Tracing The Evolution Of Research On International Accounting

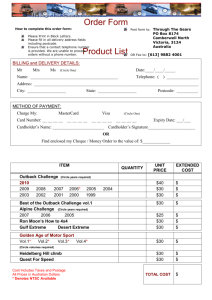

advertisement