1 National Income Accounting - University of British Columbia

advertisement

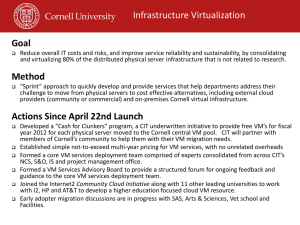

University of British Columbia Department of Economics, International Finance (Econ 556) Prof. Amartya Lahiri Handout #1 1 1 National Income Accounting We start our analysis of open economies with a quick look at some national income accounting identities. These identities serve a dual purpose. They highlight the key di¤erence between closed and open economies along with establishing some key open economy accounting identities. To start with note that gross domestic product (GDP) and gross national product (GNP) are linked by the relation: GN P = GDP + N F IA where N F IA is net factor income from abroad A familiar national income decomposition is GDP = C + I + G + X M where C is private consumption, I is private investment, G is government spending, X M denotes net exports (exports minus imports).which says that from the expenditure side domestically produced output can be used for either domestic consumption, domestic investment, government consumption or net exports. Using the relationship between GDP and GNP, we cn also write the national income accounting identity in terms of GNP: Y =C +I +G+X 1 M + N F IA c Amartya Lahiri. Not to be copied, used, or revised without explicit permission from the copyright owner. 1 where Y is GNP. Subtracting taxes T from both sides, this identity becomes Y Letting Y T T =C +I +G C = S p and T T +X M + N F IA G = S g , this can be rewritten as Sp + Sg I=X M + N F IA where S p is private saving and S g is public saving. Since national saving for this economy is S = S p + S g , the identity reduces to S I=X M + N F IA But, an economy’s current account is de…ned as the di¤erence between exports and imports of goods and services plus net factor income from abroad. Hence, X M + N F IA = CA. This implies that we must have CA = S I (1) There are two key insights that emerge from equation 1. First, in a closed economy there are no exports or imports and GDP equals GNP. Hence, domestic investment must equal national saving at all times in a closed economy. In an open economy, on the other hand, there is no similar constraint. Domestic investment can be greater or less than national saving. The di¤erence between saving and domestic investment determines the current account imbalance for an open economy with a current account surplus indicating that some national saving is being invested abroad while a de…cit implies net capital in‡ows from abroad which are …nancing domestic investment. Second, the fact that a current account de…cit indicates that foreigners are …nancing some part of domestic investment puts the debate about current account imbalances in perspective. While trade restrictions imposed by foreign countries might de…nitely play a role in depressing our exports to them –thereby worsening our current account balance, the ‡ip side of the coin is that foreigners are helping us by augmenting our saving in order to …nance our planned investment. If not, domestic investment would have to be …nanced by a cut in consumption. 2 A key focus of this course is going to be on determining how the current account is determined in open economies, what are the key variables that a¤ect it, what is the optimal response of the current account to di¤erent types of shocks, what e¤ect money has on the current account etc. Since a current account imbalance implies that either we are lending to foreigners or foreigners are lending to us, the issue of current account determination is inherently a dynamic issue. After all, the reason we lend abroad (or to anyone for that matter) is that we expect a return on our investment/lending in the future which allows us to augment our future consumption. Hence, the focus of this course is going to be on dynamic, intertemporal models of open economies. Moreover, for most of the course we are going to focus on developing economies. So we are going to study small open economies which take as given prices in world markets 2 The one-good, pure exchange model We start our study of small open economies by developing the simplest canonical intertemporal model available –the in…nite horizon, pure exchange small open economy world. Consider a small open economy perfectly integrated with the rest of the world in both capital and goods markets. The economy takes as given the world price of the good as well as the interest rate at which it can borrow and lend abroad. The economy is inhabited by a representative household whose problem can be summarized by: Utility function: 1 X t u(ct ); (2) t=0 where ct denotes consumption of the only traded good and 2 (0; 1) is the subjective discount factor. Flow budget constraint: Bt+1 + ct = (1 + r) Bt + yt ; 3 (3) where Bt is the (net) stock of an internationally-traded bond; y is the exogenous output ‡ow of the good; and r is the (constant and exogenously-given) world real interest rate. In the following, where convenient, we shall use the notation R to denote the gross rate of interest. Crucially, Bt is assumed to be predetermined in that it was decided in a previous period. Intertemporal budget constraint: For future reference, we can also determine the household’s lifetime budget constraint by using the ‡ow constraint (3). In particular, we can update equation (3) one period and get that Bt+1 = R 1 (ct+1 yt+1 + Bt+2 ) Substituting this into (3) gives ct yt + R 1 (ct+1 yt+1 ) + R 1 Bt+2 = RBt Continuing this iterative substitution one can get T X s=t 1 R s t (cs ys ) + R T Bt+T +1 = RBt Letting T ! 1 and imposing the transversality condition lim T !1 consumer’s intertemporal budget constraint: 1 X t=0 1 R 1 T R Bt+T +1 = 0, we get the t (ct yt ) = RB0 (4) In other words, the present discounted value of lifetime dissaving must equal the net initial foreign assets of the household inclusive of interest earnings. Optimal consumption-saving plans: Consumers maximize (2) subject to a sequence of ‡ow constraints given by (3) for a given B0 . The Lagrangean for this problem is: 4 $= 1 X t u(ct ) + t=0 1 X t [RBt + yt ct Bt+1 ] t=0 This problem gives two …rst order conditions (one for ct and another for Bt+1 ): These can be combined to give: u0 (ct ) = Ru0 (ct+1 ): (5) This condition is typically called the intertemporal Euler equation. It determines the optimal allocation of current resources between current consumption and saving (or future consumption). The Euler equation reveals the time path of optimal consumption as a function of R. Since u(:) is concave, it follows that ct+1 R ct as R R 1: Intuitively, R > 1 implies that the interest factor dominates the discount factor. Hence, one unit of foregone current consumption delivers more than one unit of discounted future consumption. Hence, households choose a path of consumption that is loaded toward the future, i.e., high current saving and future consumption. The logic for the consumption path induced by R < 1 follows symmetric lines. The preceding suggests an important feature of small open economy models. Since small economies are assumed to be price takers in world markets, any con…guration other than R = 1 will imply secular consumption dynamics even without any corresponding output growth. Hence, in the following we shall retain the assumption that R = 1. Note that in the closed economy case, this is not a problem since R is determined endogenously. 2.1 General solution of the model For a given initial level of bonds, B0 , and a given path of output, yt , equations (4) and (5) fully determine the optimal paths of c. Given our assumption that R = 1, equation (5) says that the path of consumption will be ‡at over time regardless of the time path of 5 output. In other words, consumption is perfectly smoothed over time. From (4), it follows that the constant value of ct is given by: 1 X ct = rB0 + r t yt ; t (6) 0: t=0 Hence, consumption equals permanent income, de…ned as the annuity value of the present discounted value of available resources. Given the path of output and the value of consumption determined in (6), the current account follows from equation (3). Note that the trade balance (= yt ct ) will fully absorb variations in output. The present discounted value of the trade balance will be equal to the initial level of net foreign debt ( i.e., minus the initial level of net foreign assets). Before proceeding further, we set up a special case which will be useful for future didactic reasons. Let yt = y for all t 0. Hence, assume that the endowment is constant throughout. In this case, the equilibrium consumption and asset position of this economy is given by ct = c = rB0 + y; Bt = B0 . Obviously, this economy jumps to the steady state at time 0. Moreover, in this special case the current account is in balance at all points in time. Whether or not the economy runs a perpetual trade surplus, balance or de…cit depends on the initial asset position B0 . In particular, T Bt 2.2 y ct = rB0 : Output shocks and the current account To gain further insights, we will study the e¤ects of permanent and temporary changes in output that take place at time 0. It will be assumed that just prior to the shock, output is expected to remain constant forever; that is, yt = y for all t. In the initial steady-state, the current account is zero. 6 2.2.1 Permanent rise in output Suppose now that at time 0 there is an unanticipated and permanent increase in output from y to y H , where y H > y. From (4) and (5), it follows that consumption adjusts instantaneously to its new (and lower) value: cH = rb0 + y H > c; t 0: Since consumption rises one-to-one with output, the trade and current account do not change. Hence, an unanticipated and permanent increase in output has no impact on the current account. 2.2.2 Temporary rise in output Suppose that the economy is in the initial steady-state described above. At time 0, there is an unanticipated and temporary increase in output: Consumption path: 8 < yH ; yt = : y; t=0 t (7) 1; From (4), (5), and (7), it follows that consumption rises immediately to: c^H = rb0 + (1 ) y H + y; t 0: (8) Note that c^H < cH . Hence, a temporary rise in output raises consumption less than when the increase is permanent. This is to be expected since the increase in permanent income is smaller in this case. Trade balance path: From (7) and (8), it follows that the trade balance will be higher during [0; T ) and lower during [T; 1) relative to its initial value ( rB0 ): 7 T Bt = 8 < : rB0 + (y H rB0 + (1 y); ) (y Thus, relative to the initial trade balance of t=0 y H ); T (9) 1: rB0 , the trade balance improves at date t = 0 before worsening on a long run basis from date t = 1. Current account path: The current account rises on impact and then jumps back to zero at t = 1. 2.2.3 Summary of key ideas An open economy should adjust to (negative) permanent shocks but “…nance” temporary shocks through the current account. In this model with no production, the trade balance/current account behave procyclically (i.e., they improve in good times and worsen in bad times). This is not consistent with the data (see Table 1 in Chapter 1 of Vegh book). 3 A model with investment A key prediction of the exchange economy model analyzed above is that the trade balance is procyclical – it improves when output is high and worsens when output is low. Since this is counterfactual, we now augment the exchange economy model with production and investment. The idea is that if investment is also procyclical then it could overturn the predicted procyclicality of the trade and current accounts. Let output per person be given by f 0 > 0; f 00 < 0 yt = At f (kt ); where A is productivity while k is capital per person. The capital stock evolves according to kt+1 = It + kt 8 (10) The ‡ow budget constraint for the household is now given by (11) ct + It + Bt+1 = At f (kt ) + RBt As before, the household maximizes lifetime utility (2) subject to a sequence of ‡ow constraints given by equations (10) and (11). At time t the variables Bt and kt are both predetermined, i.e., they were chosen in a previous period. Hence, the household chooses ct ; kt+1 and Bt+1 :The problem gives rise to three …rst order conditions which can be combined to give u0 (ct ) = R u0 (ct+1 ) At+1 f 0 (kt+1 ) = r The …rst condition is the old Euler equation. The second says that at an optimum the marginal product of capital should equal the interest rate on saving. The second condition implies that the capital stock is given by kt+1 = ' r At+1 for t > 0 (12) where '0 < 0. Hence, an increase in productivity raises the capital stock while an increase in the cost of funds (or the interest rate) reduces it. Note that equation (12) does not hold for t = 0 since k0 is predetermined. We simplify marginally by assuming, with no loss of generality, that At = A for all t and k0 k. From equation (12) it is clear that the capital stock will be constant from t = 1 onward. Hence, the economy will adjust to its long run steady state in one period. It is straightforward to check that c = rB0 + (1 where k = ' r A ) Af (k0 ) + k0 k + Af (k) . The trade balance is given by T B0 = rB0 A f (k) T Bt = rB0 + (1 f (k0 ) + k ) Af (k) k0 Af (k0 ) + k 9 k0 for t > 0: Conjecture: the …rst equation above should be T B0 = rB0 A f (k) Note that T Bt > T B0 while T B0 < f (k0 ) + (1 ) k k0 rB0 . Hence, the economy borrows in period zero to …nance the transition of the capital stock to its steady state value. Thereafter it runs a trade surplus in order to payo¤ the additional borrowing in period 0. It is easy to check that the economy runs a current account de…cit in period zero and returns to a balanced current account from period 1 onward. 3.1 Productivity shocks We now study the e¤ects of permanent and temporary shocks to productivity A: We assume that the economy is in an initial steady state with A = A and k = k. Moreover, we assume that in the initial steady state, c = rB0 + Af (k) T Bt = 3.1.1 for t rB0 0 Permanent productivity shock Assume that at t = 0 there is an unexpected productivity shock in that A rises permanently to AH > A. Capital stock: The new long run capital stock is kH = ' r AH > k. Consumption: cH = rB0 + (1 ) AH f (k) 10 kH k + AH f (k H ) Trade balance: AH f (k H ) T B0 = rB0 T Bt = rB0 + (1 Note that T Bt > f (k) + k H ) AH f (k H ) k < AH f (k) + k H rB0 k for t > 0: rB0 . Current account: CA0 = rB0 + T B0 < 0 Hence, the current account goes into a de…cit at t = 0 and reattains balance from t = 1: The key result here is that a permanent increase in productivity produces a current account de…cit on impact. Hence, the trade balance and current account both exhibit countercyclicality as opposed to the procyclicality we saw in the endowment economy case. 3.1.2 A temporary, one period increase in productivity Assume that at t = 0 there is an unexpected productivity shock in that A rises to AH > A for one period and is expected to revert to A at t = 1. Capital stock: The long run capital stock remains unchanged in this case. Consumption: c^H = rB0 + (1 ) AH f (k) + Af (k) > c Trade balance: T B0 = rB0 + f (k) AH T Bt = rB0 Note that T Bt < (1 A > ) f (k) AH rB0 . 11 rB0 A for t > 0: Current account: CA0 = rB0 + T B0 > 0 Hence, the current account goes into a surplus at t = 0 and reattains balance from t = 1: The key result here is that a temporary, one period, increase in productivity produces a current account surplus on impact. Hence, this shock induces e¤ects very similar to those induced by a temporary endowment shocks. 4 Summary of key ideas We have seen that: – A one-period increase in productivity leads to a current account surplus. – A permanent increase in productivity leads to a current account de…cit It follows that shocks of intermediate duration (i.e., more than one period but not permanent) may lead to either current account surpluses or de…cits (see Chapter 1 of the Végh book for a formal analysis of this case). Hence, in the presence of investment, the current account/trade balance may behave countercyclically due to the fact that positive productivity shocks lead to higher investment. 12