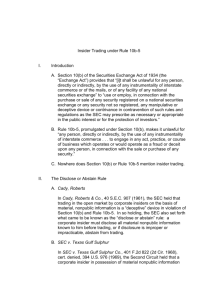

Missappropriation Theory: Are the Boundaries Limitless, The

advertisement

COMMENT THE MISAPPROPRIATION THEORY: ARE THE BOUNDARIES LIMITLESS? I. INTRODUCTION Insider trading' has increased significantly in recent years.2 Correspondingly, the Securities and Exchange Commission (SEC) has undertaken efforts to thwart such activity.3 There has been a favorable public reaction to the SEC's campaign against insider trading, which is primarily based upon traditional no1. See 3 A. BROMBERG & L. LOWENFELS, SECURITIEs FRAUD AND COMMODrrIEs FRAUD BROMBERG & LOWENFELs] "Insider. Trading" prohibited securities trading utilizing material non-public information when the trader has a duty to disclose the information or abstain from trading. Id. "Insider trading" a term used to describe the unlawful buying or selling of securities based upon material nonpublic information. Id. See also Insider Trading Sanctions Act of 1984, Energy and Commerce Comm., H.R. Rep. No. 355, 98th Cong., 1st Sess. 21 n.33 (1983), reprinted in 1984 U.S. CODE CONG. & ADMIN. NEws 2274, 2293 n.33. 2. 134 Cong. Rec. h7470 (daily ed. Sept. 13, 1988). See also The Insider Trading Sanctions Act of 1983: Hearings on H.R. 559 Before the Subcomm. on Securities of the Senate Comm. on Banking, Housing and Urban Affairs, 98th Cong., 2d Sess. 33 (1984). [hereinafter Hearings] During the hearings, the SEC Chairman John Shad reported on the increased number of proceedings which have alleged insider trading violations. Id. at 33-34. Commentators have noted the sharp increase in insider trading actions by the SEC since 1970, yet expressed doubt that such trading has been significantly affected, § 7.4(100) (Nov. 1984) [hereinafter even by successful prosecutions See also BROMBERO & LOWENFELS, supra note 1, at § 7.4(144); Dooley, Enforcement of Insider Trading Restrictions, 66 VA. L.REv. 1, 2, 74-83 (1980); Illegal Insider TradingSeems to Be on Rise: Ethics Issues Muddled, Wall St. J., Mar. 2, 1984, at 1, col. 6. 3. See supra note 2 for a discussion of the increased actions undertaken by the SEC to thwart insider trading. BRIDGEPORT LAW REVIEW [Vol. 12:317 tions of fair play.4 The United States Supreme Court's position concerning insider trading has caused a limitation on the SEC's power to pursue and penalize market outsiders5 and tippees. The Court has stated that despite the absence of statutory language or legislative history addressing the issue of nondisclosure, silence in connection with the purchase or sale of securities may give rise to a common law fraud action under Section 10(b) of the Securities and Exchange Act of 1934.7 The Court has held that for nondisclosure of information in securities transactions to constitute fraudulent misrepresentation, a relationship of trust and confidence must exist between the parties.' Premised upon this holding, the SEC and the Second Circuit Court of Appeals have adopted a misappropriation of information theory." The misappropriation theory extends liability to 4. See Arkin, Insider Trading - Distinguishing Unequal Advantage from Fraud, N.Y.L.J., June 19, 1986, at'l col. 3 (favorable public reaction to the SEC campaign). 5. See Aldave, Misappropriation:A General Theory for Trading on Non-public information, 13 HOPSTRA L. REv. 101, 112 (1984). "Outsiders" are those individuals who have access to material non-public information although they have no direct relationship to the corporation or shareholders. Id. 6. Dirks v. S.E.C., 463 U.S. 646, 665 (1983). A "tippee" is a person who buys or is given non-public information from an insider or a corporation when no one else is given that information. In Re Cady, Roberts, 40 S.E.C. 907, 912 (1961). See Chiarella v. United States, 445 U.S. 222, 231-35 (1980) (employee of a financial printer had no fiduciary relationship with the shareholders from whom he purchased stock; therefore he had no duty to disclose before trading). The Chiarella Court held that a market outsider, who had no fiduciary relationship with the shareholders from whom he purchased stock, had not violated section 10(b) and Rule 10b-5 since he did not have a duty to disclose before trading. Id. See infra notes 35-49 and accompanying text for a discussion of the Chiarella decision. Three years later, in Dirks v. S.E.C., the Court held that a tippee violates section 10b and Rule 10b-5 only if the insider breached a fiduciary obligation for personal gain and if the tippee knew or had reason to know of the breach. 463 U.S. at 660-63; See infra notes 50-69 and accompanying text for a discussion of the Dirks decision. 7. Chiarella v. United States, 445 U.S. at 230. 15 U.S.C. § 78j (1982). See infra notes 12-28 and accompanying text for a discussion of 10b-5 and its application to insider trading cases. 8. See Dirks, 463 U.S. at 654; Chiarella,445 U.S. at 229-30. 9. See United States v. Carpenter, 791 F.2d 1024 (2d Cir. 1986), cert. granted, 484 U.S. 19 (1987), aff'd, 484 U.S. 19 (1987) (employee of financial newspaper breached newspaper's policy by misappropriating confidential information as part of insider trading scheme); S.E.C. v. Materia, 745 F.2d 197 (2d Cir. 1984) (employee of financial printer traded on corporate information entrusted to his employer by employer's client), cert. denied, 471 U.S. 1053 (1985); See United States v. Newman, 664 F.2d 12 (2d Cir. 1981), aff'd without opinion, 722 F.2d 729 (2d Cir. 1981) (investment bankers breached duties 1991] MISAPPROPRIATION THEORY those who trade on non-public information in breach of a fiduciary duty owed to a person or persons who entrusted the information to the fiduciary. 10 .For example, an employee breaches a duty to his employer when he misappropriates confidential information belonging to his employer by using the information for his own personal gain. This Comment examines the decision of the United States District Court for the Southern District of New York in United States v. Willis" in light of the United States Supreme Court decisions concerning liability under Rule 10b-5. 12 Part II examto employer by disclosing confidential information concerning proposed mergers), cert. denied, 464 U.S. 863 (1983); S.E.C. v. Peters, 735 F. Supp. 1505 (D. Kan. 1990) (partner in an investment consultant company had an obligation to keep confidential any information relating to his partner's consulting work which was excluded from the work of the partnership). United States v. Elliott, 711 F. Supp. 425 (N.D. Ill. 1989) (a former partner in a law firm misappropriated confidential client information about planned acquisitions by purchasing stock in the target company expecting prices would rise when the prospective acquisitions became public); S.E.C. v. Tome, 638 F. Supp. 596 (S.D.N.Y. 1986) (defendant exploited his relationship with an executive officer of Joseph Seagram & Co., to gain access to material non-public information regarding Seagrams plans for a hostile tender offer and thereafter traded on the securities of the target company); United States v. Reed, 601 F.Supp. 685 (S.D.N.Y.) rev'd in part, 773 F.2d 477 (2d Cir. 1985) (misappropriation theory supported the indictment of a tippee even though he would not have been liable under Dirks); S.E.C. v. Musella, 578 F. Supp. 425 (S.D.N.Y. 1984) (tippee of a law firm violated Rule 10b-5 by trading on non-public information which employee misappropriated from his employer by trading on confidential client information). 10. United States v. Newman, 664 F.2d 12 (2d Cir. 1981) (employees guilty of securities fraud for breach of a fiduciary duty to employer). The misappropriation theory is based on the principle that the one who trades on material confidential information acquired during the course of employment, breaches a fiduciary duty to his employer and, therefore, is guilty of securities fraud if the information is used to obtain personal gain from the purchase or sale of securities. See Note, Insider Tradingand the Misappropriation Theory: Has the Second Circuit Gone too Far?, 61 ST. JOHN'S L. REV. 78, 98-100 (1986) (history of the SEC and securities regulations) [hereinafter Second Circuit]. In response to the limitations imposed by the Supreme Court, the SEC advocated a misappropriation theory which imposes liability on nontraditional insiders and tippees. Id. at 98. See also LANGEVOORT, INSIDER TRADING REGULATION 177-79 (1988) (misappropriation theory applies 10b-5 liability to persons who trade on non-public information in breach of a fiduciary duty owed to the person or persons who entrusted the information to the fiduciary); See also Note, The SEC's Regulation of the FinancialPress: The Legal Implications of the MisappropriationTheory, 52 BROOKLYN L. REV. 43, 54-63 (1978) (history of the misappropriation theory). 11. 737 F. Supp. 269 (S.D.N.Y. 1990) 12. Chiarella v. United States, 445 U.S. 222, 232-35 (1980) (mere possession of nonpublic information does not bring with it corresponding duty to disclose information or abstain from trading on information). Dirks v. Securities Exchange Commission, 463 U.S. 646, 665 (1983) (possession of material non-public information does not give rise to BRIDGEPORT LAW REVIEW (Vol. 12:317 ines the evolution of 10b-5. Part III summarizes the facts of the Willis case and reviews the decision of the District Court. Additionally, the Comment suggests that the decision of the District Court neither comports with the United States Supreme Court's guidelines nor effectuates the objectives of the securities laws. II. BACKGROUND In 1934, the United States Congress enacted the Securities and Exchange Act of 1934 which provided a broad mechanism for the regulation of the sale and purchase of securities. I3 The primary goal of the Act is to require full and fair disclosure of material facts to the prospective purchasers of securities to prevent inequitable and unfair practices in securities transactions. 4 Section 10(b) of the 1934 Act 5 makes it unlawful to defraud or engage in fraudulent business in both the purchase and sale of securities and thus provides the statutory basis for the proscriptions of insider trading."e Pursuant to Section 10(b) the SEC duty to disclose or abstain from trading absent relationship of trust and confidence between parties). 13. Securities and Exchange Act of 1934, 15 U.S.C. §§ 78a-78kk (1982). See also Second Circuit, supra note 10, at 86-90 for a discussion of the parameters and limitations of the Securities and Exchange Act of 1934. 14. R. SHIELDS & R. STROUSE, SECURITIES AND PRACTICE HANDBOOK (5th ed. 1987). See, e.g., Eichler v. Berner, 472 U.S. 299, 315 (1985) (primary objective of securities laws is the protection of investing public and national economy); United States v. Carpenter, 791 F.2d 1024, 1032 (2d Cir. 1986) (protection of investors is the major purpose of Section 10(b) and Rule 10b-5). 15. 15 U.S.C. § 78j (1982). Section 10b provides: It shall be unlawful for any person, directly or indirectly, by use of any means or instrumentality of interstate commerce or of the mails, or of any facility of any national securities exchange (a) To effect a short sale, or to use or employ any stop loss order in connection with the purchase or sale, of any security registered on a national securities exchange, in contravention of such rules and regulations as the Commission may prescribe as necessary or appropriate in the public interest or for the protection of investors. (b) To use or employ, in connection with the purchase or sale of any security registered on a national securities exchange or any security not so registered, any manipulative or deceptive device or contrivance in contravention of such rules and regulations as the Commission may prescribe as necessary or appropriate in the public interest or for the protection of investors. Id. 16. See 15 U.S.C. §§ 77q(a), 78(b) (1982). These provisions do not specifically prohibit insider trading. The Securities and Exchange Act has been administratively and judicially interpreted as encompassing such activity. See, e.g., Affiliated Ute Citizens of 19911 MISAPPROPRIATION THEORY promulgated Rule 10b-5 to effectuate the purpose of 10(b).1 7 For almost twenty years after the enactment of Rule 10b-5, courts limited their analyses of insider trading to activities of traditional corporate insiders, i.e., directors, officers and controlling shareholders.' Because of their position with the corporation, traditional insiders were said to have a fiduciary relationship to the shareholders of the corporation requiring them to adhere to the "disclose or abstain rule."' 19 Pursuant to this rule, anyone in possession of material ° inside information must eiUtah v. United States, 406 U.S. 128, 151-52 (1972) (bank employees liable under Section 10(b) for failure to disclose material information regarding stock value); In Affiliated Ute, the Supreme Court recognized that the provisions of 10(b) and Rule 10b-5 "are broad and by repeated use of the word 'any' obviously meant to be inclusive." Id. In re Cady, Roberts & Co., 40 S.E.C. 907, 912 (1961) (brokerage firm liable for trading on basis of material information received from insider pursuant to sections 17(a), 10(b) and Rule 10b-5). 17. 17 C.F.R. § 240.10b-5 (1987) which states as follows: It shall be unlawful for any person directly or indirectly, by the use of any means or instrumentality of interstate commerce, or of the mails or of any facility of any national securities exchange, (a) To employ any device, scheme, or artifice to defraud, (b) To make any untrue statement of a material fact or to omit to state a material fact necessary in order to make the statements made, in light of the circumstances under which they were made, not misleading or, (c) To engage in any act, practice, or course of business which operates or would operate as a fraud or deceit upon any person, in connection with the purchase or sale of any security. Id. The SEC promulgated Rule 10b-5 to close a loophole in the protection against fraud under Section 10(b) of the Securities Act of 1934. See Second Circuit, supra note 10, at 86-89. Rule lOb-5 was created by the SEC pursuant to its rule-making power to regulate securities trading. Id. Prior to 1942, the SEC had promulgated rules under Section 10(b) but they did not prohibit insider trading. Id. 18. Speed v. Transamerica Corp., 99 F. Supp. 808, 828-29 (D. Del. 1951) (traditional insiders are corporate officers, directors, or majority shareholders). 19. See S.E.C. v. Texas Gulf Sulphur Co., 401 F.2d 833, 848 (2d Cir. 1968). Officers of Texas Gulf purchased stock in the corporation after finding out that one of the company's properties had tested positive for an ore discovery. Id. at 843-44. They traded without first disclosing the drilling rights. Id. at 841-42. See generally Brudney, Insiders, Outsiders and other Informational Advantages under the Federal Securities Laws, 93 HARV. L. REV. 322 (1979) (history of the disclose or abstain rule). 20. The Texas Gulf court stated that "the basic test of materiality... is whether a reasonable man would attach importance ... in determining his choice of action in the transaction in question ....This of course, encompasses any fact ...which in reasona- ble and objective contemplation might affect the value of the corporation's securities ...." 401 F.2d at 849 (emphasis in original) (quoting List v. Fashion Park, Inc., 340 F.2d 457, 462 (2d Cir. 1965). See also TSC Industries v. Northway, Inc., 426 U.S. 438 (1976). The Court held that information is material "if there is a substantial likelihood that a reasonable shareholder would consider it important in deciding how to vote." Id. at 449. See Basic, Inc. v. Levinson, 485 U.S. 224 (1988). Information is material if there BRIDGEPORT LAW REVIEW [Vol. 12:317 ther disclose2 ' the information to the investing public or abstain from trading on such information.22 This duty is predicated upon a relationship affording one access to information intended to be available only for corporate purposes and the inherent unfairness that can result when a person uses that information knowing it is unavailable to those with whom they are dealing. 28 The Securities and Exchange Commission and various courts have broadened the reach of Rule 10b-5 by expanding the category of persons who owe a duty to disclose or abstain.2 ' In In re Cady, Roberts & Co., 25 the SEC extended this rule by plac- ing liability on "anyone who traded on material non-public information, regardless of whether they owed a duty to the corporation. ' 2 Additionally, the Second Circuit Court of Appeals in is a substantial likelihood that a reasonable investor would consider it important in deciding his choice of action in a particular securities transaction. Id. at 231. See also S.E.C. v. MacDonald, 699 F.2d 47, 49 (1st Cir. 1983) (violation of § 10b when defendant made purchases of RIT stock without disclosing material inside information learned in his capacity as chairman of the board of RIT); TSC Indus., Inc. v. Northway, Inc., 426 U.S. 438, 449 (1976) (proxy statement issued to recommend approval of the acquisition of TSC to National was incomplete and misleading). 21. Texas Gulf, 401 F.2d at 848-49. Disclosure is effectuated if it is disseminated by the public at large. Id. "Material facts include not only information disclosing the earnings of a company but also those facts which affect the probable future of the company and those which may affect the desire of investors to buy, sell or hold the 'company's securities." Id. at 849. The SEC views disclosure as requiring more disclosure to buyers than to purchasers or sellers. Id. See In re Faberge, Inc., 45 S.E.C. 249, 256 (1973). Proper disclosure is achieved by a public release through the appropriate public media designed to achieve dissemination to the investing public generally. Id. 22. Texas Gulf, 401 F.2d at 848-49. See also Brudney, supra note 19, at 324-35 (insiders who possess information of a consequential nature must either disclose it or abstain from trading unless information becomes public). 23. In re Cady, Roberts, 40 S.E.C. 907, 912 (1961). Chairman Carey set forth a two prong test for imposition of the duty to disclose beyond the traditional corporate insiders: first, the existence of a relationship which gives access, directly or indirectly, to information intended to be available only for corporate purposes and not for the personal benefit of anyone, and second, the inherent unfairness involved where a party takes advantage of such information knowing it is unavailable to those with whom he is dealing. Id. at 912. 24. Texas Gulf, 401 F.2d at 848. Chairman Carey reaffirmed the expansion of liability under 10(b) to include those persons who are in a special relationship with a company and privy to its affairs. Id. 25. 40 S.E.C. 907 (1961). 26. Id. Rule 10b-5 restricts trading activities of "any person who has a relationship that allows access to material non-public information." Id. See also Speed v. Transamerica Corp., 99 F. Supp. 808, 829 (D. Del. 1951) (extending fiduciary duties to majority shareholders); New Park Mining Co., v. Cranmer, 225 F. Supp. 261, 266 (S.D.N.Y. 1963) (corporation allowed to sue former officers and directors, thus relaxing privity require- 1991] MISAPPROPRIATION THEORY S.E.C. v. Texas Gulf Sulphur Co. 27 and Shapiro v. Merrill Lynch, Pierce, Fenner & Smith, Inc.2" held that Rule 10b-5 lia29 bility extends to "tippees" as well as corporate insiders. Although both the Securities and Exchange Commission and the Second Circuit Court of Appeals extended liability under Rule 10b-5, the basis for the liability was quite different. The SEC's decision in Cady, Roberts rested on the "fiduciary" theory to define the boundaries of the duty to disclose or abstain.30 The fiduciary theory protects the relationship of trust between an insider and the shareholders of a corporation.3" If an insider trades on non-public information without first disclosing such information and subsequently earns a profit, he has breached his fiduciary duty.3 2 In S.E.C. v. Texas Gulf Sulphur Co., the Second Circuit Court of Appeals defined Rule 10b-5 in such a way as to ensure that all investors have equal access to information regardless of whether a traditional or fiduciary relationship exists. 3 According to the Texas Gulf rule, anyone in possession of material non-public information has a duty to disclose the information or abstain from trading on it. 4 This theory ments under Rule 10b-5); Pettit v. American Stock Exchange 217 F. Supp. 21, 28 (S.D.N.Y. 1963) (suit against variety of persons accused of defrauding an insurer of stock). 27. 401 F.2d 833 (2d Cir. 1968). In Texas Gulf, several officers and directors purchased additional shares in the corporation's stock based on confidential information concerning a possible mineral strike. In addition, the defendants selectively disclosed the information to a number of individuals who also purchased shares. Id. at 839-43. 28. 495 F.2d 228 (2d Cir. 1974). Merrill Lynch was advised of material adverse information regarding Douglas aircraft earnings. Id. at 232. Merrill Lynch tipped information to certain customers who then sold stock before the information was public. Id. 29. Id. In Shapiro, the court stated that the purpose of 10b-5 is to prevent corporate insiders and their tippees from taking advantage of uninformed outsiders. Id. at 235. The Shapiro court held that the defendant tippees knew or should have known of the confidential source of the earnings information, and that they were under a duty not to trade Douglas stock without disclosing the information. Id. at 238. See also, In re Cady, Roberts, 40 S.E.C. 907. A "tippee" is a person who is given non-public information from an insider or a corporation when no one else is given that information. 30. Cady, Roberts, 40 S.E.C. at 912. 31. Id. 32. See Cady, Roberts, 40 S.E.C. at 916 n.31. The SEC in Cady, Roberts provided the following description of the duty one owes to the shareholders of a corporation: "he would have a duty not to take a position adverse to them, not to take secret profits at their expense, not to misrepresent facts to them, and in general to place their interests ahead of their own." Id. 33. S.E.C. v. Texas Gulf Sulphur Co., 401 F.2d 833, 848 (2d Cir. 1968). 34. Id. at 848. BRIDGEPORT LAW REVIEW [Vol. 12:317 espouses informational parity; all investors in the market should have equal access to all material investment information.3 5 The United States Supreme Court in United States v. Chiarella3 settled the different approaches taken by the Securities and Exchange Commission and the Second Circuit and held that a duty to disclose or abstain could only apply to those who had a fiduciary relationship.3 7 Liability under Rule 10b-5 could not be upheld absent a relationship of trust and confidence between the parties to a transaction.3 8 In Chiarella,the United States Supreme Court in a 6-3 decision rejected the expansive view taken by the Second Circuit and reaffirmed the traditional theory that liability under Rule 10b-5 is premised upon a breach of a fiduciary duty. 9 The defendant, Chiarella, was an employee of a financial printing company, Pandick Press.4 0 His position afforded him access to various forms and statements relating to corporate acquisitions that 35. Id. at 849. Judge Skelly Wright in Dirks v. S.E.C., 681 F.2d 824 (D.C. Cir. 1982) stated that those cases adopting the information theory "imply that the securities laws impose a duty to disclose or refrain from trading based on the nature of the undisclosed information." Id. at 835. Judge Skelly Wright, however, went on to state that a "full equality of access to information is an illusory goal." Id. at 835 n.14. 36. 445 U.S. 222 (1980). 37. Id. at 230. 38. Id. The Chiarefla Court stated that liability under section 10(b) is "premised upon a duty to disclose arising from a relationship of trust and confidence between parties to a transaction. Id. Application of a duty to disclose prior to trading guarantees that corporate insiders, who have an obligation to place the shareholders welfare before-their own, will not benefit personally through fraudulent use of material non-public information." Id. 39. Id. at 224-25. Justice Powell wrote the opinion for the Court in which Justices Stewart, White, Rehnquist and Stevens joined. Justice Brennan wrote a concurring opinion. Id. at 238. The applicable law is that a person violates section 10b whenever he improperly obtains or converts, to his own benefit, non-public information which he uses in connection with the purchase or sale of securities. Id. at 239. Justice Stevens also wrote a concurring opinion. He stated that the identification of a duty is necessary for liability under Rule 10b-5. Stevens agreed with the majority but established two duties which Chiarellaarguably violated: (1) a duty to disclose owed to sellers from whom he purchased stock; (2) a duty of silence owed to acquiring companies. Id. at 237. Chief Justice Burger dissented. Burger argued that a person who misappropriated non-public information has a duty to disclose that information or refrain from trading. These provisions reach any person engaged in any fraudulent scheme. Id. at 240, and Justice Blackmun wrote a dissenting opinion in which Justice Marshall joined. The dissent opined that persons having access to confidential market information that is not legally available to others are prohibited from using that information to their advantage through trading in affected securities. Id. at 249. 40. ChiareUa, 445 U.S. at 224. 19911 MISAPPROPRIATION THEORY Jzo 41 the documents he Pandick prepared for its customers. Among takeover bids with the handled were five announcements of concealed to protect the confinames of the acquiring companies 2 Chiarella, however, managed to dentiality of the information.' s Without disclosing the indeduce the names of the companies.' of the target company formation, he used it to purchase shares for a profit after the takeover attempts and then sold his shares 44 were made public. the SEC, and he Chiarella's activities were uncovered by Section 10(b) and Rule was indicted and convicted of violating of Appeals for the Sec10b-5.1 A divided United States Court e held that The majority ond Circuit affirmed his conviction.4 regularly receives mawho not or' "[alnyone - corporate insider information to use that terial non-public information may not an affirmative duty to trade in securities without incurring disclose."'4 the parity of inThe United State Supreme Court rejected as to the scope view formation rule and adopted a more limited "a duty to disclose that of a duty to disclose .' The Court held between parconfidence and arises from a relationship of trust nonpossession of material 0 ties to a transaction."' The mere disclose. a duty to public information does5 not require States Supreme Court furUnited In Dirks v. S.E.C., ' the duty doctrine by deciding the ther developed the 10b-5 fiduciary 5 the Court held that a liability of a stock "tippee." In Dirks, 41. Id. 42. Id. 43. Id. 44. Chiaiella, 445 U.S. at 224. 45. Id. at 224-25. 46. Id. at 224. Cir. United States, 588 F.2d 1358, 1365 (2d 47. Id. at 231, (citing Chiarella v. 1978)). 48. Chiarella,445 U.S. at 235. an 40 S.E.C. 907 (1961), the SEC stated that 49. Id. at 230. In Inre Cady, Roberts, (officers, insiders corporate on imposed been affirmative duty to disclose has traditionally belief at 912. The duty is premised on both the Id. shareholders). corporate and for directors available be to intended access to information that the party's position afforded them advantage of the take to insider an allowing of corporate purposes, and the unfairness Id. information by trading without disclosing. 235. at U.S. 445 Chiarella, 50. 51. 463 U.S. 646 (1983). was the first case establishing "tippee" 52. Dirks, 463 U.S. at 655. Cady, Roberts BRIDGEPORT LAW REVIEW [Vol. 12:317 tippee violates Rule 10b-5 if: (1) an insider breaches a fiduciary duty to the corporation's insiders by divulging material nonpublic information;5" (2) the tippee knew or should have known that the tipper breached a duty;5' and (3) the tippee traded on the information. Dirks was a security analyst who specialized in providing investment analysis of insurance company securities to institutional investors. 56 On March 6, 1973, Dirks was contacted by Ronald Secrist, a former officer at Equity Funding, a diversified corporation primarily engaged in selling life insurance and mutual funds.57 Secrist alleged that the assets of Equity Funding had been vastly overstated as a result of fraudulent practices within the corporation. 8 Moreover, Secrist informed Dirks that a number of regulatory agencies had failed to take action on it.59 Thereafter, Dirks began to investigate the allegations.60 He verified the existence of the fraud and advised his clients of the findings.6 Many of these people, in response to the circulating rumors, sold their holdings in Equity Funding before the price liability under Rule 10b-5. 40 S.E.C. at 907. The tip involved reporting of a dividend by Curtis-Wright Corporation. Id. A director of the firm revealed information that the Curtis-Wright dividend had been cut to a stockbroker prior to the official publication by Dow Jones. Id at 908-10. Gintel, the stockbroker, proceeded to trade shares of stock in Curtis-Wright for client accounts. Id. When the dividend announcement later appeared on the Dow Jones ticker tape, trading of Curtis-Wright stock was suspended because of the large number of sell orders. Id. The emphasis in Cady, Roberts was on expanding the category of insiders, see id. at 912-13, and it was not until S.E.C. v. Texas Gulf when the issue of the receipt of material non-public information was specifically addressed. See S.E.C. v. Texas Gulf, 401 F.2d 833 (2d Cir. 1968), cert. denied, 394 U.S. 976 (1969). The Court adopted the Cady, Roberts delineation of insider status, but focused on the equal access to material information regardless of whether traditional facts of fiduciary concepts were applied. Id. at 848. 53. Dirks, 463 U.S. at 659-61. 54. Id. at 660 (Tipper must know or have reason to know the information is nonpublic and improperly obtained). See A. JAcoBs, THE IMPACT OF RULE 1OB-5 § 167 (1980). 55. Dirks, 463 U.S. at 659-61. To determine whether the insider breached a duty, the court will consider if the insider received a direct or indirect personal benefit from disclosure, such as a pecuniary gain or a reputational benefit that will translate into future earnings. In Re Cady, Roberts, 40 S.E.C. at 912 n.15. The insider by giving information, in effect, selling it for value to himself. Id. 56. Dirks, 463 U.S. at 648. 57. Id. at 649. 58. Id. Secrist urged Dirks to verify the fraud and disclose it publicly. Id. 59. Id. 60. Dirks, 463 U.S. at 649. 61. Id. He met with several officers and employees of the corporation. Id. Senior management denied any wrongdoing but certain employees corroborated the fraud. Id. MISAPPROPRIATION THEORY 1991] . could decline."2 After the exposure of the fraud, the Securities and Exchange Commission found Dirks guilty of aiding and abetting those who sold stock based on non-public information." The United States Supreme Court reversed the Dirks conviction." The Court stated that whether a tippee breaches a fiduciary duty depends upon the insider's purpose in disclosing the information. 8 Accordingly, the Court found that Dirks was not liable under Rule 10b-5 because the insider who gave the information to Dirks had not breached a duty to the corporation when he passed along the information. 6 Since Dirks was not a tippee under the Court's analysis, he could freely divulge the information to others without incurring liability. 7 Thus, the insider's act of tipping must be a breach of the insider's fiduciary duty before a tippee can inherit a derivative duty.68 The tippee must know or have reason to know that the tipper has breached a fiduciary obligation by revealing that information. 9 In addition, whether the insider's tip constitutes a breach depends on whether the insider receives a direct or indirect personal 70 benefit. 62. Id. at 649-50. Throughout the investigation Dirks openly discussed the information he obtained with a number of clients. Id. After the purchase the price of Equity stock fell from $26 per share to $15 per share. Id. 63. Id. at 650-51. 64. Dirks, 463 U.S. at 667. 65. Id. at 663. The Court stated that the test is an objective one focusing on "whether the insider receives a direct or indirect personal benefit from disclosure." Id. at 663. The Court held that an insider's tip is improper only if he benefits personally. Id. at 664. In his dissent, Justice Blackmun criticized the test, but conceded that Dirk's informant did not benefit from the tip. Id. at 669. 66. Id. at 666-67. The corporate insider who revealed the information to Dirks did not violate their Cady, Roberts duty to the corporation by providing the information to Dirks. Id. at 666. Thus, the Court found no derivative duty to the corporation by Dirks. Id. at 887. 67. Id. The Court, however, suggested the definition of "insider" might be enlarged to include those who enter into a special relationship and have access to information solely for corporate purposes. Id. at 655 n.14. Those persons become constructive insiders and violate Rule lob-5 when they use confidential information for the purchase or sale of securities. Id. at 660. 68. Dirks, 463 U.S. at 667. 69. Id. at 660-61. 70. Id. at 662. Whether an insider receives direct or indirect personal benefit from disclosure is a question of fact. The Court provided examples of personal benefits: pecuniary gain, enhanced reputation which would translate into future earnings, gifts of inside information to friends or relatives, or, in general, any quid pro quo transaction. Id. at 663-64. See also Cady, Roberts, 40 S.E.C. at 912, n.15.; Brudney, supra note 19 at 348. BRIDGEPORT LAW REVIEW [Vol. 12:317 In response to Dirks and Chiarella, the SEC and the Second Circuit have advocated a misappropriation theory71 to impose liability on non-insiders who traded on inside information.72 This theory was first advanced in Chiarella.7 ' Although the United States Supreme Court never directly addressed the validity of the misappropriation theory, several members of the Court expressed support for its use.7 Based on this indication of support, the government advocated the misappropriation theory in United States v. Newman.75 In Newman, two employees of investment banking firms conveyed information to Newman, a securities trader, concerning proposed mergers and acquisitions.7 6 Newman used the information to purchase stock in the companies that were merger and takeover targets. 77 When the mergers or takeovers were announced and the market price rose, Newman reaped substantial gains. 78 In reversing the District Court's dismissal of the indictment, the Second Circuit approved the misappropriation theory. 79 The Court held that the employees' breach of their duty of "The theory ... is that the insider, by giving information out selectively, is in effect selling the information to its recipient for cash, reciprocal information, or other things of value for himself .... Id. 71. See supra notes 9-10 and accompanying text for a discussion of the misappropriation theory and its application. 72. See United States v. Reed, 601 F. Supp. 685, 699 (S.D.N.Y. 1985) (misappropriation theory supported the indictment of a tippee even though he would not have been liable under Dirks). See also Rothberg v. Rosenbloom, 771 F.2d 818 (3d Cir. 1985) (implicitly approving use of misappropriation theory in an in pari delecto defense case). 73. See Chiarella,445 U.S. at 234-37. 74. Id. at 238-51. In his concurrence, Justice Stevens stated that an argument could be made that his actions constituted a "fraud or deceit" upon those acquiring corporations, but they would not be able to recover damages because they were neither purchasers nor sellers of the traded securities. Id. at 237-38. Chief Justice Burger and Justice Brennan would have imposed liability on Chiarella on the theory that any person who has misappropriated non-public information has an absolute duty to disclose that information and refrain from trading. Id. at 239-45. 75. 664 F.2d 12 (2d Cir. 1981), cert. denied, 464 U.S. 863 (1982). 76. Id. at 15. Since 1972 both employees, Antinou and Curtois, worked for Morgan Stanley. Id. In 1975 Antinou left Morgan Stanley to work for Kuhn Loeb. Id. 77. Id. The stock purchased was that of companies that were merger and acquisition targets-clients of Morgan Stanley and Kuhn Loeb. Id. 78. Id. Newman shared his profits with Curtois and Antoniu, the sources of the wrongfully acquired information. Id. 79. See Newman, 664 F.2d at 17 (quoting Chiarella 445 U.S. at 245 (Burger, C.J., dissenting)). The Newman court quoted Justice Burger's statement in Chiarella that "the defendant 'misappropriated-stole to put it bluntly-valuable non-public information entrusted to him in utmost confidence.'" Id. 1991] MISAPPROPRIATION THEORY confidence by misappropriating information for their own use satisfied the requirements set forth in Chiarella for Rule 10b-5 liability.80 Four years later, in S.E.C. v. Materia,8 1 the Second Circuit held that Materia, a copy reader for a firm specializing in financial documents, violated Rule 10b-5 by misappropriating confidential information concerning proposed tender offers by trading in the securities of the target companies.8 2 Additionally, the Second Circuit in United States v. Grossman"s held that Grossman, an attorney, breached firm policy by disclosing information entrusted to his employer by his employer's client. 84 Grossman misappropriated information he received from a colleague at his law firm regarding a client's planned recapitalization."s The Second Circuit expanded its application of the misap6 In Carpenpropriation theory in United States v. Carpenter.8 ter, Winans, a reporter for The Wall Street Journal, wrote a daily column discussing selected stocks, giving positive and negative information about them and then taking a position on in80. Newman, 664 F.2d at 16. 81. 745 F.2d 197 (2d Cir. 1984), cert. denied, 471 U.S. 1053 (1985). 82. Id. at 199-201. A tender offer occurs when an individual, corporation or some group gain control over a corporation by offering to buy the shares of the corporation. D. VAGTS, BASIC CORPORATION LAW 834 (2d ed. 1973). See S.E.C. v. Materia, 745 F.2d at 199. Word of an upcoming tender offer may send prices of the target company's stock soaring. Id. Because of this the firm drafting the documents uses code names for the company until the eve of publication, when the names are filled, in. Id. Materia, despite efforts to keep the identities confidential, was able to decipher the entities of four tender offers. Id. 83. 843 F.2d 78 (2d Cir.), cert. denied, 488 U.S. 1040 (1988), reh'g denied, 490 U.S. 1059 (1989). 84. Id. at 82. Kramer Levin-the law firm employing Grossman- circulated a memorandum while Grossman was affiliated with the firm stating that attorneys receiving information from clients could not use that information for trading or pass it on to someone else. Id. at 80. 85. Grossman, 843 F.2d at 80-81. Events occurring after the meeting between Grossman and his colleague were in dispute but substantial circumstantial evidence was produced. Id. Recapitalization is the procedure of changing the rights of one class of stock. D. VAGTS, BASIC CORPORATION LAW 831 (2d ed. 1973). This allows the entity to reduce the par or stated value of stock or the number of shares therefore diminishing capital and eliminating a retained earnings deficit. Id. 86. United States v. Carpenter, 791 F.2d 1024 (2d Cir. 1986), aff'd, 479 U.S. 1016 (1987). In Carpenter,Winans and Felis were found guilty of securities fraud by misappropriating non-public information from The Wall Street Journal. Carpenter, 791 F.2d at 1026. Carpenter was convicted of aiding and abetting in the commission of securities fraud and mail and wire fraud. Id. at 922. BRIDGEPORT LAW REVIEW [Vol. 12:317 vestments in that particular stock. 7 The column had the potential to affect the price of a stock depending upon what Winans reported."' Winans enlisted the assistance of another Wall Street Journal employee, David Carpenter, to contact a stock broker about selling the contents of the column before publication." Prior to publication, Winans gave confidential information to a broker/dealer who in turn traded prior to publication. 0 The Court found that Winans violated Rule 10b-5 by misappropriating information obtained in the course of his employment with the Wall Street Journal.9 1 Carpenter was convicted of aiding and abetting Winans. 2 The Second Circuit upheld the convictions under Rule 10b5 and the wire and mail fraud statutes.9 3 The Court held that "87. See United States v. Winans, 612 F. Supp. 827, 830 (D.C.N.Y. 1985). 88. Id. The Wall Street Journal had a regulation that the contents of all articles were confidential and the property of the Journal prior to publication. Id. 89. Id. at 831-32. 90. Id. at 832. The net profit from the trading amounted to $690,000.00. Id. at 834. 91. United States v. Winans, 612 F. Supp. 827, 850 (D.C.N.Y. 1985). 92. Id. 93. United States v. Carpenter, 791 F.2d 1024, 1034-35 (2d Cir. 1986). In addition to prosecution for insider trading under Rule 10b-5 federal prosecutors can also bring actions for securities fraud under the wire and mail fraud statutes. See also United States v. Newman, 664 F.2d 12 (2d Cir. 1981) (defendant charged with violating Rule 10b-5 and the wire and mail statutes, 18 U.S.C. §§ 1341, 1343 (1976)). Title 18, Section 1341 of the United States Code provides: Whoever, having devised or intended to devise any scheme or artifice to defraud, or for obtaining money or property by means of false or fraudulent pretenses, representations, or promises, or to sell, dispose of, loan, exchange, alter, give away, distribute, supply or furnish or procure for unlawful use any counterfeit or spurious coin, obligation, security, or other article, or anything represented to be or intimated or held out to be such counterfeit or spurious article, for the purpose of executing such scheme or artifice or attempting so to do, places in any post office or authorized depository for mail matter, any matter, or thing whatever to be sent or delivered by the Postal Service, or takes or receives therefrom, any such matter or thing, or knowingly causes to be delivered by mail according to the direction thereon, or at the place at which it is directed to be delivered by the person to whom it is addressed, any such matter or thing, shall be fined not more than $1,000 or imprisoned not more than five years, or both. Id. Title 18, Section 1343 of the United States Code provides: Whoever, having devised or intended to devise any scheme or artifice to defraud, or for obtaining money or property by means of false or fraudulent pretenses, representations, or promises, transmits or causes to be transmitted by means of wire, radio, or television communication in interstate or foreign commerce, any writings, signs, signals, pictures, or sounds for the purpose of exe- MISAPPROPRIATION THEORY 1991] Winans violated Rule 10b-5 when he misappropriated material non-public information that he gained in the course of his employment and sold in violation of a fiduciary duty to his employer. 4 The United States Supreme Court, in an evenly divided four to four opinion, affirmed the lower court's application of the misappropriation theory without discussion." III. A. THE DECISION Facts Jane Doe's 6 husband, Sanford I. Weill, served as Chief Executive Officer of Shearson Loeb Rhodes between 1970 and 1981. 91 In 1981, Weill sold his interest in Shearson to the American Express Company, and he subsequently became president of American Express. 8 In late October 1985, Weill developed an interest in becoming the Chief Executive Officer (CEO) of BankAmerica. 99 "As part of his effort to become CEO of BankAmerica, Weill secured a commitment from Shearson to invest one billion dollars in BankAmerica."' 100 The investment was contingent on Weill's success in the negotiations. 10 1 Weill attempted to meet with representatives of BankAmerica to discuss his proposal.1 02 These contacts were not disclosed publicly.103 cuting such scheme or artifice, shall be fined not more than $1,000 or impris- oned not more than five years, or both. Id. 94. United States v. Carpenter, 791 F.2d 1024, 1026 (1986). 95. Carpenter v. United States, 479 U.S. 1016 (1986), af'd, 484 U.S. 19 (1987). The Court stated: "The Court is evenly divided with respect to the convictions under the securities laws and for that reason affirms the judgement below on those counts." Id. 96. United States v. Willis, 737 F. Supp. 269, 271 n.1 (S.D.N.Y. 1990). "The indictment refers to the patient as 'Jane Doe.'" Id. Both the government and the defendant agree that Jane Doe is really Joan Weill, the wife of Sanford I. Weill. Id. 97. Id. at 270. Shearson Loeb Rhodes and subsidiaries is collectively Shearson. Id. 98. Id. Willis served as president of American Express from 1981 to 1985. Id. 99. Id. at 270. 100. Willis, 737 F. Supp. at 270. 101. Id. 102. Id. Weill attempted to meet with representatives in January and February of 1986. Id. 103. Id. At the same time Weill attempted to negotiate with BankAmerica, the public perception of BankAmerica was unfavorable; BankAmerica had reported huge losses. Id. Losses included $178 million in the fourth quarter of 1985, and $337 million in the calendar year 1985. Id. In addition, $5.7 billion of debt owed by BankAmerica was reportedly downgraded by Moody's Investor Service. Id. BRIDGEPORT LAW REVIEW (Vol. 12:317 Throughout the negotiations Weill openly discussed his efforts to become CEO of BankAmerica with his wife."" Because of the effect Weill's interest in and contact with BankAmerica could have on Jane Doe's life, she discussed these matters with her 1 05 psychiatrist, Dr. Robert H. Willis. From January 14, 1986 through February 6, 1986, Willis disclosed to his broker the information he received from Jane Doe and purchased a total of 13,000 BankAmerica shares for himself, his wife, and his children.10 6 On February 20, 1986, BankAmerica announced that it had been approached by Weill. 107 On this date, BankAmerica shares traded at prices ranging from 13 7/8 to 15 %/ per share."' 8 On the following day, February 21, BankAmerica traded at prices ranging from 14 to 15 1/2.109 On this day, Willis sold all 13,000 shares of BankAmerica at a price of 15 /s per share. 110 He yielded a profit of approximately $27,475.79.111 Willis purchased the BankAmerica shares in twenty-three separate transactions." 2 Willis' activities were uncovered and he was charged with twenty-three counts of securities fraud in violation of Sections 10(b) and 32 of the Securities and Exchange Act of 1934, 15 U.S.C. Sections 78j, 78ff, and Rule 10(b)5, 17 C.F.R. Section 240.10b-5 and twenty-three counts of mail fraud in violation of 18 U.S.C. Sections 1341 and 1342.113 The United States District Court Judge Cedarbaum denied a motion to dismiss the indictment and held that Willis could be subject to lia114 bility under the securities laws. 104. Willis, 737 F. Supp. at 271. 105. Id. at 271. Jane Doe's spouse discussed these evento with Jane Doe on a contemporaneous basis within the context of their marital relationship. Id. Jane Doe also told Willis that Shearson had committed to invest $1 million in BankAmerica if Weill was successful in becoming Chief Executive Officer. Id. 106. Id. 107. Id. BankAmerica announced that they were not interested in Weill's proposal. Id. 108. Willis, 737 F. Supp. at 271. 109. Id. 110. Id. 111. Id. 112. Willis, 737 F. Supp. at 271. 113. Id. The securities fraud was based upon the twenty-three purchases. Id. Willis is also charged with twenty-three counts of mail fraud because the confirmations of the purchases were sent through the mail. Id. 114. Id. at 275. Willis made a motion to dismiss pursuant to the Rule 12(b) of the MISAPPROPRIATION THEORY 1991] B. Opinion In order to -prove securities fraud the government intended to utilize the misappropriation theory.1 1 The indictment charged that Willis breached the physician's traditional duty of confidentiality to his patient when he misappropriated non-public information for his own benefit.1 1 Willis purchased BankAmerica stock while in possession of, and in reliance on, confidential, non-public information given to him by Jane Doe concerning her husband's attempt to become Chief Executive Officer of BankAmerica." 7 The key to this theory of liability is a breach of a fiduciary or similar duty of trust or confidence. 1 The court relied upon the relationship between doctor and patient and based it on a physician's ethical obligation to his patient." 9' "A person who receives secret business information from another because of an established relationship of trust and confidence between them has a duty to keep that information confidential."1 10 Jane Doe did not breach a duty of trust and confidence to her husband when she revealed the information to Willis. 2 ' Good therapy depends on her confidence in being candid and frank.'2 2 Willis, by not disclosing to his patient his intention to use information obtained from her during consultation, fraudulently induced her to confide in him in connection with his purchase and sale of securities. 2 ' Federal Rules of Criminal Procedure. Id. at 270. 115. Id. at 271. See Chiare~la,445 U.S. at 235-37; See also Carpenter,484 U.S. 19 (convictions under securities laws affirmed without discussion by an evenly divided court.) See supra notes 9-10, 70-94 and accompanying text for a discussion of the misappropriation theory. 116. Willis, 737 F. Supp. at 272. The Court classified the information as non-public business information. Id. 117. Id. 118. Id. 119. Id. The Court cites the "oath" of Hippocrates, which has guided the medical practice for more than 2,000 years. Id. The public is aware of the oath and has a right to rely upon this warranty of silence. Id. The oath concludes with the following words: "Whatsoever things I see or hear concerning the life of men, in my attendance on the sick or even apart therefrom, which ought not be noised abroad, I will keep silence thereon, counting such things to be as sacred secrets." Id. 120. Willis, 737 F. Supp. at 274. 121. Id. at 275. 122. Id. at 274. 123. Id. The fiduciary, Willis, defrauded the confider, Jane Doe, who was entitled to rely on the fiduciary's tacit representation of confidentiality. Id. BRIDGEPORT LAW REVIEW [Vol. 12:317 Willis contended that the indictment did not allege that his patient suffered an injury.12 4 Additionally, Willis argued that the indictment did not allege that any market participant was harmed by the defendant's trades. 125 Nevertheless, the court recognized that a patient has a cause of action against a doctor who discloses confidential information obtained during consultation.'26 This is because a patient has a property interest in continuing psychiatric treatment.12 7 Willis' disclosures jeopardized this relationship and subjected Jane Doe's financial investment 28 1 to risk. Willis renewed his motion to dismiss after the Second Circuit's decision in United States v. Chestman 2 9 on the basis that Jane Doe did not tell him the information was confidential or that he, Willis, should not disclose it.'30 In Chestman, Chestman, a stockbroker, received inside information from a member of the Waldbaum family, Keith Loeb regarding Waldbaum, Inc.' 3 ' Using the information, Chestman purchased shares of Waldbaum stock for himself and for Loeb. 13 2 He later was convicted of securities fraud because he aided and abetted Loeb in misappropriating non-public information in breach of 124. Willis, 737 F. Supp. at 274. 125. Id. 126. Id. 127. Id. Success of a psychiatrist/patient relationship often depends on confidentiality of information revealed during consultation. Id. Jane Doe had an economic interest in the preservation of the confidentiality of information revealed during her consultation. Id. Willis' use of that information may have impacted her husband's success in his negotiations with BankAmerica. Id. See also Heller, Some Comments on the Practice of Psychiatry, 30 Temple L.Q. 401, 405-06 (1957). Heller observed as follows: This need to keep in confidence all disclosures made by a patient ... true of the psychiatric relationship .... is ... the patient is called upon to discuss in a candid and frank manner personal material of the most intimate and disturbing nature .... to speak of things ... requires trust, confidence and toler- ance .... Patients will only be helped only if they can form a trusting relationship with the psychiatrist. Id. 128. Willis, 737 F. Supp. at 274. Jane Doe's financial investment in treatment was put at risk, "either by provoking the termination of the relationship and increasing the cost of treatment by requiring that she find a new psychiatrist, or by requiring additional treatment time to discuss the impact of his disclosures on their relationship." Id. 129. 903 F.29 75 (2d Cir. 1990). 130. Willis, 737 F. Supp. at 275. 131. Chestman, 903 F.2d at 77. 132. Id. MISAPPROPRIATION THEORY 19911 Loeb's duty to the Waldbaum family.1 33 The Second Circuit reversed his conviction because there was no evidence that the family member revealed the critical information in breach of a 34 duty of trust and confidence known to Chestman. The court in Willis distinguished this case from Chestman.135 The court stated that Jane Doe was not in the position of Loeb and that Willis was not in the position of tipper/ tippee.1 3 6 The court concluded that the information revealed to Willis, by virtue of the nature of their doctor/patient relationship, was obviously confidential." 7 Willis knew that he was receiving confidential information, and by disclosing it he breached a duty of trust and confidence which he owed to his patient.33 Accordingly, the court found this case distinguishable from Chestman because the information did not lose its confidential character by "passing through several family channels" as it did in Chestman.1 3 9 The information was confided directly by the insider to his wife and by her to the psychiatrist.1 0 133. Id. at 78. 134. Id. at 77-82. Chestman, a stockbroker, traded shares of stock for himself and clients including Keith Loeb, based on information he received from Keith Loeb, a client. Id. Loeb revealed critical information to Chestman concerning Waldbaum stock. Id. Chestman was aware that Loeb was a member of the Waldbaum family. Id. Since there was no evidence of a breach of a duty or trust by Loeb, Chestman's conviction for securities fraud and mail fraud was reversed. Id. The information concerning Waldbaum was passed from Ira Waldbaum who told his sister; she told her daughter, Susan Loeb; and Susan told her husband Keith Loeb. Id. There was no showing of confidentiality to Chestman in view of the attenuated passage of information. Id. There was no showing that family relationship implied that confidentiality would be maintained. Id. 135. Willis, 737 F. Supp. at 275. 136. Id. Evidence that Keith Loeb revealed critical information in breach of a duty of trust and confidence known to Chestman is essential to the imposition of liability on Chestman as an aider/abettor or as a tippee. Id. The Willis court stated that it was irrelevant whether Willis knew that the information imparted to him by Jane Doe was confidential. Id. It was relevant, however, that Willis knew he was receiving the information in confidence, that it was valuable, non-public information, and that by disclosing it he was breaching a duty of trust and confidence that he owed to his patient. Id. 137. Id. The Information has significant meaning because it concerns Jane Doe's personal life. Id. 138. Id. Jane Doe did not breach a duty to her husband. Id. 139. Willis, 737 F. Supp. at 275. 140. Id. BRIDGEPORT LAW REVIEW IV. [Vol. 12:317 ANALYSIS The District Court based its decision in United States v. Willis on allegations that Willis purchased BankAmerica stock while in possession of confidential information given to him by Jane Doe. 141 The information was given to Willis in the context of a physician-patient relationship. 142 He then traded on the information in violation of his duty to his patient of trust and confidence.14 The act of trading in violation of his duty to Jane Doe constituted criminal securities fraud in violation of Section 10b5.1 The complaint did not assert that Willis owed any duty to Sanford I. Weill or to BankAmerica. 45 In addition, the complaint did not charge that Jane Doe had any obligation not to disclose the information to Willis. Nor did the complaint allege that she imparted the information for any wrongful purpose. 46 The conviction was premised upon a breach of Willis's duty to his patient. The complaint asserted no duty owed to a market participant or to any participant in the corporate world. 147 Jane Doe was neither an insider nor a market participant.148 The premise upon which liability was found was not within the traditional securities fraud/duty analysis that the United States Supreme Court has approved.149 Trading securities on the basis of material non-public information is fraud under Section 10(b) and Rule 10b-5 only where the trader owed a duty of disclosure.15 The United States Su- preme Court in Chiarella held that the mere possession of nonpublic information did not bring with it a corresponding duty to publicly disclose that information or to abstain from trading on 141. Id. 142. Id. at 272. 143. Willis, 737 F. Supp. at 272. 144. Id. at 270. 145. Id. at 272, 274. 146. Id. at 273. Jane Doe had a duty not to trade on the information acquired through marital confidence. Id. 147. Willis, 737 F. Supp. at 274. 148. Id. at 271. 149. See Chiarella v. United States, 445 U.S. 222, 235 (1980) (the mere possession of non-public, confidential market information does not bring with it a corresponding duty to publicly disclose information or to abstain from trading on basis of that knowledge). Id. at 234. See also Dirks v. S.E.C., 463 U.S. 646, 654-55 (1983) (restating principles set forth in Chiarella). 150. See Dirks, 463 U.S. at 654; Chiarella, 445 U.S. at 229-30. 1991] MISAPPROPRIATION THEORY the basis of that information."5 In Dirks, the United States Su- preme Court restated the principle that the mere possession of material non-public information does not give rise to a duty to disclose or abstain from trading absent a relationship of trust and confidence between the parties to the transaction. The Supreme Court in Dirks held that a tippee who receives information from an insider only assumes a fiduciary duty when the insider breached his fiduciary duty to the shareholders by disclosing the information improperly and the tippee knew or should have known that there has been a breach." 52 The District Court did not view Willis as a tippee, thus he would have needed a direct duty to the corporation before he would have been under an obligation to disclose or abstain.'"3 In Willis, the complaint did not allege that Willis owed any duty to BankAmerica or its shareholders."" Nor did the complaint allege that Jane Doe was an insider or that she disclosed the information concerning her husband's desire to become chief executive officer of BankAmerica with the idea that she would personally benefit from disclosure.55 Since there was no duty owed nor breached in the transaction there can be no liability under Section 10(b). 5 e In order to circumvent the fiduciary relationship requirement, however, the Second Circuit has applied the misappropriation theory. 5 ' The District Court premised liability on Willis' breach of a duty owed to his patient, i.e., his misappropriation of non-public information received in confidence. 51 Jane Doe was in lawful possession of material non-public information.5 e She communicated this to Willis in the context of a relationship of 151. Chiarella,445 U.S. at 235; See also In re Cady, Roberts & Co., 40 S.E.C. 907 (1961) (the obligation to "disclose or abstain" imposed upon corporate insiders.) 152. 153. 154. 155. Dirks, 463 U.S. at 666-67. Id. Willis, 737 F. Supp. 269, 273 (S.D.N.Y. 1990). Id. at 270, 272. 156. See supra note 148 and accompanying text for a discussion of the United States Supreme Court's bases of liability under 10b-5. 157. Willis, 737 F. Supp. at 271. 158. Id. at 271-72. Central to this theory is a breach of a duty of trust and confidence. Id. at 272. The court speaks of relationship between doctor and patient which requires a high degree of trust and confidence. Id. 159. Id. at 274. BRIDGEPORT LAW REVIEW [Vol. 12:317 trust and confidence.16 0 Consequently, Willis breached his duty to Jane Doe by misappropriating the information and using it for his own personal benefit."6 1 The Second Circuit has held that Section 10(b) and Rule 10b-5 prohibit the purchase and sale of securities while in possession of material non-public information that has been improperly misappropriated. 6 2 In light of the foregoing, the Section 10(b) counts do validly allege a federal offense. However, the misappropriation theory has never been adopted by the Supreme Court.16 3 Because this theory was only affirmed by the United States Supreme Court, it is of no precedential value. 6 It remains an open question whether the four justices who voted against the affirmation of liability under 10b-5 did so because of the theory to the particular facts of Carpenter or a general dis6 approval of the misappropriation theory.1 5 The facts of Willis make it distinguishable from Carpenter, Materia, Grossman, and Newman. In Carpenter,Materia, and Newman the fact pattern involved an employee breach of a duty of confidence to his employer by misappropriating information received during the course of employment.' All of the employ160. Id. at 272. 161. Willis, 737 F. Supp. at 276. 162. See United States v. Grossman, 843 F.2d 78, 84 (2d Cir. 1988) (associate in law firm breached firm policy by disclosing information entrusted to his employer by his employer's client regarding the client's planned recapitalization); United States v. Carpenter, 791 F.2d 1024, 1031-32 (2d Cir. 1986) (employee of financial newspaper breached newspaper's policy by misappropriating confidential information as part of insider trading scheme); S.E.C. v. Materia, 745 F.2d 197, 201 (2d Cir. 1984) (employee of a financial printer traded on corporate information entrusted to his employer by his employer's client); United States v. Newman, 664 F.2d 12, 18 (2d Cir. 1981) (investment bankers breached duties to employers and employers' corporate clients), cert. denied, 464 U.S. 863 (1983). 163. See United States v. Carpenter, 791 F.2d 1024 (2d Cir. 1986), aff'd, 484 U.S. 19 (1987). The Supreme Court was evenly divided in affirming the conviction based on the securities laws but did not address the misappropriation theory in its opinion. Id. 164. See Neil v. Biggers, 409 U.S. 188 (1972) (an evenly split affirmance is not considered an actual adjudication of the case); Trans World Airlines, Inc., v. Hardison, 432 U.S. 63 (1977) (judgment entered by an evenly divided court is not entitled to precedential weight); Arkansas Writers' Project, Inc. v. Ragland, 481 U.S. 221 (1987) (an affirmance by an equally divided court is not entitled to precedential weight); See also J. NOWACK, R. ROTUNDA & J. YOUNG, CONSTITUTIONAL LAW § 2.5, at 33 (1986). (Commentators have recognized the weakness of the Carpenter decision and have urged legislation that would codify the misappropriation theory). 165. See Langevoort, supra note 10, at 185. 166. See supra notes 74-94 for a discussion of the misappropriation theory and the 19911 MISAPPROPRIATION THEORY ers in these cases were involved in the securities industry.'67 In Willis, on the other hand, Willis's breach of a duty to his patient had no relation to any business involved in the securities industry. Nor was it a breach concerning a relationship of employer/ employee. In addition, Jane Doe did not suffer any injury. She is not alleged to have had a genuine business purpose for acquiring the information from her husband which she then imparted to Willis. The court delineates this information as "business information" and characterizes Jane Doe as an "employer.' 6 8 However, Jane Doe gave Willis the confidential information because of personal, nonbusiness reasons. The government attempted to satisfy the requirement of injury to the defrauded person by asserting that because Willis disclosed information received in confidence, it created a cognizable wrong. However, no facts were presented which suggest that Jane Doe actually or potentially suffered any harm. Furthermore, the United States Supreme Court has held that not every breach of a fiduciary duty constitutes securities fraud under70 10b-5. ss The Court has rejected a general duty to disclose.1 Willis, the employee, breached a duty of confidentiality to his employer, Jane Doe. This constitutes fraud against the employer, not against investors in the securities market.17 1 There was no relationship between Jane Doe's psychiatric treatment and the securities market. Since the United States Supreme facts and holding of Carpenter, Materia, Grossman, and Newman. 167. See supra notes 10, 74-94 for a discussion of some misappropriation cases. Carpenter, 484 U.S. 19 (the Wall Street Journal was actively involved in the securities industry and gathered information about the securities industry); Newman, 664 F.2d 12 (investment banking was an integral part of the securities industry); Materia, 745 F.2d 197 (financial printers served as a vital service to participants in the securities industry); See also, Grossman, 843 F.2d 78 (a law firm represented a client regarding their capital position); United States v. Elliott, 711 F. Supp. 425 (N.D. Ill. 1989) (a law firm represented clients in merger and acquisitions transactions); S.E.C. v. Tome, 638 F. Supp. 596 (S.D.N.Y. 1986) (the information concerned a hostile tender offer of Seagram); S.E.C. v. Peters, 735 F. Supp. 1505 (D. Kan. 1990) (partnership information concerning a possible investor to purchase ERG was misappropriated by a partner); S.E.C. v. Musella, 578 F. Supp. 425 (S.D.N.Y. 1984) (lawyer traded on confidential information of his firm's client regarding the client's potential acquisition). 168. Willis, 737 F. Supp. 269, 276 (S.D.N.Y. 1990). 169. Id. 170. See Chiarella v. United States, 445 U.S. 222, 232. n.14 (1980). 171. There was no claim in Willis that he perpetrated a fraud against investors in BankAmerica. Rather the emphasis was on the fraud against Jane Doe which was held sufficient to support a 10b-5 claim. Willis, 737 F. Supp. at 272. BRIDGEPORT LAW REVIEW (Vol. 12:317 Court did not resolve any of the questions presented concerning the misappropriation theory, it's proper application is still undetermined. " 2 The District Court's expansion of this theory in Willis converts liability under 10b-5 into a vehicle to protect a doctor/patient relationship which is not interrelated with the securities industry. The misconduct at issue here, whether ethical or unethical, does not fall within the reach of the securities laws. 3 A breach under the securities laws must have some relation to the securities market. 74 V. CONCLUSION The United States Supreme Court has set forth the basis for liability under Rule 10b-5 in a coherent and logical manner. The Supreme Court, while recognizing that Section 10(b) is a catch-all provision, realizes that what it catches must be fraud.'" Nondisclosure can only be fraudulent when there is a duty to speak, and a relationship that gives rise to a duty must exist before 10b-5 can be violated.176 The Supreme Court has continually stated that while Section 10(b) was intended to prevent common law fraud, the Court is not empowered to expand the reach of the rule beyond the statute so as to judicially rewrite it.'" The district court's, decision illogically extends the reach of federal securities laws by eliminating the requirement of fraudulent nondisclosure. Not every moral or ethical violation in conjunction with the trading of securities necessarily violates 172. See Langevoort, supra note 10 at 185. Although the exact vote was not disclosed, one commentator suggests the four votes in favor of upholding the conviction were Justices Brennan, Marshall, Stevens, and Blackmun. Id. Whether the Justices voting against the theory signal their disapproval of the theory or the application in this particular case is unknown. Id. According to Langevoort's analysis the four Justices vot- ing against the use of the misappropriation theory were Chief Justice Rehnquist and Justices O'Connor, Scalia, and White. Id. 173. See Chiarella,445 U.S. at 232. 174. See supra note 16-22 for the requirements of the securities fraud provisions. "These anti-fraud provisions are not intended as a specification of particular acts or practices which constitute fraud, but rather are designed to encompass the infinite variety of devices by which undue advantage may be taken of investors and others." In re Cady, Roberts, 40 S.E.C. 907, 911 (1961). 4 175. Chiarella, 445 U.S. at 234-35. 176. Id. at 235. 177. See Blue Chip Stamps v. Manor Drug Store, 421 U.S. 723, 748-49, 756 (1975). Before a court can extend Section 10(b) to include the offer to sell any security there must be support in the structure of the legislation. None exists in this case. Id. at 756. 1991] MISAPPROPRIATION THEORY 341 the federal securities laws. Federal Courts must set boundaries to allow the rules to satisfy the objectives upon which they are based. Suzanne Krudys