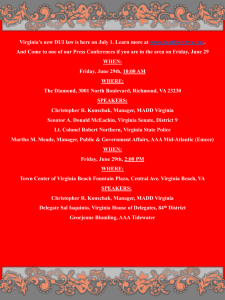

Working for you

advertisement