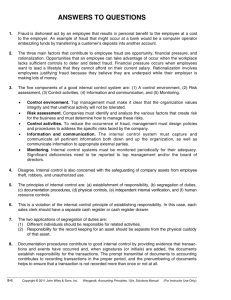

Chapter 8 Fraud, Internal Control, and Cash

advertisement