Luxembourg Captive Reinsurance Companies

advertisement

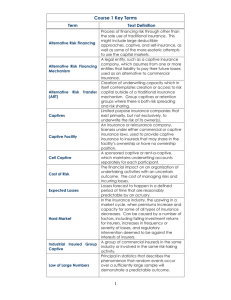

Luxembourg Captive Reinsurance Companies Contents 2 Executive summary 9 Captive solutions in Luxembourg 3 Introduction 4 The advantages of creating a captive 9 Facts and figures 10 Legal framework 10 Technical provisions 11 Actors in the captive business 4 Solution to market inadequacies 4Reduction or stabilisation of insurance premiums at group level 5Retention of the profits of good risk management 5Optimisation of financial flows linked to risk management 6Direct access to worldwide professional reinsurers 6Better risk management 11 Supervision 11 Administration 12Authorisation procedure 12 Prerequisites for authorisation 12 Summary of the process 12 Preparing the application file 14Tax aspects 7Why use a captive reinsurance company? 14 Direct taxes 15 Indirect taxes 16 Useful contacts 8 Why choose Luxembourg ? 1 Luxembourg Captive reinsurance companies Executive summary A captive reinsurance company is • reduction and/or optimisation of risk a reinsurance company created or financing costs; owned by an industrial, commercial or • retention of underwriting profits; financial group, the purpose of which is to reinsure exclusively all or part of the • direct access to the wholesale risks of the group it belongs to. professional reinsurance market; Companies are confronted with an • group-wide focus on risk financing escalating number of risks while, at the strategy and servicing provided by same time, steadily growing corporate professional insurers. governance requirements result in additional rules relating to the tracking The Luxembourg financial centre provides the ideal legal framework and management of these risks. and administrative infrastructure A reinsurance captive provides the for captive reinsurance solutions. following advantages: With over 250 licensed reinsurance undertakings, most of which are • compensation for market inadecaptive companies, Luxembourg quacies: coverage of some risks that has become the largest domicile for are otherwise difficult to insure; reinsurance captives in the European • independence from insurance market Union and one of the largest in the cycles; world. 2 Luxembourg captive reinsurance companies are authorised and regulated by the Commissariat aux Assurances (CAA). They must appoint a Luxembourg domiciled manager who is also subject to authorisation by the CAA. Information concerning the application process, together with details of direct and indirect taxes pertaining to reinsurance captives can be found in the final parts of this brochure. Introduction In recent years, the general economic climate has generated an increased interest in captive reinsurance. Faced with new constraints and challenges, it has become essential for companies to master risks and their cost. Recent developments in the insurance and reinsurance markets have had particularly hard consequences. While the European insurance market has shown constant growth in terms of premiums, the coverage requirements have considerably worsened for companies having to face: • high volatility in premiums; • difficulty in finding cover adapted to the risks resulting from their activities; • insurers’ refusal to cover some risk areas; • market capacity constraints; • appearance of new risks or intensification of existing ones. Companies are confronted with an escalating number of risks while, at the same time, steadily growing corporate governance requirements result in additional rules relating to the tracking and management of these risks. The implementation of a risk mitigating policy is now essential to preserve the value of a company and the confidence of its investors. These constraints, combined with growing competition, worldwide uncertainty 3 and increasing dependency on financial markets force companies to search for alternative solutions to control and finance their risks. Among these alternatives, the captive presents numerous benefits, notably in terms of the monitoring and reduction of costs and the ongoing tracking and integration of risk management policy at a consolidated level. Luxembourg Captive reinsurance companies The advantages of creating a captive The reasons for a company or a group to create a captive are numerous and can vary considerably from one group to another, depending on its objectives, location and activities. It is nevertheless a common factor that the long-term success of the captive will only be guaranteed if this vehicle is conceived as an active risk financing tool. Solution to market inadequacies The traditional insurance market dictates restrictions to some policies, particularly in difficult market conditions. Companies thus face considerable difficulty finding protection against certain risks and coping with the increase of their risk retention (deductibles) and are sometimes unable to find cover for particular risks. The captive provides the group with tailor-made policies that can, for instance, compensate for lack of appropriate cover available in the insurance market. Reduction or stabilisation of insurance premiums at group level Another reason for a company to create a captive is to reduce and/or optimise its risk financing expenses. The often high price of insurance cover results from intermediation costs and cycles in the insurance market which can provoke severe increases in premium levels. Increasingly, this has driven companies to consider self-financing a greater portion of their risks. One way is to increase the level of risk retention on existing insurance contracts by which the company retains a first layer of risk on 4 each claim. The enterprise can thus obtain reductions on its insurance premiums, while remaining protected against large losses. The use of a high global retention is nevertheless limited because the financial situation of individual business units must be taken into account. Local managers have different requirements with regard to the level of protection they need and they generally choose to limit the retention and maintain insurance cover. In such a case, the use of a captive will enable the global economic strength of the group to be taken into consideration and allow an increase in global risk retention above the local deductible of the individual affiliates and business units while offering them adequate protection. The group will thus benefit from the mutualisation of its risks. Finally, the captive gives the group increased negotiating power with the insurance market. Depending on its capacity, a captive can progressively cover larger amounts and limit the volume transferred to the market if the conditions offered by insurers are not optimal. Retention of the profits of good risk management Setting up a captive enables a company to retain the profits of its underwriting policy. On the one hand, the mothercompany can choose to keep risks with a good loss ratio within the captive and achieve savings in the case of low frequency losses, when premiums retained are higher than losses. On the other hand, the captive can generate a potential reduction in premiums. Commercial insurers fix their premiums based on global market figures using average statistical risk and loss data. By possessing a captive, the company will be able to negotiate a price established on the basis of its own undertaking specific loss experience and will thus be less impacted by fluctuations in the market and downgrading due to the loss experiences of other insured parties. Optimisation of financial flows linked to risk management Some risks cannot be transferred to the insurance market and threaten the financial performance and future development of the group as they are retained on the balance sheet. In the event of a catastrophic claim, the resulting loss will have to be completely absorbed in the profit and loss account and deducted from profits. This potential increase in the 5 volatility of the group’s results impacts the price of the shares and generates an increase in financing costs. By using a captive the group will achieve adequate protection of its balance sheet under Luxembourg Generally Accepted Accouting Principles (GAAP) which provide for the constitution of a technical reserve against future losses. In addition, the captive enables the company to keep hold of the return on accumulated funds which is lost when premiums are paid to an insurer. This feature is particularly attractive when the captive provides cover for risks with a long life such as legal liability, for which the period between a claim and its final payment can last five or ten years. Luxembourg Captive reinsurance companies Direct access to worldwide Better risk management professional reinsurers A captive simplifies the centralisation A further advantage of the captive is that it provides direct access to the wholesale professional reinsurance market. The conditions offered by this market can be more favourable, since structural costs are lower for reinsurers than for direct insurers and the required premiums are usually better adapted to the specificities of each client. In addition, the group can implement long-term programmes with some reinsurers for its major risks in order to spread the risks over an extended period of time. of worldwide insurance programmes and the collection of group risk data (loss statistics, nature of the cover, control measures, etc.). This in turn enables risk to be managed at group level, guarantees better risk awareness at an operational level and increased transparency with regard to insurancerelated costs. In addition, centralised risk management is crucial in order to respond efficiently to information requests from financial market authorities regarding risks and risk management reporting. 6 Why use a captive reinsurance company? Various solutions are possible for the financing of risks, each resulting in a higher or lower degree of retention or transfer of risk. If full transfer of risk provides the enterprise with a reasonable level of security, enabling the company to improve its financial stability and standing in the financial markets, it has the major disadvantage of generating considerable cost. Self-retention For this reason, companies are Free cash flow increasingly looking at the option Reserves on balance sheet of retaining their risk. The captive is perfectly suited to finance an increase in the risk retention of an enterprise Alternative risk or a group. It provides multiple transfer solutions Captive advantages in terms of centralised risk management, financing and control. Insurance Outsourcing of activity Full transfer Functioning of a typical captive reinsurance situation. Capitalisation Affiliate Insurance premiums Claims Mother company Affiliate Insurance premiums Claims Insurance premiums Claims Direct insurer Direct insurer Direct insurer Insurance premiums Insurance premiums Claims Claims Insurance premiums Claims Reinsurance captive Insurance premiums Claims Insurance premiums Insurance premiums Claims Claims Investments Financial markets 7 Professional reinsurance market Luxembourg Captive reinsurance companies Why choose Luxembourg ? Luxembourg is a fully diversified financial centre with particular strength in certain areas. It is the second largest investment fund centre in the world after the United States, with 1,700 billion euros under management, and the largest private banking centre in the Eurozone. Luxembourg is also the largest captive reinsurance domicile in the European Union. Companies from around the globe have domiciled over 250 captive reinsurance companies in the financial centre. They have chosen Luxembourg for a variety of reasons: • Luxembourg is a stable democracy with a strong economy and a neutral position in the European Union; • as a member of the EU and the OECD, with a strong regulatory environment focusing on investor protection, it is attractive to institutional investors; • economic, social and political stability ensure a secure legal and tax framework; • Luxembourg offers an attractive legal framework for captive reinsurance companies; • Luxembourg’s unique multilingual and multicultural workforce is accustomed to working in different jurisdictions and time zones. The success of the financial centre is grounded in the social and political stability of the Grand Duchy and on a modern legal and regulatory framework that is continuously updated, inspired by regular consultation between the government, the legislator and the private sector. Thus, over the years, specific regulatory frameworks have been created for different financial sectors, alongside rigorous anti-money laundering policies. This legal framework, combined with Luxembourg’s openness to the outside world, has attracted banks, insurance companies, investment fund promoters and specialised service providers from all over the world. Luxembourg is well placed in international surveys • ranked the world’s least risky business environment (out of 203 countries). Source: Global Insight, Country Risk Ratings, October 2008 • ranked 5th most competitive market (out of 55 countries). Source: IMD Global Competitiveness Index, 2008 • ranked 15th freest economy in the world (out of 157 countries). Source: Heritage Foundation: Index of Economic Freedom, 2008 • Luxembourg City is ranked 1st in the world for personal safety and 17th in the world for overall Quality of Living (12th in Europe) out of 215 cities. Source: Mercer Human Resources Consulting, Worldwide Quality of Living survey, 2008. 8 Captive solutions in Luxembourg Facts and figures In 1984 Luxembourg adopted a first legal framework for the establishment and pursuit of reinsurance activities, including captive reinsurance, both within Luxembourg and abroad. The law and its implementing measures promoted the development of the captive industry in Luxembourg by setting the right balance between strong prudential supervision and the need to take into account the specificities of captive business compared to professional (wholesale) reinsurers. In 2007 this law was updated to implement the European Reinsurance Directive 2005/68/EC. The Directive ensures the mutual recognition of authorisations and prudential control systems, thereby making it possible to grant a single authorisation that is valid throughout the European Union, while applying the principle of home country supervision. The Directive also recognises the specificities of reinsurance business by setting adequate technical provisioning requirements and providing for the ‘equalisation provision’ to enable captives with a less favourable spread of risks to build up technical reserves financing their exposure. The sector was an immediate success, with an average of 10 new captives licensed each year, while a handful disappeared due to mergers or cessation of business. With over 250 licensed captive reinsurance companies, Luxembourg has become the largest reinsurance captive domicile in the European Union and one of the largest in the world. The following pie charts illustrate the wide range of players in the captive market, both in terms of country of origin and market sector. Country of origin of the parent company The Netherlands 10 Belgium 59 The Iberian Penisula 17 Other 23 Scandinavia 37 Germany 15 Sector of the parent company’s activity Food-processing 14 Insurance 48 Other 19 Distribution 24 Chemistry 19 Banking 37 France 68 Italy 12 Luxembourg 21 Source: CAA Annual Report 2007 9 Industry 80 Telecommunications 8 Transport 13 Luxembourg Captive reinsurance companies Legal framework The legal framework for reinsurance companies is guided by: • the Law of 6 December 1991 on the insurance sector, as amended; of insurance and reinsurance undertakings in an insurance or reinsurance group; • c ircular letters on reinsurance published by the CAA. These documents are available on • the Law of 8 December 1994 on the CAA website www.commassu.lu annual and consolidated accounts, as and on the Luxembourg for Finance amended; website (www.lff.lu) in the section • regulations pertaining to the Law of 6 Actors / Captive reinsurers. December 1991, in particular - the Grand Ducal Regulation of 5 December 2007, which implemented EU Directive 2005/68/EC, concerning the conditions for authorisation and carrying on business for reinsurance companies, and - the Grand Ducal Regulation of 5 December 2007 concerning the supplementary supervision Technical provisions Luxembourg reinsurance captives must establish sufficient technical provisions in respect of their entire business. The amount of these provisions is determined following rules laid down by law on the annual accounts. Reinsurance captives must set up a claims equalisation provision 10 to equalise fluctuations in loss ratios in future years or to provide for special risks. This provision includes the equalisation reserve referred to in Article 33(1) of EU Directive 2005/68/EC of 16 November 2005 on reinsurance. Luxembourg reinsurance undertakings must at all times hold sufficient assets to cover the technical provisions including a claims equalisation provision. The Grand Ducal Regulation of 5 December 2007 determines the manner in which the provisions shall be applied and, in particular, the absolute minimum of the guarantee fund, the nature of the underlying assets and the basis on which, and the limits within which, they shall be apportioned. Actors in the captive business Supervision Administration Reinsurance captives operate in a regulatory framework defined at EU level by the Reinsurance Directive (2005/68/CE) which was transposed into Luxembourg legislation on 5 December 2007 by a law and a grand ducal regulation. Reinsurance captives are managed in the Grand Duchy of Luxembourg by a manager authorised by the Commissariat aux Assurances. The day to day administration of the reinsurance captive is therefore carried out in Luxembourg. Control of the reinsurance captive is the responsibility of the Commissariat aux Assurances (CAA), the independent auditor and the manager (dirigeant), themselves both authorised by the CAA. Management will be undertaken either by an authorised manager within the reinsurance captive itself or by employing the services of a Luxembourg company specialised in captive management. During the ongoing life of the captive, the company is required to comply with a number of supervisory and control measures. The authorised manager must be of good standing and professional experience and must reside in Luxembourg. The CAA may require the manager to undergo tests in order to establish his / her professional experience. 11 The authorised manager is responsible for the day to day management of the company, including: • acting as legal representative of the reinsurance captive; • liaison with auditors, fronting companies, reinsurance companies, banks, actuaries, etc.; • reporting to the Commissariat aux Assurances; • company secretarial duties, organising Board meetings, AGMs, etc.; • preparation of the financial statements; • tracking risk levels and reporting on them to the Board. Luxembourg Captive reinsurance companies Authorisation procedure Prerequisites for authorisation With the implementation of the European Reinsurance Directive into Luxembourg law, a reinsurance captive operating on a cross-border basis in different European countries is supervised only by its home country supervisory authority (where the undertaking is licensed). Hence any reinsurance company which establishes itself within the territory of the Grand Duchy of Luxembourg must be licensed by the Ministry of Treasury and Budget before starting activity. Summary of the process From planning to launch, the process generally takes between three and six months. Minimum guarantee fund The law requires a reinsurance company to maintain a minimum guarantee fund of 1,225,000 euros for reinsurance captives and 3,000,000 euros for professional (wholesale) reinsurance companies. Articles of incorporation Once signed, the articles of incorporation will be registered at a local Notary. Head office and central administration Captive reinsurance companies with a head office in Luxembourg must have their central administration on Luxembourg territory and possess sound administrative and accounting procedures and adequate internal control mechanisms. Preparing the application file Share ownership An application file for authorisation must be submitted to the Luxembourg insurance supervisory authority, the Commissariat aux Assurances. The quality of shareholders, who directly or indirectly possess qualifying holdings or holdings enabling them to significantly influence the conduct 12 of the business, must be satisfactory in view of the need to ensure sound and prudent management of the undertaking. In view of the examination of the application file, the following shareholder information must be communicated to the Commissariat aux Assurances: • an organisational chart of the group to which the undertaking to be authorised belongs, including all parent undertakings and affiliated companies; • the latest annual accounts of the major and ultimate shareholders. Authorisation shall be subject to the transparency of the direct and indirect shareholding structure of the undertaking. Board of directors/managers The company must be administrated by a Board of directors of minimum three members. Their professional skills and good standing will be examined, based on biographical details and an extract from the judicial record. Authorised manager The company must, by way of a contract, secure the services of a natural or legal person whom it shall appoint to carry out its management functions. Prior to assuming these functions, the manager must have received the authorisation of the Minister. In order to be authorised as the manager of a reinsurance undertaking each natural person must give proof of his / her good standing, Decision to start the study Group appraisal of the interest of a captive high level of professional knowledge of reinsurance matters and be domiciled in the Grand Duchy of Luxembourg. External auditor A reinsurance undertaking must submit its annual accounts to external audit by an independent auditor chosen from a list approved by the Commissariat aux Assurances. Business plan The business plan must include a presentation of the risks that will be underwritten (i.e. the nature of Decision to create the captive Feasibility study risks covered, policy period, insured companies, activity of the insured, policy limit, exclusions, etc.), together with the projected level of premiums, reinsurer’s share, fronting commission, retrocession policy, pro forma threeyear financial statements, and compliance with the EU solvency regime. Group’s decisional process Start the business 1st Board meeting Contracts issuance etc. Business plan 13 Review of business plan by authorities and license Luxembourg Captive reinsurance companies Tax aspects Direct taxes Net worth tax Corporate income tax and municipal business tax Net worth tax is levied annually at a rate of 0.5% on the company’s total gross adjusted assets reduced by its debts and liabilities (“unitary value”). Luxembourg reinsurance companies are fully liable to: • corporate income tax on their worldwide income at the rate of 21.84% (standard rate of 21% increased by an employment fund contribution of 4%), and Withholding tax A withholding tax of 15% is levied on dividend payments, unless tax treaties provide for lower rates or a participation exemption regime applies to reduce withholding tax to 0% (see below). • municipal business tax levied on income of businesses operating in Normal interest payments (i.e. non Luxembourg (this rate is 6.75% for companies established in Luxembourg profit-linked interest) are generally not subject to withholding tax, unless the City). EU Savings Directive applies. The corporate income tax rate should be progressively reduced in the coming No withholding tax is levied on the remittance of liquidation proceeds, years.1 regardless of the tax status of the recipient. 1D eclaration made by the Luxembourg Prime Minister, Mr. Junker, during its State of the Nation speech on May 22, 2008. 14 Participation exemption Indirect taxes Luxembourg tax law provides a participation exemption for qualifying investments held directly or indirectly by fully taxable resident companies (including reinsurance companies). The exemption from income tax is extensive, covering dividends, capital gains and liquidation proceeds. In addition, no withholding tax is due on dividend distributions made by reinsurance companies if certain conditions are fulfilled and the value of qualifying investments is generally not included in total asset value for net worth tax purposes. Capital duty Double tax treaties Luxembourg reinsurance companies benefit from the provisions of the double tax treaties concluded by Luxembourg. More than 50 such treaties are already in existence. Capital duty has been abolished as from January 1, 2009 and has been replaced by a fixed registration duty of 75 euros. This fixed registration duty is due upon incorporation of Luxembourg companies, upon amendment of the articles of incorporation, or upon transfer of the registered seat or place of effective management to Luxembourg. VAT Reinsurance companies are subject to VAT, however most of their activities are VAT exempt. Input VAT is recoverable in proportion to 15 reinsurance premiums originating from insurance companies located in countries outside the European Union. Tax on reinsurance premiums Premiums related to reinsurance policies are exempt from tax on insurance premiums. Luxembourg Captive reinsurance companies Useful contacts In Luxembourg AGERE (Association des Gestionnaires de Réassurances), the insurance and reinsurance managers’ association c/o ACA (+352) 44 21 44-1 aca@aca.lu c/o Association des Compagnies d’Assurances du Grand-Duché de Luxembourg - ACA www.aca.lu Commissariat aux Assurances (+352) 22 69 11-1 www.commassu.lu CODEPLAFI : legal observatory (+352) 29 11 39-1 www.codeplafi.lu IRE (Institut des Réviseurs d’Entreprises) www.ire.lu Outside Luxembourg European insurance and reinsurance federation www.cea.assur.org Committee of European Insurance and Occupational Pensions Supervisors www.ceiops.eu European Commission ec.europa.eu/internal_market/insurance/index_en.htm Luxembourg for Finance thanks the members of the LFF Reinsurance Working Group for their work on this brochure. 16 Luxembourg for Finance Agency for the Development of the Financial Centre Luxembourg for Finance a public-private partnership between the Luxembourg Government and the Luxembourg Financial Industry Federation (PROFIL). It consolidates the efforts made by the public authorities and principal actors of the financial sector to ensure the development of an innovative and professional financial centre through a coherent and structured communications policy. Thus Luxembourg for Finance will enhance the external presentation of the financial centre, communicating the advantages of its products and services to a wider public and highlighting the numerous opportunities available to investors and clients, whether institutional or private, from around the world. Luxembourg for Finance organises seminars in international financial centres and takes part in selected world class trade fairs and congresses. The Agency also develops its contacts with opinion leaders from international media and is the first port of call for foreign journalists. Luxembourg for Finance Agency for the Development of the Financial Centre 7, rue Alcide de Gasperi • P.O. Box 904 • L-2019 Luxembourg Tel. (+352) 27 20 21 1 • Fax (+352) 27 20 21 399 Email lff@lff.lu • http://www.lff.lu © LFF Januar 2009 www.lff.lu 7, rue Alcide de Gasperi • P.O. Box 904 • L-2019 Luxembourg • Tel. (+352) 27 20 21 1 • Fax (+352) 27 20 21 399 • Email lff@lff.lu