tuition , feesandpaymentinforma tion

advertisement

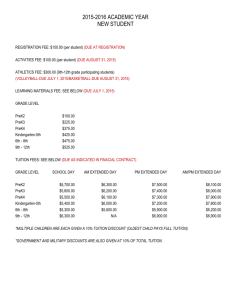

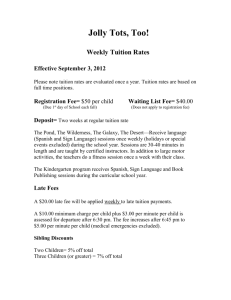

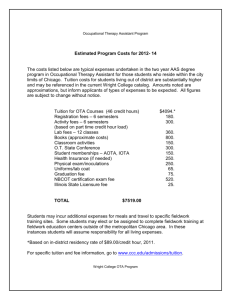

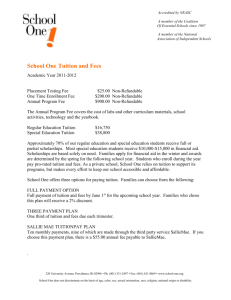

TUITION, FEES AND PAYMENT INFORMATION Payment Deadlines Frequently Asked Questions Fall 2010 Tuition and Fee Rates Payment Plans Refund Information FINANCIAL CALENDAR - Fall 2010* Emergency Tuition Loans Available August 2, 2010 Invoices to Registered Students July 28, 2010 Tuition Payment Deadline for Students Who Registered between April 1st - Aug 15th August 16, 2010 Drop for Non-Payment for Students Who Registered between April 1st - Aug 15th August 18, 2010 Tuition Payment Deadline for Late Registration (Aug 16th - 26th) August 27, 2010 Final Drop for Non-Payment September 8, 2010 Installment Plan Payment Due in 5 Equal Installments 8/16; 9/15; 10/15; 11/15; and 12/15 Tuition Loans Due November 19, 2010 Student Account Referral to Collections for Fall 2010 Past Due Balances February 10, 2011 Important Payment Information When do I pay for my classes? Fall 2010 Tuition and Fees Payment Deadline for Fall Registration (04/018/15/10) is August 16, 2010. Non-payment of tuition and fees will result in the loss of your Fall 2010 class schedule on August 18, 2010. Note that if you are registered for any part of term that begins prior to August 23rd, tuition and fees are due on the 1st day of class for the part of term. See the Alternate Parts-of-Term Schedule online to determine deadline. Payment Options 1. Pay All - Pay in full 2. Pay 20% - Pay 20% of total tuition and fees assessed and defer the balance through the EasyPay Installment Tuition Loan option 6 3. Pay Nothing Now - Apply for Emergency Tuition Loan and EasyPay Installment Tuition Loan option For payment options #2 and #3, go to loans.utep.edu. Email Notification Invoices, installment, and emergency loan payment deadlines will be sent via email to continuing students. If you do not have a “miners.utep.edu” email address, obtain one. Without one, you will not receive any notifications during the term. You can obtain your “miners.utep. edu” email address by logging on to the following website: newaccount.utep.edu. The invoice will include assessed tuition and fees and your class schedule. Also reflected on the invoice will be any credits you may have from financial aid or scholarship awards. If you registered by July 27, 2010 and you do not receive Fall 2010 | SCHEDULE OF CLASSES your Invoice by August 5, 2010, contact the Student Business Services Office. If you do not receive your email invoice, log on to Goldmine via my.utep.edu and select Invoice option; you are obligated to meet the payment deadline whether or not you receive an invoice. For students who register and who make changes to their initial registration after July 27, 2010, an updated schedule and tuition and fees can be viewed and printed through my.utep.edu; click on Goldmine and then select Invoice option. Where can I locate the most current financial information regarding my registration? For up-to-date information on tuition and fees and payments, visit my.utep. edu; click Goldmine icon; select from the options or contact the Student Business Services Office in the Academic Services Building, 915/747-5116. TUITION, FEES AND PAYMENT INFORMATION Methods of Payment The University accepts Cash, Check, MasterCard, Visa, Discover and American Express. Credit card payments must be made via Touchtone Registration (915/545-1145) or online at my.utep.edu, then click on Goldmine icon. All mailed payments must be received by the Student Business Services Office by the close of business, on the tuition payment deadline. Checks must include student ID number, state and driver’s license number. A non refundable fee of $25.00 will be assessed for each returned check. DO NOT MAIL CASH. How much do I owe? Assessment of tuition and fees is based on your residency classification and the number of semester credit hours you are taking. Refer to the Student Business Services website for details. (http://admin.utep.edu/sbs.) How do I obtain residency for tuition purposes? The Admissions Office (915/747-5890) is responsible for determining the official residency for undergraduate students. The Graduate Office (915/7475491) is responsible for determining the residency for Graduate students. See Applying for Admission online for additional information. To ensure that your invoice is correct, you must resolve all residency issues BEFORE you begin the registration process. What if I cannot pay my entire invoice amount by the payment deadline? 20% of tuition and fees must be paid and you can defer the balance through the EasyPay Installment Tuition Loan. Under the installment tuition loan, you must pay 20% of assessed tuition, mandatory and incidental fees by the published payment due date (if you do not have the funds to pay the required 20% of assessed tuition and fees, please refer to the next question explaining tuition loans). You then pay the remaining tuition and fees balance in four equal installments – due on 15th of each month (if the 15th fall on the weekend or a Holiday, it will be due the next business day). Contact Student Business Services at 915/747-5116 if you have any questions. How can I apply for a tuition loan? This loan only covers 20% of the assessed tuition and fees; mandatory and course related fees and will automatically set up the installment tuition loan for the rest of the tuition. To be eligible to apply for a tuition loan, your account has to be current. You must pay all prior debts to UTEP before requesting this short term loan. To apply, go to loans. utep.edu. If you do not have access to a computer or are having problems finalizing the loan, visit the Financial Aid office on the 2nd floor of the Academic Services Building Between 8:00 am 5:30 p.m. Loans will be available starting August 2, 2010. What if I have an outstanding balance at the end of the term? If you have an account with an outstanding balance at the end of term, it will be forwarded to a collection agency by February 10, 2011, unless arrangements are made with authorized personnel at the Student Business Services. What do I do with my invoice if someone else (such as employers or government agencies) will be paying? You must visit the Student Business Services Office after you receive your invoice and present your purchase order, letter of payment or tuition voucher before the 1st day of classes. The applicable payments to your account will be made by the payment deadline. If assessed tuition and fees are not paid in full by the respective agency, it is your responsibility to make payment for the amount not paid by third party by the published payment deadline. If I am registering during Late Registration, when do I pay? You MUST pay by the late registration payment deadline (refer to the Important Dates section). Please note that an Invoice will not be emailed for initial registrations made after July 27, 2010. Is there a fee for registering for the first time during Late Registration? Yes. If you register for the first time during late registration, you will be charged a late registration fee. The fee schedule is as follows: Late registration prior to classes beginning: $20.00 for WEB Registration $30.00 for In-person Registration Late registration on/after classes begin: $20.00 for WEB Registration $50.00 for In-person Registration Is there a fee for dropping or adding classes during Late Registration? Yes. You will be charged a fee of $5.00 for each ADD or DROP transaction completed during late registration. Can I receive a refund for a dropped class? You are eligible to receive a refund of applicable tuition and fees for dropped courses provided the course(s) are dropped prior to the part of term’s census date and that you remain enrolled for the part of term. You must submit a Student Drop Form to the Registration and Records Office on or before the Course Drop Deadline to be eligible for a refund. If I have to withdraw from UTEP, can I receive a refund? The Refund Policy is established by and subject to change by the legislature of the State of Texas. The percentage of refund is based upon total assessed tuition and fees, not on the amount paid. Unless you do a complete withdrawal prior to the first official class day, you are responsible for a percentage of the total assessed tuition and fees. To view the refund schedule visit http://admin. utep.edu/sbs, select Refund Schdule under Important Dates. If your tuition was paid through federal financial assistance (Pell Grant, Supplemental Educational Opportunity Grant, Federal Perkins Loan, Federal Stafford loan, or Federal PLUS loan), refer to the “Return of Title IV Funds” information on the Student Business Services website. SCHEDULE OF CLASSES | Fall 2010 7 TUITION, FEES AND PAYMENT INFORMATION How is my refund processed? Refunds are processed by the Student Business Services Office based on the original method of payment. Credit card payments will be refunded by check unless you call 915/747-5116 to make arrangements to return funds back to the credit card. Cash and check payments are refunded by check. (allow 5 working days) Payments on your behalf by a sponsor or scholarship are refunded to the original source. Title IV aid (Pell Grant, Supplemental Educational Opportunity Grant, Federal Perkins Loan, Federal Stafford loan, or Federal PLUS loan) is refunded back to the original source. Dropped Courses (Class Schedule Must Be Maintained Within Part Of Term) Provided the student remains enrolled for the part of term, refunds of applicable tuition and fees will be made for courses dropped for the part of term. Dates coincide with the census date for each designated part of term. The Drop Form must be submitted to the Registration and Records Office on or before the appropriate date for the term to be an official drop and thus eligible for a refund. The Drop Schedule is not available at time of this printing. To view the drop schedule online visit http://admin.utep. edu/sbs, select Course Drop Deadline under Important Dates. Refund Policy Refund policies are established by and subject to change by the legislature of the State of Texas and are applicable to withdrawals and dropped courses. Refund Schedule (applicable to complete withdrawals only) • Percentage of refund is based on total tuition and fees assessed, not on amount paid • Unless you do a complete withdrawal from school prior to the first official class day, you are responsible for a percentage of total tuition and fees. Please contact the Student Business Services Office if you have any questions. The refund schedule is not available at time of this printing. To view refund schedule online visit http://admin.utep. edu/sbs, select Refund Schedule under Important Dates. 8 Fall 2010 | SCHEDULE OF CLASSES Return of Title IV Funds In addition to institutional policies and procedures regarding refunds, students receiving Title IV funds will be subject to a separate calculation to determine the return of any Title IV funds. The federal formula provides a return of Title IV aid if the student received federal financial assistance in the form of a Pell Grant; Supplemental Educational Opportunity Grant; Federal Perkins Loan; Federal Stafford or PLUS loan and withdrew on or before completing 60 percent of the semester. The percentage of the refund is equal to the number of calendar days remaining in the semester. If any refund remains after the required return of Title IV aid, the refund will be used to repay UTEP funds, state funds, other private sources and the student in proportion to the amount paid by each non-federal source, as long as there was no unpaid balance; then all aid sources will be repaid before any refund is paid to the student. Worksheets used to determine the amount of refund or repayment are available upon request. Example: Paydirt Pete completely withdraws on the third week of school (17th calendar day into the semester). The number of calendar days in the semester is 54. He had $500 in Federal Pell and was charged $438 in tuition and fees. Under the federal Return of Title IV Aid policy, this student would owe $20.98. T U I T I O N F E E S A N D P A Y M E N T I N F O R M A T I O N UNDERGRADUATE Resident GRADUATE Resident Non-Resident Hours Non-Resident Graduate in EDUC/ LA Science/Univ Coll/MASE/ ESE Graduate in Engineering Graduate in Business Graduate in Health Sciences Graduate in Nursing Graduate in EDUC/ LA Science/Univ Coll/MASE/ ESE Graduate in Engineering Graduate in Business Graduate in Health Sciences Graduate in Nursing 1 286.48 621.48 337.48 337.48 337.48 337.48 345.48 672.48 672.48 672.48 672.48 680.48 2 500.76 1,145.76 602.76 602.76 602.76 602.76 618.76 1,247.76 1,247.76 1,247.76 1,247.76 1,263.76 3 715.04 1,670.04 868.04 868.04 868.04 868.04 892.04 1,823.04 1,823.04 1,823.04 1,823.04 1,847.04 4 929.32 2,194.32 1,133.32 1,133.32 1,133.32 1,133.32 1,165.32 2,398.32 2,398.32 2,398.32 2,398.32 2,430.32 5 1,143.60 2,718.60 1,398.60 1,398.60 1,398.60 1,398.60 1,438.60 2,973.60 2,973.60 2,973.60 2,973.60 3,013.60 6 1,357.88 3,242.88 1,663.88 1,663.88 1,663.88 1,663.88 1,711.88 3,548.88 3,548.88 3,548.88 3,548.88 3,596.88 7 1,572.16 3,767.16 1,929.16 1,929.16 1,929.16 1,929.16 1,985.16 4,124.16 4,124.16 4,124.16 4,124.16 4,180.16 8 1,786.44 4,291.44 2,194.44 2,194.44 2,194.44 2,194.44 2,258.44 4,699.44 4,699.44 4,699.44 4,699.44 4,763.44 9 2,000.72 4,815.72 2,459.72 2,459.72 2,459.72 2,459.72 2,531.72 5,274.72 5,274.72 5,274.72 5,274.72 5,346.72 10 2,215.00 5,340.00 2,725.00 2,725.00 2,725.00 2,725.00 2,805.00 5,850.00 5,850.00 5,850.00 5,850.00 5,930.00 11 2,429.28 5,864.28 2,990.28 2,990.28 2,990.28 2,990.28 3,078.28 6,425.28 6,425.28 6,425.28 6,425.28 6,513.28 12 2,643.56 6,388.56 3,255.56 3,255.56 3,255.56 3,255.56 3,351.56 7,000.56 7,000.56 7,000.56 7,000.56 7,096.56 13 2,842.84 6,897.84 3,505.84 3,505.84 3,505.84 3,505.84 3,609.84 7,560.84 7,560.84 7,560.84 7,560.84 7,664.84 14 3,042.12 7,407.12 3,756.12 3,756.12 3,756.12 3,756.12 3,868.12 8,121.12 8,121.12 8,121.12 8,121.12 8,233.12 15 3,241.40 7,916.40 4,006.40 4,006.40 4,006.40 4,006.40 4,126.40 8,681.40 8,681.40 8,681.40 8,681.40 8,801.40 16 3,423.43 8,408.43 4,239.43 4,239.43 4,239.43 4,239.43 4,367.43 9,224.43 9,224.43 9,224.43 9,224.43 9,352.43 17 3,605.46 8,900.46 4,472.46 4,472.46 4,472.46 4,472.46 4,608.46 9,767.46 9,767.46 9,767.46 9,767.46 9,903.46 18 3,787.49 9,392.49 4,705.49 4,705.49 4,705.49 4,705.49 4,849.49 10,310.49 10,310.49 10,310.49 10,310.49 10,454.49 19 3,969.52 9,884.52 4,938.52 4,938.52 4,938.52 4,938.52 5,090.52 10,853.52 10,853.52 10,853.52 10,853.52 11,005.52 20 4,151.55 10,376.55 5,171.55 5,171.55 5,171.55 5,171.55 5,331.55 11,396.55 11,396.55 11,396.55 11,396.55 11,556.55 21 4,333.58 10,868.58 5,404.58 5,404.58 5,404.58 5,404.58 5,572.58 11,939.58 11,939.58 11,939.58 11,939.58 12,107.58 This table of Tuition and Mandatory Fees does not include incidental, course related or major fees. Please refer to the Current University Catalog The following must also be added if you are a first time student (new student) to the above quoted tuition and fees,: Student General Property Deposit ($10.00 - one time deposit) Student ID Fee ($6.00 - one time issuance fee) New Entering Undergraduate Resident Student ($180.00 – one time fee) New Entering Undergraduate International Student ($200.00– one time fee) New Entering Transfer Student ($150.00– one time fee) Did you know? You are obligated to meet payment deadlines whether or not you received an invoice. The New Entering Undergraduate Fee, the New Entering Undergraduate Transfer Fee, Late Registration Fee, Drop/Add Fees, Student General Property Deposit, and ID Fee are not posted at the time of registration. TUITION, FEES AND PAYMENT INFORMATION Tuition and Fee Rates for 2010 - 2011 - Subject to Approval Name of Charge Classification Residency Amount Notes Undergraduate Resident $168.78/sch* Tuition revenue is used to fund general University instructions and operative expenses. Tuition: Non-Resident $478.78/sch* Graduate in Engineering/ MASE/ESE Resident $218.78/sch* Non-Resident $528.78/sch* Graduate in Business Resident $218.78/sch* Non-Resident $528.78/sch* Graduate in Health Sciences Resident $218.78/sch* Non-Resident $528.78/sch* Graduate in Nursing Resident $226.78/sch* Non-Resident $536.78/sch* Graduate in Liberal Arts/ Univ Coll/Education/ Science Resident $218.78/sch* Non-Resident $528.78/sch* All Students All students $15.00/sch, up to a maximum of $180.00 Required Fees: Student Service Fees As recommended by the Student Service Fee Committee A compulsory fee to fund student-related services; intramural activities, student government, student organizations, career services, cheerleaders, student publications, health services, intercollegiate athletics, others. Energy Fee All Students All Students $2.50/sch A fee to defray utility expenses. Library Fee Undergraduate Students All Students $10.75/sch Graduate Students All Students $11.75/sch A fee to purchase library materials, to replace, maintain, and acquire new equipment and to provide technical support for personal computers and terminals. Student Union Fee All Students All Students $30.00/semester Fee may be used for finance, construction, operation, and maintenance of a student union building and its programs. International Education Fee All Students All Students $4.00/semester For funding an international education financial fund for University students. Recreation Fee All Students All Students $20.00/semester Fee for financing, constructing, maintaining, and operating new and existing recreational facilities and programs. Registration Fee All Students All Students $5.00/semester To defray the costs associated with Technology services for telephone registration. Technology Fee All Students All Students $17.25/sch, up to a maximum of $258.75 An incidental fee that provides for development of campus computers and network facilities for students. Health Center Fee All Students All Students $13.20/semester Fee to provide support and medical services to the student population. All Students All Students Variable For specific services such as late registration, library fines, add/drop fees, bad check charges, application processing fees, and others as approved by the governing board. All Students (depending on courses taken) All Students Variable Mandatory charges for certain laboratory courses; may not be less than $2/semester nor more than $30/semester and must not exceed the cost of actual materials and supplies used by a student. All Students (depending on courses taken) All Students Variable Charges in addition to regular tuition for certain course-related materials and/or for individual instruction. All Students (depending on courses taken) All Students Variable May include such items as parking fees, orientation fees, and installment tuition fees. Incidental Fees: Variety (see Catalog) Laboratory Fees: Variety (see Catalog) Supplemental Fees: Variety (see Catalog) Voluntary Fees: Variety (see Catalog) *sch= Semester Credit Hour. Effective with the fall semester, 1997, the former general use fee has become part of tuition charges per action of the Texas Legislature. Notice: The Texas Legislature does not set the specific amount for any particular student fee. The student fees assessed are authorized by state status; however, the specific amounts and the determination to increase fees are made by the University administration and the University of Texas System Board of Regents. Tuition and fees are subject to change due to legislative and/or institution action and become effective when enacted. Note: Although unlikely, changes in tuition and fees charges may occur after the information is first published; updated information may be obtained from the Student Business Services Office. 10 Fall 2010 | SCHEDULE OF CLASSES TUITION, FEES AND PAYMENT INFORMATION Additional Fee Details Tuition and Fee Increases Tuition and fees provided herein represent the figures at the time of publication, are subject to change by regental or legislative action and become effective on the date enacted. The Texas Legislature does not set the specific amount for any particular student fee. The student fees assessed above are authorized by state statute; however, the specific amounts and the determination to increase fees are made by the University administration and The University of Texas System Board of Regents. Policies governing the payment or refund of tuition, fees, and other charges are approved by the Board of Regents of The University of Texas System and comply with applicable state statues. Add/Drop Fee A fee of $5 is assessed for each ADD and each DROP transaction completed during late registration. See Add/Drop in the REGISTRATION section of this schedule for details. Distance Learning Fees Additional fees are assessed in excess of tuition rates to support the technology required to deliver a course. Undergraduates are assessed $25/semester credit hour and Graduate students are assessed $50/semester credit hour. Note that if you are enrolled in ONLY distance learning courses through the UT Telecampus, and/or WEBB courses through Web CT, the following fees are waived; Activity Fee, Union Fee, Health Center Fee, and Recreation Fee. Graduation Fee A fee of $30 is assessed of candidates for University degrees, payable as part of the degree application process. See the section titled GRADUATION INFORMATION for details on deadlines, diplomas and commencement. Late application fee will remain at $15.00. Refer to the General Information/Graduate Information for further details. Health and Nursing Insurance Information - Fall 2010 Not available at time of printing. For up-to-date information visit or contact the Student Business Services Office located in the Academic Services Building room 118. (915)747-5116. Late Registration Fees Registration begun during the first or second week of late registration will incur a late registration fee. Late registration prior to classes beginning: $20.00 for WEB Registration $30.00 for In-person Registration Late registration on/after classes begin: $20.00 for WEB Registration $50.00 for In-person Registration Returned Check Fee A fee of $25.00 is assessed to students that issue payment to the University with a check that is returned to the University. Student ID Replacement Fee A fee of $20.00 is assessed for the replacement of lost ID cards. Transcript Fee A $2.00 fee is assessed to students for an unofficial copy of their transcript. A fee of $5.00 is assessed for an official copy. A fee of $7.00 is assessed for an official copy requiring immediate processing. Payment Options 1. Pay All - Pay in full 2. Pay 20% - Pay 20% of total tuition 3. and fees assessed and defer the other balance through the EasyPay Installment Tuition Loan option Pay Nothing Now - Apply for Emergency Tuition Loan and EasyPay Installment Tuition Loan option For payment options #2 and #3, go to loans.utep.edu Tuition Loans To be eligible to apply for a tuition loan, your account has to be current and all outstanding debts to UTEP must be paid prior to requesting this short term loan. Visit loans.utep.edu to apply. If you do not have access to a computer or are having problems finalizing the loan, you may visit the Financial Aid Office in the Academic Services Building, 2nd Floor, between 8:00 am - 5:30 pm beginning August 2, 2010. EasyPay Installment Tuition Loan The Installment Tuition Loan requires 20% payment of tuition and fees due at the time of registration, with the remaining balance due in four equal installments the 15th of each month. QUICK REFERENCE EasyPay Installment Tuition Loan formula for payment: 20% of tuition and fees assessed $17 installment tuition handling fee. Student General Property Deposit Entire past due amount for previous semesters or fines (if applicable) Items for which payment CAN be deferred include the following: Tuition Fees (Library Fee, Student Service Fee, Energy Fee, Student Union Fee, Recreation Fee, Technology Fee, International Studies Fee, Registration Fee). Incidental Fees (Course-related, Laboratory, Fine Arts, Transportation Fees). New Entering Student Fee & Smart Card Fee Assessment amount for Parking decal, and health insurance Items for which payment CANNOT be deferred include the following: Student General Property Deposit Installment Tuition Handling Fee Service Fees (Late Registration and Add/Drop) Fines (Traffic and Library) Discretionary Fees (liability insurance) Amounts due for financial holds from prior periods Note that all charges that are not deferrable are due immediately if the EasyPay Installment Tuition Loan is selected. SCHEDULE OF CLASSES | Fall 2010 11 TUITION, FEES AND PAYMENT INFORMATION Additional Policies for the Installment Tuition Loan 1. All student account balances due from prior semesters, including items associated with deferred payment, must be paid in full before a student may begin registration for a subsequent semester. 2. The University shall assess an Installment Tuition Handling Fee of $17.00 for students choosing the plan: this charge is payable at the time of registration. An Installment Tuition Deliquency Fee of $15.00 will be assessed if payment due for that period is not paid in full and on time. 3. The Student Business Services Office will send email notifications to your miners.utep.edu email address as appropriate to students paying tuition and fees under the EasyPay Installment Tuition Loan. 4. The courses for which a student is enrolled on the official census date - 12th class day in a long semester - will be the basis for the student’s tuition and fees assessment. Except for students who officially withdraw up to the end of the refund period, no reduction in amounts due will be made after this date; further, the student is obligated to pay the assessed amounts whether or not class attendance is subsequently interrupted or terminated. 5. A signed promissory note must accompany the student’s initial payment. 6. Section 54.007 of the Texas Education Code, which authorizes the option of paying tuition and fees by installment, also provides for the following penalties of non-payment: A student who fails to provide full payment of tuition and fees including late fees assessed, to the University when the payments are due is subject to the following actions at the University’s option: a) Bar against readmission at the institution; b) Withholding of grades, degree and official transcript; c) Delinquent accounts are referred to Collection Agency for follow up; and/ or d) Dis-enrollment from classes. Outstanding Tuition/Installment Tuition Loans Student accounts with an outstanding Fall 2010 tuition/installment loan balance will be forwarded to a collection agency by February 10, 2011 unless arrangements are made with authorized personnel at the Student Business Services office. Tuition and Fees At A Glance Tuition and fees are subject to change due to legislative and/or institution action and become effective when enacted. Note: Although unlikely, changes in tuition and fees charges may occur after the information is first published; updated information may be obtained from the Student Business Services Office. Charge Non-Resident/International Tuition $168.78/credit hour $478.78/credit hour Students enrolled in Graduate Courses offered in College of Engineering/MASE/ESE $218.78/credit hour $528.78/credit hour Students enrolling in Graduate courses offered in College of Business $218.78/credit hour $528.78/credit hour Students enrolled in Graduate courses in College of Health Sciences $218.78/credit hour $528.78/credit hour Students enrolled in Graduate courses in College of Nursing $226.78/credit hour $536.78/credit hour Students enrolled in Graduate Courses offered in College of Education/ College of Liberal Arts/College of Science/UNIV College $218.78/credit hour $528.78/credit hour $15.00/credit hour (max of $15.00/credit hour (max of Undergraduate: $10.75/credit hour Graduate: $11.75/credit hours Undergraduate: $10.75/credit hour Graduate: $11.75/credit hours $17.25/credit hours (max of $17.25/credit hours (max of Energy Fee $2.50/credit hour $2.50/credit hour Student Union Fee $30/student/term $30/student/term Student Services Fee Library Fee Technology Fee ($180.00) ($258.75) ($180.00) ($258.75) International Studies Fee $4/student/term $4/student/term Recreation Fee $20/student/term $20/student/term Registration Fee $5/student/term $5/student/term $13.20/student/term $13.20/student/term - $25/student/term (International) Health Center Fee International Student Services Fee 12 Resident Fall 2010 | SCHEDULE OF CLASSES DISCLAIMER DISCLAIMER This Schedule of Classes is a general information publication only. It is not intended to nor does it contain all regulations that relate to students. The provisions of this Schedule of Classes do not constitute a contract, express or implied, between any applicant, student or faculty member and the University of Texas at El Paso or the University of Texas System. The University of Texas at El Paso reserves the right to add or withdraw courses at any time, to change fees or tuition, calendar, curriculum, degree requirements, graduation procedures, and any other requirements affecting students. Changes will become effective whenever the proper authorities so determine and will apply to both prospective students and those already enrolled. STATEMENT OF EQUAL EDUCATIONAL OPPORTUNITY To the extent provided by applicable law, no person shall be excluded from participation in, denied the benefits of, or be subject to discrimination under, any program or activity sponsored or conducted by the University of Texas System or any of its component institutions, on the basis of race, color, national origin, religion, sex, age, veteran status, or disability. FAMILY EDUCATIONAL RIGHTS AND PRIVACY ACT FERPA affords students certain rights with respect to their education records. These rights are: The right to inspect and review the student’s education records within 45 days of the day the University receives a request for access. Students should submit to the Vice President for Finance and Administration written requests that identify the record(s) they wish to inspect. The Vice President for Finance and Administration will make arrangements for access and notify the student of the time and place where the records may be inspected. The right to request the amendment of the student’s education records that the student believes is inaccurate or misleading. A student who believes that his or her education records are inaccurate or misleading, or that the records violate his or her privacy rights, may informally discuss amendment of the record with the university office or agency concerned with the particular record. If agreement is reached with respect to the student’s request, the appropriate records will be amended. (Note: The substantive judgment of a faculty member about a student’s work, expressed in grades and/or evaluations, is not within the purview of this right to seek amendment of education records.) If the record is not amended pursuant to the student’s request, the university will inform the student of its decision and of the student’s right to request a formal hearing. Additional information regarding the hearing procedures will be provided to the student when notified of the right to a hearing. The right to consent to disclosures of the personally identifiable information contained in the student’s education records, except to the extent that FERPA authorizes disclosure without consent. One exception, which permits disclosure without consent, is disclosure to school officials with legitimate educational interests. A school official is defined as a person employed by the University in an administrative, supervisory, academic, or support staff position (including law enforcement unit and health staff); a person or company with whom the University has contracted (such as an attorney, or collection agent); a person serving on the Board of Trustees; or assisting another school official in performing his or her tasks. A school official has a legitimate educational interest if the official needs to review an education record in order to fulfill his or her professional responsibility. Upon request, the University discloses education records without consent to officials of another school in which a student seeks or intends to enroll or is enrolled. The right to request that directory information not be disclosed to the public. “Directory Information” means information in a student’s education record that would not generally be considered harmful or an invasion of privacy if disclosed. The University of Texas System component institutions policies will designate the following minimum information as directory information: student’s name; local and permanent address; email address; telephone number; date and place of birth; field of study; dates of attendance; enrollment status; student classification; degrees, certificates and awards (including scholarships) received; photographs; participation in officially recognized activities and sports; weight and height of members of athletic teams; and the most recent previous educational agency or institution attended. Directory information may appear in public documents and may otherwise be disclosed without student consent unless a student submits a written request to the registrar during the first 12 class days of a fall or spring semester or during the first 4 class days of a summer semester to withhold such information from disclosure. Requests to withhold directory information will be honored by the University for only the current enrollment period; therefore, a request to withhold Directory Information must be filed each semester or term in the Office of the Registrar. The right to file a complaint with the U.S. Department of Education concerning alleged failures by the University to comply with the requirements of FERPA. The name and address of the Office that administers FERPA is: Family Policy Compliance Office U.S. Department of Education 400 Maryland Avenue, S.W. Washington, DC 20202-4605 COLLECTION OF PERSONAL INFORMATION NOTICE With few exceptions, you are entitled upon request to be informed about the information the University of Texas at El Paso collects about you. Under Section 552.021 and 552.023 of the Texas Government Code, you are entitled to receive and review the information. Under Section 559.004 of the Texas Government Code, you are entitled to have the University of Texas at El Paso correct information about you that is held by University of Texas at El Paso that is incorrect, in accordance with the procedures set forth in the University of Texas System Business Procedures Memorandum 32. The information that the University of Texas at El Paso collects will be retained and maintained as required by Texas records retention laws (Section 441.180 et seq. of the Texas Government Code) and rules. Different types of information are kept for different periods of time. SCHEDULE OF CLASSES | Fall 2010 13