The World Luxury Index™ American Fashion

advertisement

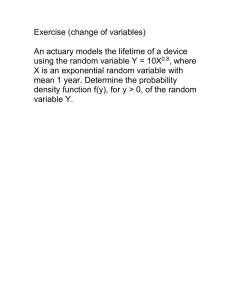

The World Luxury Index™ American Fashion The Most Sought After American Luxury Fashion Brands Globally October 2012 In partnership with and A new luxury benchmark is born. Created as a way to provide luxury brands and service providers with a standardized way of measuring brand interest at an international level, Digital Luxury Group, in partnership with Luxury Society, has unveiled: An international ranking and analysis of the most searched-­‐‑for brands within the luxury industry. The World Luxury Index. Notable past reports include: © Digital Luxury Group, SA 2 Why search matters. What is particularly interesting with Internet, is that everything users search for or click on is stored on servers. Generating a huge amount of raw data that can be used to reveal an unbiased representation of the market demand. We realised that until now, nobody was collecting, sorting and analysing luxury specific data. Nor was anybody trying to explain to luxury brand marketers the implications for their business. ~ Philippe Barnet, We were excited to collaborate on this report from DLG because it is purely data-­‐‑ driven, from a team who not only understands the industry but works in it on a daily basis. The rankings gathered in this report are completely objective, with an added value of informed, experienced perspective used to infer, identify and analyze what this means to the industry. ~ Elizabeth Canon, © Digital Luxury Group, SA 3 Consumers thirst for Fashion. “Women'ʹs wear represents 41.9% of the $1.4 trillion apparel, accessories and luxury goods market globally” ~ Datamonitor, 2011 Introducing a standardized benchmark, The World Luxury Index™ American Fashion, focusing on Luxury Fashion brands based in the US. © Digital Luxury Group, SA Photo source: Tory Burch Fall 2012 Runway 4 The World Luxury Index American Fashion. Covering: 35 US-based fashion brands Unbiased insights from the world’s top search engines: 10 global markets Brazil China France Germany India Italy Japan Russia United Kingdom United States 31 million+ searches* © Digital Luxury Group, SA * From January to June 2012 5 What are the most searched for American fashion brands worldwide? Photo Source: Michael Kors, Marc Jacobs, Ralph Lauren, Calvin Klein Fall 2012 Runway 6 Top 10 Most-Searched American Fashion Brands Worldwide. #1 #6 #2 #7 #3 #8 #4 #9 #5 # 10 January – June 2012 Source: Digital Luxury Group 7 Top 30 Most-Searched American Fashion Brands Worldwide. 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 Michael Kors Marc Jacobs Ralph Lauren Calvin Klein Vera Wang Tory Burch Kate Spade Diane von Furstenberg Betsey Johnson Tom Ford Alexander Wang The Row Hervé Léger St. John Carolina Herrera 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 Marchesa Monique Lhuillier Jenny Packham Anna Sui 3.1 Phillip Lim Oscar de la Renta Rick Owens Donna Karan Jason Wu Proenza Schouler Helmut Lang John Varvatos Zac Posen Catherine Malandrino Rodarte January – June 2012 Source: Digital Luxury Group 8 A Note on Diffusion Lines. All top 5 brands have created diffusion lines to expand into a wider retail network – consequently benefiting from increased search volumes. Rank Designer Line 1 Michael Kors MICHAEL by Michael Kors 2 Marc Jacobs Marc by Marc Jacobs 3 Ralph Lauren Polo Ralph Lauren 4 Calvin Klein CK 5 Vera Wang White by Vera Wang, Simply Vera Of note: Searches for much larger diffusion lines such as CK, Polo or Simply Vera were not included in the calculation of the global ranking © Digital Luxury Group, SA 9 Handbags and Ready-To-Wear, the most sought after fashion categories Photo Source: Ralph Lauren Fall 2012 Ad Campaign 10 Handbags and Ready-to-Wear Lead. Global Breakdown of Searches by Product Category 5.9% 7.6% Bags 36.1% 14.1% Ready to wear Wallets Shoes Sunglasses Belts & Scarves 34.9% January – June 2012 Source: Digital Luxury Group § On average around the world, American brands are most often searched for within the Handbag and Ready-­‐‑to-­‐‑Wear categories § In China, as one example, handbags represent even a larger slice, with more than 50% of fashion category interest © Digital Luxury Group, SA 11 Brands Shine via Different Products. Global Breakdown of Searches by Product Category by Brand 5.1% 8.5% 23.7% 8.7% 3.9% 7.9% 6.6% 3.5% 13.6% 12.4% 19.7% Belts & Scarves 54.1% 59.6% 4.5% 89.0% Sunglasses Shoes Ready to wear 59.1% 5.4% 16.9% Michael KorsMarc Jacobs 50.0% 9.1% 20.0% Wallets 1.7% Bags 3.7% Ralph Calvin KleinVera Wang January – June 2012 Lauren Source: Digital Luxury Group § Fashion accessories such as handbags and wallets drive interest for #1 and #2 brands, Michael Kors and Marc Jacobs § Ralph Lauren (#3) and Calvin Klein (#4), on the other hand, are best known for their apparel lines © Digital Luxury Group, SA 12 Michael Kors tops global interest for US fashion brands Photo Source: Michael Kors Fall 2012 Ad Campaign 13 Michael Kors - Facts. § The Michael Kors brand was launched in 1981. By the end of 2003, Michael left his position at Celine, to focus solely on his own brand. In 2004 he launched KORS and MICHAEL § Online interest for the brand took off in 2010, supported by Michael’s participation on Project Runaway, reception of a CFDA lifetime achievement award, and massive rollout of retail stores Michael Kors is the most searched for American fashion brand, capturing 19.6% of total brand searches. § At the end of 2011, Michael Kors entered into an IPO and was in operation in more than 230 points of sale in 74 countries § Q1 2012 results saw profits triple § Strong focus on Asia © Digital Luxury Group, SA Photo Source: Michael Kors Pinterest 14 Michael Kors – Strong 2012 Performance. Global Demand Evolution of Michael Kors Compared to Top 5 Average Note : Smoothed data – 1 being the maximum volume observed 1.0 0.8 Michael Kors 0.6 0.4 0.2 0.0 Huge jump in interest coming from Brazil (+22%) and China (+97%) Huge jump in interest coming from handbag related searches in China Top 5 Average January – June 2012 Source: Digital Luxury Group § For the first half of 2012, Michael Kors outperformed other Top 5 brands in search demand volume, with jumps in March and May thanks to increased interest in particular markets / segments © Digital Luxury Group, SA 15 American brands lag in capturing the BRIC wave Photo: Flags of Brazil, Russia, India, China 16 American Brands strong at home but lag in BRIC markets . Geographic Breakdown of Global Online Demand for US and European Fashion Brands 7.5% 20.7% 30.5% BRIC 24.7% Europe 69.8% 41.5% American Brands Japan United States * European Brands January – June 2012 Source: Digital Luxury Group § US-­‐‑based brands are, on average, strongest on home turf § BRIC markets count for less than 10% of global search interest for American brands § European brands, on the other hand, show greater than 30% of interest from BRIC markets © Digital Luxury Group, SA * Benchmark composed of Hermès, Louis Vuison , Dior, Chanel, Gucci 17 China’s desire for Handbags. Breakdown of Demand by Product Category for US Fashion Brands in the USA and China 5.1% 7.4% 15.1% 34.3% 5.3% 17.9% 21.9% Belts & Scarves Sunglasses Shoes Wallets 36.9% USA 51.9% Ready to wear Bags China January – June 2012 Source: Digital Luxury Group § Significantly higher interest for handbags from Chinese consumers (51.9% of total) than their US counterparts (36.9%) © Digital Luxury Group, SA 18 Surprises from China. Rank in China Compared with global 1 = 2 +4 3 +10 4 -­‐‑2 5 = 6 -­‐‑2 7 -­‐‑4 8 +11 9 +2 10 -­‐‑3 Brand § Michael Kors maintains a dominant position in China, thanks to its handbag offering, which Michael Kors Chinese consumers are looking for Tory Burch § Tory Burch is rewarded for its strategy Hervé Léger localization and is 2nd in China (6th globally) Marc Jacobs § Hervé Léger’s collections appeal to local celebrities placing it in 3rd (13th globally) Vera Wang § Highest jump for Anna Sui (+11 compared to Calvin Klein position in global rank) indirectly benefiting Ralph Lauren from a strong awareness in beauty § Ralph Lauren lagging in China (-­‐‑4 vs. global Anna Sui rank) which could be explained by its Alexander Wang difficulties in establishing the brand as Kate Spade “luxury” with Chinese consumers © Digital Luxury Group, SA 19 Anna Sui benefiting from her Chinese roots. § The fact that Anna Sui is a Chinese-­‐‑American designer, has helped the brand in resonating with Chinese consumers § Ranked #47 in the World Luxury Index™ China, Anna Sui is most desirable in China for perfume and cosmetics, which asracts a young female audience thanks to its playful designs Share of Fashion vs. Beauty Product Searches Anna Sui in China Fashion 5% Beauty 95% January – June 2012 Source: Digital Luxury Group © Digital Luxury Group, SA 20 Hervé Léger & Tory Burch successful in China. Hervé Léger*, supported by local celebrities § The most classic bandage dress of the brand is adored by many well-­‐‑known local celebrities, increasing its awareness Tory Burch, a tailored approach to China § The brand’s first store in Mainland China was opened in Beijing in 2011 § The brand has done extensive market research to be successful in China, and carefully tailored some of its luxury merchandise for the Chinese market: scaling down its popular Amanda satchel, introducing some new colors like coral and providing smaller clothing sizes. * Originally founded in 1985, Hervé Léger was acquired by BCBGMAXAZRIAGROUP in 1998, marking the first time in fashion history that a French couturier was absorbed by an American designer. © Digital Luxury Group, SA Chinese actress Angelababy in Hervé Léger Tory Burch Amanda Mini Satchel 21 A quick look at Brazil. Rank Compared with global 1 +3 Calvin Klein 2 -­‐‑1 Michael Kors 3 = Ralph Lauren 4 +1 Vera Wang 5 -­‐‑3 Marc Jacobs 6 +9 Carolina Herrera 7 +9 Marchesa 8 +13 Oscar de la Renta 9 -­‐‑1 Diane von Furstenberg 10 = Tom Ford Brand © Digital Luxury Group, SA § The Brazilian luxury goods market grew from $5.2 Billion in 2007 to $7.2B in 2011, and $3B is expected to be spent on 100 new Brazilian shopping malls by 2014. § For the Phillips-­‐‑Van Heusen group (owners of Calvin Klein), Brazilians are the #1 international shoppers of Calvin Klein in the US, thanks in part to more than a decade of operation in Brazil. § Brands like Vera Wang and Carolina Herrera benefit from Brazilian brides online researching and eventually travelling to Miami looking for designer gowns at beser prices than at home. 22 Interested in More Information? Digital Luxury Group offers the opportunity to subscribe to a business intelligence service, which monitors the changing consumer interest of luxury fashion prospective clientele. Through unique benchmarking metrics, fashion brands receive timely updates on the consumer demand for brands, competitors, product categories as well as various key marketing drivers capturing the asention of fashion consumers worldwide. For more information, contact us: fashion@digital-­‐‑luxury.com ABOUT. The World Luxury Index™ is an international ranking and analysis of the most searched-­‐‑for brands and services within the luxury industry. Covering over 400 companies within six key segments (fashion, beauty, jewelry, cars, watches, and hospitality) in ten key luxury markets, the World Luxury Index™ provides insights on the unbiased search inputs coming from global luxury consumers in the world’s top search engines (Google, Bing, Baidu, Yandex). The result is a one-­‐‑of-­‐‑a-­‐‑kind benchmark of the luxury brands capturing the asention of luxury-­‐‑minded consumers around the world. As featured in: © Digital Luxury Group, SA 24 ABOUT. www.digital-luxury.com www.fashionscollective.com www.luxurysociety.com © Digital Luxury Group, SA With offices in New York, Geneva, Shanghai, and Dubai, Digital Luxury Group (DLG) is the first international company to provide luxury industry market intelligence and use this strategic viewpoint to create and implement digital marketing and communication strategies for luxury brands. Fashion'ʹs Collective is an educational resource for fashion and luxury brands focused on new-­‐‑age marketing. Through high caliber editorial content, private interactive workshops and conferences, Fashion'ʹs provides a level of perspective, expertise and thoughtful analysis to the intersection of luxury and digital technology. Luxury Society is the world'ʹs most influential online community of top luxury executives. Based in Paris, with members in more than 150 countries, Luxury Society informs and connects CEOs, managers, journalists, consultants, designers and analysts from across the luxury industry. 25 CONTACT. GENEVA NEW YORK SHANGHAI DUBAI 7 Avenue Krieg 1208 Geneva T: +41 22 702 07 60 E: geneva@digital-­‐‑ luxury.com 590 Madison Ave New York, NY 10022 T: +1 212-­‐‑521-­‐‑4310 E: newyork@digital-­‐‑ luxury.com Room 810, B Block 15/F One Corporate Avenue 222 Hubin Road, Luwan District Shanghai, 200021, P.R. China T: +86 571 8883 9161 E: shanghai@digital-­‐‑ luxury.com Suite 1509, Shatha Tower, Dubai Media City PO Box 50954 Dubai T: +971 4 454 8464 E: dubai@digital-­‐‑luxury.com www.digital-luxury.com