Management Accounting Fundamentals Process costing

advertisement

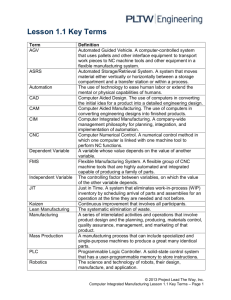

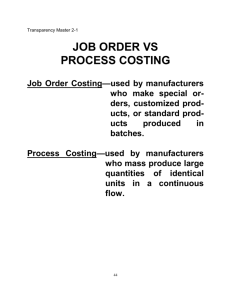

Management Accounting Fundamentals Module 3 Process costing Lectures and handouts by: Shirley Mauger, HB Comm, CGA Module 3 - Table of Contents Part 1 2 3 4 N/A 5 6 7 8 Content 3.1 Comparison of job-order and process costing 3.2 A perspective of process cost flows 3.3 Equivalent units of production 3.4 Production report – Weighted average method 3.5 Production report – FIFO method 3.6 Shrinkage, spoilage, and lost units 3.7 Operation costing 3.8 Computer illustration: Production report (not covered) Review questions: Production worksheet - spoilage Review questions: Comprehensive process costing – weighted average method Multiple choice questions: Questions 1-8 Multiple choice questions: Questions 9-13 2 MA1 – MODULE 3 Part 1 Comparison of job-order and process costing A perspective of process cost flows Equivalent units of production Topics 3.1-3.3 3 Part 1 – Comparison of job-order and process costing (Topic 3.1) Identify the major similarities and differences between joborder and process costing. (Level 2) Process costing •Masses of identical or similar units of a product or service Job-order costing •Distinct units of a product or service 4 Part 1 – Comparison of job-order and process costing (Topic 3.1) Process costing Job-order costing • Cost object: department (Costs are accumulated by departments) • Cost object: job (Costs are accumulated by individual jobs) • Unit costs are computed by department • Unit costs are computed by job • A single product is produced for a long period of time. • Many jobs are worked during the period. • Department production report is the key document. • Job cost sheet is the key document. 5 Part 1 – Comparison of job-order and process costing (Topic 3.1) Manufacturing costs From module 1… Conversion cost Manufacturing Overhead labour materials •Heat Direct •Electricity Tires, seat, handlebars Labour •Rent Workers who assemble bikes •Etc. Direct Materials •Indirect •Indirect 6 Part 1 – A perspective of process cost flows (Topic 3.2) Prepare journal entries to record the flow of materials, labour, and overhead through a process costing system. (Level 1) Direct materials used in production Raw Materials Issued to each departments' WIP To finished goods Department A Department B WIP - Dept. A WIP – Dept. B Raw materials used Raw materials used 7 Part 1 – A perspective of process cost flows (Topic 3.2) Direct materials used in production Raw Materials Issued to each departments' WIP Department A Department B To finished goods WIP – Dept. A WIP – Dept. B Raw materials xxx xxx xxx 8 Part 1 – A perspective of process cost flows (Topic 3.2) Direct labour used to produce goods Salaries & wages payable Recorded in each departments' WIP Department A WIP - Dept. A Direct labour Department B To finished goods WIP – Dept. B Direct labour 9 Part 1 – A perspective of process cost flows (Topic 3.2) Direct labour used to produce goods Salaries & wages payable Recorded in each departments' WIP Department A Department B To finished goods WIP – Dept. A WIP – Dept. B Salaries & wages payable xxx xxx xxx 10 Part 1 – A perspective of process cost flows (Topic 3.2) Overhead applied Manufacturing overhead Recorded in each departments' WIP Department A WIP - Dept. A Overhead applied Department B To finished goods WIP – Dept. B Overhead applied 11 Part 1 – A perspective of process cost flows (Topic 3.2) Overhead applied Manufacturing overhead Recorded in each departments' WIP Department A Department B WIP – Dept. A WIP – Dept. B Manufacturing overhead To finished goods xxx xxx xxx 12 Part 1 – A perspective of process cost flows (Topic 3.2) Transfer goods completed in department A to department B Department A WIP - Dept. A Cost of goods completed Department B To finished goods WIP – Dept. B Transferred in cost 13 Part 1 – A perspective of process cost flows (Topic 3.2) Transfer goods completed in department A to department B WIP – Dept. B WIP – Dept. A Department A WIP - Dept. A Cost of goods completed xxx xxx Department B To finished goods WIP – Dept. B Transferred in cost 14 Part 1 – A perspective of process cost flows (Topic 3.2) Completed and transferred to finished goods. Department A Department B WIP - Dept. A WIP – Dept. B Finished goods Cost of completed goods Cost of completed goods 15 Part 1 – A perspective of process cost flows (Topic 3.2) Completed and transferred to finished goods. Finished goods WIP – Dept. B xxx xxx Department A Department B WIP - Dept. A WIP – Dept. B Finished goods Cost of completed goods Cost of completed goods 16 Part 1 – Equivalent units of production (Topic 3.3) Explain and compute the equivalent units of production for both the weighted-average method and the FIFO method. (Level 1) Equivalent units: The amount of whole units that could be gained from the amount of materials and effort contained in the partially completed units eg: Work in process consists of 2 unfinished units that are ½ complete. That is equal to 1 equivalent unit. + = © McGraw-Hill Ryerson Limited., 2004 17 Part 1 – Equivalent units of production (Topic 3.3) Equivalent units example: Walner company had 2,000 litres of apple juice in process on January 1. 80% of the ingredients had been added to the juice. What are the equivalent units? 18 Part 1 – Equivalent units of production (Topic 3.3) Equivalent units example: Walner company had 2,000 litres of apple juice in process on January 1. 80% of the ingredients had been added to the juice. What are the equivalent units? 2,000 x 80% = 1,600 equivalent litres 19 Part 1 – Equivalent units of production (Topic 3.3) Equivalent units example: Walner company had 2,000 litres of apple juice in process on January 1. 80% of the ingredients had been added to the juice. The company records show that 40,000 litres were transferred to the finished goods inventory during the year. Furthermore, 1,500 litres were on hand on December 31. This juice contained 60% of the total ingredients. Beginning Ending WIP WIP 2,000 litres 80% complete How many litres were started and completed for the year? 1,500 litres 60% complete 20 Part 1 – Equivalent units of production (Topic 3.3) Equivalent units example: Walner company had 2,000 litres of apple juice in process on January 1. 80% of the ingredients had been added to the juice. The company records show that 40,000 litres were transferred to the finished goods inventory during the year. Furthermore, 1,500 litres were on hand on December 31. This juice contained 60% of the total ingredients. Beginning Ending WIP WIP 2,000 litres 80% complete 38,000 litres started and completed 40,000 litres were transferred to finished goods. 2,000 of those litres were started the previous year. 1,500 litres 60% complete 21 Part 1 – Equivalent units of production (Topic 3.3) Equivalent units example: Weighted average method Beginning WIP 2,000 litres 80% complete 38,000 litres started and completed Units completed and transferred to next department Work in process ending (1,500 x 60%) Equivalent units of production Ending WIP 1,500 litres 60% complete 40,000 900 40,900 22 Part 1 – Equivalent units of production (Topic 3.3) Equivalent units example: First in first out (FIFO) method Beginning WIP 2,000 litres 80% complete 38,000 litres started and completed Work in process beginning (2,000 x (100%-80%)) Units started and completed Work in process ending (1,500 x 60%) Equivalent units of production Ending WIP 1,500 litres 60% complete 400 38,000 900 39,300 23 MA1 – MODULE 3 Part 2 Production report – Weighted average method Topic 3.4 24 Part 2 – Production report – Weighted-average method (Topic 3.4) Prepare a production report using the weighted-average method. (Level 1) Process Costing – production report tutorial Weighted average method: pages 1 – 3 of handout 1 Stop the audio and download the handouts • Questions with solutions: ma1_mod3_handout1.doc • Production worksheets: ma1_mod3_handout2.doc 25 Part 2 – Production report – Weighted-average method (Topic 3.4) Steps to preparing a production report STEP 1:Prepare a quantity schedule and compute the equivalent units STEP 2:Compute costs per equivalent unit STEP 3:Prepare a cost reconciliation Handout1 – P. 2 26 Part 2 – Production report – Weighted-average method (Topic 3.4) Production report tutorial Fraser Inc. has two processing departments; assembly and finishing. In the assembly department, direct materials are added at the beginning of the process while conversion costs are added evenly throughout the process. Conversion costs Assembly Direct materials Finishing Handout1 – P. 1 27 Part 2 – Production report – Weighted-average method (Topic 3.4) Production report tutorial Fraser Inc. has two processing departments; assembly and Percentage completion finishing. In the assembly department, direct materials are added numbers are helpful for at the beginning of the process while conversion costs are STEP 1 of the production added evenly throughout the process. report Beginning WIP inventory: • 2,000 units •. Completion is: • 100% of materials: $5,400 • 40% of conversion cost: $4,000 Activity and costs incurred for the period •Units started: 28,000 •Materials: $67,200 • Conversion costs: $49,600 Ending WIP inventory: • 4,000 units •. Completion is: • 100% of materials • 20% of conversion cost Allocate the assembly department costs to work in process and the costs transferred to the finishing department Handout1 – P. 1 28 Part 2 – Production report – Weighted-average method (Topic 3.4) Production report tutorial Fraser Inc. has two processing departments; assembly and Dollar figures are required finishing. In the assembly department, direct materials are added for STEP 2 of the at the beginning of the process while conversion costs are production report added evenly throughout the process. Beginning WIP inventory: • 2,000 units •. Completion is: • 100% of materials: $5,400 • 40% of conversion cost: $4,000 Activity and costs incurred for the period •Units started: 28,000 •Materials: $67,200 • Conversion costs: $49,600 Ending WIP inventory: • 4,000 units •. Completion is: • 100% of materials • 20% of conversion cost Allocate the assembly department costs to work in process and the costs transferred to the finishing department Handout1 – P. 1 29 Part 2 – Production report – Weighted-average method (Topic 3.4) Steps to preparing a production report STEP 1:Prepare a quantity schedule and compute the equivalent units STEP 2:Compute costs per equivalent unit STEP 3:Prepare a cost reconciliation 30 Part 2 – Production report – Weighted-average method (Topic 3.4) Production report tutorial STEP 1: Units to be accounted for: Work in process, beginning Quantity schedule Production report: Assembly department 2,000 Started into production 28,000 Total units 30,000 Equivalent Units Units accounted for: Materials Conversion Transferred to finishing Work in process ending Total units and equivalent units of production Handout1 – P. 2 31 Part 2 – Production report – Weighted-average method (Topic 3.4) Production report tutorial STEP 1: Units to be accounted for: Work in process, beginning Quantity schedule Production report: Assembly department 2,000 Started into production 28,000 Total units 30,000 Equivalent Units Units accounted for: Materials Transferred to finishing 26,000 Work in process ending Total units and equivalent units of production 4,000 Conversion 30,000 Handout1 – P. 2 32 Part 2 – Production report – Weighted-average method (Topic 3.4) Production report tutorial STEP 1: Units to be accounted for: Work in process, beginning Started into production Total units Quantity Production report: All goodsAssembly transferred to schedule department finishing are completed 2,000 during the period. (100% of materials and conversion 28,000 costs) 30,000 Equivalent Units Units accounted for: Transferred to finishing 26,000 Work in process ending Total units and equivalent units of production 4,000 Materials Conversion 26,000 26,000 30,000 Handout1 – P. 2 33 Part 2 – Production report – Weighted-average method (Topic 3.4) Production report tutorial STEP 1: Units to be accounted for: Work in process, beginning Started into production Total units Quantity Production report: Because materials schedule Assemblyare department added at the beginning of 2,000 the process, work in process at year end has 28,000 100% of materials cost. 30,000 Equivalent Units Units accounted for: Materials Conversion 26,000 Transferred to finishing 26,000 26,000 Work in process ending Total units and equivalent units of production 4,000 4,000 30,000 Handout1 – P. 2 34 Part 2 – Production report – Weighted-average method (Topic 3.4) Production report tutorial STEP 1: Units to be accounted for: Work in process, beginning Started into production Total units Quantity Production report: schedule Assembly department The ending work in process 2,000 is only 20% complete with respect to conversion costs. 28,000 (20% of 4,000) 30,000 Equivalent Units Units accounted for: Materials Conversion Transferred to finishing 26,000 26,000 26,000 Work in process ending Total units and equivalent units of production 4,000 4,000 800 30,000 30,000 26,800 Handout1 – P. 2 35 Part 2 – Production report – Weighted-average method (Topic 3.4) Production report tutorial STEP 1: Units to be accounted for: Work in process, beginning Quantity schedule Production report: Assembly department 2,000 Started into production 28,000 Total units 30,000 Equivalent Units Units accounted for: Materials Conversion Transferred to finishing 26,000 26,000 26,000 Work in process ending Total units and equivalent units of production 4,000 4,000 800 30,000 30,000 26,800 Handout1 – P. 2 36 Part 2 – Production report – Weighted-average method (Topic 3.4) Steps to preparing a production report STEP 1:Prepare a quantity schedule and compute the equivalent units STEP 2:Compute costs per equivalent unit STEP 3:Prepare a cost reconciliation 37 Part 2 – Production report – Weighted-average method (Topic 3.4) Production report tutorial STEP 2: (Assembly department production report) Cost to be accounted for: Work in process, beginning Cost added in the assembly department Total cost (a) Total Production Costs Materials Conversion $9,400 $5,400 $4,000 $116,800 $67,200 $49,600 $126,200 $72,600 $53,600 Equivalent units of production (b) (Step 1 above) Cost per equivalent unit (a / b) Handout1 – P. 2 38 Part 2 – Production report – Weighted-average method (Topic 3.4) Production report tutorial STEP 2: (Assembly department production report) Cost to be accounted for: Work in process, beginning Cost added in the assembly department Total cost (a) Equivalent units of production (b) (Step 1 above) Cost per equivalent unit (a / b) Total Production Costs Materials Conversion $9,400 $5,400 $4,000 $116,800 $67,200 $49,600 $126,200 $72,600 $53,600 30,000 26,800 $2.42 $2.00 Handout1 – P. 2 39 Part 2 – Production report – Weighted-average method (Topic 3.4) Steps to preparing a production report STEP 1:Prepare a quantity schedule and compute the equivalent units STEP 2:Compute costs per equivalent unit STEP 3:Prepare a cost reconciliation 40 Part 2 – Production report – Weighted-average method (Topic 3.4) Production report tutorial STEP 3: Cost Reconciliation Cost accounted for as follows: Transferred to finishing: 26,000 x ($2.42 + $2.00) TOTAL Equivalent units COST Materials Conversion $114,920 26,000 26,000 Ending work in process: Materials Conversion Total ending work in process Total cost Handout1 – P. 2 41 Part 2 – Production report – Weighted-average method (Topic 3.4) Production report tutorial STEP 3: Cost Reconciliation Cost accounted for as follows: Transferred to finishing: 26,000 x ($2.42 + $2.00) TOTAL Equivalent units COST Materials Conversion $114,920 26,000 Materials at $2.42 per EU $9,680 4,000 Conversion at $2.00 per EU $1,600 26,000 Ending work in process: 800 Total ending work in process Total cost Handout1 – P. 2 42 Part 2 – Production report – Weighted-average method (Topic 3.4) Production report tutorial STEP 3: Cost Reconciliation Cost accounted for as follows: Transferred to finishing: 24,000 x ($2.40 + $2.00) TOTAL Equivalent units COST Materials Conversion $114,920 26,000 Materials at $2.42 per EU $9,680 4,000 Conversion at $2.00 per EU $1,600 26,000 Ending work in process: Total ending work in process Total cost 800 $11,280 $126,200 Handout1 – P. 2 43 Part 2 – Production report – Weighted-average method (Topic 3.4) Production report tutorial Direct materials are purchased as needed. What is the journal entry for direct materials usage in the assembly department? DR CR Work in process, assembly Accounts payable 67,200 67,200 Handout1 – P. 3 44 Part 2 – Production report – Weighted-average method (Topic 3.4) Production report tutorial What is the journal entry for conversion costs? DR CR Work in process, assembly Various accounts (overhead and salaries and wages payable) 49,600 49,600 Handout1 – P. 3 45 Part 2 – Production report – Weighted-average method (Topic 3.4) Production report tutorial What is the journal entry to transfer goods completed in assembly to the finishing department? (transferred in cost) DR CR Work in process, finishing Work in process, assembly 114,920 114,920 Handout1 – P. 3 46 Part 2 – Production report – Weighted-average method (Topic 3.4) Production report tutorial WIP Assembly Conversion Accounts Payable 67,200 Beg. inv. 9,400 Materials. 67,200 114,920 49,600 End. inv.11,280 Transfer to finishing Various Accounts 49,600 WIP Finishing 114,920 Handout1 – P. 3 47 MA1 – MODULE 3 Part 3 Production report – FIFO method Topic 3.5 48 Part 3 – Production report – FIFO method (Topic 3.5) Prepare a production report using the FIFO method. (Level 1) Process Costing – production report tutorial FIFO method: pages 4 – 5 of handout 1 Stop the audio and download the handouts • Questions with solutions: ma1_mod3_handout1.doc • Production worksheets: ma1_mod3_handout2.doc 49 Part 3 – Production report – FIFO method (Topic 3.5) STEP 1: Units to be accounted for: Work in process, beginning Started into production Total units Units accounted for: Transferred to finishing From beginning inventory: Quantity Schedule 2,000 28,000 30,000 ASSEMBLY DEPARTMENT FIFO Method Equivalent units Materials Conversion Started and completed Ending inventory Total units and EU of production Production report tutorial Handout1 – P. 4 50 Part 3 – Production report – FIFO method (Topic 3.5) Production report tutorial STEP 1: Units to be accounted for: Work in process, beginning Started into production Total units Units accounted for: Transferred to finishing From beginning inventory: Units inASSEMBLY beginning Quantity work in process do not Schedule DEPARTMENT require any additional 2,000 FIFO materials to Method complete. 28,000 30,000 Equivalent units Materials Conversion 2,000 0 1,200 Started and completed Ending inventory Total units and EU of production Handout1 – P. 4 51 Part 3 – Production report – FIFO method (Topic 3.5) Production report tutorial STEP 1: Units to be accounted for: Work in process, beginning Started into production Total units Units accounted for: Transferred to finishing From beginning inventory: 60% of ASSEMBLY total Quantity conversion costs are Schedule DEPARTMENT required to complete 2,000 FIFO Method the units. 28,0002000 x (100%-40%) 30,000 Equivalent units Materials Conversion 2,000 0 1,200 Started and completed Ending inventory Total units and EU of production 52 Part 3 – Production report – FIFO method (Topic 3.5) Production report tutorial STEP 1: Units to be accounted for: Work in process, beginning Started into production Total units Units accounted for: Transferred to finishing From beginning inventory: Started and completed Ending inventory Quantity Schedule 2,000 28,000 30,000 2,000 24,000 ASSEMBLY DEPARTMENT FIFO Method Equivalent units Materials Conversion 0 24,000 1,200 24,000 Total units and EU of production Total units minus beginning and ending inventories 30,000-(2,000 + 4,000) Handout1 – P. 4 53 Part 3 – Production report – FIFO method (Topic 3.5) Production report tutorial STEP 1: Units to be accounted for: Work in process, beginning Started into production Total units Units accounted for: Transferred to finishing From beginning inventory: Started and completed Ending inventory Total units and EU of production Quantity Schedule 2,000 28,000 30,000 ASSEMBLY DEPARTMENT FIFO Method Equivalent units Materials Conversion 2,000 24,000 0 24,000 1,200 24,000 4,000 4,000 800 Ending inventory contains 100% of materials and 20% of conversion costs Handout1 – P. 4 54 Part 3 – Production report – FIFO method (Topic 3.5) Production report tutorial STEP 1: Units to be accounted for: Work in process, beginning Started into production Total units Units accounted for: Transferred to finishing From beginning inventory: Started and completed Ending inventory Total units and EU of production Quantity Schedule 2,000 28,000 30,000 ASSEMBLY DEPARTMENT FIFO Method Equivalent units Materials Conversion 2,000 24,000 0 24,000 1,200 24,000 4,000 4,000 800 30,000 28,000 26,000 Handout1 – P. 4 55 Part 3 – Production report – FIFO method (Topic 3.5) Production report tutorial STEP 2: Cost to be accounted for: Total Total costs Production Materials Conversion Costs Work in process, beginning $9,400 Cost added in the assembly department $116,800 $67,200 $49,600 Total cost (a) $126,200 Equivalent units of production (b) (Step 1) Cost per equivalent unit (a / b) 28,000 26,000 $2.40 $1.9076* (* don’t round) Handout1 – P. 4 56 Part 3 – Production report – FIFO method (Topic 3.5) Production report tutorial STEP 3: Cost Reconciliation Cost accounted for as follows: Transferred to finishing: From beginning inventory: Cost in beginning inventory Cost to complete the units Total cost Units started and completed this period Total cost transferred Ending work in process Materials at $2.40 per EU Conversion at $1.9076* per EU Total Total cost Equivalent units Materials Conversion $9,400 $2,289 $11,689 0 1,200 Conversion costs to complete $1.9076 x 1,200 units Handout1 – P. 5 57 Part 3 – Production report – FIFO method (Topic 3.5) Production report tutorial STEP 3: Equivalent units Cost Reconciliation Materials Conversion Cost accounted for as follows: Transferred to finishing: From beginning inventory: Cost in beginning inventory $9,400 Cost to complete the units $2,289 0 1,200 Total cost $11,689 Units started and completed this period $103,385 24,000 24,000 Total cost transferred $115,074 Ending work in process Materials plus conversion costs Materials at $2.40 per EU Conversion at $1.9076* per EU ($1.9076* + $2.40) x 24,000 units Total Total cost Handout1 – P. 5 58 (* don’t round) Part 3 – Production report – FIFO method (Topic 3.5) Production report tutorial STEP 3: Cost Reconciliation Cost accounted for as follows: Transferred to finishing: From beginning inventory: Cost in beginning inventory Cost to complete the units Total cost Units started and completed this period Total cost transferred Ending work in process Materials at $2.40 per EU Conversion at $1.9076 per EU Ending work in process Total cost Equivalent units Materials Conversion $9,400 $2,289 $11,689 0 1,200 $103,385 $115,074 24,000 24,000 $9,600 $1,526 $11,126 $126,200 4,000 800 Handout1 – P. 5 59 Part 3 – Production report – FIFO method (Topic 3.5) Production report tutorial STEP 3: Cost Reconciliation Cost accounted for as follows: Transferred to finishing: From beginning inventory: Cost in beginning inventory Cost to complete the units Total cost Units started and completed this period Total cost transferred Ending work in process Materials at $2.40 per EU Conversion at $1.9076 per EU Ending work in process Total cost Equivalent units Materials Conversion $9,400 $2,289DR WIP -0Finishing 1,200 $11,689 CR WIP - Assembly $103,385 $115,074 $9,600 $1,526 $11,126 $126,200 24,000 24,000 Ending balance in 4,000 WIP - Assembly 800 Handout1 – P. 5 60 Part 3 – Production report – FIFO method (Topic 3.5) Production report tutorial WIP Assembly Beg. inv. 9,400 Materials. 67,200 115,074 49,600 End. inv.11,126 Conversion Accounts Payable 67,200 Transfer to finishing Various Accounts 49,600 WIP Finishing 115,074 Handout1 – P. 5 61 Part 3 – Production report – FIFO method (Topic 3.5) Weighted Average FIFO • equivalent units and costs relate to beginning work in process and work done during the current period. •equivalent units and units costs relate only to work done during the current period • Beginning work in process inventory is treated as if they were started and completed during the current period. •both beginning and ending work in process inventories are converted to an equivalent unit basis. 62 MA1 – MODULE 3 Part 4 Shrinkage, spoilage and lost units Operation costing Topics 3.6-3.7 63 Part 4 – Shrinkage, spoilage, and lost units (Topic 3.6) Compute the cost of lost units or shrinkage. (Level 1) Normal spoilage an inherent result of the particular production process and arises even under efficient operating conditions. Abnormal spoilage spoilage that should not arise under efficient operating conditions. Write off the cost of spoiled units as a loss of the accounting period. 64 Part 4 – Shrinkage, spoilage, and lost units (Topic 3.6) Page 6: Handout 1 Silver Valley Inc., manufactures snowboarding equipment. All direct materials are added at the beginning of the production process and conversion costs are added evenly throughout the process. In September, $47,600 in direct materials were introduced into production. 17,500 units were started and 15,000 good units were completed. 500 units were spoiled (all normal spoilage). Ending work in process was 2,000 units (each 100% complete as to direct material costs). Allocate the direct materials costs to work in process, completed goods, and spoilage. Stop the audio and download the handout (ma1_mod3_handout1.doc) 65 Part 4 – Shrinkage, spoilage, and lost units (Topic 3.6) Approach A recognize spoiled units when computing output in equivalent units. Approach B do not count spoiled units when computing output in equivalent units. 66 Part 4 – Shrinkage, spoilage, and lost units (Topic 3.6) Page 6: Handout 1 Direct materials costs added Divide by equivalent units Cost per equivalent unit Good units completed: 15,000 x $2.72 Don’t Recognize recognize (count) (count) spoiled units spoiled units $47,600 $47,600 17,500 17,000 $2.72 $2.80 $40,800 15,000 x $2.80 Add normal spoilage: 500 x $2.72 Cost of good units transferred out Work in process: 2,000 x $2.72 $42,000 $1,360 $42,160 2,000 x $2.80 Costs accounted for $42,000 $5,440 $5,600 $47,600 $47,600 67 Part 4 – Shrinkage, spoilage, and lost units (Topic 3.6) Page 6: Handout 1 Direct materials costs added Divide by equivalent units Cost of spoilage is unit allocated to Cost per equivalent completed goods Good units completed: 15,000 x $2.72 Don’t Recognize recognize (count) (count) spoiled units spoiled units $47,600 $47,600 17,500 17,000 $2.72 $2.80 $40,800 15,000 x $2.80 Add normal spoilage: 500 x $2.72 Cost of good units transferred out Work in process: 2,000 x $2.72 $42,000 $1,360 $42,160 2,000 x $2.80 Costs accounted for $42,000 $5,440 $5,600 $47,600 $47,600 68 Part 4 – Shrinkage, spoilage, and lost units (Topic 3.6) Cost of spoilage is split between completed goods and work in process Direct materials costs added Spoilage recorded in Divide by equivalent units ending work in Cost per equivalent unit process is carried into the next period. Good units completed: 15,000 x $2.72 Don’t Recognize recognize (count) (count) spoiled units spoiled units $47,600 $47,600 17,500 17,000 $2.72 $2.80 $40,800 15,000 x $2.80 Add normal spoilage: 500 x $2.72 Cost of good units transferred out Work in process: 2,000 x $2.72 $42,000 $1,360 $42,160 2,000 x $2.80 Costs accounted for $42,000 $5,440 $5,600 $47,600 $47,600 69 Part 4 – Shrinkage, spoilage, and lost units (Topic 3.6) Recognize (count) the spoiled units when computing output in equivalent units. •Highlights the cost of normal spoilage •Ending work in process costs will not be distorted by being charged twice for spoiled units (from this period and the next) 70 Part 4 – Operation costing (Topic 3.7) State the conditions under which operation costing is useful to management, and explain the impact of a flexible manufacturing system on job-order and process costing (Level 2) Operation costing •Units have some common and some individual characteristics •Batches of units •Materials are added as in job-order costing •Labour and overhead are accumulated and applied by department as in process costing Process costing Job-order costing •Masses of identical or similar units of a product or service •Distinct units of a product or service 71 MA1 – MODULE 3 Part 5 Review question: Production worksheet Spoilage (download the additional questions handout: ma1_mod2_handout1.pdf) 72 Part 5 – Review questions: Production worksheet spoilage Handout pages 7 thru 12 What are the costs assigned to units completed, spoiled, and in ending work in process inventory? • • Using the weighted average approach Using the FIFO approach Stop the audio, read and attempt the question in the handout then come back to listen to the solution. 73 Part 5 – Review questions: Production worksheet spoilage Handout pages 7 thru 12 Now working on pages 8-9 What are the costs assigned to units completed, spoiled, and in ending work in process inventory? • • Using the weighted average approach Using the FIFO approach 74 Part 5 – Review questions: Production worksheet spoilage Handout pages 7 thru 12 Now working on pages 10-12 What are the costs assigned to units completed, spoiled, and in ending work in process inventory? • • Using the weighted average approach Using the FIFO approach 75 MA1 – MODULE 3 Part 6 Review question: Comprehensive process costing: Weighted average method (download the additional questions handout: ma1_mod2_handout1.pdf) 76 Part 6 – Review question: Comprehensive process costing: Weighted average method Problem 4-24 pages 181-182 Handout pages 13 thru 15 Required • Prepare journal entries • Post the journal entries to T-accounts • Prepare a production report for the assembly department Stop the audio, read and attempt the question in the handout then come back to listen to the solution. 77 Part 6 – Review question: Comprehensive process costing: Weighted average method Problem 4-24 pages 181-182 Handout pages 13 thru 15 Now working on page 13 Required • Prepare journal entries • Post the journal entries to T-accounts • Prepare a production report for the assembly department 78 Part 6 – Review question: Comprehensive process costing: Weighted average method Problem 4-24 pages 181-182 Handout pages 13 thru 15 Now working on page 14 Required • Prepare journal entries • Post the journal entries to T-accounts • Prepare a production report for the assembly department 79 Part 6 – Review question: Comprehensive process costing: Weighted average method Problem 4-24 pages 181-182 Handout pages 13 thru 15 Now working on page 15 Required • Prepare journal entries • Post the journal entries to T-accounts • Prepare a production report for the assembly department 80 MA1 – MODULE 3 Part 7 Review questions: Multiple Choice Questions Questions 1-8 (download the additional questions handout: ma1_mod2_handout1.pdf) 81 Part 7 – Review questions: Multiple choice 1-8 Multiple choice questions Handout pages 16 thru 19 Now working on page 16 Q1 Cost of units completed and transferred out Q2 Equivalent units of production Q3 Cost of production for equivalent unit Stop the audio, read and attempt the question in the handout then come back to listen to the solution. 82 Part 7 – Review questions: Multiple choice 1-8 Multiple choice questions Handout pages 16 thru 19 Now working on page 17 Q4 Operation costing Q5 Production report Q6 Process costing journal entries 83 Part 7 – Review questions: Multiple choice 1-8 Multiple choice questions Handout pages 16 thru 19 Now working on page 18 Q7 a) Process costing unit cost b) Units completed and transferred 84 Part 7 – Review questions: Multiple choice 1-8 Multiple choice questions Handout pages 16 thru 19 Now working on page 19 Q8 a) Work in process account b) Direct materials cost c) Conversion costs in work in process 85 MA1 – MODULE 3 Part 8 Review questions: Multiple Choice Questions Questions 8-13 (download the additional questions handout: ma1_mod2_handout1.pdf) 86 Part 8 – Review questions: Multiple choice 9-13 Multiple choice questions Handout pages 20 thru 22 Now working on page 20 Q9 Cost of units completed and transferred out Q10 Effect of errors on computation of equivalent units and costs Q11 Equivalent units Stop the audio, read and attempt the question in the handout then come back to listen to the solution. 87 Part 8 – Review questions: Multiple choice 9-13 Multiple choice questions Handout pages 20 thru 22 Now working on page 21 Q12 a) Units in ending work in process b) Equivalent units of production - materials c) Equivalent units of production – conversion costs 88 Part 8 – Review questions: Multiple choice 9-13 Multiple choice questions Handout pages 20 thru 22 Now working on page 22 Q13 a) Units in ending work-in-process inventory b) Equivalent number of units produced c) Unit cost of production 89