Benefits of Changing Depreciation Methods

Benefits of Changing Depreciation Methods:

Straight-Line to Accelerated

March 16, 2005

Table of Contents

Table

Executive Summary 2

Introduction 4

Accelerated

¾ Table 1 Double-Declining vs. Straight-Line

¾ Graph 1 Depreciation Patterns

¾ Table 2 Computer Depreciation Comparison

6

7

7

Benefits 9

¾ Graph 2 Accelerated Depreciation and Repairs &

Comparison 9

¾ Table 3 Depreciation Comparison with Repairs & Maintenance 10

Cost

Timeline

12

13

Qualifications 14

Conclusion/Recommendations 15

Works Cited 16

Appendix

Résumé 18

1

Executive Summary

Marietta Computer Rentals currently uses the straight-line depreciation method; however, changing to an accelerated depreciation method would be more beneficial.

Depreciation can often be overlooked when preparing the financial statements, and

Marietta Computer Rentals is overlooking its depreciation. After researching the difference between the two methods in several articles, textbooks, and Financial

Accounting Standards Board (FASB) statements, the benefits of utilizing the accelerated method become obvious.

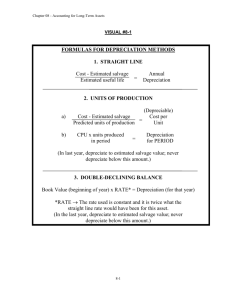

First, the straight-line method merely takes the cost of an asset and divides the expense equally over the useful life (5), while the accelerated method takes rapid reductions early in the asset’s life, with smaller reductions later (7). While the difference of when the depreciation expense is recognized may not seem important, timing is everything.

By taking the increased expenses earlier, benefits can arise including tax benefits.

“All things being equal, the rule of thumb is to accelerate deductions whenever possible,” as stated in the Knight-Ridder Tribune Business News (1). Other benefits include equalizing the increased maintenance costs later by having greater depreciation expense earlier, and also balancing the rapid reduction of value for items that become obsolete quicker, like technological assets (e.g. computers).

Of course, costs will be incurred to switch over to the accelerated method, but these costs are minimal compared to the benefits that can be reaped. The only costs would be to reprogram the computer software currently used to figure out depreciation on an accelerated basis instead of straight-line. Moreover, the time to make the change would also be insignificant: a day or two at the most to train personnel in how to change the software and input the data for the new method. In the end, the new depreciation method would benefit the financial statements and the company as a whole with little costs or time incurred.

My recommendation comes from my research from relevant sources and my accounting background. Having worked at a manufacturing company, Euclid Refinishing

Company Inc., has given me a solid basis in accounting. In addition, my education at

2

Marietta College by obtaining a bachelor’s degree in Public Accounting gave me even more knowledge and experience with the accounting field. Even my internship with the

Ohio State Auditor has allowed me to grasp an understanding of how financial statements work.

These experiences now give me confidence to make the recommendation of switching the depreciation method at Marietta Computer Rentals from straight-line to accelerated. Changing methods is a logical and favorable way to improve the financial statements and take advantage of tax benefits. By not changing, a great opportunity would be missed, and Marietta Computer Rentals would not be as profitable at it could be. For example, by using information from last year’s financial statements, an increased tax deduction of $2000 could have been taken if the company used the accelerated method. In addition, savings in the next few years will come from the offsetting of the repair and maintenance.

3

Introduction

Depreciation can often be overlooked when preparing the financial statements.

However, with the proper treatment, depreciation can improve the net income figure and reap other benefits for a company. As Daniel D. Morris, a partner with Morris &

D’Angelo in San Jose, mentioned, “Depreciation is a timing game….You need to think it through” (1).

The Committee on Terminology of the American Institute of Certified Public

Accountants (AICPA) defines depreciation as an allocation process that aims to systematically and rationally distribute the cost of a tangible capital asset, less any salvage value, over an estimated useful life of the asset (2). Salvage or residual value, defined in the Financial Accounting Standards Board (FASB) financial accounting statement 13, paragraph 5h, would be any amount of money expected to be gained from the sale or disposal of the asset after its use or the lease term is completed (3).

In determining what depreciation method to use, there are three main assumptions or estimates that need to be considered: the cost basis, useful life of the asset, and salvage value (4). In terms of the cost basis, the total depreciable cost would include any costs involved for the asset’s acquisition and preparation for use less any salvage value (5).

The Accounting Terminology Bulletin (ATB) No. 1 describes how the useful life considers the asset’s expected wear and tear from use, inadequacy, and obsolescence in the future (6). Of course, the criteria used for the useful life also play a role in any salvage value of the asset. Therefore, both physical and functional factors effect how depreciation is determined (5).

Marietta Computer Rentals currently uses the straight-line depreciation; however, the accelerated method could offer more benefits if the company were to switch. As defined by Rupp's Insurance & Risk Management, straight-line is the depreciation of a capital asset in equal installments over its useful life; the accelerated method, like doubledeclining balance, on the other hand is defined as having greater depreciation taken earlier in the useful life with smaller amounts at the end (7).

Therefore, the double-declining accelerated method would front load the depreciation expenses when the computers’ value would decrease more rapidly. Since

4

computers have relatively short life spans due to constant upgrades in technology, depreciating more at the beginning makes sense. In addition, the computers’ value would be greater at the beginning, while at the end more maintenance and repairs will be needed. The accelerated method helps offset those added costs at the end of the useful life to keep the computers running properly, since the decline in depreciation would occur when the economic usefulness or advantage of the asset declines (5). Moreover, as an article in the Crain’s Cleveland Business explains, the accelerated method allows a larger tax deduction in the earlier years due to the larger depreciation expense (8). For instance, by using information from last year’s financial statements, an increased tax deduction of

$2000 could have been taken if the company used the accelerated method. In addition, savings in the next few years will come from the offsetting of the repair and maintenance.

To take advantage of these benefits, Marietta Computer Rentals needs to change to the accelerated depreciation method. Outlined in the following pages is a plan on how the accelerated method works, the benefits for Marietta Computer Rentals from changing methods, the costs associated with the changeover, a timeline for implementation, and my qualifications for making the recommendation. Researching used to make the recommendation comes from a variety of sources ranging from articles and textbooks to

FASB statements.

5

Accelerated Method vs. Straight-Line

According to the Rental Equipment Register website, rental companies use different methods to report depreciation (9). “Buying the equipment is the easy part.

Then comes figuring out the most advantageous way to deduct costs,” as mentioned by the Knight-Ridder Tribune Business News (1). As previously defined by Rupp's

Insurance & Risk Management, the accelerated method takes rapid reductions early in the asset’s life, with smaller reductions later (7). Straight-line merely takes the cost and divides the expense equally over the useful life (5). A simple illustration of the differences is shown in Table 1 below. For example, a computer system that costs $2000 has an expected useful life of four years and a salvage value of $500.

Table 1: Double-Declining vs. Straight-Line

As seen from the example, the accelerated depreciation method expensed the computer a lot earlier than the straight-line. In addition, another important consideration to note is that the salvage value is not used to figure the double-declining amount; however, when the book value reaches the residual amount, then the depreciation stops

(10). The double-declining rate is normally twice the percentage of the straight-line method (4). Therefore, since the straight-line was one-fourth or twenty-five percent, then the double-declining was half or fifty percent. Accordingly, if the straight-line was onefifth or twenty percent, then double-declining would be two-fifths or forty percent. For a quick visual representation of the differences between double-declining and straight-line, refer to Graph 1 on the next page.

6

Graph 1: Depreciation Patterns

$1,200.00

$1,000.00

$800.00

$600.00

$400.00

$200.00

$0.00

1 2

Years

3 4

Double-Declining

Straight-Line

Source: Example data from Table 1

As seen in the graph, the straight-line is constant over time while the accelerated approach declines drastically. The consistency of the straight-line method allows for more “income smoothing,” where income has a more gradual change over time without dips and mountains. However, the accelerated method offers other benefits that make up for the lack of a constant expense over time. These benefits include offsetting the repairs and maintenance and larger tax deductions that improve profits.

For example, last year Marietta Computer Rental purchased about $10,000 of new computers. An estimated useful life is five years with no residual value since newer technology will cause these computers to become obsolete. Table 2 below illustrates the difference in the two methods.

Table 2: Computer Depreciation Comparison

1 $2000 $8000 $4000 $6000

2 $2000 $6000 $2400 $3600

3 $2000 $4000 $1440 $2160

5 $2000 $0 $1080* $0

Source: Taken from last year’s financial statements

* Method switched back to straight-line for the last two years to get to a zero book value

7

As shown, the accelerated method used the double-declining balance. The last two years utilized the straight-line method, since constantly multiplying the book value by the 40% would never reach zero, but continually create a smaller number; by switching to straight-line, the amount can be completely expensed.

8

Benefits

Several benefits arise from using the accelerated method as opposed to the straight-line. One benefit relates to offsetting future expenses in the upkeep of the asset.

Often this approach is more logical when the annual benefit from the asset’s use decreases with age and the asset’s cost of repair and maintenance increases (5). By offsetting the increased repair and maintenance costs, the accelerated method equalizes the combined charges of both repairs and depreciation. In Graph 2 below, the equalization shows how accelerated depreciation can affect the company.

Graph 2 : Accelerated Depreciation and Repairs & Maintenance Comparison

Repairs &

Maintenance

Depreciation

Total

Expense

Asset Age

Source: Intermediate Accounting, 15e. Thomson: 2004

By accelerating the depreciation to offset the repairs and maintenance, in the end the overall costs are shown on a straight-line. If the straight-line were used, then the depreciation would be constant, but the repairs and maintenance costs would increase causing the total expenses to increase.

Another benefit would be if the asset was anticipated to provide significant benefit early on in the useful life, and future benefit less definite or if the asset has the potential to become obsolete or inadequate at a premature date (5). In Marietta Computer

Rentals, this case proves true. Continual technological improvements often make computers become obsolete or at least inadequate for their purpose. As a result, by using the accelerated approach, the depreciation expense can be taken early when the computers are still used and providing benefit for the company.

9

In addition, FASB’s financial accounting statement 33 paragraph 197 reports how companies use the accelerated method to make an allowance for inflation: the aggregate depreciation increases during periods when the amount of property, plant, and equipment is growing or if conservative estimates of useful life or salvage values are used (9). In simpler terms, by expensing more of the cost of the asset at the beginning, then in the future when inflation causes expenses to be higher, the amount of expense will be lower.

Finally, there are also tax benefits from using the accelerated method. “All things being equal, the rule of thumb is to accelerate deductions whenever possible,” as stated in the Knight-Ridder Tribune Business News (1). The Job Creation and Worker Assistance

Act of 2002, section 179, allows businesses to accelerate depreciation on qualified assets, like office furnishings, for tax benefits (11). With this tax break, Terry Nicholson, senior vice president of Venvest Inc., reported how small business owners can save the additional money and apply it toward future growth (12). However, a Goldman Sachs survey showed that almost a third of corporate chief information officers did not know about this tax advantage (13). Yet, from 2001-2003, one industry that benefited from the accelerated depreciation was electronics or electric equipment which includes computers

(14). Accordingly, Marietta Computer Rentals could also benefit from using the accelerated method.

An evaluation of the depreciation methods with repairs and maintenance expenses will show how much money can be saved from switching methods. Below in Table 3 is the comparison of total expenses for the next five years of the computers purchased last year.

Table 3: Depreciation Comparison with Repairs & Maintenance

Year Repairs/Maintenance Straight-Line Accelerated Difference

Source: Taken from last year’s financial statements & Table 2

10

While the total expense was more expensive in the earlier years with the accelerated method, later when the repairs and maintenance became more expensive, the total cost was smaller. This will allow for a larger benefit in the income statement in the later years. In addition, the larger depreciation expense in the first few years will allow for greater tax deductions, which in turn will lower the amount of taxes paid by the company. For instance, in year one a deduction of an additional $2000 can be taken by using the accelerated method. Again, this will improve net income on the income statement.

11

Cost

In terms of cost for changing depreciation methods, there are no real monetary costs. Simply implementing one depreciation method over another does not cost anything (5). Basically, the only item affected by the change in methods would be the financial statements themselves. Preparation of the statements would need to be changed.

As a result, having the computer software system changed to apply the new accelerated method would need to occur; however, the modification would not cost much or take a long time. Training of the accountants to switch from the straight-line to the accelerated method would be minimal, particularly since the computer will handle the computations once programmed.

However, increasing deductions outweigh the minor costs of executing the change. Section 179 for tax benefits allows a company to claim large write-offs immediately for items like computers and software (1). One may question whether the larger depreciation is advantageous or not. According to Gabe Adler, real estate accounting partner at Zinner & Co., the answer is yes: “The tax rates are set to decline over the next few years, so enacting tax liability savings now vs. later when tax rates have declined is an opportunity for cost savings in the long run” (8). The larger deductions will help lower taxes which in turn allow the company to retain more money to be used to increase profits. Again, last year Marietta Computer Rentals could have had the increased depreciation expense of $2000 would allow for a larger tax deduction, lower taxes and increasing profits with the accelerated method.

12

Timeline

To implement the change of methods, the timeline is short. Starting off the next fiscal year with the new depreciation method would be logical. Therefore, the changeover should occur near the end of the year by modifying the computer program and instructing staff to follow the new procedures. The whole substitution process could be handled within one day. From that point in time on, the accelerated method would be used to calculate depreciation methods on any future computer purchases, and need to be applied to the currently owned assets.

13

Qualifications

Previous experience for working at a manufacturing company, Euclid Refinishing

Company Inc., has given me a solid basis in accounting. After that initial experience in accounting, I pursued a major in Public Accounting at Marietta College, and completed the 150 hour requirement and am eligible to sit for the certified public accounting (CPA) exam. Numerous accounting classes at Marietta College discussed depreciation methods and the pros and cons of each method in certain situations. In addition, researching the

FASB statements on how to handle accounting issues help guide my decisions. Finally, working for the Ohio State Auditor in an internship has given me further experience in accounting issues, particularly the financial statements. For further qualifications, refer to my résumé located in the appendix.

14

Conclusions/Recommendations

After researching the affect of changing the depreciation method from straightline to the accelerated method, Marietta Computer Rentals would benefit from the switch.

Since computers have relatively short useful lives due to constant upgrading of technology, the accelerated method would match more closely the depreciation expense to the benefit the computers provide early on in their lives (7). Also, Marietta Computer

Rentals can offset the added costs from repairs and maintenance of the computers that occur later with the larger, earlier depreciation expenses (5). Moreover, larger tax deductions can be taken by using the accelerated method, especially in regards with section 179 (11), and any time a company can take advantage of a tax law, the opportunity should be taken (9). Marietta Rental Company could have saved an additional $2000 by taking a larger tax deduction by using the accelerated method as opposed to the straight-line last year.

In addition, changing to the new method requires very little cost and manpower, thereby only increasing the benefits even more. Only one day would be needed to modify the computer software program to account for the accelerated method as opposed to the current straight-line method. Accordingly, by not changing methods, the company would actually be losing potential tax savings and missing the opportunity to improve net income figures. Therefore, at the start of the next fiscal year, I recommend changing to the accelerated method of depreciation to better represent the value of the computers and allocate the expense more effectively.

15

Works Cited

(1) Schwanhausser, Mark. “2-4-6-8, What Can You Depreciate? Here’s a Rarity in Tax Law: Choices.” Knight-Ridder Tribune Business News . 6 Feb.

2005. Available from Dawes Library, Business & Industry database.

(2) American Institute of Certified Accountants (AICPA). 1 Mar. 2005.

<http://www.aicpa.org/>.

(3) Financial Accounting Standards Board (FASB). “Financial Accounting

Statement 13, Par. 5h.” Financial Accounting Research System (FARS)

Online. 28 Feb. 2005. <http://www.nxt4.wiley.com/gateway>.

(4) Cathey, Jack M., Myrtle W. Clark, and Richard G. Schroeder. Financial

Accounting Theory and Analysis. 8 th ed. Hoboken: Wiley, 2005.

(5) Skousen, K. Fred, Earl K. Stice, and James D. Stice. Intermediate

Accounting.

15 th ed. Mason: South-Western, 2004.

(6) Financial Accounting Standards Board (FASB). “Accounting Terminology

Bulletin 1.” 28 Feb. 2005. <http://www.nxt4.wiley.com/gateway>.

(7) “Accelerated Depreciation.” Rupp’s Insurance & Risk Management. 1 Mar.

2005. <http:// insurance.cch.com/rupps/accelerated-depreciation.htm>.

(8) Bottar, Deanna. “Cost-Segregation Analyses Help Owners Get More for

Their Money.” Crain’s Cleveland Business. 19 July 2004. Available from

Dawes Library, Business & Industry database.

(9) Stansberry, Gary. “The Do’s & Don’ts of Depreciation.” Rental Equipment

Register. 1 June 2004. 28 Feb. 2005.

<http://rermag.com/mag/equipment_dos_donts_depreciation_060104/>.

(10) Financial Accounting Standards Board (FASB). “Financial

Accounting Statement 33.” Financial Accounting Research System

(FARS) Online. 28 Feb. 2005. <http://www.nxt4.wiley.com/gateway>.

(11) Ullakko, James. “Depreciation Benefits Under the Jobs and Growth Tax

Relief Reconciliation Act of 2003: Leasehold Improvements and Office

Furnishings.” Real Estate News & Articles.

Sept. 2003. 28 Feb. 2005.

<http://www.mihalovich.com/articles/ullakko200309.htm>.

16

(12) “IRS Depreciation Ruling can Benefit Contractors.” Air Conditioning,

Heating, & Refrigeration News. 30Aug. 2004. Available from Dawes

Library, Business & Industry database.

(13) Hederman, Jr., Rea S. “Tax Cuts Boost Business Investment.” The Heritage

Foundation Web Memo. 3 Feb. 2004. 28 Feb. 2005.

<http://heritage.org/Research/Taxes/wm412.cfm?renderfor print=1>.

(14) McIntyre, Bob. “Bush Policies Drive Surge in Corporate Tax Freeloading.”

Citizens for Tax Justice. 22 Sept. 2004. 1 Mar. 2005.

<http://www.ctj.org/corpfed04pr.pdf>.

17