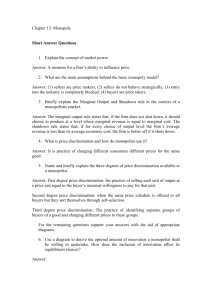

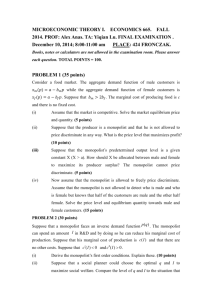

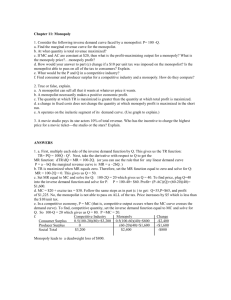

Monopoly - during menopause has been such

advertisement