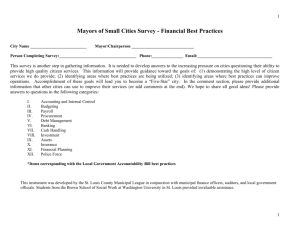

County Auditors' Association of Ohio INTERNAL ACCOUNTING

advertisement