Vorlage für eine Pressemitteilung

advertisement

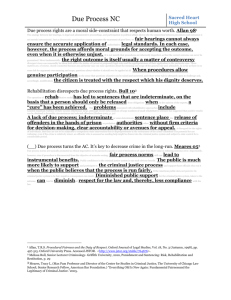

Let’s Prevent the Last One! Regulation, Law Enforcement and the Financial Crisis International Conference Max Planck Institute for Foreign and International Criminal Law 7-8 September 2012 • Freiburg, Germany Concept of the Conference & Program 2/8 Concept of the Conference The financial crisis has been the topic of numerous academic articles, books, symposia and conferences across many disciplines, ranging from economics to psychology, political science to criminal law. Yet as various disciplines are seeking to grasp this complex social phenomenon, it is increasingly clear that a fuller understanding of what happened, as well as what is to be done, presupposes an interdisciplinary discourse integrating many paradigms from numerous fields of study. This is especially true when it comes to criminal law and criminology. In order to understand the complex processes that lead to breaches of the law on the one hand, and the state reactions to these violations on the other hand, criminology needs to employ a far more interdisciplinary approach to white collar crime, integrating theories and methodologies of other disciplines, such as political science, psychology, economics, organisational studies and ethnography. Moreover, in fields like financial regulation and securities law, research should not be confined to questions of criminal law: it is vital to understand the very process of drawing the line, both in legislation and enforcement practice, between criminal and non-criminal conduct. Traditional approaches to white collar crime and financial criminal law do not possess the theoretical complexity and methodological diversity required to describe the intricate interplay between economic, legal and political rationalities and the way they shape financial regulation and financial criminal law, or to analyse the fine line between legal and illegal on, for example, the capital markets. Research into causation in the field of financial or corporate crime is also scarce. The same applies to the reaction to these crimes: how financial regulation comes about, how institutional and interpretative practices of regulatory authorities, law enforcement agencies, and the courts shape our understanding of what is criminal on the financial markets and what is not. It is not only state instances that influence the formulation and interpretation of the law: as science and technology studies and the anthropology of financial regulation show, the delicate relationship between discourses in economics and discourses in legal sciences also play a profound role. These issues are not only of relevance to criminologists. Criminal law, in the form of financial criminal law, is a crucial tool for the regulation of financial markets in several jurisdictions. The effect of criminal law regulation on the marketplace is, however, poorly understood. How is the threat of criminal prosecution translated, via compliance and otherwise, into the market and within financial institutions? What effect do judicial practices, such as plea bargaining (both in civil and common law systems), or civil set- 3/8 tlement have? What is the difference, if there is one, between the threat of criminal prosecution and civil/administrative enforcement? Another question to address is the political economy of enforcement. The political economy of financial regulation is a well-researched field in comparative and international political economy: how the differences in corporate governance, corporate finance, the banking system or even the real economy affect the regulatory architecture. Political science is also beginning to turn its attention, especially in the US, to the empirical research of the regulatory process, from congressional politics all the way down to organisational practices within regulatory agencies. But we know relatively little about the political economy of enforcement of financial criminal law. Does, for example, the investment behaviour of the population, as the well-known discourse of “Wall Street vs. Main Street” suggest, affect criminal enforcement? Might this be one possible explanation for differences in national enforcement? For these reasons, our conference takes on the financial crisis from a very broad perspective, and in a very interdisciplinary setting, bringing together not only scholars of financial regulation, finance, anthropology, political science, criminology and criminal law, but also but practitioners: regulators, prosecutors and defense lawyers. Through this conference, the Max Planck Institute for Foreign and International Criminal Law hopes to foster international interdisciplinary exchange in the study of regulation and white collar crime, and to provide incentives to further cooperation and research . 4/8 Program Thursday, 6 September 18:00 Informal Get-Together Venue: Hausbrauerei Feierling Welcome by Hans-Jörg Albrecht, director, Max Planck Institute for Foreign and International Criminal Law Friday, 7 September 9:00-9:30 Opening Remarks Hans-Jörg Albrecht, director, Max Planck Institute for Foreign and International Criminal Law Introduction and Concept of the Conference Csaba Györy, Max Planck Institute for Foreign and International Criminal Law Panel I. Legal Knowledge and the Governance of Financial Markets Chair: Johanna Mugler, University of Bern, Department of Social Anthropology 9:30-10:15 (TBA) Vincent Antonin Lepinay, Program in Science and Technology, Massachusetts Institute of Technology 10:15-10:45 Coffee break 10:45-11:30 State of Mind and the Global Financial Crisis Donald C. Langevoort, Georgetown University Law Center 5/8 11:30-12:15 Against Market Totalitarianism: Thinking Through Legal Technique Annelise Riles, Cornell University, Department of Anthropology / Clark Program in East Asian Law and Culture, Cornell University 12:15-13:00 Lunch break (a light lunch is served at the conference venue) 13:00-13:45 Regulatory Reform from a System-Theory Perspective Marc Amstutz, University of Fribourg (Switzerland), Faculty of Law Panel II. The Game is against Regulation: Institutional Culture, Creative Compliance and Financial Governance Chair: Kerrin-Sina Arfsten, MPICC 13:45-14:30 Too Smart to be Regulated? Wall Street Moralities and White-Collar Crime Karen Ho, University of Minnesota, Department of Anthropology 14:30-15:15 Rethinking Responsibility for the Financial Crisis: Corporate Culture and the Role of the Corporate Lawyer Doreen McBarnet, Professor of Socio-Legal Studies, University of Oxford 15:00-15:30 Coffee break 15:30-16:15 Securities Enforcement as a Social Field James W. Williams, York University, Department of Social Science 6/8 Panel III. The Political Economy of Regulatory Reform and Enforcement Chair: Adepeju Solarin, MPICC 16:15-17:00 Beyond “Light Touch”? Regulatory Responses to the Financial Crisis in AngloAmerica Paul Langley, Durham University, Department of Geography 17:00-17:45 Too Big to Jail Neil M. Barofsky, New York University, Center on the Administration of Criminal Law; former Special Inspector General of the Troubled Asset Relief Program (TARP) 17:45:18:30 Law Enforcement Responses to Financial Crimes since the Financial Crisis Michel Levi, University of Cardiff, School of Social Sciences 20:00 Dinner Venue: Restaurant zum Storchen La Cicogna (Schwabentorplatz 7) Saturday, 8 September Panel IV. Regulation, Enforcement and the Crisis: The View from the Practice Chair: Jing Lin, MPICC 9:00-9:45 Financial Crisis and Financial Regulation in the United States David Rosenfeld, Associate Director, SEC New York Regional Office 9:45-10:30 Financial Crisis: The Lessons for Regulators Thomas Eufinger, Chief, Department of Market Surveillance, BaFin 7/8 10:30-11:15 Securities Law Enforcement in the United States After the Crisis Barry Rashkover, Partner, Sidley Austin LLP, New York 11:15-11:45 Coffee break Panel IV. Criminal Law as a Means of Regulation? Chair: Kiyomi von Frankenberg, MPICC 11:45-12:30 Criminal Law as a Means of Regulation in Germany Klaus Volk, LMU Munich, Faculty of Law 12:30-13:30 Lunch break (a light lunch is served at the conference venue) 13:30-14:15 Prosecuting Financial Crimes in Germany Michael Bolz, Senior Prosecutor, Frankfurt am Main 14:15-15:00 Prosecuting Financial Crimes in the US Arlo Devlin-Brown, Assistant US Attorney, District Attorney`s Office for the Southern District of New York (attendance pending approval) 15:00-15:30 Coffee break Panel IV. Corporate Crime and the Financial Crisis Chair: Julia Kasselt, MPICC 15:30-16:15 Corporate Crime on the Global Financial Markets Wim Huisman, University of Amsterdam, Faculty of Law 16:15-17:00 Corporate Crime and the Financial Crisis in Eastern Europe Miklos Levay and Eva Inzelt, ELTE University Budapest 8/8 17:00-17:45 General Discussion Chair: Csaba Györy, MPICC 17:45-18:00 Wrap-Up and Closing Remarks Hans-Jörg Albrecht 20:00 Dinner Venue: Restaurant zum Kranz (Herrenstraße 40, 79098 Freiburg) Contact Csaba Györy Max Planck Institute for Foreign and International Criminal Law Günterstalstraße 73 79100 Freiburg i. Br. Germany Tel.: (49) 761 7081 314 Fax: (49) 761 7081 294 c.gyoery@mpicc.de Cover Picture: Still from the Songs from the Second Floor (Roy Anderson, 2000) © Studio 24 Roy Andersson Productions