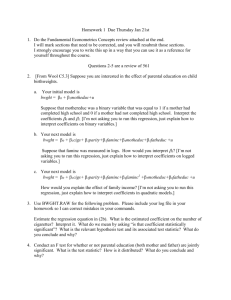

Answers to Odd-Numbered Exercises

advertisement