics for the full sample, poor (below median income), and rich

(above median income).

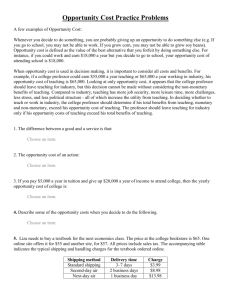

After these sections, surveyors introduced the water purifier by reading a passage with

information on the TATA Swach Smart. The TATA Swach Smart follows US EPA guidelines and is economical in terms of both the initial cost of the water purifier (market price of

999 Rs) and the cost per liter compared to similar water purifiers (for example, the PureIt

brand).9 Surveyors showed respondents an assembled TATA Swach Smart and gave respondents time to examine the water purifier and its box which displays the Maximum Retail

Price. Figure 1 contains an annotated diagram of the TATA Swach Smart, and Appendix A

contains the passage that surveyors read to respondents.

Two sections of the main survey elicited respondent’s monetary willingness to pay and

non-monetary willingness to pay for the TATA Swach Smart using the Becker-DeGrootMarshak (BDM) mechanism. The BDM mechanism is similar to a second-price auction

6

Single occupant households were excluded because they were primarily bachelors who traveled to Hyderabad for school and would frequently return to their family outside of Hyderabad.

7

The asset section of the pre-survey asked questions regarding tablets/laptops/computers, washing machines, four-wheeled vehicles, motorbikes/motorcycles/scooters, coolers, and cots/beds.

8

In addition, the survey included two sections regarding mental accounting statements developed in

Soman (2011), with one section for time and one section for money. The order of these two sections was

randomized by household.

9

The market price of 999 Rs is approximately 16.50 USD.

9

in which the second-price is an unknown, randomly drawn price. The respondent states

her maximum willingness to pay for a good and then a price is randomly drawn from a

distribution of possible prices. If the price is less than or equal to the respondent’s WTP,

she purchases the good at the randomly drawn price. If the price is above the respondent’s

WTP, she cannot purchase the good. For expected utility maximizers, the BDM mechanism

should elicit respondents’ true maximum willingness to pay. The theory behind the BDM

mechanism and experimental evidence of its ability to elicit truthful WTP are described in

Appendix B.

Each willingness to pay section walked respondents through the BDM mechanism. First,

the respondent was asked to state her maximum willingness to pay (WTP) for the water

purifier in rupees or in time spent sorting seeds by type. Next, the respondent was asked

if she would purchase the water purifier at each price on a price list, beginning at 50 Rs (1

hour) lower than her initial bid. The prices on the price list increased by an increment of 50

rupees (1 hour). Once the respondent stated that she would not purchase at a given price,

no questions were asked regarding higher prices. The highest price at which the respondent

stated that she would purchase was confirmed as her maximum willingness to pay. If a

respondent indicated that she would not purchase the water purifier at a price 50 Rs (1

hour) lower than her initial bid or she refused to answer a question in the price list, the

process was started again by asking the respondent to revise her initial willingness to pay.10

The two willingness to pay sections were designed to be identical except for the references

to time and money. The order of these two sections was randomized by household. The script

for both sections clearly state that the respondent cannot change her bid after seeing the

price and emphasize that respondents must be willing and able to pay the amount that they

bid on the following Saturday when all transactions take place. These scripts are shown in

Appendix A.

After eliciting each respondent’s maximum willingness to pay in money and in time,

respondents were randomly assigned to treatment groups with 418 assigned to the monetary price group and 380 assigned to the non-monetary price group.11 Respondents in the

monetary group randomly drew a price in the range 50 Rs to 999 Rs and respondents in

10

In pre-trials, this method resulted in the fewest respondents refusing to purchase or reporting regret when

the price chosen was less than or equal to their stated maximum willingness to pay and the most respondents

stating that they preferred not to purchase when the price chosen was above their stated maximum willingness

to pay.

11

To assign treatments, without looking, respondents chose a tile from a box that contained two tiles

with the word money and two tiles with the word time. The tile that the respondent chose determined the

respondent’s treatment group.

10

the non-monetary group randomly drew a price in the range 1 hour to 18 hours. The nonmonetary price range was chosen to be approximately equal to the monetary price range at

the prevailing male casual labor wage (about 450-500 Rs per 8-9 hour day).12

If the random price was below the respondent’s maximum willingness to pay (of the

same price type), she was given a voucher for the water purifier. Respondents who received

a voucher for the water purifier (those whose willingness to pay was above the price) were

asked if they wished that they had not bid so high and respondents who did not receive

a voucher for the water purifier (those whose willingness to pay was below the price) were

asked if they wished that they had bid more. At the conclusion of the survey, all respondents

were compensated for participation with a steel dining plate.13

For logistical reasons, both monetary and non-monetary price vouchers were redeemed

the following Saturday in a temple, school, or community center in the neighborhood.14 This

also kept the time and conditions of transaction consistent across money and time treatment

groups. Respondents who redeemed a voucher with a monetary price simply paid a surveyor

the price on her voucher and received a TATA Swach Smart. Respondents who redeemed a

voucher with a non-monetary price sorted seeds into piles by type for the number of hours

on their voucher. Although vouchers could be redeemed by either the respondent or his/her

spouse, 86% of redeemed vouchers were redeemed by the respondent.15

4

Willingness to Pay

I begin by looking at the distributions of monetary WTP and non-monetary WTP. Figures 2

and 3 show the percentage of respondents who stated a willingness to pay at least as high as

the price for each price level. Willingness to pay was elicited for one water purifier through

the BDM mechanism. Separate distributions are shown for target, poor households and nontarget, richer households. The poor subsample consists of households with per capita total

income less than or equal to the median in the sample.16 The objective of the pre-survey

was to oversample households in the top and bottom quartiles of the population income

12

450 Rs is approximately 7.50 USD.

The plates were purchased at a bulk price of approximately 30 Rs. per plate (approximately 0.50 USD).

14

Redemption centers were open Saturdays from 10am to 6pm but stayed open past the closing time or

opened on Sunday if a respondent needed additional time to complete her non-monetary payment.

15

Figures 11 and 12 show the number of vouchers issued and redeemed by income level for monetary

prices and for non-monetary prices.

16

The poor comprise 51% of the sample because many households report the median per capita household

income.

13

11

distribution. Splitting the sample into rich and poor subsamples at the median ensures that

all households in the bottom quartile of the population income distribution are included in

the poor subsample. For simplicity, non-target households with per capita household income

above the median are referred to as “rich”.

Figure 2 shows the percentage of households in each income group with BDM bid greater

than or equal to the price for each monetary price. As predicted by Proposition 1, for every

monetary price except 50 Rs, demand is greater among the rich than among the poor. The

Kolmogorov-Smirnov test rejects equality of the rich and poor distributions of monetary

WTP (p-value < 0.001). Appendix Figure 1 shows the proportion of respondents with

monetary willingness to pay above the price by quartile of the income distribution. The

poorest quartile generally has the lowest demand and the richest quartile generally has the

highest demand. However, the richest quartile does not have the highest demand at very

low prices and the poorest quartile does not have the lowest demand at very high prices.

Figure 3 shows the percentage of each income group with BDM bid greater than or equal

to the price for each non-monetary price. Proposition 2 described the conditions under which

poor demand will exceed rich demand at non-monetary prices. The curves suggest that the

sufficient condition for non-monetary prices to result in greater demand among the poor than

the rich does not hold. Although the poor have greater demand than the rich for all nonmonetary price levels, the difference between the curves is small at all price levels, and the

Kolmogorov Smirnov test does not reject equality of the rich and poor distributions of nonmonetary WTP (p-value of 0.326). Appendix Figure 2 shows the proportion of respondents

with non-monetary willingness to pay above the price by quartile of the income distribution.

The richest quartile generally has the lowest demand while the demand of the first and third

quartiles are very similar.

Figure 2 suggests that monetary prices will select richer households while Figure 3 suggests that non-monetary prices will not provide strong selection on income. In order to

quantify the correlation between income and willingness to pay for each price type, I directly

analyze the relationship between income and willingness to pay.

Tables 2 and 3 present the results of OLS regressions of the natural logarithm of WTP

on the natural logarithm of income with robust standard errors. Table 2 presents the results

using monetary WTP (Rs) as the dependent variable, and Table 3 presents the results using

non-monetary WTP (minutes) as the dependent variable.17 In each table, Panel A uses

17

In order to facilitate comparison of coefficients across price types, non-monetary willingness to pay is

denominated in minutes. The market wage for male casual labor is approximately 450-500 Rs per 8-9 hour

day or a wage rate of approximately 1 Rs per minute.

12

variables measuring daily labor income, Panel B uses daily total income variables, and Panel

C uses hourly wage variables.18 Columns (1)-(2) look at the effect of household income on

WTP and columns (3)-(4) look at the effect of respondent income on WTP. Columns (1) and

(3) present baseline regressions. Columns (2) and (4) include neighborhood fixed effects.

Columns (1)-(2) of Table 2 show that household income is positively correlated with monetary WTP for the water purifier; when including neighborhood fixed effects, a 10% increase

in household daily labor income implies a 2.0% increase in monetary WTP. At the mean,

this implies that an additional 52 Rs of household daily labor income raises WTP by 5.8 Rs.

As shown in columns (3)-(4) of Table 2, respondent income is also positively correlated with

monetary WTP. When neighborhood fixed effects are included, a 10% increase in respondent

daily labor income implies a 1.7% increase in monetary WTP. At the mean, this implies that

an additional 22 Rs of respondent daily labor income raises WTP by 5.2 Rs.19

Columns (1)-(2) of Table 3 show that household income is negatively correlated with nonmonetary WTP for the water purifier, although the effect is small relative to the effect for

monetary willingness to pay. When neighborhood fixed effects are included, a 10% increase

in household daily labor income implies a 0.5% decrease in non-monetary WTP. At the mean,

this implies that an additional 52 Rs of daily household labor income lowers non-monetary

WTP by 8.6 minutes. Columns (3)-(4) show that respondent income does not appear to be

correlated with non-monetary WTP.

Tables 2 and 3 show there is stronger selection on household income than on respondent

income, particularly for non-monetary prices. The presence of a respondent who does not

work or who works for a low wage does not necessarily identify a poor household. Therefore,

the results in Tables 2 and 3 support the use of non-monetary prices to select poor households.

Corroborating this, Appendix Table 1 shows that the asset index is positively correlated with

monetary WTP and negatively correlated with non-monetary WTP.20 Further, selection

occurs on household income rather than on household characteristics that may affect a

household’s valuation of the water filter. Appendix Tables 2 and 3 shows that, with the

exception of owning a water purifier at baseline, household characteristics (the number of

children in the household under age 14, episodes of illness perceived to be caused by the

18

The hourly wage is calculated for salaried workers by assuming 26 working days per month. The number

of hours worked per day is taken from survey data.

19

I cannot reject that the coefficients for household income (column (2)) and respondent income (column

(4)) are equal in any of the three panels.

20

The asset index is the first principal component of variables representing household ownership of five

durable goods: automobiles, motorbikes/scooters, tablets/computers, washing machines, and evaporative

coolers. The asset index is normalized to have mean 0 and standard deviation 1.

13

drinking water, treating drinking water at baseline, and credit constrained) are not correlated

with WTP.21

Using each households’ monetary WTP and non-monetary WTP, I can focus on the differential effect of income on monetary WTP and non-monetary WTP. I use a pooled sample

in which the dependent variable is either the natural logarithm of monetary WTP or the

natural logarithm of non-monetary WTP scaled by the median respondent hourly wage (23

Rs per hour). The regression equation contains household fixed effects, an indicator variable for non-monetary WTP, and the interaction between the non-monetary WTP indicator

and the natural logarithm of an income variable with robust standard errors clustered by

household. Because the household fixed effect controls for household’s fixed valuation of the

water purifier, the general effect of income on WTP for the water purifier is not identified in

this specification. However, the coefficient on the interaction term identifies the differential

effect of income on monetary WTP and non-monetary WTP.

Table 4 presents the results of the pooled regressions using various measures of household

and respondent income. Columns (1)-(2) use daily labor income variables, columns (3)(4) use daily total income variables, and columns (5)-(6) use hourly wage variables. As

household income and respondent income rise, non-monetary WTP falls relative to monetary

WTP. Column (1) shows that increasing household daily labor income by 10% decreases

non-monetary WTP by 2.3% relative to monetary WTP. Similarly, column (2) shows that

increasing respondent daily labor income by 10% decreases non-monetary WTP by 2.0%

relative to monetary WTP. The difference in monetary WTP and non-monetary WTP is

increasing in income, implying that non-monetary prices may better target the poor than

monetary prices.

Because I observe each respondents’ monetary WTP and non-monetary WTP, I can

compare respondents’ value of time (monetary WTP divided by non-monetary WTP) to

their wage. Respondents who make the decision of whether to pay a non-monetary price or

work for a wage at the margin have a value of time close to their hourly wage. On average,

respondents who work for a wage and have the flexibility to work part of a day value their

time at 1.07 times their wage.22 Respondents who work but do not make the decision of

whether to pay a non-monetary price or work for a wage at the margin have a value of

time that is much greater than their hourly wage. On average, respondents who work for a

21

Households that own a water purifier at baseline have lower monetary WTP and non-monetary WTP

than households that do not own a water purifier at baseline.

22

There are 88 respondents who report working for a wage and report the flexibility to work part of a

day.

14

wage but cannot work part of a day value their time at 3.5 times their hourly wage.23 These

respondents have a value of time greater than the hourly wage because they must forgo more

than an hour of labor income to pay an hour of the non-monetary price.

The flexibility of hours worked is an important determinant of non-monetary WTP relative to monetary WTP, and therefore, differences in the flexibility of hours worked across

income levels is an important determinant of the targeting achieved by non-monetary prices

relative to monetary prices. The percentage of respondents who work for a wage is very similar across income levels, but the percentage of respondents who report the ability to adjust

hours worked downwards differs across income levels. 45% of rich respondents who work for

a wage report downward flexibility in hours worked and 30% of poor respondents who work

for a wage report downward flexibility in hours worked.24 This implies that non-monetary

prices will better target the poor in contexts in which the rich do not have greater flexibility

in hours worked than the poor.

Finally, I consider the targeting achieved by each of the price types. Consistent with

Proposition 3, Table 5 shows that for any level of take-up among the poor, non-monetary

prices result in fewer windfall beneficiaries (rich households) than monetary prices.25 For

example, poor demand at the monetary price 200 Rs is 277 households. This is nearly

identical to poor demand at the non-monetary price 2 hours, 273 households. However,

the monetary price results in demand of 297 rich households while the non-monetary price

results in demand of 257 rich households. Similarly, poor demand at the monetary price

350 Rs is 103 households which is nearly identical to poor demand of 99 households at the

non-monetary price 4 hours. The monetary price results in rich demand of 158 households

and the non-monetary price results in rich demand of 89 households. In both cases, the

non-monetary price results in fewer windfall beneficiaries.

Table 5 also compares prices on the basis of the targeting ratio (proportion of purchasers

who are poor). Table 5 shows that non-monetary prices have a greater targeting ratio than

monetary prices. Further, as prices rise, non-monetary prices better target the poor, while

the opposite occurs for monetary prices. Figure 4 graphs the targeting ratio versus poor

demand for each price type. Moving right along the x-axis, prices rise and poor demand

falls. The figure illustrates that as prices rise the targeting ratio for monetary prices falls

and the targeting ratio for non-monetary prices rises. Despite the better targeting achieved

by non-monetary prices, non-monetary prices may not be the most cost effective method of

23

There are 151 respondents who work for a wage and report that they cannot work part of a day.

36% of rich respondents work for a wage and 33% of poor households work for a wage.

25

Table 5 includes prices for which total take-up is at least 20 households.

24

15

targeting the poor.

5

Principal’s Problem

I describe the problem of a principal, such as an NGO or government health ministry, whose

objective is to increase take-up of a health good within its borders. The principal most

values reaching those with greatest need, in this case, the poor. The principal can choose

either a monetary price or a non-monetary price to allocate the good.

The principal has fixed budget B dedicated to purchasing the health good at the market

price, M . The total number of units that the principal can distribute at a price P is the

minimum of total demand at price P , D(P ), and the number of units the principal can

afford to purchase. For each price type, there is a unique market clearing price, because the

number of units the principal can afford to purchase is weakly increasing in the price and I

assume demand is decreasing in both price types.

Although non-monetary prices achieve better targeting than monetary prices for a given

level of poor demand, a non-monetary price is not necessarily optimal. Unless the nonmonetary price is highly productive, for a given level of demand, monetary prices recover

greater products costs than non-monetary prices. Therefore, the principal effectively has

a larger budget when using a monetary price. Because the optimal price is decreasing in

the budget, there may be little difference in targeting between the optimal monetary price

and the optimal non-monetary price, but the monetary price can reach substantially more

households.

The principal’s objective places weight δ ∈ [0, 1] on total allocation, A(P ), and places

weight 1 − δ on allocation to the poor, Ap (P ):

δ ∗ A(P ) + (1 − δ) ∗ Ap (P ).

Since the distribution to the poor is included in the total allocation, this implies that a unit

allocated to the rich receives weight δ while a unit allocated to the poor receive a weight of 1.

I examine the choice between using a monetary price or a non-monetary price to allocate the

health good as a function of the productivity of the non-monetary price, ω, and the relative

weight on a unit allocated to the rich, δ. This is distinct from the problem of a social planner

who maximizes a social welfare function.

If the principal uses a monetary price, the total number of units that the principal

B

]. Similarly, if the principal uses a

can distribute is given by A(PM ) = min[D(PM ), M −P

M

16

non-monetary price, the total number of units that the principal can distribute is given by

B

A(PN M ) = min[D(PN M ), M −ωP

], where ω represents the benefit to the principal of each

NM

hour worked in exchange for the the health good. If PN M is pure deadweight loss then ω = 0.

I assume the only tools available to the principal for targeting are prices. This implies

that units are randomly allocated among demanders when there is excess demand.26 When

there is excess demand, the number of water purifiers distributed to the poor with a monetary

p (P )

B

M

price is given by Ap (PM ) = DD(P

∗ M −P

, where Dp (PM ) is poor demand at price PM ,

M)

M

and the number of units distributed to the poor with a non-monetary price is given by

p (P

B

NM )

∗ M −ωP

, where Dp (PN M ) is poor demand at price PN M .

Ap (PN M ) = DD(P

NM )

NM

When δ = 1, the principal values only the total number of units distributed. In this case,

B

∗

∗

and similarly

the principal maximizes A(PM ) by choosing PM

such that D(PM

) = M −P

∗

M

B

maximizes A(PN M ) by choosing PN∗ M such that D(PN∗ M ) = M −ωP

.

∗

NM

When δ < 1, the principal values targeting in addition to maximizing total demand. In

this case, the principal will not necessarily choose the monetary price or the non-monetary

price at which demand equals the number of units that the principal can supply. In particular,

when the targeting ratio is decreasing in the monetary price, the principal may choose a low

price such that there is excess demand but a higher targeting ratio. However, a price for which

there is excess supply will never be optimal. If there is excess supply, lowering the price will

improve coverage and targeting by monotonicity of the demand function. For a monetary

B

] =

price, the total number of units distributed is given by A(PM ) = min[D(PM ), M −P

M

B

27

.

M −PM

Similarly, a non-monetary price for which there is excess supply is never optimal so the

B

total number of units distributed can be written as A(PN M ) = min[D(PN M ), M −ωP

] =

NM

B

28

. In addition, when the targeting ratio is increasing in the non-monetary price,

M −ωPN M

a non-monetary price for which there is excess demand is never optimal and the principal

B

. When the targeting

chooses the non-monetary price PN∗ M such that D(PN∗ M ) = M −ωP

∗

NM

ratio is increasing in the non-monetary price, increasing the non-monetary price allows the

B

B

When there is excess demand at a monetary price A(PM ) = M −P

, and A(PN M ) = M −ωP

when

M

NM

there is excess demand at a non-monetary price

27

Define P̄M such that D(P̄M ) = M −BP̄M . Suppose that there is excess supply at a price P̃M , then

26

A(P̃M ) = min[D(P̃M ), M −BP̄M ] = D(P̃M ). Since demand is decreasing in the price and

B

M −PM

is increasing

in the price, P̃M > P̄M . Then A(P̃M ) = D(P̃M ) < D(P̄M ) = A(P̄M ). Therefore, there is greater coverage

with price P̄M than with price P̃M . At both price P̃M and price P̄M , all demand is satisfied. Then Ap (P̃M ) =

Dp (P̃M ) < Dp (P̄M ) = Ap (P̄M ). Therefore, the principal will never choose a monetary price such that there

is excess supply.

28

This follows the same argument as above for monetary prices.

17

principal to allocate weakly more units and increase the targeting ratio resulting in more

units allocated to the poor.29

∗

The principal compares the value of the objective function with price PM

and with price

PN∗ M . The principal will choose the non-monetary price, PN∗ M , if:

∗

M − PM

>

M − wPN∗ M

δ + (1 − δ) ∗

δ + (1 − δ) ∗

∗ )

Dp (PM

∗ )

D(PM

∗

Dp (PN

M)

∗

D(PN

M)

The left hand side of the inequality represents the ratio of the per unit cost paid by the

principal with the monetary price and with the non-monetary price. When δ = 1, the

principal does not place any additional weight on the poor and the right hand side simplifies

to 1. Then the principal simply choses the price type with a lower net cost per unit. When

δ = 0, the principal values only units distributed to the poor and the right hand side simplifies

Dp (P ∗ ) Dp (P ∗ )

to D(P ∗M) / D(P ∗N M) . In this case, the principal compares the difference in the cost per unit to

M

NM

the difference in the targeting achieved by the price types. As δ decreases from 1 to 0, the

principal places increasing weight on the difference in targeting achieved by the price types.

Next, I use the data from the field experiment to evaluate the principal’s problem. The

survey data indicate that targeting the poor is desirable. The poor are significantly less

likely to report that they treat their drinking water, and among households that do report

treating their drinking water, the poor are more likely to report using inferior methods of

water treatment. The poor are also more likely to report that a household member suffered

from an illness perceived to be caused by the drinking water, such as diarrhea. Importantly,

these results appear to be driven by differential water purifier ownership across income

levels as opposed to differential water purifier use (conditional on ownership) across income

levels. The relationship between income and water treatment is discussed in greater detail

in Appendix C and the results are shown in Appendix Tables 3, 4, and 5.

Using the experimental data, I evaluate the principal’s problem in three steps. First, I

estimate the total demand curve and the poor demand curve for each price type. Households

with per capita total daily income less than or equal to the median are used to estimate

Consider a price PN0 M such that there is excess demand. Then PN0 M < PN∗ M where PN∗ M is defined

B

by D(PN∗ M ) = M −ωP

. By increasing the price from PN0 M to PN∗ M the principal can afford to purchase

∗

29

NM

B

B

a weakly greater number of units M −ωP

≤ M −ωP

. This holds with equality when ω = 0 because the

0

∗

NM

NM

number of units that can be purchased does not depend on the non-monetary price. The number of units

allocated to the poor is strictly greater at the higher price since the targeting ratio is increasing in the price:

0

D p (PN

D p (P ∗ )

B

B

M)

< D(P ∗N M) M −ωP

.

∗

D(P 0 ) M −ωP 0

NM

NM

NM

NM

18

the poor demand curve in my sample. The objective of the pre-survey was to oversample

households in the top and bottom quartiles of the population income distribution. Splitting

the sample into rich and poor subsamples at the median ensures that all households in the

bottom quartile of the population income distribution are included in the poor subsample.

Second, using the estimated demand curves, I determine the optimal monetary price and

the optimal non-monetary price for a budget of 120,000 Rs or approximately 150 Rs per

household within the borders.30 I assume that the relevant population has a total demand

curve equivalent to the total demand curve in my sample and that 1/4 of the population

has a demand curve equivalent to the poor demand curve in my sample. Third, I compare

the value of the principal’s objective using the optimal monetary and non-monetary prices

to determine the optimal price.

First, I estimate demand curves for each price type using the WTP data. I create

synthetic observations such that the dataset includes an observation for each respondent at

every possible price. I code take-up as an indicator variable equal to 1 if WTP is greater

than or equal to the price to represent the purchase decision at that price. I estimate smooth

demand curves by regressing take-up on a fourth order polynomial of price.

Table 6 presents the results of estimating demand curves in the full sample and the rich

and poor subsamples. Monetary price regressions include prices 50 Rs-700 Rs and nonmonetary price regressions include prices 1 hr-9 hrs.31 For monetary prices, the demand

curves differ significantly across income levels. I can reject the joint test that the coefficients

for rich and poor are equal (p-value < 0.0001). In contrast, the rich and the poor have

similar demand at non-monetary prices. I cannot reject the joint test that the coefficients

are equal across income levels (p-value of 0.623).

Appendix Figures 3-6 show the estimated demand curves and the underlying demand

data used to estimate the curves. Appendix Figure 3 plots total demand at monetary prices

and Appendix Figure 4 plots poor demand at monetary prices. Appendix Figure 5 plots total

demand at non-monetary prices and Appendix Figure 6 plots poor demand at non-monetary

prices. In each case, the estimated demand curves are a close fit of the data.

It is an assumption that the relevant population has a total demand curve equivalent to

the total demand curve in my sample because the sampling strategy excluded households

with middle incomes.32 However, 11 households reported incomes in the excluded range

30

This is approximately the budget that I had for the health product when implementing the field experiment.

31

Prices are included in the regression if at least 1% of the sample has WTP greater than or equal to the

price.

32

The pre-survey included a categorical income question. Households who reported total monthly income

19

but were included in the sample, and an additional 19 households reported incomes outside

the excluded range in the pre-survey but have income in the excluded range according to

the income section of the full survey.33 I estimate monetary price and non-monetary price

demand curves for these 30 households. Figures 5 and 6 show the total demand curves for

the sample and the demand curves for the 30 households with middle incomes. As shown

in these figures, although the estimated demand curve for the middle income households

is slightly below the confidence interval for low and high prices, the estimate is imprecise

due to the small sample size. For both price types, the confidence interval for the total

demand curve lies in the center of the confidence interval for the middle income households.

This supports the use of the total demand curve for the sample as an estimate for the total

demand curve for the population despite the fact that households from the top and bottom

quartiles were overrepresented in the sample.

Second, I find the optimal monetary price as a function of δ, and the optimal nonmonetary price as a function of δ and ω. Figure 7 plots the optimal monetary price as a

function of δ and shows that when nearly complete weight is placed on the poor (very low

δ), the principal’s monetary objective is maximized at a monetary price for which there

is excess demand and the pieces are randomly allocated among demanders, i.e. according

to the targeting ratio. This price is lower than the market clearing price, and therefore,

has a higher targeting ratio. As the weight on overall take-up increases relative to the

weight on targeting the poor, the principal moves toward the market clearing price which

maximizes overall take-up by equating the number of pieces the principal can purchase and

total demand. The principal slowly increases the monetary price from 278.75 Rs to the

market clearing price of 402.58 Rs as δ increases from 0 to 0.079.

Figure 8 plots the optimal non-monetary price as a function of δ for ω = 50. In this

case, the principal receives 50 Rs of labor for each hour of the non-monetary price. This

is approximately the hourly wage for females in formal employment. Because the targeting

ratio, using the estimated demand curves, is increasing in the non-monetary price, the principal’s non-monetary objective is maximized at the price that equates total demand and the

number of pieces that the principal can purchase with budget B. As shown in Figure 8, the

principal optimally chooses the market clearing non-monetary price, 4.382 hours regardless

between 7,001 Rs and 15,000 Rs were not eligible for the full survey.

33

Most likely the respondent made an error when answering the categorical income question in the presurvey. The full survey collected income data by household member. Of the households in which no household

members report working for a daily income, there are 19 households who did not reported income in the

excluded range but actually have monthly income in the excluded range. I do not consider households in

which one or more households members reports daily income because their monthly income may fluctuate.

20

of δ.

Third, I compare the value of the principal’s objective when using the optimal monetary price and the optimal non-monetary price to determine the price that maximizes the

principal’s objective. Holding ω fixed at 50 Rs, Figure 9 graphs the value of the principal’s

objective with the optimal monetary price and with the optimal non-monetary price for

δ ∈ [0, 1]. The principal’s objective is maximized using a monetary price for a large range

of values for δ. The previous section illustrated that the targeting ratio is higher for nonmonetary prices than for monetary prices. However, as shown in Figure 9, the principal’s

objective is maximized using a non-monetary price only when the principal places nearly

complete weight on the poor. When ω = 50, the monetary price is optimal for δ > 0.136.

When the principal places a relative weight of 0.136 or greater on the rich, the higher targeting ratio achieved by the non-monetary price is outweighed by the greater product cost

recoupment of the monetary price.

Holding δ fixed at 0.527, Figure 10 graphs the value of the principal’s objective with

the optimal monetary price and the optimal non-monetary price for ω ∈ [0, 100]. I focus

on δ = 0.527 because the rich report 52.7% of the number of instances of diarrhea cases

that the poor report. The principal prefers the monetary price until the productivity of the

non-monetary price is at least 85 Rs. For lower levels of productivity, the improved targeting

of the non-monetary price is outweighed by the greater recoupment of product costs using a

monetary price.

6

Robustness Checks

A concern with using the BDM method in practice is that it is difficult to enforce purchase

decisions, eroding the incentive compatibility underlying the method.34 If purchase decisions

are not enforced, respondents could purposely overstate their willingness to pay and then

decide whether or not to purchase the good after the randomly chosen price is revealed.

Surveyors emphasized that purchase decisions would be enforced, but due to logistical constraints during surveying, households had the built-in option of choosing whether or not to

redeem their voucher. 99 of 121 (82%) respondents who received a voucher in the monetary price treatment group redeemed their vouchers and 39 of 50 (78%) respondents who

received a voucher in the non-monetary price treatment group redeemed their vouchers. I

34

The theoretical limitations of using the BDM method to elicit willingness to pay are described in

Appendix B.

21

present evidence using the distribution of WTP, non-incentivized survey data, and voucher

redemption data to argue that respondents are not systematically overstating their WTP.

First, as shown in the pseudo-demand curves, no respondent in the sample states a

monetary WTP above 850 Rs or a non-monetary WTP above 16 hours. This is evidence

that respondents are not systematically reporting their WTP as the price that they guess

to be the maximum possible price since the script that surveyors read to respondents states

the market price (999 Rs) and explicitly addresses non-monetary bids above 16 hours.

Second, using non-incentivized survey data, a small fraction of respondents reported

overestimating their WTP.35 12% of respondents who received a voucher for the water purifier stated that they overestimated their WTP.36 Further, whether or not a respondent

redeems her voucher is not correlated with reported overestimation of WTP. Panel A of Table 7 presents the results in the sample of monetary vouchers, the sample of non-monetary

vouchers, and subsamples by price level.

Third, I test whether respondents systematically overstate their WTP using voucher

redemption data. If respondents were systematically overstating their WTP then, all else

equal, the probability that a voucher is redeemed should be increasing in the difference

between the respondent’s WTP and the price. I regress an indicator for voucher redemption

on the difference between respondent’s WTP and the price in the sample of monetary price

vouchers and the sample of non-monetary price vouchers. For a given WTP, a lower price

indicates a higher difference between WTP and the price. In general, low price vouchers are

more likely to be redeemed than high price vouchers which positively biases the coefficient

on the difference between WTP and the price, increasing the chance that I find evidence of

overstatement of WTP. Despite this bias, as shown in Panel B of Table 7, the coefficient on

the difference is small and insignificant in both samples.37 Across all three types of data,

there is no evidence that respondents systematically overstated their willingness to pay.

Even if the overall level of WTP is not overstated, the cost effectiveness of the nonmonetary program could be overestimated. The cost-effectiveness of a non-monetary price

35

A respondent is coded as overstating her WTP if she states that she wished that she had not stated a

WTP as high as the revealed price.

36

The percentage is similar across price types: 12% in the monetary price treatment group and 10% in

the non-monetary price treatment group.

37

Separating the effect of the difference between WTP and the price from the effect of price, I regress

an indicator for voucher redemption on an indicator which equals 1 if price equals the respondent’s WTP

and 0 if the price is strictly less than the respondent’s WTP controlling for price in the sample of monetary

price vouchers and the sample of non-monetary price vouchers. While the indicator for price equal to WTP

has less power than the variable representing the difference between WTP and price, I find no evidence of

systematic overstatement of WTP.

22

program will be overestimated if the targeting achieved by the non-monetary price is overestimated relative to the targeting achieved by the monetary price or if the partial recoupment

of product costs is underestimated.

The targeting achieved by the non-monetary price program relative to that of the monetary price program will be overestimated if the rich overstate their monetary WTP relative

to the poor or if the poor overstate their non-monetary WTP relative to the rich. I test for

relative overstatement of WTP between the rich and poor using three different methods.

First, I use voucher redemption data to test whether income or wealth has predictive

power for a household’s decision of whether to redeem its voucher. Figures 11 and 12 show

the number of vouchers issued and redeemed by price level. In particular, if the rich were

overstating their monetary WTP relative to the poor, then the rich should be less likely

to redeem monetary price vouchers than the poor. Similarly, if the poor were overstating

their non-monetary WTP relative to the rich, then the poor should be less likely to redeem a

non-monetary price voucher than the rich. Panel C of Table 7 shows the results of individual

regressions of an indicator for voucher redemption on per capita household income and the

asset index controlling for price. Neither per capita household income nor the asset index

significantly predict voucher redemption.

Additionally, I use demographic variables proxying income or wealth to test for differential

voucher redemption by income level. Controlling for price, the respondent’s education level,

the asset index, indicator for credit constrained, and an indicator for whether the respondent

works are not significant predictors of whether a household redeems its voucher in either the

monetary price treatment group or the non-monetary price treatment group. There is no

evidence of differential voucher redemption by income or wealth level. However, because

there are other reasons that a household may not redeem its voucher besides overstatement

of WTP, such as forgetfulness or budget shocks, that are potentially correlated with income,

I directly test for overstatement of WTP using the voucher data.

Second, I follow the same strategy used above to test for universal overstatement of

WTP using voucher redemption data. I regress an indicator for voucher redemption on the

difference between the respondent’s WTP and the price in the four subsamples created by

splitting the sample by income level and price type. Table 8 shows that in all four subsamples

the coefficient on the difference is small. The coefficient is positive and significant (at the

10% level) in the sample of rich households with non-monetary price vouchers. This indicates

that the rich may be more likely to overstate their non-monetary WTP, which would imply

that the targeting results are underestimated. However, overall, there is strong evidence that

23

neither the poor nor the rich are more likely to overstate their WTP.38

Third, I use non-incentivized survey data to determine whether income is correlated with

reported overstatement or understatement of WTP.39 I regress an indicator for reported

overstatement of WTP on an indicator for poor in the sample of households who received

a voucher. The indicator for income level is not significant in either the monetary or the

non-monetary price groups. Similarly, in the sample of households that did not receive a

voucher, the poor were no more likely to report that they underestimated their WTP for

either price type.

Across all three methods, there is no evidence that the rich are overstating their monetary

WTP relative to the poor or that the poor are overstating their non-monetary WTP relative

to the rich. Thus, the targeting results are not driven by systematic differences in reporting

of WTP across income levels.

Finally, I address whether the recoupment of product costs is underestimated. The

amount of product costs recovered is determined by the monetary price required to reach

a desired level of demand among the poor. Therefore, recoupment of product costs will be

underestimated if the poor’s monetary WTP is understated.

Testing for understatement of WTP relies on non-incentivized survey data. While there

may be an incentive for respondents to overstate their WTP because of the built-in redemption option, there is no incentive for respondents to understate their WTP. Using this survey

data, 14% of the poor respondents in the monetary price group who did not receive a voucher

reported that they understated their WTP at the conclusion of the main survey. However,

I expect that this overestimates true understatement of WTP because the question likely

captures other phenomena, such as regret, as well as true understatement of WTP.

38

In order to control for the price, I also use a regression specification in which the dependent variable

is an indicator which equals 1 if price equals the respondent’s WTP and 0 if the price is strictly less

than the respondent’s WTP. This indicator has lower power than the variable representing the difference

between the respondent’s WTP and the price. The indicator is positive and significant in the sample of poor

households with non-monetary price vouchers indicating that the poor may be more likely to overstate their

non-monetary WTP. The coefficient on the indicator is small and insignificant in each of the other three

samples.

39

A respondent is coded as overstating her WTP if she states that she wished that she had not stated a

WTP as high as the revealed price and is coded as understating her WTP if she states that she wished that

she had stated a willingness to pay at least as high as the revealed price.

24

7

Conclusion

Although health products have high private and social returns, especially for the poor, takeup rates are low even at highly subsidized monetary prices. Many governments and NGOs

distribute subsidized health products in an effort to increase take-up. Non-monetary prices

may better target the poor because selection occurs on willingness to pay in time rather than

money.

I develop a model of household demand based on households’ decision whether or not to

purchase the health product when the product is offered at a monetary price and at a nonmonetary price that illustrates three features of demand. First, I show that for any monetary

price rich demand exceeds poor demand. Second, the model shows that non-monetary prices

may not result in greater demand among the poor than the rich due to opposing income

and substitution effects. For a concave utility function, the utility cost of the non-monetary

price may not be increasing in the wage. Third, regardless of whether the utility cost of

a non-monetary price is increasing in the wage, relative to the rich, the utility cost of a

monetary price is greater than the utility cost of a non-monetary price for the poor. This

implies that non-monetary prices result in better targeting of the poor than monetary prices.

In order to empirically test whether non-monetary prices target health products to the

poor better than monetary prices, I conducted a field experiment in Hyderabad, India.

To obtain estimates of demand at monetary and non-monetary prices, I used the BeckerDeGroot-Marshak (BDM) mechanism (Becker, DeGroot, Marshak, 1964) to elicit respondents’ willingness to pay (WTP) at monetary prices and at non-monetary prices. I find that

monetary WTP is increasing in income and I can reject that the rich and poor have the same

demand at monetary prices. In contrast, non-monetary WTP in decreasing in income, but

I cannot reject that rich and poor demand are the same for non-monetary prices. Using a

pooled sample of monetary WTP and non-monetary WTP, non-monetary WTP falls relative

to monetary WTP as income rises, and non-monetary prices result in better targeting than

monetary prices.

In order to evaluate non-monetary prices as a policy to allocate health products, I model

the problem of a principal who has a fixed budget dedicated to distributing water purifiers.

The principal can choose to use either a monetary price or a non-monetary price to allocate

the health product. The principal’s objective is to increase take-up of the health product,

in particular by the poor because the poor have greater need for the health product.

Using demand functions estimated from the experimental willingness to pay data, I determine the optimal price given the additional weight that the principal places on the poor

25

and the productivity of the non-monetary price. I show that the monetary price is preferred

for a larger range of parameters. Increasing the productivity of the non-monetary price

increases the range of parameters for which the non-monetary price is optimal.

26

References

[1] Abdul Latif Jameel Poverty Action Lab (J-PAL). “The Price is Wrong: Charging Small

Fees Dramatically Reduces Access to Important Products for the Poor.” J-PAL Bulletin

April 2011.

[2] Alatas, Vivi, Abhijit Banerjee, Rema Hanna, Benjamin A. Olken, Ririn Purnamasari,

and Matthew-Wai-Poi. 2013. “Self-Targeting: Evidence from a Field Experiment in

Indonesia.” Working Paper.

[3] Arnold, Benjamin F., and John Colford, Jr. 2007. “Treating Water with Chlorine at

Point-of-Use to Improve Water Quality and Reduce Child Diarrhea in Developing Countries: a Systematic Review and Meta-Analysis.” American Journal of Tropical Medicine

and Hygiene, 76(2), 354-364.

[4] Ashraf, Nava, James Berry, and Jesse Shapiro. 2010. “Can Higher Prices Stimulate

Product Use? Evidence from a Field Experiment in Zambia.” American Economic

Review, 100 (5): 2383-2413.

[5] Baird, Sarah, Joan Hamory Hicks, Michael Kremer, and Edward Miguel. 2011. “Worms

at Work: Long-Run Impacts of Child Health Gains.” Unpublished.

[6] Barzel, Yoram. 1974. “A Theory of Rationing by Waiting.” Journal of Law and Economics, XVII (April 1974): 73-96.

[7] Becker, Gordon, Morris DeGroot, and Jacob Marschak. 1964. “Measuring Utility by a

Single-Response Sequential Method.” Behavioral Science, 9, 226-236.

[8] Berry, James, Greg Fischer, and Raymond Guiteras. 2012. “Eliciting and Utilizing Willingness to Pay: Evidence from Field Trials in Northern Ghana.” Working Paper.

[9] Besley, Timothy and Stephen Coate. 1992. “Workfare versus Welfare: Incentive Arguments for Work Requirements in Poverty-Alleviation Programs.” American Economic

Review, 82 (1): 249-261.