business law & practice an introduction to business law & practice

advertisement

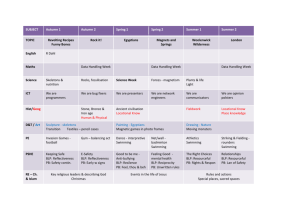

Legal Practice Course 2012 – 2013 BUSINESS LAW & PRACTICE AN INTRODUCTION TO BUSINESS LAW & PRACTICE Copyright Bristol Institute of Legal Practice 1 Copyright Bristol Institute of Legal Practice 2 The BLP course is the longest course that you will tackle on the LPC. We have 16 Study Units. Each Study Unit consists of preparatory work, a face to face workshop and post workshop tasks/ review and consolidation work. There are also online exercises for each Study Unit. In addition, there are five Large Group Sessions and two Additional Exercises (one on Drafting and one on Business Accounts). The reading for BLP (the BLP Pre- Course Materials) will give you general information on the topic areas that we cover on BLP. This Introduction will give more specific information on the format and content of the UWE BLP course. The course leader (Cathy) will also provide further information during the first BLP Large Group Session. There are a number of tutors who teach BLP, and we rotate workshop groups on a regular basis so that you will experience a variety of tutors. We also share the large group sessions. The course is quite challenging, but also full of variety, so we hope that you will find something to interest you. It is a good time to be studying BLP because the fairly dramatic changes as a result of the Companies Act 2006 (CA 2006) have now bedded in (the CA 2006 was brought into force in stages, with full implementation on the 1st October 2009). The CA 2006 marks the first major reform in this area of law since the 1980‟s & the aims of the 2006 Act were to modernise and simplify company law and to “think small company first”. You may still, on occasion, be referred to the certain of the provisions of the Companies Act 1985 on the BLP course even though it is no longer in force, where it is important that you understand some of the more dramatic changes that have taken place. You will of course often encounter companies that have been incorporated under the 1985 Act in practice. An Overview of the Course Full- time students will study BLP (including one Study Unit on Business Accounts, SU 12) from September to March. Part- time students will study BLP (including one Study Unit on Business Accounts, SU 12) from September to March of the first year. The course comprises: 5 numbered Large Group Sessions 16 Study Units 2 Additional Exercises for you to do at home in your own time Various online exercises- one for each Study Unit and Revision exercises Sometimes you will be required to hand in a piece of work for marking (for example in SU 3 and in SU 7). At other times you will be provided with a detailed marking guide so that you can self- assess your own or a peer-assess a colleague‟s work. You are always welcome to ask your tutor to have a look at any piece of work at any time, should you so wish. The Large Group Sessions will be recorded using our lecture capture technology and will be available for all students (full- time and part- time) to view online. The workshop structure is identical for both full time and part- time courses. As you can see, the course is delivered using: Large Group Sessions Copyright Bristol Institute of Legal Practice 3 Study Units consisting of preparatory work, a face to face workshop and post workshop tasks/ review and consolidation work online exercises for each Study Unit Two Additional Exercises Each of these elements will be considered in more detail in the following pages. There are certain pervasive elements that will appear during the course and, indeed, that may crop up in the BLP assessment such as tax. In addition, you could be assessed in Professional Conduct/ or Financial Services in the BLP assessment. We have also included information about the BLP assessment in this introduction. Delivery of the Course 1. Large Group Sessions Face to face lectures are optional and a recording of the lecture will be available for you to view on line after the lecture has taken place. Lectures are designed to provide an introduction/ give you an overview of the material to be covered in greater detail in the Study Units that follow. All students may be required to do some pre-reading before attending (or watching online) certain Large Group Sessions. Here are some brief details of the topics to be covered in the Large Group Sessions, which will be 50 minutes long: Large Group Session 1 Introduction to the different types of Business Media in the UK This large group session introduces the core subject of BLP, how it is taught and assessed and the material to be covered in Study Units 1 and 2. We shall consider the most important types of business media in the UK (sole traders, partnerships, limited liability partnerships and companies). We shall also consider the factors that might influence a client in choosing an appropriate vehicle for his or her business. Large Group Session 2 Introduction to Companies This large group session is an overview lecture and introduces material to be covered Study Unit 5. We shall look at the constitutional documents of a private limited company (the memorandum and articles of association). We shall also look at the model forms of articles of association contained in the Companies Act 2006 (the "Model Articles"). Large Group session 3 Directors and Shareholders Overview lecture This large group session will consider the distribution of power between directors who run the day to day business of a company and its shareholders who own it. It will also introduce the topics that you will consider in Study Units Copyright Bristol Institute of Legal Practice 4 7-9 including directors‟ duties and statutory provisions in the CA 2006 affecting directors. Large Group Session 4 Company Finance and Creditor Issues – An Overview This lecture relates to material to be covered in Study Units 11 and 13. We shall consider the statutory framework surrounding the borrowing of money by a company and issues affecting creditors generally. Large Group Session 5 Review Lecture We shall provide an overview of the BLP course in order to assist you with your revision for the BLP and Drafting assessments. In particular, we shall review any matters arising from your BLP and Drafting Practice Assessments (see below). 2. Study Units Each Study Unit consists of a block of learning of approximately 11 hours consisting of preparatory work for the workshop, the workshop itself and post workshop tasks and review and consolidation work. There is an online multiple choice tests for you to do for each Study Unit (sometimes two). Your tutors will monitor your performance in these tests. Before the Workshop At the Workshop The workshops will be of two and a half hours duration plus a 15-minute break. They are designed to be interactive sessions where you put into practice the law and procedure to which you have been introduced in your preparatory work and through your directed reading. There is a substantial amount of preparatory work for each workshop (approximately 6-7 hours) and you must make sufficient time to thoroughly prepare for your workshop. There will be a mixture of group and individual work. The workshops will also provide an opportunity for you to practice the skills of legal writing and drafting in particular (the latter is assessed in the context of BLP – see below). Some workshops will also require you to conduct an interview or a negotiation and to use your research skills. Please note that we do not hand out model answers as a matter of course; these will be provided very sparingly. It is essential that you are fully prepared for the workshops. Full time students will receive hard copies of their instruction sheets in batches well before the relevant workshop takes place. After the initial study session, instruction sheets for part time students will be included in the study packs provided at the study session before the relevant workshops take place (we call these „Student Instructions‟). This should give all students plenty of time to complete the Copyright Bristol Institute of Legal Practice 5 directed reading, complete the preparatory work and attend the relevant lectures, where appropriate. Workshop instruction sheets will also be available on-line. After the workshop It is also very important that you complete any post workshop tasks (some of which will involve „new‟ work and any review and consolidation work which is designed to strengthen and cement the knowledge that you have gained in the workshop. Materials to bring to the Workshops The instruction sheets will tell you what you need to bring to the workshops. For most workshops you will need your: BLP Manual Companies Legislation Handbook Law Society's Professional Conduct handbook You will also require a calculator for the tax and accounts workshops. 2.2 The Content of the Study Units Here is a brief outline of the subject matter of each of the Study Units. All workshops within the relevant Study Unit will be of two and a half hours duration unless otherwise stated: Introductory matters and sole traders Study Unit 1 - Choice of Business Media Partnerships Study Unit 2 – Partnership (including LLPs) Bankruptcy, sole traders and partnerships Study Unit 3 – Bankruptcy, sole traders and partners. In this Study Unit you will be required to produce a letter to a client explaining the relevant law to be handed in within a specified period, this will be marked by your tutor. Taxation Study Unit 4 – Income tax for sole traders and the self-employed and capital gains tax for sole traders and the self-employed. Companies Study Unit 5 – Constitution (memorandum and articles of association) Study Unit 6 – Share issue and transfer and pre-emption rights Copyright Bristol Institute of Legal Practice 6 Study Unit 7– Company stakeholders (1) – Directors. In this Study Unit you will be required to draft certain company documents to be handed in within a specified period, this will be marked by your tutor. Study unit 8 – Company Stakeholders (2) – Shareholders Study Unit 9 – Company Decision Making – A case study on the removal of directors Study Unit 10 – Company Stakeholders (3) – Minority Shareholders. Study Unit 11 – Raising company finance. Study Unit 12 – Business Accounts Study Unit 13 – Company Stakeholders (4)- Creditors (and Company Searches) Study Unit 14 – Share capital, distributions and corporation tax (including the taxation of directors and employees) Study Unit 15 –Corporate insolvency Study Unit 16 – Structured Revision 3. Online Exercises You will also be required to attempt a number of on-line exercises for each Study Unit and assessments at strategic points during the course. In most cases, instantaneous electronic feedback will be provided to enable you to assess your own performance. Your tutors will also monitor test results to see whether any particular topics are causing difficulties. It is important that you attempt these exercises by the times stated in your instructions for the relevant Study Unit so that your tutors can check your performance prior to the workshop. 4. Additional Exercises There are two Additional exercises comprising of about four hours work on the BLP course for you to complete in your own time. These are best completed proximate to the relevant Study Unit as directed in your Student Instructions. There is one Additional Exercise associated with the Study Unit on Drafting and one on Business Accounts (Study Unit 12). Answer Guides will be available online on Blackboard. 5. Legal Skills 5.1 Introduction In the context of the BLP course, you will come across both written and oral skills that you will need to use daily in a lawyer's office. Copyright Bristol Institute of Legal Practice 7 The written skills will be developed in the workshops through the drafting of: file notes and memoranda letters to clients agreements, minutes, notices of meetings, resolutions etc. In addition, the course will expose you to the oral skills involved in role-play, interviewing and negotiation. 4.2 Drafting The core skill of Drafting is assessed within the context of BLP. You will have a separate assessment in Drafting which will take place close to your BLP assessment. You will have a combined Study Unit on Writing and Drafting early in the course and this will be followed by a separate Study Unit on the core skill of Drafting and a further study Unit on writing on the LPC. This note will not give further guidance on drafting as it will be fully covered throughout the BLP course and we will be teaching you from first principles. 4.3 Writing We will introduce you to the core skill of Writing early on in the course in the combined Study Unit on Writing & Drafting; this will be followed by a separate Study Unit on Writing. Writing is assessed in the context of Property law & Practice (a year two subject if you are a PT student). Preparation of file notes, letters of advice and memoranda File Notes The purpose of the file note is to provide an accurate summary of the current position on a client‟s file. This will assist the author when writing a follow-up letter of advice to the client following a meeting. It will also provide a clear account for somebody else looking at the file at a later date. This might occur when the person originally dealing with the matter is on leave or where a file is inherited by a person who has just joined the relevant department. Even where a file is not to be handed on, it is very important to keep accurate and comprehensive file notes, especially for a busy solicitor who is involved in many on-going matters. It is good practice to make a file note in the following circumstances: to summarise a telephone call or a meeting with one‟s own client or “the other side”; to note some key date (such as the date for serving a notice); to record some relevant research. A file note may simply comprise a few words dashed down (such as `X rang to say no offer at this stage') or might extend to several pages, dictated and typed up. Whatever the type and subject matter, file notes should be constructed with a view to helping with the management and orderly conduct of the file; once prepared they should be placed on the file in date order. There is no point having a whole pile of file notes that are not dated and do not identify the file to Copyright Bristol Institute of Legal Practice 8 which they relate. All the good work done in preparing the file notes will be reversed in the laborious and time-consuming task of having to sort them out. There is no set format for a file note (although different firms such as the firm that we will use on the BLP course, Harringtons LLP, will undoubtedly have their own ways of doing things) but the following items might appear, depending on the nature of the particular file note: the file name and number and the name of the client; the date on which the note was prepared, and the dates of any relevant events that it refers to; an accurate summary of the relevant events; an accurate summary of any relevant legal issues. The file note should be written in plain English and should be comprehensible to any other person who picks up the file. As file notes are designed to be read by lawyers it is acceptable and advisable to have technical content. Letters of Advice to Clients When you are in practice, you may be surprised to find how infrequently you are required to write a letter of advice to a client. Typically, business lawyers will find themselves in lengthy meetings negotiating documents and may also spend a lot of time on conference calls and in giving advice over the telephone or corresponding via e-mail. However, it is essential that you are able to write a competent professional letter of advice and much time on the BLP course will be spent in acquiring this skill. Bear in mind the following points when writing to your clients: (i) Before you start, think about the recipient and adjust your style accordingly. Rarely, if ever, will it be appropriate to use technical language such as legal terms, case names and references to statute in a letter to a lay client. This will not apply as regards letters to fellow professionals. (ii) Use plain English and correct spelling and grammar. A poorly written and presented letter will not look professional even if the advice that you give is correct. (iii) Try to be as succinct as possible – lawyers no longer charge by the word and your clients will not want to plough through several pages of unnecessary information before getting to the crucial point. (iv) Explain yourself clearly avoiding waffle. (v) State the law accurately and give practical advice. Your client is unlikely to be interested in the law in general; he or she will only want to know how the law applies to his or her particular case The final point cannot be over-emphasised. Students coming onto the LPC straight from their degree courses have a tendency to write essays rather than letters of practical legal advice. This is a tendency that must be curbed Copyright Bristol Institute of Legal Practice 9 in the early days of your LPC career, not only as regards exercises undertaken in the workshops, but also in assessments where you must take extra care to give specific advice based on the factual scenario that you have been given. Everyone has his or her own style of writing and this will be borne in mind. As long as your letters follow the guidelines set about above and the criteria for the skill of legal writing, you should not go far wrong. Once or twice during the BLP course you will be handed a specimen letter indicative of a piece of work that the team thinks would achieve a respectable mark in an assessment. You will also be required to hand in a piece of work for your tutor to look at in order to give you some guidance as to how your letter writing skills are coming along. When you are in practice you are likely to find that your firm has a house-style that you will be required to follow. To some extent, we have a certain housestyle that we will expect you to follow on the LPC. When you are asked to write a letter of advice, we will expect you to use the following format: (i) Include a resemblance of a letterhead and a letter opening such as: Name of your firm Address Telephone and fax numbers Client‟s name and address Our ref: Your ref: Date: Dear _____, [Heading] (ii) Business letters should always contain a brief heading followed by a short introduction. Resist the urge to use flowery prose and get to the point quickly. (iii) Keep sentences and paragraphs short. If you are unsure of your grammar, keep it simple. You cannot go far wrong if you stick to brief sentences and include the odd comma. (iv) Use subheadings and/ or number your main paragraphs if the letter is, say, more than a page long. (v) End the letter by making it clear to the reader as to what is to happen next (for example, do you need further instructions from the client?). (vi) Always have your client‟s best interests at the forefront of your mind. Copyright Bristol Institute of Legal Practice 10 Memoranda of Advice As a junior lawyer within your department, you are likely to be required to carry out research for your colleagues. Typically, you will need to present your research in the form of a memorandum. Your approach to writing a memorandum as opposed to a letter of advice should be different, not least because your memorandum will be an “in-house” document prepared for a fellow lawyer rather than a lay client. Again, your firm is likely to have a house style for memoranda. On the BLP course, we shall expect your memoranda to adopt the following format: (i) Your memoranda should start with the following details: To: From: Date: File name and number [Heading] (ii) Your style should be business-like and to the point and you should avoid using social chit-chat such as “Dear so-and-so, thank you very much for asking me to help you with this matter”. (iii) It will be acceptable (and usually necessary) to go into detail on the legal issues that you have researched. Remember that your memo will be addressed to a fellow lawyer who is likely to be more senior than you. You should be comprehensive, and not simplistic. You should use technical language (such as case names, legal terms and references to statute) where appropriate. (iv) Use subheadings and/or numbering in all but the very shortest of memoranda. (v) Memoranda are not usually signed off in the way that letters are. It is acceptable to stop once you have conveyed all of the necessary information. Although your “formal” assessment in legal writing will take place in the context of Property Law & Practice, please note that your writing skills will also be taken into account in the BLP assessment and many other assessments on the LPC. In particular, if you are asked to answer a question using a particular format (such as a file note, memorandum or letter) then you must use that format. If you do not, you are likely to have marks deducted. 5. Pervasive elements – Tax and Professional Conduct /Financial Services Each of the subjects on the LPC incorporate references to particular elements that are regarded as integral to the particular subject matter covered. In BLP tax is one such element. Although you will not have a discrete assessment on tax, this topic may occur in the BLP assessment. You may also be assessed in Professional Conduct/Financial Services in the BLP assessment. 6. Business Assessment Copyright Bristol Institute of Legal Practice 11 Content You may be assessed on any part of the BLP syllabus whether covered in: Large Group sessions Study Units (including the preparatory work, what is covered in workshops and any post workshop work and the review / consolidation work) Online exercises The BLP Manual (as well as relevant parts of the skills and foundations manuals) Any other directed reading Relevant skills and Foundations Work Financial Services and tax Format of the Assessment The BLP assessment will be “open book”. This means that you will be allowed to take certain materials with you into the assessment. You will be notified of these materials (which will be comprehensive) early on in the autumn term. The assessment will contain both short form and multiple choice type questions to test your knowledge across a broad spectrum of the BLP syllabus. It will also contain longer “transactional” type questions to test your application of the law to particular circumstances. These will be broadly similar to the Study Unit style questions. As well as legal content, there will be an emphasis on the relevant skills, especially writing. You will have three hours in which to complete the assessment. You must answer all questions and will not have a choice. This means that you will be allowed to take certain materials with you into the assessment. You will be notified of these materials (which will be comprehensive) early on in the autumn term. Practice Assessments in BLP and Drafting We think it important for you to have some practice at LPC assessments before you have to undertake the real thing. We shall therefore provide a BLP and Drafting practice assessments in November. The purpose of these practice assessments is to give you some experience at undertaking an assessment of the kind to be taken in February and also to give you an indication of how you are performing on the LPC. These practice assessments will be marked by your tutors. In addition, you will also be given a detailed answer guide so that you can assess your own performance. In addition, plenary feedback will be given to all students. This feedback will highlight likely strengths and weaknesses in the answering of the BLP / Drafting practice assessment questions. Finally, all students will be able to make an appointment with the relevant subject tutor to discuss any specific queries arising out of the practice assessments. You will be given further details of the BLP and Drafting practice assessments later in the autumn term. For the time being, full time students should note the following: Copyright Bristol Institute of Legal Practice 12 It will take place in the last week of the autumn term It will be held under „controlled conditions‟ (effectively exam conditions) You will be entitled to have with you the same permitted materials as you will have in the BLP subject assessment. Details of these materials will be given to you during the autumn term. Part time students will be required to attempt the practice assessments in Session 5 in December. Plenary feedback and an opportunity to discuss performance with tutors will also be provided. As with the other practice assessments, the BLP and Drafting practice assessment is not intended to give you guidance on the subject matter to be covered in the BLP subject assessment. You should not use the practice assessment to try to „question spot‟ what will, or will not, be in the subject assessment in February. Business Accounts You will look at Business Accounts in Study Unit 12 of the BLP course. However, there will be occasional references to the accounts of businesses at various times throughout the BLP course in other Study Units. This introduction is intended to help you understand those references to accounts. 1. Reasons for Businesses keeping Accounts Management: to enable a sole trader, partners in a partnership and directors and members of a company to monitor the performance of the business to ensure liquidity (the ability to pay debts as they fall due) and profitability. Legal obligations: many partnership agreements require the production of accounts. Directors of companies have a statutory duty to keep accounting records; to have annual accounts produced; to send copies to all members and to file accounts at Companies House. Taxation: the Inland Revenue will need to agree the accounts of a business to determine the tax liability of the sole trader, partners or company. Valuation : For example, if a sole trader is selling his or her business, or a partner is retiring or a shareholder is selling shares, accounts can help determine the value of the business, share of the business or shares in the company, as the case may be. Borrowing: if a business wants to borrow money, accounts can help convince the bank that the business is a good credit risk; that it has the assets to give adequate security, and that it is likely to have the income to pay the interest and repay the capital. 2. The Need for Solicitors to Understand Business Accounts Your work as a solicitor may require an understanding of business accounts. Many areas of practice will require you to be able to find your way around the accounts of a business (to a greater or lesser extent). Copyright Bristol Institute of Legal Practice 13 In addition, solicitors run businesses (sometimes as sole traders, sometimes as partnerships or limited partnerships). Any solicitor offered a partnership must consider the accounts to assess whether what is being offered (such as a share of assets and profits) is worth the price that is being asked. Once in a partnership, a solicitor needs to be able to interpret the accounts to monitor his or her business. 3. Terminology Assets: items owned by the business. Consider the basis of valuation: alternative valuations include the cost price; the book value (cost price less accumulated depreciation), and market value. Capital: long-term investments in a business to fund its operation. Capital is both an asset (funds available to finance its operations), and a liability (the business has to repay the capital at some stage - often not until the business is wound up). Creditors: a debt due from the business (a liability), for example, the purchase of goods or receipt of services on credit, where the business pays later. Current Assets: these are constantly changing and are sometimes referred to as „circulating assets‟: they are part of the „cycle of production‟. Current assets: - start with cash (used to buy stock or raw materials) … raw materials turn into … - work-in-progress (when raw materials are partly made into products) .. turns into … - stock (when made into saleable products) … turns into … - debtors (when stock sold on credit) … turns into … - cash (once debtor pays or if stock sold for cash). Debtors: a debt due to the business (an asset), for example, the sale of goods or the provision of services on credit, where the business is paid later. Fixed Assets: assets retained in the business and used in the generation of profits. Fixed assets are generally „static‟ - not frequently changing (such as premises and plant and machinery) Liabilities: these are owed by the business. categories: Liabilities are divided into two Long-Term Liabilities: amounts due to be paid in more than 12 months‟ time: and Current Liabilities: amounts due to be paid with in the next 12 months. Net Assets: a business will have net assets where total assets exceed total liabilities (meaning that the business is solvent) Net Current Assets: where current assets exceed current liabilities. If current liabilities exceed current assets then the business will have Net Current Liabilities. Net Liabilities: a business will have net liabilities where total assets are less than total liabilities (meaning that the business will be insolvent). Purchases of stock: an expense paid (or payable) by the business for goods purchased by the business (such as stock for re-sale). Copyright Bristol Institute of Legal Practice 14 Sales of stock: income paid (or payable) to the business on the sale of goods. THE ACCOUNTING PROCESS 1. The Preliminary Stage : book-keeping entries Accounts / Ledgers Each type of asset, liability, income and expense will have a ledger account in which to record the amount of the asset, liability, income and expense. Double-entry Book-keeping System In order to understand business accounts it is necessary to be able to understand how the accounts have been produced and what they represent. This involves an understanding of the basic concepts of double-entry book-keeping. As the name suggests, for every transaction entered into by a business there must be (at least) two entries made in the accounts of the business. Every transaction has two (opposite) consequences for the business - which must be recorded by entries in the accounts / ledgers of the business. These will be a debit and a credit with the debit equalling the credit. Debits (DR): There are three types of debits. These reflect the: acquisition of an asset (including the receipt of money) [assets up] payment of a liability [liabilities down] recording of the incurring of an expense (not the payment of an expense). It is not easy to see what is „good news‟ about incurring an expense, but it is the recording of the receipt of the benefit of the subject matter of the expense. Credits (CR): There are three types of credits. These reflect the: sale of an asset [assets down] increase in the amount of a liability [liabilities up] recording of an item of income. It is not easy to see what is „bad news‟ about income, but it is recording what the business has given in order to be entitled to the income (not the recording of the income). 2. The Intermediate Stage : checking accounting entries - theTrial Balance In order to make sure that the double-entry accounts balance, at any given date a Trial Balance can be produced to check that total DRs = total CRs. This should be the case since each transaction will have a DR entry and a CR entry of equal amounts. A Trial Balance is simply a statement listing all the accounts with a DR balance and listing all the accounts with a CR balance (in separate columns). The total for each column should be the same. 3. The Final Stage : the ‘final accounts’ Profit and Loss Account This is (normally) produced at end of an accounting period. It is a statement showing total income (for a trading business that will be „sales‟) less total expenses during the Copyright Bristol Institute of Legal Practice 15 accounting period. If the income exceeds the expenses, there will be a „net profit‟. If the expenses exceed the income, there will be a „net loss‟. Balance Sheet This is (normally) produced at the end of an accounting period and is a “snap-shot” of the assets and liabilities on a stated date. It shows the assets and liabilities of the business as at that date. The aggregate of all assets and the aggregate of all liabilities must balance. Trading Account This is optional. It is used by sole traders, partnerships and companies which trade in goods. A Trading Account is a management tool. It provides additional information on the performance of the business - showing the gross profit after deducting the „costs of sales‟ from the sales. The „cost of sales‟ is the direct cost of buying the stock which has been sold to generate the „sales‟. Accounts of Partnerships Capital Accounts When a business is set up in whatever form, capital will be introduced into the business. Capital can be introduced in the form of cash or non-cash (such as the transfer of the ownership of an asset to the business). With a sole trader there will be one capital account for the sole trader. In a partnership there will be a separate capital account for each of the (equity) partners Current Accounts In theory, there is no reason why sole traders could not have a current account (separate from their capital account), but we will not have them in our examples of sole trader‟s accounts. With a partnership, each partner will have a current account showing the amounts due from the partnership to the partner (other than by way of capital) and the amounts due from the partner to the partnership on a day-to-day basis. By analogy, a partner‟s investment in the partnership is like a customer having money in two bank accounts: - a long term investment account (equating to a capital account); and - a current account dealing with day-to-day matters. Drawings by Partners Drawings are cash taken out of the partnership by a partner during the financial year on account of his or her share of profits for the year. Otherwise, if the partner had to wait until the end of the accounting period (to see what profit, if any, had been made), he or she would have nothing to live on in the meantime. He or she is „drawing‟ out in advance part of his or her anticipated profits. Profit and Loss Account Up to the determination of the net profit, the Profit & Loss Account is the same for both a sole trader and a partnership (and, indeed, a company). Once the net profit of Copyright Bristol Institute of Legal Practice 16 a partnership has been determined, the Profit & Loss Account is „extended‟ by the addition of an Appropriation Account showing the allocation of the profit (or loss) between all of the partners in accordance with their contractual / legal entitlements (or obligations). Balance Sheet The form of the Balance Sheet will be largely the same for both a sole trader and a partnership. However, there will be only one capital account shown for a sole trader whereas the accounts of a partnership will show the balances on capital account for each partner. The accounts of a partnership will also show the balances on current accounts for each partner as well as movements in the balances of the current accounts from the start of the financial year to the end of the year Accounts of Companies Accounting Treatment of Share Capital The accounting treatment of the introduction of share capital (equity) into a company is similar to the treatment of the introduction of capital into a sole trader‟s business or into a partnership. However, the capital account is replaced by the „share capital account‟ (shares being the method of investing in a company by shareholders). Final Accounts of Companies Trading Accounts and Profit & Loss accounts are the same for sole traders, partnerships and companies. However, there are differences in the Appropriation Account and part of the Balance Sheet: The Appropriation Account for a company will show: the amount of corporation tax payable and the net profit after tax the amount of any profits paid or to be paid by way of dividends the balance of any profits to be retained or transferred to reserves. The Balance Sheet for a company will show funds invested in the business by way of share capital and profits retained in the company (not paid out by way of dividends). We wish you all the best with your studies in BLP and we look forward to meeting you all. Cathy Biggs Practice Area Head: Business Law & Practice September 2012 Copyright Bristol Institute of Legal Practice 17