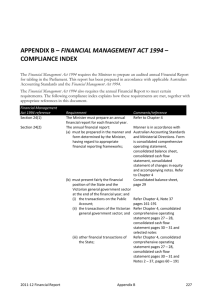

Consolidated Balance Sheets

advertisement