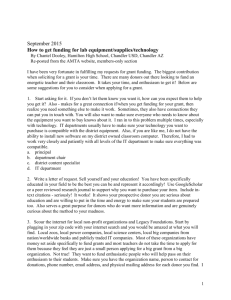

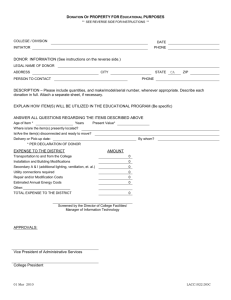

DONATIONS - Louisiana State University

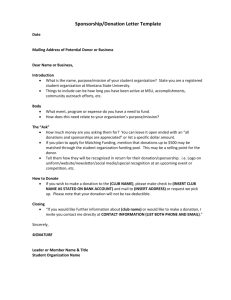

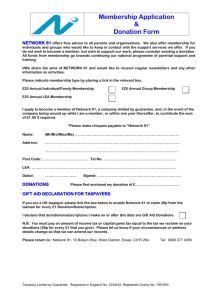

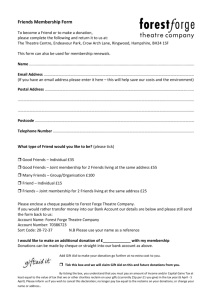

advertisement