Concepts and Definition - Bangko Sentral ng Pilipinas

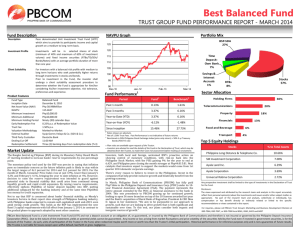

advertisement