Sample syllabus - Carnegie Mellon University

CARNEGIE MELLON UNIVERSITY

Wednesday Evenings

FINANCIAL MANAGEMENT 91-855

INSTRUCTOR: Robert Bartolacci, M.S., CPA, CIA

Email: RBartolacci@Vanadium.Com

TEXTS: Essentials of Corporate Finance by Ross, Westerfield and Jordan (& Student Problem Manual)

Asian Neighborhood Design Case (Stanford University). Some students will have purchased this case in the

Financial Analysis for Managers course.

Harvard (HBS) & Darden School Case Studies (packaged and for sale in the bookstore)

Additional Case Studies as defined in class may be required during the semester

OPTIONAL:

Financial Management for Public, Health and Not-for-Profit Organizations by Finkler

OPTIONAL:

Financial Management for Nonprofits by Shim and Siegel

WHO SHOULD TAKE THIS COURSE

Although there is usually a narrow list of an organization’s personnel titled Financial Managers, virtually anyone may at some point in a professional career be charged with the responsibility for making financial decisions. Moreover, it is incumbent on all executives within and organization to withhold the fiduciary responsibility presented with leadership. Financial Management is a course designed for students intending to pursue a career requiring financial practice or expertise (e.g. senior management or member of the finance department in a corporation, non-profit, etc., or the corporate finance group of an investment bank). Also, the course provides executives, or executives in training, with the necessary tools to understand the balance-sheet value implications associated with necessary policy, and short or long-term decisions. And lastly, the course is recommended for students that need to deepen their understanding of the analytical tools and financial concepts not addressed in the Accounting Foundations, or Financial Analysis courses. Most of the principles and management techniques described in this course can be applied to financial decisions in both for-profit and nonprofit organizations.

COURSE PURPOSE/OBJECTIVE and OVERVIEW

There is a twofold goal desired for this course. First is to provide the required tools to objectively frame financial management issues. Second is the ability to synthesize and incorporate these tools and other academic and professional experiences into a standard yet flexible model for solving financial management problems.

Decisions regarding financing, raising capital, managing investments and other short-term assets, and management of liabilities are critical functions within any organization regardless of profit motives. Therefore it is important to understand the financial environment and be able to navigate the fiduciary terrain towards the most objective decisions. This course will discuss and teach the tools to objectively make: capital budgeting, capital structure and working capital decisions.

Through case studies, lectures, videos, readings and exams, students learn structured techniques and how to apply them in financial decision making. The course addresses the three fundamental questions of Business

Finance: What, Where and How. More specifically: what assets will be needed to support the lines of business, where will the financing for those assets come from, and how will we fund the daily operations of those lines of business. As the course progresses, new topics and skills are integrated into a more sophisticated framework of financial understanding. Students develop and evaluate standard techniques such as:

•

Discounted cash flow valuation models, Capital budgeting, Pro forma statements & Forecasting

•

Social Return on Investment

•

Stock & Bond Valuation

•

Scenario and Sensitivity Analysis

•

Security Market Line and Weighted Avg. Cost of Capital

•

Short and Long Term funding sources and Working Capital Management

Nonprofit focus

In accordance with the Heinz School’s non-profit and governmental focus, relevant topics presenting the dichotomy of for-profit versus social goals will be used to provide in-class discussion. Course content and discussions will relate for-profit financial management tools to non-profit organizations. Most specifically, the concept of Social Return on Investment will be highlighted. This concept, a derivative of for-profit management techniques is characteristic of the ever-growing application of for-profit tools in the non-profit world.

Short videos will present real-life discussion topics relating to financial management goals and decisions and their socio-economic impacts. Students will have the opportunity to identify constraints, formulate and synthesize alternatives, and present solutions that maximize the resources of stakeholders. Discussions include:

Management towards the Social Good vs. Shareholder Wealth

Resource Maximization in every organization type

Stakeholders vs. Shareholders (and Shareholders vs. debt-holders)

Creditors & Lessors vs. Organizations

REVIEW SESSIONS , TEACHING ASSISTANTS (TA) and THEIR ROLES

Review Sessions: Are to be arranged with the Instructor

Teaching Assistant(s): TBD

Role of the TA (if applicable): The TA acts as a study guide, a resource to be used for course content clarification, translator of course information, and liaison to the instructor. The TA can provide assistance in completing difficult homework assignments, help explain confusing course topics, or provide insights into the general nature of the subject matter. The TA will not: provide homework or exam answers, previous or anticipated exam questions, assist students that haven’t attempted to resolve issues independently, or provide any information in an inappropriate or unfair manner.

The TA(s) will provide the class with a weekly schedule of office hours of when and where the students may address course questions. Students are to turn all homework assignments into the TA(s) only and not the instructor. The student is responsible to ensure that the TA receives the respective assignments, and the TA is responsible to update the student’s course scores to reflect homework completion. Students should always address course-related questions to the TA(s) prior to making inquiries of the instructor.

STANDARDS OF CONDUCT

The school clearly defines the ethical and academic standards expected of its students and faculty. This syllabus adds to that definition. Working together on homeworks is strongly encouraged. Cheating (looking at another student’s documents) on exams however will not be tolerated. Collaboration or plagiarism on nonhomework assignments is strictly prohibited. If these offenses are detected, the students in question will be removed from the course. Any expenses associated with the dropped or failed course will be the student’s responsibility.

“Faculty can impose penalties based on the circumstances with the most severe penalty being failure on the assignment or in the course. Instructors can recommend to the Dean that more severe penalties be imposed, such as suspension or dismissal from the program.” Excerpt from the HEINZ SCHOOL POLICY ON CHEATING AND PLAGIARISM

INSTRUCTOR RESPONSIBILITIES PER THE HEINZ SCHOOL

(SUMMARIZED)

•

Detailed Syllabus

•

Defining course goals, content and procedures

•

•

Clear standards for assignments, tests

Describe prohibited types of collaboration

•

Ensure fair and confidential grading

•

Will determine how grades are assigned

HOMEWORK Homeworks and answers are found in the Student Problem Manual and are due the class following its assignment. Late homeworks will receive a grade of zero. Students are encouraged to read assigned chapters prior to class, then review again after class for reinforcement, and attempt both the Graded and Suggested problems. Students are to turn all homework assignments into the TA(s) (when applicable) only and not the instructor. The student is responsible to ensure receipt of the respective assignments.

SLIDES The slides used during each class are in Microsoft PowerPoint, and are available from the Blackboard.

GRADING and EXAMINATIONS

Quizzes/exams can include cases, multiple choice, problems, essays, and/or a combination of each. All questions and problems are based on the course’s textbooks, articles or lectures. The instructor reviews each quiz/exam. Confidentiality is ensured through a single grade book.

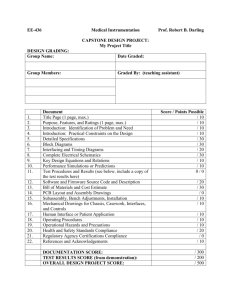

Grade Weight Your Score % Weighted Score

Chapters 1 & 2 Quiz

Chapters 4, 5 & 8 Quiz

Chapters 6 & 7 Quiz

Chapters 12, 13 & 14 Quiz

Graded Homeworks

5%

7.5%

7.5%

10%

5%

X

X

X

X

X

=

=

=

=

=

AT & T Executive Analysis

Investment Detective Case

Daycare - Northville Case

Pioneer Petroleum Corp. Case

Ocean Carriers Case

Duke Corp. Case

2.5%

10%

12.5%

12.5%

12.5%

15%

X

X

X

X

X

X

=

=

=

=

=

=

TOTAL 100%

GRADING SCALE

97% TO 100% A+

94% TO 96% A

90% TO 93% A-

87% TO 90% B+

84% TO 86% B

80% TO 83% B-

77% TO 80% C+

74% TO 76% C

70% TO 73% C-

Below F

COURSE SCHEDULE

This schedule is only a guide. All examinations and cases follow the completion of preceding subject

material, not the calendar. Please see the blackboard for notices of any homework changes.

CLASS 1 8/31/05

Objectives: Intro to Financial Management, brief review

Objectives: Stakeholders vs. shareholders, seeking the social good

Objectives: Taxes and Cash Flow

Readings: Chapter 1, Chapter 2

Slides: New First Class.ppt

Readings: Chapters 1 and 2

Topic: Forms of business organization, forms of nonprofits

Topic:

Topic:

Goal of Financial Management

The agency problem and control of the organization

Topic:

Topic:

Relevant tax topics

Cash Flow and the Cash Flow Identity

Film: AT & T (Shareholder vs. Stakeholder)

Suggested Homework: Chapter 2’s Concept tests

Graded Homework: Chapter 1’s Concept tests, Chapter 2 #’s 1 thru 11

CLASS 2 9/7/05

AT & T Executive Analysis Due

Objectives: Review of Time Value of Money

Objectives: Continuation of previous week’s topics

Objectives: Discounted Cash Flow Valuations, Net Present Value and Other Investment Criteria for For-profit and Non-profit applications

Readings: Chapters 4 & 5

Readings:

Readings:

Slides:

Chapter 8

Asian Neighborhood Design Case

FMClass2

Slides:

Topic:

Topic:

FMCH8

Future and Present Value (compounding and discounting), and Annuities

Loan types and amortizations

Net Present Value and Internal Rate of Return Topic:

Topic: Payback, Accounting Return and Profitability Index

Topic: Social Return on Investment

Film: Rightsizing

Suggested Homework: Concept tests (all problems not assigned for grading)

Graded Homework: Chapter 4 #’s 1 thru 4, 8 thru 10, 13 Chapter 5 #’s 1, thru 6, Chapter 8 #’s 1 thru 7, 9

CLASS 3 9/14/05

QUIZ 1:

Chapters 1 & 2

Objectives: Interest rates and Bond Valuation

Objectives: Continuation of Time Value of Money as nec.

Readings:

Slides:

Chapters 6

Int&bonds

Topic:

Topic:

Topic:

Bond valuation

Protective covenants

Bond Issuances

Bond Ratings Topic:

Film: Steering the course , Bonds

Suggested Homework: Concept tests

Graded Homework: Chapter 6 #’s 1 thru 12

CLASS 4 9/21/05

QUIZ 2:

Chapters 4, 5 & 8

Objectives: Equity Markets and Stock Valuation

Objectives: Continuation of Bonds as nec.

Readings:

Slides:

Chapter 7

Int&bonds

Topic:

Topic:

Common Stock Valuation

Features of Common and Preferred Stock

Topic: The Stock Markets

Film: How low can it go?

Suggested Homework: Concept test

Graded Homework: In-class case due (to be reviewed in class and turned in as homework)

Graded Homework: Chapter 7 #’s problems 1 thru 9

CLASS 5 9/28/05

QUIZ 3:

Chapters 6 & 7

Objectives: Catch-up of previous weeks’ discussions if necessary. Time permiting, Chapter 9 will begin.

CLASS 6 10/5/05

Investment Detective Case Due

Objectives: Making Capital Investment Decisions – Capital Budgeting

Objectives: Continuation of Discounted Cash Flow Valuations, Net Present Value and Other Investment

Criteria as nec.

Readings: Chapter 9

Slides:

Topic:

FMCH9

Project Cash Flows

Topic:

Topic:

Forecasting

“What if,” Scenario, and Sensitivity analysis

Film: Capital Budgeting, EVA

Suggested Homework: Any problems not graded

Graded Homework: Chapter 9#’s 1 thru 5 or 6 thru 8

CLASS 7 10/12/05

Daycare comes to Northville (non-profit / forecasting) Case Due

Objectives: Capital Market History

Readings:

Slides:

Chapter 10

FMCH10

Topic:

Topic:

Returns

Return Variability

Topic: Capital Market Efficiency

Suggested Homework: All problems not graded

Graded Homework: Chapter 10 #’s 1 thru 8

Graded Homework: In-class case due (to be reviewed in class and turned in as homework)

CLASS 8 10/19/05

Ocean Carriers (cash flow, NPV) Case Due

Objectives: Continuation of Capital Market History as nec.

Objectives: Capital Market History, and Risk and Return

Readings:

Slides:

Chapter 11

FMCH11

Topic:

Topic:

Expected Returns and Variances

Portfolios, Diversification and portfolio risk

Film: Day on Wall Street, Portfolio Management

Suggested Homework: All problems not graded

Graded Homework: Chapter 11 #’s 1 thru 12, any of the last 6 problems

CLASS 9 10/26/05

Objectives: Cost of Capital

Readings:

Slides:

Chapter 12

FMCH12

Topic:

Topic:

Cost of equity

Cost of debt and preferred stock

Topic: Weighted Average Cost of Capital

Topic: Divisional, project, or opportunity cost of capital

Film: Financial Markets

Film: International Finance

Suggested Homework: Concept test

Graded Homework: Chapter 12 #’s 1 thru 8, 10 thru 12

Graded Homework: In-class case due (to be reviewed in class and turned in as homework)

CLASS 10 11/2/05

Pioneer Petroleum (cost of capital) Case Due

Objectives: Leverage & Capital Structure

Readings:

Slides:

Chapters 13

Chapter 13

Topic:

Topic:

Optimal Capital Structure

Modigliani & Miller Propositions (I & II)

Topic: Risks & Bankruptcies

Film: Leverage Legacy

Suggested Homework: Concept test

Graded Homework: Chapter 13’s #’s 1 thru 9

CLASS 11 11/9/05

Objectives: Dividends and dividend policy

Readings:

Slides:

Chapters 14

Dividends

Topic:

Topic:

Cash dividends and payouts

Stock dividends, splits and repurchases

Topic:

Topic:

Does policy matter?

Establishing a policy

Film: TBD

Suggested Homework: Concept test

Graded Homework: Chapter 14’s #’s 1 thru 4, 8, 10 thru 14

CLASS 12 11/16/05

QUIZ 4:

Chapter 12, 13 & 14

Objectives: Raising Capital

Readings:

Slides:

Chapters 15

Raisingcap

Topic:

Topic:

Financing Life Cycle – from Bootstrap through Venture Capital to the exit plan and beyond

Selling securities

Topic:

Topic:

Underwriting

IPO’s

Film:

Film:

Going Public

Mergers

Film: Derivatives (may be moved to different night)

Suggested Homework: TBD

Graded Homework: TBD

CLASS 13 11/23/05 NO CLASS – THANKSGIVING HOLIDAY

CLASS 14 11/30/05

Objectives: Short-term Financial Planning

Readings:

Slides:

Chapters 16

FM16

Topic:

Topic:

Cash & Net Working Capital

Short-term financial policy

Topic:

Topic:

Short-term borrowing

Short-term planning

Film: TBD

Suggested Homework: TBD

Graded Homework: TBD

CLASS 15 12/7/05

Objectives: Working Capital Management

Readings:

Slides:

Chapters 17

FM17

Topic: Float and cash management

Topic:

Topic:

Cash management – collections, disbursements, and investing

Credit and receivables

Topic: Inventory management

Film: TBD

Suggested Homework: TBD

Graded Homework: TBD

CLASS 16 12/14/05

Duke (summary of topics) Case Due

Objectives: Synthesis of course topics, review of case study in class