Online - The Grocer

advertisement

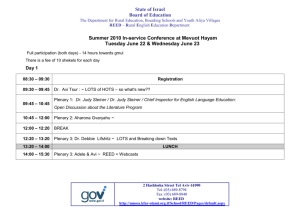

Online D ATA OPEN OP EN 33 O P EN OPEN 33 D ATA O P EN D ATA Media Pack fast moving coverage guaranteed OPE N Introduction D ATA 33 First published in 1862, The Grocer is recognised as the must-read for everyone who works in or wants to understand today’s grocery and FMCG market. Today, it is so much more than a magazine; it is one of the nation’s best known media-brands, extending from the printed page to digital formats and nationally recognised events. D ATA With a circulation of 30,397*, a readership in excess of 112,000** and an annual brand coverage of 2.1 billion*** The Grocer’s readership encompasses every aspect of the industry, from directors of large multiples to independent retailers. OP EN 33 “In the last 150 years, the UK food and drink industry has changed almost OPEN beyond recognition, but there has been one constant in this thriving sector of our OPE N economy throughout the years: The Grocer. The fact that this fifth-generation family-owned magazine is now celebrating 150 years is testament to the high regard in which it is held by all parts of the food, 33 drink and grocery retailing industry. It remains vital reading, too, for many other media organisations, which so often follow where The Grocer has led. I warmly congratulate The Grocer on its 150th anniversary, and wish it every OPEN success in the years ahead.” D ATA D ATA David Cameron, Prime Minister * ABC profile 1 July 2010 - 30 June 2011 D ATA ** NSM Readership Results 2009 *** Durrants 2009 Online D ATA OPEN Thegrocer.co.uk provides a really powerful way to communicate your messages, delivering up to the minute news, data, reports and essential industry information. • T hegrocer.co.uk gives access to over 126,000* articles from The Grocer, Convenience Store and selected newspaper sources • P roviding the ideal advertising platform to target key business decision makers across the UK grocery retail industry • A pproximate monthly traffic figures: – 118,785* unique users – 356,366* page impressions • I nteractive elements include blogs, forums, polls, videos and a digital edition for subscribers, in addition to daily email alerts and news flashes • G rocerJobs has sophisticated functionality and faceted search. With over 56,000 users every month from within the FMCG industry and beyond, GrocerJobs delivers more for jobseekers and advertisers * Google Analytics OPE N Market Information D ATA 33 THE UK MARKET SECTOR The £146.3 billion market sector is the third biggest element of household expenditure in the UK, after housing and transport, and is by far the most important retailing sector. The UK grocery market is made up of over 92,796* stores and is divided into four main sectors according to store size, customer offer and trading style. Convenience retailers and supermarkets/ superstores account for 89% of all sales. The UK’s biggest supermarket chains are arguably the most efficient food and drink retailers that the world has ever seen. The multiples account for 68.3% of the total market and continue to grow their share through an expanding number of retail outlets and diversifying retail formats. D ATA The convenience sector has grown beyond expectations , though distinction between sectors has been blurred by some leading multiple operations diversifying into operations within the convenience sector. OP EN 33 Online Traditional 2.6% Retailing 4.5% D ATA Discounters Convenience 3.9% 20.7% O PE N 33 D ATA Supermarkets, Superstores & Hypermarkets 68.3% Source IGD UK Grocery Outlook 2011 D ATA “I got my job at Morrisons by reading The Grocer. In six weeks it got me up to speed on the industry in the UK. And I still read it. In fact I get two copies: one in O PE N the office and one delivered to my home on a Saturday. It’s essential weekend reading.” Marc Bolland former CEO Morrisons Kantar Media Research 2011 D ATA OPEN The Grocer delivers to the advertiser: Overall rating of The Grocer • Trade magazines remain the most highly regarded information source for the grocery industry overall. Of all the media surveyed, 86% rated trade magazines as good to excellent. • The Grocer is rated highly across all sectors in the grocery retail market in terms of importance to business and job. Campaigns 81% Quality of writing 92% Authoritativeness 88% Columnists and Comment 84% Accuracy 91% Features 88% New product information 92% News 93% Importance of The Grocer to your business/job: (% Rating Important to Essential ) • A staggering 96% of all respondents took some form of action after seeing information in the trade press. Independent (non-affiliated) 72% Independents (symbol) 70% Multiple Head Office 33 Multiple In Store 44% Wholesaler Branch 69% Wholesaler Head Office 56% OPEN OPE N Respondents from our research stated that The Grocer has excellent editorial features with a rating of 90% across all editorial categories, with an impressive 96% taking some form of action after seeing information in the trade press. 74% OP EN D ATA Overall rating of information sources 3for 3 general information: (% Rating Good - Excellent) Trade magazines National Press Exhibitions Conferences and Seminars D ATA 86% D ATA 65% 61% OPEN 54% Direct Mail 50% Manufacturers Reps 63% Trade Media websites 54% Supplier websites 58% N OPE N Advertising Opportunities 33 D ATA The Grocer provides a multitude of opportunities to communicate your message to over 112,000* readers. Leading the market as the voice of the industry, The Grocer is trusted and regularly quoted by the media and is the first place to come for the latest news, product launches and campaigns for all retail sectors across independents, multiples and wholesalers. Opportunities: D ATA • The magazine offers the perfect platform through Focus On features, Guide To category supplements and editorial supplements as well as being able to offer a wide range of bespoke creative executions to further enhance your advertising. • Corporate supplements provide a fantastic way to target the entire industry with a corporate message, and Factfiles are 33 generic category guides, giving readers information on developments and new initiatives within specific categories. • Sponsorship opportunities are available for the monthly Independent View section for Independent retailers as well as some of our annual reports. OP EN Throughout history, Stolichnaya Premium vodka has remained the most original vodka, was the pioneer of flavoured vodka and has been the inspiration for the most original cocktails. NEW £1m support package for Stoli this year including digital and a fantastic national summer TV campaign! O PE N 3 3 - 30 June 2011 * ABC profile 1D ATA July 2010 Great cocktails start with responsible measuring. DRINK WITH CARE. STOLICHNAYA® Premium vodka. 40% Alc./Vol. 100% Grain Neutral Spirits. © 2012. Marketed and distributed in the UK by Maxxium UK. D ATA Advertisements are available throughout the issue, and advertorials such as case studies or educational pieces provide yet more opportunity for powerful communication. O P EN A flexible solution for your resourcing issues Grow your sales with our new Own Brand range THE IGD CONVENTION 2012 Category Management, Shopper Marketing and Account Management THE TOUGH QUESTIONS TACKLED FROM EVERY SIDE Over 500 products Over 100 new lines 9 OCTOBER 2012, LANCASTER LONDON, W2 igd.com/convention #IGDConv12 Competitive prices Great margins On average 20% cheaper than the leading brands* J oin us at the IGD Convention 2012 as we explore the really big issues that will define our sector. What’s the future shape of retailing, how can we compete globally, and how can we better engage with shoppers through digital channels? If your business is tackling tough questions like these, this lively, interactive forum is the place to test your thinking, find inspiration and network with over 700 peers. Last year’s Convention sold out well in advance, so guarantee your place by booking before the end of May. EARLY BIRD DISCOUNT ! MAY EXPIRES 31 R RESERVE YOU PLACE AT IGD.COM/ CONVENTION HEAR FROM: We provide a total package of People, Tools and Processes • Skilled practitioners across Category Management, Shopper Marketing GILL BARR MARC BOLLAND DAN COBLEY MD UK & Ireland JOANNE DENNEY-FINCH OBE RICHARD HODGSON JUSTIN KING CBE JUDITH MCKENNA ANDREW MORGAN Group Marketing Director and Account Management Chief Executive Chief Executive • Trained and equipped with Bridgethorne Tools and Processes © • Access to the wider Bridgethorne team • We hit the ground running for immediate impact D ATA Group Commercial Director CHARLES WILSON *See musgrave.co.uk/SuperValu for more details. Call 0808 178 8644 to join us today We also do: Category Visions |Market Assessments | Range Reviews | Data Insights & Analytics| Joint Business Planning |Training Contact Diane Price on: Tel: + 44 (0) 7795 516333 Email: diane.price@bridgethorne.com Partner to Entrepreneurial Food Retailers 33590-SuperValu-Trade-Press-Ad-A4-AW-NIC-v1.indd 1 joinlondis.co.uk joinbudgens.co.uk 26/04/2012 11:26 Chief Executive Chief Operating Officer President, Europe • Flexible assignments from 3 months www.bridgethorne.com President, IGD and Chief Executive DAVE WOODWARD President - Rest of the World MICHAEL BUERK Convention chair © Book now: igd.com/convention Convention Grocer ad v2.indd 1 5/3/2012 10:09:57 AM D ATA OPEN 13 NOVEMBER 2010 GUIDE TO... LOGISTICS, WAREHOUSING & TRANSPORTATION 6 NOVEMBER GUIDE TO... 2010 SOFT DRIN KS Factfile Bread & Baker y Bakery is a win with consumerner s Allied Bakerie s is the num ber sector in the UK1 and is com one bread and bakery supplier in an extensiv the convenienc e range of prod mitted to growing the category by e ucts that effe the key brea continuing to d sectors. One ctively mee offer t the latest con of its brands grocery bran sumer needs ds. Kingsmill – Kingsmill in – is among the bread has a approximately retail value UK’s top 10 6.5 million of over £350 loaves a wee million and k. sells Bakery Sector Stati stics The UK bread and morning goods market ® is worth £3.38 billion, making it one of the largest sectors in the food indust 2 ry. Bakery is worth more than many popular UK groceries including soft drinks, chocolate confec tionery, and biscuits. Bread in particular is an essential part of most consum er diets, with virtual every household ly buying in to the category. The average UK Fe wbuys house heover hold alth 80ca per year and spend hi loaves re cate s ongh averag lyede gories overpe £75.00 on sliced bread.3 nden in Factfile PERCENTAGE SHAR E OF BREAD CONSUMPTION OCCASIONS Coming out of l 11 September 2010 www.thegrocer.co.uk MOVIN G FORW ARD unusua 50RPM STEREO © 1706-2010 ? A promot ional sup Milk is game for a sporty tie-up 186178_1 _GRO_G SK.indd plement 1 from Glax oSmithK line L COVE RAGE Consum OPEN er Healthc are GROC ERY MU LT IPLES * Neilsen | Date to TS What can dairy expect from the new coalition government? COUGH WINTER REMEDIE S MULTI SYMPTO M Asda shares its vision for quality in the dairy aisle DECONGES TAN The Grocer with Nielsen TS In association DECONGES TAN Produced by 33 WINTER REMEDIE S MULTI SYMPTO M SORE THROAT OP EN WHAT KEEPS BRANDS IN THE CHAR TS? Are we ready to super-size the farm? OPE N DID YOU KNOW • Bread is purcha sed in 99% of house • Over 5 million holds in the UK.8 loaves • Plant bread (wrap are sold per day – that’s 3,500 per minute.9 ped, sliced bread) Bread Category. accounts for approx st perform t marke imately 89% of t with gro sales in the trend wh ing the total ma cery rke 2 ich looks set to con t - an ongoing A promotional mosupple ve awament tinu y from from e Allied pha in growth s as consumers rmaBakerie cy. All sec and mu tors are lti-sympto strongly. 2 Value m Wit % Chan accounting h multi-sympto is recovering ge Vs m 192206_1_GRO for 29. Year Ag Allied 26 W/ marke Bakeries .indd 1 9% of the oE 10.07 t 2 and cold recently Value .2010* NPD and being the and flu 20 % Chan abo main focu ge Vs much brig ve the line sup s for Year Ag port, the hter for 26 W/ this imp outlook oE 10.07 suggests orta is that mu .2010 04/11/2010 13:44 15 20 lti-sympto nt sector. History * ground as the m will reg ain Whilst mu driving force in the marke lti-sympto accounts 10 for just 10% 10 m own label cur t. 15 sector (by ren value), its of the multi-sym tly negative ptom growth effe may hav ea necessaril ct on a categor 10 5 y that is y not products price sensitive. 5 Cold and are flu symptoms. most likely to be bought 0 5 to treat early reli Consumers react ef and rese to they buy arch has the need for at suggested In healthc a premium and that 0 on are brands like , trust is a fact 5 impulse. 5 or and Beechams, household regular which NPD and marketing benefit from to be win support, ner are likely one of the s in the categor y and rep best stra resents tegies for growth. TOTA SORE THROAT SUPPLEMENT TO THE GROCER Cheese £2.40bn Fresh Poultry & Game £2.32bn Despite Biscuits £2.31bn the figures sho lly poor Chocolate Confectio season, w a buo nery £2.18bn late out yan COUGH dairymen the cold Snacking 4% are as cidenc t on in unpred cidenc ictable in swin e appear to e – bu Breakfast 31% be lowe ry in the Conveniene flu al asLunchb t last ye coldox an so r 4.4 million custom for man ce Secto d flu 15% ufactu r failed to m than in prev ar took an ers top up on bread unusua with each se at rers least once a monthlarges ious ye and re aterialise. 1 t caience from a conven l Lunch ason ars turn tegory store.4 Bread is bounce tailers – es However, th but the antic also the numbe 28% . Not only r 3 reason pe did er s back 2 customers visitingLOOK for ipated cially convenience . ING in groc e is good ne winter stores – behind BA only milk and newsp Althoug ws on ery – as CK h the 5 apers. the ho spike he Consumers arethe summe re was a slight sale al rizon thcare increa r oftime s uplift in 200pressu Bread consump followedsingly 9, the red and are using conven core sea tion throughou’s second iencesaw a thre stores son that to quickly the swi t pop in and purcha the day ar low in ne flu hyp e-ye se essent 3 sale ial e, produc far the big wittsh like bread without having multi-sym s despite ges • Breakfast is the to do secsuperptom a tbig tor – unc largest individual market shop. bearing the haracteris – by bru 4 consumption occasi 11 tically Multi-sym nt. • Sandwiches contin on. incidence, ptom underperfo ue to dominate • Availability is the THE LARGEST rmed 4 due but grocery lunchboxes. number 1 factor totaGROC CATEGstill to low l markeERY ORIE in outSperform satisfy ing bread shopp t in this ers 2.5% com Fresh Meat £5.25bn ed the sector, wit in pared to (above factors such convenience Convenience has h units dowstores and with a become more impor Vegetable £4.60bn as cost).6 just shopp multiple market decline • An bread consumers as they tant to er generates 50% of 9.9% grocery work longer hours Fruit £3.96bn Multi-sym more turnov gai er shorte and take ning sha 4 and spends £500 r lunch breaks. in the cor ptom own label re. per year more in-store Sandwiches perfec Milk £3.41bn e season meet today’s luncht del than the averag tly e convenience due to stro ivered growth Howeve ime needs. The Bread & Mornin r, it accoun sandwich market is estima ng distribu shopper.7 g Goods £3.38b ted to be worth multi-s tion. Take Home Soft £4.1 billion.12 ymptom n ted for just 10% 10 Drinks £3.06bn sector, lag of the bra nde ging way Frozen Ready Meals d £2.86bncontributio behind n. Total Bake the Cold & F lu Teatime 9% Evening Meal 13% WE 10.07 .10 13/10/20 10 14:2 7 GRO1012_BBB_ cover2.indd 2 D ATA CHEAP AS CHIPS Can dairy break free from promotions? x2_Contents & Cover.indd 1 33 11/3/10 14:37:51 D ATA 6/9/10 16:53:36 OPEN Contact Special creative opportunities are also available, for further information please call the sales team on 01293 610216. D ATA OPE N Awards D ATA 33 The Grocer organises a wide range of industry events that deliver great networking opportunities as well as offering bespoke marketing and sponsorship solutions. Why sponsor an event by The Grocer? OP EN • Reach a wider audience • Be seen to support the industry 33 • Target specific markets • PR Coverage • Benefit from our extensive event • Networking marketing and promotion Why not entertain your clients at one of our key events? D ATA OPEN OPE N The Grocer Gold Awards recognise the best of the best in the grocery industry for financial performance, customer service, innovation, competitive pricing and product offerings. 33 D ATA Many of the awards are based on exclusive research conducted by The Grocer, and the remainder are judged by a panel of industry experts. Attended by industry leaders from retailers, manufacturers, wholesalers and trade associations. OPEN D ATA OP EN 33 Contact The event is exclusive, with limited availability www.thegrocer.co.uk/goldawards – 01293 610216 OPEN OPE N D ATA The Grocer Own Label Food & Drink Awards recognise distinction in own label 33 products within the food and drink industry, judged on appearance, taste, packaging, content, clarity of labelling and value for money. D ATA D ATA In association with Cambridge Market Research, the awards provide not only expert judging feedback but an essential consumer judging report for all entrants. OPEN Contact www.thegrocer.co.uk/ownlabelawards 01293 610216 D ATA If you would like to know more about sponsorship opportunities at any of our events, please call the sales team on 01293 610216. D ATA OP EN 33 OPEN The Grocer Marketing Advertising & PR Awards You don’t need anyone to tell you FMCG marketing is highly demanding with the OPEN N competitionOPEgrowing fiercer year on year… but you do need to tell the industry. Entering The Grocer Marketing, Advertising & PR Awards is an easy way to showcase your company’s creativity and your contribution to business excellence in the FMCG industry. They bring prestige 3 3 and kudos to future business pitches, as well as providing a focal point around which you and your team can celebrate your achievements. D ATA D ATA The Grocer Marketing, Advertising & PR Awards are split into two categories: Creative Awards and Agency Awards OPEN OP EN 33 Contact www.thegrocer.co.uk/mapawards 01293 610216 OPEN OPE N D ATA The Grocer New Product Awards The Grocer is pleased to introduce the New Product Awards 2012. 33 These brand new awards celebrate and reward outstanding fmcg innovation in both food and non-food product categories. Entrants will receive a consumer report worth hundreds of pounds, and all Winners and Finalists will be given free use of the logo to use on packaging and other marketing material to capture consumer attention. OPEN D ATA D ATA Contact For more information please visit www.thegrocer.co.uk/newproductawardsnewproductawards 01293 610216 D ATA OPE N Features list 2012 january 7 150th Anniversary 14 Focus On: Meat Free Focus On: Easter & Spring 21 Focus On: Packaging Focus On: Infant Care Special: Salary Survey 28 Focus On: Jams/Preserves/Honey Focus On: Cereals Guide To: Oils february 4 Focus On: Household Special: Big 30 Wholesalers Survey 11 Focus On: Cooking Sauces Focus On: Fairtrade Guide To: Hot Beverages 18 Focus On: Tobacco & Accessories 25 Focus On: Pizza Focus On: Ready Meals & Microwaveable Food Guide To: Cheese Special: Top 50 Independents Survey MARCH 3 Focus On: Juices & Smoothies Supplement: Britain’s 100 Biggest Brands Guide To: Tobacco & Accessories 10 Focus On: Ice Cream Guide To: Confectionery Special: Careers in FMCG 17 Focus On: Food & Drink Expo Preview Supplement: Best Of British 24 Focus On: Bottled Water Guide To: Breakfast 31 Focus On: Barbecue Guide To: Sports Nutrition & Energy APRIL 7 Focus On: Yoghurts & Pot Desserts 14 Focus On: Beauty, Suncare & Holiday Essentials 21 Focus On: Own Label/PLMA preview Focus On: Wine & Champagne Special: Branded & Own Label Supplier Survey 28 Focus On: Carbonated Drinks Focus On: Squashes & Cordials Guide To: Sales & Marketing Agencies D ATA MAY 5 Focus On: Personal Care Guide To: Beer & Cider 12 Focus On: Bakery Supplement: Meat, Fish & Poultry 19 Focus On: Crisps, Nuts & Snacks 26 Focus On: Oils Special: Power List Guide To: Pet Care JUNE 2 Focus On: Scotland Supplement: History of Brands 9 Focus On: Frozen Food 16 Focus On: Healthcare & Supplements Special: The Grocer Gold Awards Guide To: Ethnic 23 Focus On: Collectables 30 Focus On: Beer & Cider Guide To: Packaging JULY 7 Focus On: Butters & Spreads 14 Focus On: Functional Food & Drink Focus On: Free From Special: OC & C Global 50 21 Focus On: Lunchbox Special: 100 Biggest Alcohol Brands Guide To: Toiletries & Personal Care 28 Focus On: Homebaking Focus On: Canned Goods AUGUST 4 Focus On: Male Grooming OPE N Focus On: Halloween Guide To: Household 11 Focus On: Breakfast 18 Focus On: Rice & Noodles Guide To: Tobacco & Accessories 25 Focus On: Speciality & Fine Food Focus On: Organic Guide To: Christmas 33 SEPTEMBER 1 Focus On: Batteries Focus On: Newspapers & Magazines Supplement: Dairymen 8 Focus On: Hot Beverages 15 Focus On: Sauces & Condiments 22 Focus On: Spirits Guide To: Snacking 29 Focus On: SportsDNutrition & Energy ATA SIAL Preview Guide To: Franchise & Fascia Special: The Green Issue OCTOBER 6 Focus On: Confectionery Guide To: Frozen Food Special: Top 150 Food & Drink 13 Focus On: Alcoholic Drinks 20 Focus On: Cakes & Biscuits Focus On: Winter Remedies Guide To: Experiential & Field Marketing Agencies 27 Focus On: Soup Focus On: Pet Care NOVEMBER 3 Focus On: Bacon & Sausages Guide To: Soft Drinks 10 Focus On: Pasta & Pasta Sauces Guide To: Logistics, Warehousing & Transportation 17 Focus On: World Cuisine Focus On: Fish Guide To: Alcoholic Drinks 24 Focus On: Pies & Meat Snacks DECEMBER 1 Focus On: Cheese 33 Guide To: Batteries D ATA 8 Focus On: Desserts & Puddings 15 Special: Top Products Survey Focus On and supplement enquiries: 01293 610468 Guide To enquiries: 01293 610216 Advertising enquiries: 01293 610216 News-led feature enquiries: 01293 61026 Features are subject to change D ATA 3 Ratecard D ATA OPEN Rates effective 1st January 2012 Facing or Amongst/Under Matter Positions DPS Colour Colour/Mono Mono 1/2 DPS 1 Insertion £6,890 £4,995 £2,690 £4,590 Full Page Colour F/M Mono F/M £3,625 £1,440 1/2 Page Solus Colour £3,040 Colour F/M £2,430 Mono F/M£920 1/4 Page Colour STRIP U/M £1,990 Colour F/M £1,630 Mono STRIP U/M £780 Mono F/M£555 U/M- Under matter F/M - Facing matter “If it’s not in The Grocer, it’s not worth reading” Colin Bell Managing Director Orchidwood Mushrooms Ltd Special Positions Front Cover + Flap £13,050 First R/H/P £4,075 Inside Front Cover £4,185 Guaranteed position 10% extra Inside Back Cover £2,930 Second Colour (per colour) + £490 First Spread £7,700 Back Cover £3,625 FactFile£11,560 Standard Gatefold £12,985 Advertorial £4,125 Advertorial DPS £7,630 Tip-on £8265 Bound Insert Single Sheet (140gsm) £4,075 Front Cover Supplement (with flap) £11,115 Front Cover Supplement (no flap) £8,755 William Reed Business Media D ATA D ATA William Reed Business Media has been providing market leading business information for 150 years. The markets we serve are central to everyone’s life. They include food and drink, where our activities extend across manufacturing, retail, wholesale and hospitality, and, more recently, pharmaceuticals and cosmetics. Guided by our company values, we are committed to providing the information and insights our customers demand. Grocery & Retail Food Manufacturing, Processing & Ingredients Drinks Hospitality Pharmaceuticals Cosmetics As an independent company with expert knowledge of the markets it services, William Reed Business Media has the flexibility to react quickly to industry changes producing innovative products that meet its customer’s needs. 33 D ATA OPEN Published weekly since 1862 And they’re all British Winners www.thegrocer.co.uk 24 March 2012 Cold Medal | £3.00 exclusive As Morrisons signs up to GM is it really chicken feed? 16 coffee Who stands to gain from coffee price rollercoaster? 24 nuts Walkers aims to crack nuts market with Sensations launch 30 toys How next-generation products combine smartphone apps with toys 40 brian bows out Samworth Brothers CEO Brian Stein on pies, passion and poaching staff 34 meat As red meat prices rise, mults cut back on meat deals 10 wholesale Trade credit issues force DBC sale 36 social media Our survey reveals the most ‘social’ and ‘anti-social’ supermarkets 12 dairy How milk processors are facing a £125m squeeze 45 bottled water The Olympics boost to British water Job of the week: Head of commercial trading at the Co-operative food business p74 Celebrating 150 years of Winning Ice Creams for 2012 OOD navigato Dri nk pe ro eu lM ne ea ws .co t m A 21st century media business OPE N Contact Us D ATA 33 OPEN 33 OPE N OPEN Advertising & sponsorship enquiries: D ATA 33 D ATA Jonathan Daniels, Commercial Director 01293 610216jonathan.daniels@thegrocer.co.uk OPE N Beverley Burkett, Northern Area Sales Manager 01663 733883beverley.burkett@thegrocer.co.uk D ATA Sam Dack, Area Sales Manager 01293 610453sam.dack@thegrocer.co.uk Ben Lawless, Area Sales Manager 01293 610293ben.lawless@thegrocer.co.uk Lia Meredith, Area Sales Manager 01293 610371lia.meredith@thegrocer.co.uk Tim Parker, Area Sales Manager 01293 610217tim.parker@thegrocer.co.uk Simon Apps, Digital Sales Manager 01293 610453simon.apps@thegrocer.co.uk D ATA OPEN 33 OPE N OPEN Editorial enquiries: D ATA 33 D ATA The Grocer Editorial Team 01293 610259grocer.editorial@wrbm.com Adam Leyland, Editor 01293 610263 adam.leyland@thegrocer.co.uk Switchboard: 01293 613400 Websites: thegrocer.co.uk OPE N D ATA www.william-reed.co.uk Terms & Conditions D ATA OPEN ¬WILLIAM REED BUSINESS MEDIA LTD STANDARD TERMS & CONDITIONS FOR ADVERTISERS (REVISED 1st APRIL 2009) 1. In these Terms:“Advertisement” means any advertising materials supplied or entered by or on behalf of the Client in any format in the form intended for publication by Reed and shall include without limitation all advertisements, supplements, inserts, and ad banners; “Advertiser” means the Agency or the Client if a Booking is made by the Client direct; “Agency” means the person, firm, or company engaged by the Client to select and purchase advertising space on its behalf and includes its successors in title and assigns; “Booking” means all booking of advertisements; “Client” means the person, firm or company wishing to advertise products and/or services in the Publication or on the Website and includes its successor in title and assigns; “Code” means any user name, password or other identifier provided by Reed to Advertiser to enable Advertiser to enter Advertisements directly on to a Website; “Copy Deadline” means the date and time by which the Advertisement must be submitted to Reed as stated by Reed; “Directory” means a printed directory, guide, handbook or other publication issued annually by Reed; “Publication” means a magazine or any other printed publication not being a Directory issued by Reed; “Publication Date” means the date on which the Publication or Directory is made available for general circulation or when the Advertisement is made available to users on the Website; “Reed” means William Reed Business Media Ltd of Broadfield Park, Crawley RH11 9RT; “Terms” means these Terms & Conditions; “Website” means a website owned or managed by Reed. Unless the context otherwise requires, words denoting the singular shall include the plural and vice versa. 2. Subject to cl. 3, any Booking made by Advertiser will be on these Terms. By making a Booking Advertiser accepts in full these Terms in respect of the Booking and in respect of any further Booking made by the Client and/or Agency. These Terms shall apply to all Bookings made by telephone, letter, facsimile, e-mail, through the internet or any other means. 3 These Terms are an invitation to treat and as such do not constitute a binding offer to enter into a contract. Any Booking made by Advertiser will upon receipt by Advertiser of Reed’s written acceptance of the Booking create a binding contract between Reed and Advertiser. 4 In no circumstance does the placing of any Booking convey the right to renew on similar terms. 5 An Agency will be jointly and severally liable with its Client for the Client’s liabilities under these Terms. 6 Advertiser shall deliver the Advertisement to arrive at Reed by the Copy Deadline, in any format that conforms to Reed’s requirements as notified by Reed to Advertiser. Reed reserves the right to charge for production work and any other additional work that Reed may be required to undertake. Reed may in exceptional cases and at its own discretion accept Bookings and Advertisements after the Copy Deadline. Such acceptance shall not impose any obligation whatsoever on Reed to accept any other Booking or Advertisement after the Copy Deadline. 7 In the event of any Advertisement not being received by the Copy Deadline, Reed reserves the right to repeat the copy last used. In such event Reed shall not be responsible for making any changes in that copy, unless these are confirmed in writing and in time for the changes to be made. Reed reserves the right to charge for any additional expense involved in such changes. 8 Reed shall be entitled to amend, edit, withdraw, take down or otherwise deal with any Advertisement at its absolute discretion and without giving prior notice. 9 At Reed’s discretion payments may be subject to a deduction for advertising agency commission at the rate agreed between the Client and the Agency up to 10% of the relevant invoice. Save for such commission there shall be no deductions or withholdings whatsoever. All sums shall be paid together with any VAT or other sales tax applicable. 10 Advertiser shall pay all invoices within 30 days of the date of the invoice. All sums shall be paid together with any VAT or other sales tax applicable. 11 Debt recovery costs and interest on overdue invoices shall accrue on any unpaid amounts from the date when payment becomes due to the maximum extent permitted by The Late Payment of Commercial Debts (Interest) Act 1998 and Late Payment of Commercial Debt Regulations 2002 as amended, extended, consolidated or replaced from time to time. 12 In the event of late payment, Reed reserves the right to waive any agreed discounts. 13 Reed shall be entitled to cancel any Booking without incurring any liability to Advertiser. 14 In the event that Advertiser wishes to cancel any Booking it shall notify Reed in writing. 15 Where Advertiser cancels a Booking Reed shall be entitled to compensation of 100% of the total value of the advertisement space of the cancelled Advertisement where notice of cancellation is received by Reed: a) for a Directory less than two months; b) for any other Advertisement in a Publication less than six weeks; c) for a Website less than one month; before the Publication Date. 16 Subject to cl. 17 in the event that Advertiser terminates, cancels or fails to fulfil its obligations under a contract in which Reed and Advertiser have agreed a time period in which Advertiser shall book an agreed number of advertisements at rates notified by Reed, Advertiser loses the right to a series discount to which it may have been entitled. In such event, Advertiser shall pay to Reed a sum in respect of each of the advertisements placed, such sum representing the difference between the rate agreed under the said contract and the rate that is applicable for the number of advertisements actually placed, such rate to be notified by Reed to Advertiser. 17 Reed reserves the right to increase the advertisement rates as notified by Reed to Advertiser or to amend any terms agreed between the parties as to space for the Advertisement. In such event Advertiser has the option of cancelling the Booking without incurring a cancellation fee. 18 Advertiser undertakes to keep any Code strictly confidential and to notify Reed immediately in the event that any Code becomes known to a third party. 19 Advertiser is solely responsible for any liability arising out of publication of the Advertisement including an Advertisement submitted using Code without Advertiser’s knowledge or control or relating to any material to which Website users can link though the Advertisement. 20 Advertiser represents and warrants to Reed that the Advertisement and any link comply with all advertising standards, applicable laws and other regulations; that it holds the necessary rights to permit the publication and use of the Advertisement by Reed for the purpose of these Terms; and that the use, reproduction, distribution or transmission of the Advertisement will not violate any applicable laws or any rights of any third parties, including, but not limited to, infringement of any copyright, patent, trade mark, trade secret, or other proprietary right, false advertising, unfair competition, defamation, obscenity, piracy, invasion of privacy or rights of celebrity, infringement of any discrimination law, securities law or regulation, or of any other right of any person or entity. 21 Advertiser agrees to indemnify Reed and hold it harmless from any and all liability, loss, damages, claims or causes of action, including reasonable legal fees and expenses that may be incurred by Reed arising out of or related to a breach or any of these representations and warranties. 22 To the full extent permitted by law, Reed will not be liable for any loss or damage, whether direct or indirect, including consequential loss or any loss of profits or similar loss, in contract or tort or otherwise, relating to the Advertisement or any advertisement submitted using Advertiser’s Code without Advertiser’s knowledge or control or these Terms or any error in the Advertisement or lack of access to or availability of a Website or failure of the Advertisement to appear from any cause whatsoever. Reed will not be liable for any error in the published Advertisement nor its failure to appear at a specified time or in any specific position. 23 Advertiser grants to Reed the royalty-free right and licence to use, reproduce, publish, store, distribute and display the Advertisement worldwide in accordance with these Terms. No rights in the Advertisement shall transfer to Reed under these Terms. 24 Advertiser acknowledges and allows that data submitted by Advertiser in connection with a Booking may be used for the purposes of updating details of Advertiser on Reed’s databases and of compiling statistical information on Advertiser. 25 Reed reserves the right to destroy all material that has been in its (or its printers) custody for one year provided that Advertiser has not given instructions to the contrary. Reed may exercise his right under this clause without giving further notice to Advertiser. 26 Reed shall have the right to terminate any agreement between Reed and Advertiser to which these Terms apply by notice to Advertiser if Advertiser either: a) fails to make any payment due to Reed by the due date and such failure continues for 15 days after the due date; or b) is in breach of any warranty or fails to comply with any of its material obligations under any agreement between the parties or these Terms and in either case does not remedy the same (if capable of being remedied) within 30 days of receipt of notice in writing from Reed specifying the breach or failure and calling for the same to be remedied; or c) compounds or makes arrangements with its creditors or becomes insolvent or if any order is made or resolution passed for its liquidation, winding up or dissolution or if a receiver or manager or administrative receiver or administrator is appointed over the whole or a substantial part of its assets or of anything analogous to or having substantially similar effect of any such events shall occur under the laws of any applicable jurisdiction; or d) is unable to perform any of its obligations in circumstances set out in cl.26 below for a continuous period of not less than 56 days. 27 Neither party shall be liable to the other in respect of any non performance of its obligations by reason of any act of God, civil war or strife, act of foreign enemy, invasion, war, satellite failure, legal enactment, governmental order or regulation, industrial action, trade dispute, lock-out, riot or any other cause beyond their respective control provided always that in any such event the duration of the agreement between the parties shall be extended over which such event continues, but otherwise such event will not affect any obligation of Advertiser to purchase any number of advertising spots between Advertiser and Reed. 28 The rights and conditions set out in these Terms shall not be assigned by Advertiser without Reed’s prior written consent. 29 Any notice or other information to be given by either party under these Terms shall be made by first class prepaid mail, facsimile transmission to the address above or to an e-mail address supplied by Reed for the purpose for Reed, and to the address or electronic e-mail address supplied by Advertiser to Reed, and shall be deemed to have been communicated upon the date of actual delivery. 30 No waiver or any breach of any of these Terms shall be deemed to be a waiver of any other breach and no waiver shall be effective unless in writing. 31 No term or provision in these Terms shall be varied or modified unless agreed in writing and signed by the parties. 32 These Terms together with any other document incorporating these Terms shall constitute the entire agreement and understanding between the parties in relation to its subject matter. The parties acknowledge and agree that they have not relied on and shall have no right of action in respect of any representation, warranty or promise in relation to such subject matter unless expressly set out in this agreement save for such representation, warranty or promises made fraudulently. 33 These Terms or any agreement to which these Terms apply shall be governed by English law and shall be subject to the exclusive jurisdiction of the English Court. Introduction Find out more about William Reed Business Media and our portfolio at william-reed.com William Reed Business Media Broadfield Park, Crawley, West Sussex, RH11 9RT Tel: +44 (0)1293 613400