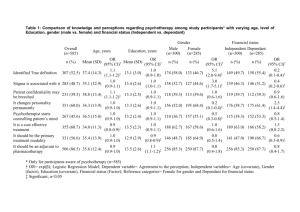

Family Caregiver Amount

advertisement

March 2013 January 2012 CONTACT US: 3553 Pembina Hwy, WPG, MB, R3V 1A5 PH 204-269-7460 FAX 204-269-7096 EMAIL talbot@talbotcga.ca WEBSITE www.talbotcga.ca “Like” us on Facebook! Did you know? The new family caregiver credit (FCA) helps Canadians with the costs of caring for a dependant with a mental or physical impairment. Important facts Introduced in the 2011 federal budget, the FCA is a 15% non-refundable tax credit on an amount of $2,000 that provides tax relief for caregivers of dependant relatives who have a mental or physical impairment. This includes, for the first time, spouses, common-law partners, and minor children. The dependant must be: The preceding information is for educational purposes only. As it is impossible to include all situations, circumstances and exceptions in a commentary such as this, a further review should be done. Every effort has been made to ensure the accuracy of the information contained in this commentary. However, because of the nature of the subject, no person or firm involved in the distribution or preparation of this commentary accepts any liability for its contents or use. An individual 18 years of age or older and dependant on you because of a physical or mental impairment; or A child under 18 years of age, with a physical or mental impairment. The impairment must be prolonged and indefinite, and the child must be dependent on you for assistance in attending to personal needs and care when compared to children of the same age. You may be asked to provide a signed statement from a medical doctor that provides information on the nature, commencement, and duration of the dependant's impairment. You can claim the family caregiver amount for more than one eligible dependant. Please note that the maximum amount for eligible dependants age 18 or older already includes the additional amount of $2,000 for the family caregiver amount. For more information, go to www.cra.gc.ca/familycaregiver or contact us with your questions! Did you know? If you use public transit, you can claim the cost of certain public transit passes to reduce the taxes you owe. Important information You can claim the cost of monthly or annual passes for unlimited travel within Canada on any of the following: buses, streetcars, subways, commuter trains, or ferries. You may also be able to claim the cost of shorter duration passes and electronic payment cards in certain circumstances. When claiming the public transit amount, keep your transit pass in case the Canada Revenue Agency (CRA) asks you to verify your claim. If you do not have your passes, you can also provide your receipts, cancelled cheques, or credit card statements to support your claim. We offer peace of mind March 2013 January 2012 CONTACT US: Upcoming Seminars 3553 Pembina Hwy, WPG, MB, R3V 1A5 PH 204-269-7460 FAX 204-269-7096 EMAIL talbot@talbotcga.ca WEBSITE www.talbotcga.ca “Like” us on Facebook! The preceding information is for educational purposes only. As it is impossible to include all situations, circumstances and exceptions in a commentary such as this, a further review should be done. Every effort has been made to ensure the accuracy of the information contained in this commentary. However, because of the nature of the subject, no person or firm involved in the distribution or preparation of this commentary accepts any liability for its contents or use. Tax Seminar - May 29th, 2013 7:00PM to 10:00PM Do you have a vacant barn or building that you are not using and that you would like to rent out? Are you someone who is looking for a place to rent for storage, or other purposes? If you answered yes to either of these questions, we may be able to help! We work with a wide variety of clients across Manitoba and often hear stories from people who are looking for a building that they could rent for their business, or people who have an unused building that could be rented out. Simply let us know if you have a building to rent out, or are wishing to rent a building from someone and we will do our best to match you up with someone who can fill your needs! For more information, and to find out how we can help, please contact our office. If you would like to get information about how to reduce your income taxes, and avoid a CRA audit, attend our Tax Seminar! You’ll learn these things and much more! Keys to Business Success Seminar - May 30th, 2013 7:00PM to 10:00PM In the Keys to Business Success Seminar you’ll learn how to increase business profits through better management. Topics include how to utilize your financial statements, how to deal with price resistance from customers, and so much more! Contact us for more information and to reserve your spot! Tax Season Is Upon Us! Don’t forget that personal income taxes and returns are due April 30th, 2013. Beat the rush, and stop by our office to drop off your tax return information! If you have any questions at all regarding your tax return, do not hesitate to call our office at 204-269-7460. We offer peace of mind