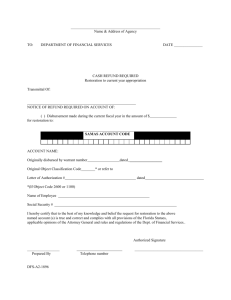

Bad Debt, Cancelled Sales, Returned Merchandise

advertisement

Bad Debt, Cancelled Sales, Returned Merchandise - 210 GENERAL - 210.1 Tax Law 1132(e), 1132(e-1) and 1139(e) as interpreted by Sales Tax Regulations 534.6 and 534.7 authorizes refunds or credits for tax paid in connection with transactions which result in a cancelled sale, returned merchandise or a bad debt. A claimant lllay recover a portion or aU of the tax collected 011 these transactions, depending on the circumstances, in one orthe following manners. A. A claim for credit or refund of an over-payment of sales tax must be filed by the claimant within three years from the time the tax was payable to the department or two years from the time the lax was paid, whichever is later. The credit maybe claimed by either reducing taxable sales by the amount of the transaction (or portion thereof) or hy deducting the amount of the tax credit from the tax due. B. When a sale is cancelled or the property is returned for full credit within ninety (90) days of the date of clelivelY of the property to the purchaser and prior to reporting the transaction on a sales tax return, the vendor may exclude the receipts from the return covering the period in which the sale was made. If the sale has been reported and tax remitted on a return filed within the ninety (90) day period but before the cancellation or return of the property, the vendor may claim a refund or credit in accordance with A. above. BAD DEBTS - 210.2 A. The analysis of taxable sales should include verification or deductions for sales tax on accounts which are wriLten ofl' as bad debts. The amount that may be written ofT as a bad debt loss would be the sales price less any trade-in allowance, payments or other credits applicable to the sale (e.g., charges [or purchases delivered oul-or-state by the vendor). Interest, finance charges, service charges and similar additions to the account shoulclnot be included in computing the allowable credit. When an account has been properly written otr, the vendor is entitled to a proportionate sales tax credit or refund, if the account includes sales taxes billed to the purchaser. NOTE: A bad debt deduction is not allowable until the uncollectible account has been written off for federal tax purposes. Written off is an accounting entry which is performed prior to a deduction on the claimants federal income t~l'\ return. B. Regardless orthe accounting procedure used by the vendor in determining the bad dcbt decluetion (i.e., percent ofsalcs, percent of accounts receiv01hle). the O111owahle sales tax credit or refund is determined, based on identification and analysis or individual accounts \vhich are considered uncollectible. 1 C. Following is an example of the method a vendor should usc in computing the allowable sales tax refund or credit on uncollectible accounts: Sales price of mere han elise is $200. Tax at 7% = $14. Interest added for late payment (prior to bad debt write off) .~ $10. Total amount due before payments = $224. Payments made belore write off is £90. As of the date the account was charged ofron the venclor1s books as uncollcctibk, the balance due $134.00. ($224- 90). To compute the amount of sales tax credit or refund, it is necessary to determine the amount of uncollected sales tax. Applying the total payments of $90.00 to the sales price anel tax thercon, $214.00, the remaining amount of $134.00 is deemed to apply on a percentage basis to sales price ($200.00) ancl sales tax ($14.00). Therefore, the credit or refund would be 14/224 x $134.00 or $8.38. * Sales price excludes sales tax and charges for financing, interest, and any other items. D. The Auditor should examine journal entries, federal income tax returns and schedules, accounts receivable journal, etc., to verify that bad debts have been properly written off, anel that the method used by the vendor to arrive at the allowable deduction and resulting tax refund or credit is substantially correct. In order to properly allow a bad debt deduction and related tax refund or credit, the following areas must be reviewed: I.) Collections Subsequent to Write-Oils Accounting records should be analyzed to cletennine that collections of all or part of previously written off accounts have been properly reported. The collected amount ::;hould be adjusted for accumulated delinquency charges in determining taxable sales. 2.) Collection Agency rees The Auditor should check if accounts receivables have been assigned to a collection agency. A refund or credit is not allowable for a transaction which is financed by a third party* or for a debt which has been assigned to a third party, whether or not such third party has recourse to the vendor on that debt. The fee charged by a collection agency lor collecting or attempting to collect bael debts is not allowable as a part of a bad debt loss and the resulting tax refund or credit. Receipts from a collection agency should be examined to determine that amounts shown as collected are gross amounts and have not been reduced by a collection fce. *See special rules for Private Label Credit Cards - Field Audit Guidelines Section 210.4. 3.) Insurance Identification The review of accounting records should include a search for insurance recoveries on accounts receivable, or similar type insurance policies applicable to sustained bad debt losses. Any such indemnification should be used to reduce claimed bact debt losses and the related tax refund or credit. 2 4.) rl12nge in Tax Rat~ Accounting records should be examined to determine that the sales tax written off as a bad debt reflects the tax rate in effect on the clate of the originnl snle and have not been adjusted for any subsequent rate increases. 5.) Aging the Account Payments made to an account should be checked to see that they were applied to the oldest charges in the account. In addition these payments must be divided proportionately between taxable and nontaxable charges, i r any. 6.) Construction Contractors Bad debt allowances for a construction contractor are limited to losses from taxable retail sales of tangible personal property and repair services. A lump sum capital improvement which is determined to be wholly or partially uncollectible would not be eligible for a reduction in taxable sales or sales tax credit as the loss did not result from a transaction on which thc contractor was required to collect a sales lax. E. Additional discussion on the topic of bad debts as well as more extensive examples can be found in Sales Tax Regulations Section 534.7. CANCELLED SALES AND RETURNED MERCHANDISE - 210.3 A. The analysis of taxable sales should include verification of deductions for cancelled sales and returned merchandise since these deductions generally reduce the amount of the vendor!s tax payment. The auditor should review the accounting records and income tax returns to verify that cancelled sales and returned merchandise have been properly deducted and that the procedure used by the vendor to record these transactions is reliable. B. \VhCll revicwing thesc transactions, the Auditor should verify that: J .) Tax was charged and remitted to the Department. 2.) The sale was actually cancelled on the merchandise returned 3.) The allowance given the customer included the sales tax originally charged 4.) The proper jurisdictional rate was computed (e.g., if merchandise is purchased in a 7% locality and returned in an 8% locality, only 7 0ft) may be claimed as a refund or credit). 5.) The full purchase price was credited or refunded to the customer. If a partial refund or credit is made and the difference retained as a restocking, handling or similar charge) only a partial tax refund based upon the amount of the refund or credit of the sale price is allowable. 6.) In the case of an exchange for defective merchandise, the auditor should verify that tax was collected on any aclj ustment to the selling price. 3 Bad Debt, Cancelled Sales Returned Merchandise - 210 c. The Auditor should examine substantiation for these transactions in the form of notations on the original sales invoice, creciit memos, correspondence with the customer and similar documents. D. Any discrepancies found should be recorded in detail on a workpaper and included on the sales tax liability schedule. PRIVATE LABEL CREDIT CARD - 210.4 A. In certain instances a bad debt credit or refund can be claimed on sales that were financed by a special class of cr~dil card companies. 1) The original purchase must have been made from a vendor whose logo was imprinted on the credit card used to purchase. 2) The account was written off on or after 1/1/09. 3) An election form was signed by both the vendor and the credit card company which indicates the party authorized to claim the credit or refunds. 4) Both the vendor and the credit carel company are registered sales tax vendors. B. The claimant must otherwise meet all the procedures concerning statute of limitations & application of payments discussed in 21 0.1 and 210.2. 4