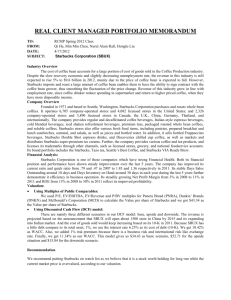

Starbucks Industry Profile and Organization Analysis Spring 2013

advertisement