Study Paper - Exporting as a Strategy

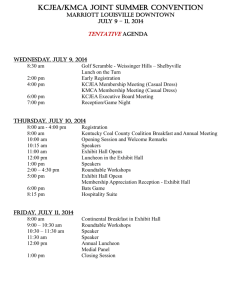

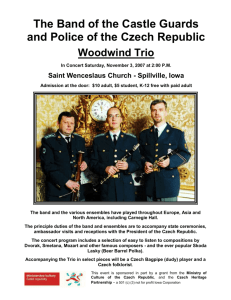

advertisement