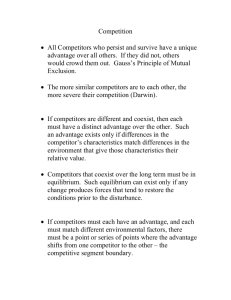

Why competitors matter for market orientation

advertisement