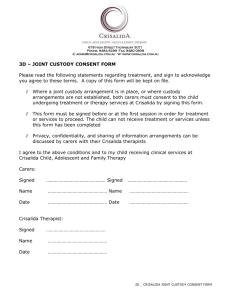

LIST OF FEES FOR ANCILLARY AND CUSTODY SERVICES

advertisement

LIST OF FEES FOR ANCILLARY SERVICES AND CUSTODY BANK SERVICES Applicable from: 28.07.2015. A. ANCILLARY SERVICES 1. Opening an account for financial instruments (owner’s, custody, escrow, summary, free shares, managing…) Free of charge 2. Opening special cash accounts for settlement of transactions with financial instruments Free of charge 3. 4. 5. FEES Domestic market: 0.30% , not less than 25 EUR monthly Safekeeping of financial instruments Foreign markets: 0.30% not less than 5 EUR monthly Domestic market: Buy (RVP): 0.30%, Sell (DVP): 0.30% min 30 RSD Clearing and settlement of transactions with financial instruments on stock exchange or over-the-counter. Payment transactions (DvP/RvP) Foreign markets: 0.20%, min. 10 EUR per transaction Domestic market: Free of charge Receiving / Subscription of fin.instruments on an account. Transactions free of payment (RF) Foreign markets: 35 EUR per ISIN Domestic market: 500 RSD per ISIN, If the recipient’s account is at Vojvodjanska banka 5,000 RSD per ISIN, If the recipient’s account is at another 6. depository Transfer of fin. Instruments to another account. Transactions free of payment (DF) Foreign markets: 5 EUR per ISIN, If the recipient’s account is at Vojvodjanska banka 50 EUR per ISIN, If the recipient’s account is at another depository 7. Transfer of financial instruments over-the-counter (OTC). 8. Collecting income (dividends,coupons share fractions etc.) 300 RSD + 2% - for clients on owner’s and other accounts 0.5% - for clients on custody and omnibus accounts Domestic market: 0,30% Foreign markets: Free of charge + cost of the third party 1 9. 10. 11. 12. 13. 14 15 Representing and proxy voting at assemblies for clients on custody and summary accounts 100 EUR per order + out-of-pocket expenses 5.000 RSD fixed 0.1%, if securities distribution has succeeded and the Opening, maintaining and calculation of special deposit account for distribution/selling of the issuer’s financial Instruments transaction is not processed by the CSD. If the CSD processed the transaction then the commission is calculated under tariff 4 Free of charge 50 EUR per report Regular reporting Extraordinary reporting on demand Custodian e-office, package and usage for domestic brokerage houses The identification of clients for credit institutions and investment companies Redemption of debt financial instruments Free of charge 300 RSD per client Free of charge 16 Cashless transfer from special cash accounts to Fund’s account managed by Asset management company, with which the Bank has agreement as “Custody bank” Free of charge 17. Withdrawals from accounts for securities transactions – up to 200.000 RSD Free of charge 18. Cash withdrawals from accounts designated for securities transactions – over 200.000 RSD B. 19. 20. 21. 22. 23. 24. 25. 26. 27. 28. 29. 30. 31. 32. 33. 34. 35. 36. 37. RSD 200 SERVICES OF „CUSTODY BANK“ AND PAYMENTS TO MANAGEMENT COMPANIES AND ITS INVESTMENT AND VOLUNTARY PENSION FUNDS Calculation of asset and liabilities of investment and voluntary pension funds („custody bank“) PAYMENT OPERATIONS Opening current account Terminating current account Dinar payment operations: Maintaining account Electronic statements Inflows Electronic internal orders within Company Electronic internal orders within the Bank Electronic external orders outside of the Bank Cashless internal orders within Company Cashless internal orders within the Bank Cashless external orders outside of the Bank FCY payment operations: Maintaining account Electronic statements Inflows/Loro payments Transfers between Companies’ accounts, within the Bank Transfers between Companies’ accounts, outside of the Bank Nostro payments to other entities, within the Bank Nostro payments to other entities, outside of the Bank 0.10% Free of charge 3.000 RSD per account 250 RSD monthly 30 RSD monthly Free of charge Free of charge 15 RSD per order 150 RSD per order Free of charge 100 RSD per order 200 RSD per order Free of charge Free of charge Free of charge Free of charge 15 EUR per order 7 EUR per order 15 EUR per order 2 Notes: Fees in EUR are calculated according to the official middle exchange rate of the NBS, on the day of calculation. The fees do not include commissions for domestic and foreign payments of the Bank, commissions of third parties, i.e brokerage companies, stock exchange, the Central Securities Depository, the NBS and the Securities Commission. Taxes are not included in the fees and they are collected specially on services which are taxed according to applicable regulations. If by executing operations for clients the Custody has certain out-of-pocket expenses, such as costs of advertisements in the public media, extra charges of executing orders or instructions of the client, postal charges, travelling expenses, documents notarization, miscellaneous costs and the like, the client is obligated to refund such costs in full amount according to invoices submitted. Tariff 3. - The fee is collected from clients on custody accounts and summary accounts and it is different from market to market. The fee is annual, while its collection is monthly. The value is calculated on the basis of actual days in a month and the calendar year of 360 days. The market value is taken for listed instruments and the nominal value for debt instruments and instruments which are not listed. Tariff 4. – Calculated per auction, stock exchange or OTC transaction. For foreign markets. For foreign markets, the fee varies from market to market. Tariff 5. – For foreign markets, the fee is different from market to market and It is not related to receiving securities as from eligible holdings (such as rights or additional shares, other instruments distributed from issuers profit) Tariff 6. – Related to the following transfers: change of depository, between 2 different accounts of the same owner (owner’s, custody, summary, managing, escrow, foreign account...) lending, transfers based on other legal agreements and court decisions. The commission may vary depending on market. Tariff 7. – The fixed part of the Fee is charged in the branch and the percentage part of fee is charged upon the transaction is settled and it is calculated per OTC transactions (over-the-counter) for the domestic market. It is related to the following transfers: selling shares, takeover of bids, buybacks, „dissenting shareholders“, squeeze-in and squeeze-out and other OTC transactions based on applicable regulations. Tariff 9. – The service is provided to clients on custody or summary accounts. The fee is related to representation by the person who is engaged in custody sales. Tariff 10. – The fixed part of fee is charged upon opening an account and the percentage fee will be charged from the amount deposited on the special deposit account Tariff 14- The fee is collected in a branch directly from the client Tariff 18 – The fee is collected in a branch upon cash withdrawal Tariff 19. – The fee is related to prescribed services of the „Custody bank“ in accordance with the Law on Investment Funds and the Law on Voluntary Pension Funds. The fee is annual, while the collection is monthly 25- 30. – Fees in dinar payment operations apply when the payments are in favour of residents and non-residents. Tarrif 36-37.-The cost of the foreign correspondent bank is calculated and charges in accordance with official fees paid by the Bank in FCY payment operations and applies if the payment cost option is OUR. PRESIDENT OF THE BOARD OF DIRECTORS Marinis Stratopoulos 3