MB PTS Questionnaire 2015

advertisement

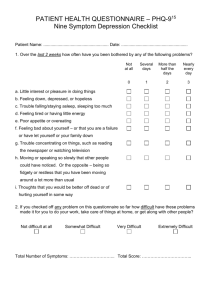

Mackay Bailey Ltd Chartered Accountants 109 Blenheim Road PO Box 13311 Christchurch 8141 New Zealand p f e w + 64 3 341 0930 + 64 3 343 9843 office@mackaybailey.co.nz www.mackaybailey.co.nz INFORMATION QUESTIONNAIRE FOR SALARY AND WAGE EARNERS TAX RETURN (PTS) FOR THE 2015 FINANCIAL YEAR NAME: Please update your contact details below if there have been any changes: Phone: Fax: Mobile: E-mail: Postal address: Please take the time to work through this questionnaire thoroughly, action each point that is applicable to you. This will greatly assist us in the efficient calculation of your tax position. Directors Tania King James Nell Michael Woodward Terms of Engagement This engagement is subject to Mackay Bailey Limited’s current Terms of Engagement which are available on our website: www.mackaybailey.co.nz/engagement By signing this page you accept responsibility for all information provided to us and agree to our Terms of Engagement. Authority to Act and Obtain Information We may use this authority to obtain additional information should we require it to complete this engagement. I authorise Mackay Bailey to obtain any financial records necessary to complete my financial statements and tax returns for the 2015 year. This may include, but is not limited to, bank statements, co-operative statements, insurance invoices as well as dividend and interest certificates. I authorise Mackay Bailey to be my Inland Revenue Tax Agent for all tax types and communicate with Inland Revenue on my behalf, including communicating via electronic methods. I authorise Mackay Bailey to communicate with financiers, banks, solicitors and other advisors as they deem appropriate to obtain information necessary to carry out this engagement. Signature: Full Name: Date Completed: 2 Do you require a Personal Tax Summary (PTS)? Did you receive more than $70,000 for the year? YES Did you receive more than $200 of interest taxed at less than 33%? NO Did you receive more than $48,000 for the year? YES You must request a Personal Tax Summary. Please complete, sign and return the attached questionnaire and we will calculate your tax position for you. NO YES Did you receive more than $200 of interest taxed at less than 30%? YES NO NO Are you liable for child support? YES Did you receive more than $200 of interest, dividends and/or Maori authority distributions? NO NO Do you think you may be entitled to a tax refund? This may be because you: • Worked only part of the year, but lived in NZ for the whole year • Have an annual income under $48,000 and also have dividend income automatically taxed at 33% • Had income fluctuations during the year • Had more than one employer during the year • Want to claim expenses such as income protection insurance • You used a secondary tax code but your income was under $48,000 NO You don’t need to do anything further. 3 YES YES You must request a Personal Tax Summary. Please complete, sign and return the attached questionnaire and we will calculate your tax position for you. You may want to request a Personal Tax Summary. Please complete, sign and return the attached questionnaire and we will calculate your tax position for you to see if you have a refund due. INCOME The following income information will be supplied directly to our office by Inland Revenue: • • • • • • • • Wages Salary NZ Superannuation Veterans Pension Taxable New Zealand Income Support Benefits Accident Compensation Payments Family Support Workplace Insurance NEW ZEALAND INTEREST AND DIVIDENDS Please supply us with all dividend and interest certificates, including joint investments Please provide full details of source and amount received. Dividend, interest and bonus issue certificates are required to show interest withholding tax paid on your behalf and imputation tax credits available to you. EXPENSES The only expenses you can claim are: • • • A fee to someone completing your tax return. Commission on interest or dividend income (but not bank fees – they are a private expense). Interest on money you borrowed to buy shares or to invest – as long as the investment is expected to produce some taxable income Premiums on loss of earnings insurance provided any payouts from the insurance policy are taxable income. • Are you able to claim for any expenses paid during the year? Yes / No If yes, attach details. WORKING FOR FAMILIES TAX CREDITS If you believe you are entitles to Working for Families Tax Credits (WFFTC), please download and complete the supplementary questionnaire from our website or contact us to request a copy. STUDENT LOANS Do you have a student loan Yes / No TAX CREDITS FOR DONATIONS § Total amount of your Donations to Charities (Please staple your donation receipts to the back of this form) § Enter the bank account number you would like your rebate and any tax refund to be direct credited to : (The Inland Revenue may also transfer the rebate credit against any tax arrears you have.) Bank Branch Account Number $_________________ Suffix Thank you for completing this questionnaire. Please sign where indicated on page 2. 4