Mayors of Small Cities Survey-Draft 2-25-11

advertisement

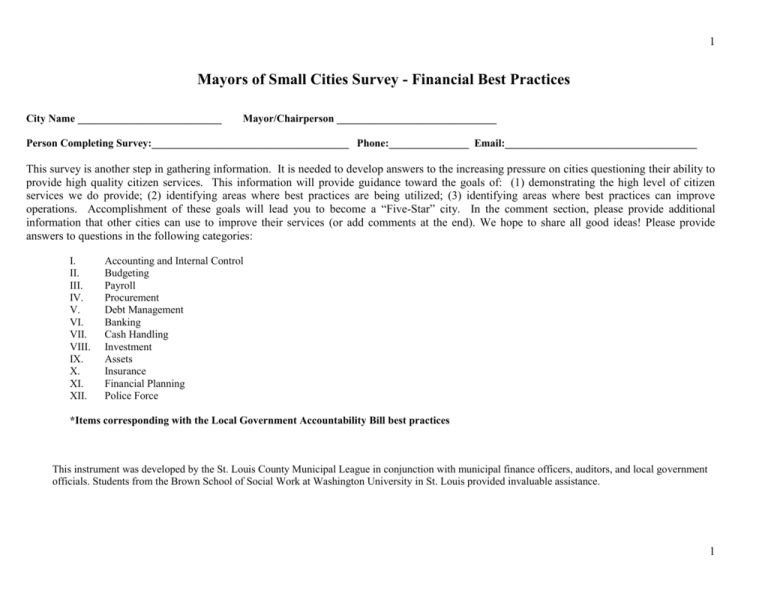

1 Mayors of Small Cities Survey - Financial Best Practices City Name ___________________________ Mayor/Chairperson ______________________________ Person Completing Survey:_____________________________________ Phone:_______________ Email:____________________________________ This survey is another step in gathering information. It is needed to develop answers to the increasing pressure on cities questioning their ability to provide high quality citizen services. This information will provide guidance toward the goals of: (1) demonstrating the high level of citizen services we do provide; (2) identifying areas where best practices are being utilized; (3) identifying areas where best practices can improve operations. Accomplishment of these goals will lead you to become a “Five-Star” city. In the comment section, please provide additional information that other cities can use to improve their services (or add comments at the end). We hope to share all good ideas! Please provide answers to questions in the following categories: I. II. III. IV. V. VI. VII. VIII. IX. X. XI. XII. Accounting and Internal Control Budgeting Payroll Procurement Debt Management Banking Cash Handling Investment Assets Insurance Financial Planning Police Force *Items corresponding with the Local Government Accountability Bill best practices This instrument was developed by the St. Louis County Municipal League in conjunction with municipal finance officers, auditors, and local government officials. Students from the Brown School of Social Work at Washington University in St. Louis provided invaluable assistance. 1 2 # Question I. *1. Accounting and Internal Control: Does your city utilize a system of financial recording? This should include: Cash and Investment Journal Cash Receipts and Disbursements Journal tracking receipts and disbursements for each fund Receipts Ledger for each source of revenue Disbursement Ledger for each activity Payroll Register Receivables Register Checks/Payables Register *2. Are there written accounting procedures for recording all financial transactions? 3. Do procedures address segregation of duties (systems in which more than one person has responsibility for a task, thus limiting the potential for error or fraud)? *4. A. Is an annual or bi-annual audit performed by an independent certified public accounting firm? B. In lieu of an annual or bi-annual audit for smaller entities, does your municipality have an independent CPA perform a review or compilation of financial records and internal controls at least annually? 5. Does your city prepare and send a required financial statement to the State Auditor each year? (If an audit was performed, this should be the audited statement.) See 15 CSR 403.030 for requirements. 6. Is an annual financial report published? II. *7. Budgeting: Does your city adopt an annual budget that conforms to state law (see Section 67.010 RSMo)? Yes No Comments 2 3 # Question 8. 9. Does your city adopt a budget for each fund (not just the General Fund)? Are regular reports prepared (at least monthly) that compare the budgeted amounts of revenues and expenditures to the actual, and is this reviewed by the Mayor and Council? 10. Does your accounting system provide a means for ensuring that certain restricted revenues are used for their intended purposes (e.g. Motor Fuel Taxes must be used for road construction and maintenance)? 11. Does a written travel policy address meal allowances, hotel rates, and mileage reimbursement, so as to ensure that the city pays reasonable travel expenses? III. 12. Payroll: Does the city maintain a pay plan (pay schedule, pay rates)? See Section 79.270 RSMo on employee compensation. 13. Has the city considered the costs and benefits of direct deposit of pay to employee bank accounts? Typically requires a fee Fast, safe and reliable transfer Reduces paper trail Simplifies processing and reconciliation processes 14. Are there written procedures covering the processing of payroll, payment of taxes, withholdings, pension, etc.? Is payroll software used? When reviewing payroll, do you compare the current payroll to the previous payroll, and does another employee also review payroll? IV. 15. Procurement: Does your city have an ordinance detailing levels of authority in purchasing? Do purchases above a specified amount require Mayoral and/or City Council approval? Yes No Comments 3 4 # 16. 17. Question Yes No Comments Does your city require competitive bids when purchasing goods and services? Have thresholds been set for when sealed written bids must be considered? Does your city participate in cooperative purchasing through St. Louis County, the state, or other organization? US Communities Government Purchasing Alliance (must register) HGACBuy (must register) MO Vocational Enterprises (direct link to items) Other (please list) 18. Have written contracts been entered into with all service providers (as prescribed by ordinance)? V. 19. Debt Management: Does city ordinance provide policies regarding when it may go into debt? Do these policies detail when Council or voter approval is necessary? 20. If taking on debt, does the city engage bond counsel and consultants to ensure it is abiding by the law? VI. 21. Banking: Does your city have a written banking agreement approved by the Council? 22. How often does your city solicit proposals for banking services? 23. Does your municipality periodically review its bank accounts (checking and pooled savings/repurchase) to ensure that it has the fewest number of accounts necessary? 24. Are all funds kept in an operating fund, savings account, or repurchase agreement until needed to cover disbursements? 25. Has your city established a desired, unappropriated General Fund balance level (reserve fund)? 4 5 # Question 26. Are all cash, checks, and deposits slips kept in a secure, locked location? 27. Are monthly cash and bank reconciliations performed by someone that does not deposit or disburse funds, and then reviewed by another party? 28. Does Council review bank statements and financial statements monthly? VII. 29. Cash Handling: Does the city have written procedures that specify how cash is handled and by whom? Court Licenses/Permits Recreation Centers o See Hochschild Bloom Manual B.3.1. for example 30. Are deposits made daily? If not, how are funds secured until deposit? 31. Are receipts prepared and verified by designated staff members? Yes No Comments VIII. Investment: Has your city adopted the MO State Treasurer’s Investment Model? If not, what model 32. does the city follow? 33. Does your city have an investment policy that abides by state law and balances safety, liquidity, and yield? See Section 30.950 RSMo. Does the policy specify what types of investment are permissible? Does the policy state which parties may make investments? 34. Does your city maintain sufficient liquidity of investments to cover operating costs? For what period? 5 6 # Question 35. Has your city’s investment portfolio been structured so investments mature to meet cash requirements? 36. Do any officials (includes staff and elected) involved in investment activities have personal interests in financial institutions with which the city does business? 37. Does your city utilize third-party custodial safekeeping for securities? 38. Have all Certificates of Deposit and Repurchase Agreements been collateralized or covered by FDIC? IX. 39. Assets: Has your city defined its “fixed assets” (e.g. streets, buildings, machinery, vehicles, cell phones)? 40. Does your city maintain an accurate record of all fixed assets? Does this record include liabilities (e.g. repairs needed)? How do you ensure this is updated? 41. Does your city use these records to determine when it is best to repair equipment and when to purchase new equipment? 42. Does your city maintain custodial records tracking who has possession of uniforms, police gear, vehicles, hardware/software, etc.? 43. Are periodic inventories performed? X. Insurance Two statewide pools available: MoPerm (Property & Liability) and MIRMA (Workers Comp, General Liability, Auto, Employee Fidelity Bonds), along with smaller pools. Yes No Comments 6 7 # Question *44. Does your city have a written policy on safety and risk management? Policies addressing what levels of insurance are necessary? Policies for reducing employee accidents? Policies for reducing risk on city property (e.g. parks, playgrounds)? 45. A) Does your city have adequate liability insurance that covers the city, members of the city council, and city employees? B) Which officials and staff are covered by fidelity bonds? 46. Are all injuries or other incidents for which the city may be liable documented and investigated? How are incidents investigated? 47. Does your city provide workers’ compensation insurance as required by law? XI. 48. Financial Planning: Does your city have a vision statement and financial strategic plan? 49. Does your city’s strategic plan cover more than one budget cycle? 50. What percentage of your budget is derived from traffic fines? 51. Does your city consider projections for future costs? 52. Does your city consider contracting or forming cooperatives to improve services and/or save money in order to provide for long-term stability? If so, please list them. XII. *53. Police Force Questions Does your city have two licensed police officers on every shift? *54. Does your city have a written pursuit policy? Yes No Comments 7 8 # Question *55. Does your city have a written use of force policy? 56. Is your city in compliance with state law requiring an annual report on racial profiling (see Section 590.650 RSMo)? Yes No Comments Additional Comments: Please fill out this survey and return to the St. Louis County Municipal League via fax or e-mail: Fax: (314) 726-1520; E-Mail: staff@stlmuni.org 8