rps suburb profile

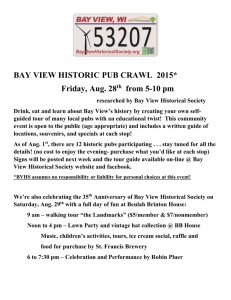

advertisement

PO Box 465, Subiaco Western Australia 6904 Golden Bay Investor Report W rpsgroup.com.au July 2014 Warnbro Golden Bay Overview Golden Bay is located along the south western coastal strip of the Perth’s metropolitan region. This suburb is located within the City of Rockingham which was the fifth fastest growing municipality in the Perth metropolitan area over the last decade. Golden Bay is a 15 minute drive to the commerical hub of Mandurah and south of the Kwinana employment centre. Perth City and Fremantle are located a 50 minute drive from Golden Bay. Port Kennedy Mandurah - North Statistical Area 2 Golden Bay The ‘Golden Bay region’ has been based on the ABS Statistical Area 2 which includes Golden Bay, Singleton and Secret Harbour. Mandurah Greater Perth and Western Australia Economic Overview The Western Australian and Perth economies underwent significant transformation over the last few years on the back of record investment in mining/energy and public infrastructure. The state has one of the fastest population growth rates and one of the lowest unemployment rates in the developed world. In spite of dire media commentary on the effects of less mining investment, the WA and Perth economies have been resilient and are expected to grow strongly in the medium term. The economy is expected to experience a minor slowdown over the next few years but remain one of the fastest growing economies in the country over the next four years. The value of exports in the state increased by 8.4% in 2013 to over $120b and is expected to increase further when large LNG projects begin exporting over the next few years. Perth, meanwhile, is transitioning to a more sustainable growth path supported by dwelling and infrastructure construction. There are currently a large number of public health and transport projects and record residential construction underway which is keeping a lid on unemployment. Annual Population Growth, 2008 to 2013 3.5% 8.0% Gross State Product, Western Australia 7.0% 3.0% Gross State Product (p.a.) Average Annual Population Growth Throughout the transition from resource investment to production, income from record exports will be a significant offsetting factor. 2.5% 2.0% 1.5% 1.0% 0.5% 6.0% 5.0% 4.0% 3.0% 2.0% 1.0% 0.0% 0.0% WA NSW VIC QLD Source: ABS Regional Population Growth Cat No. 3218.0 (2014) AUS 2002/03 2004/05 2006/07 2008/09 2010/11 2012/13 2014/15 2016/17 Actual Estimate Source: ABS National Accounts Cat No. 5220.0 (2014), WA Treasury (2014) Population and Demographics RPS has explored the population and demographics of the Golden Bay region. Some of the key demographic findings of the region are as follows: • Population of 18,400 in 2013, up 9.4% p.a. since 2003; • The region is typically home to young families, with a large proportion of school-age children. The median age of residents is 31, compared to the national median of 37. • 62% were born in Australia, which is lower than the Australian average of 70%. Relatively large and growing proportions were from England (18.5%); The unemployment rate in the area was 4.5%, below the Western Australian rate; and • Average weekly household income for residents was $1, 977 - $518 greater than the metropolitan Perth average - as the region has a high number of families with two income earners. The demographics indicate a predominantly “blue collar” workforce in the region with a high proportion of skilled technicians and trades workers and less “white collar” professionals than that observed nationally. Population, Singleton‐Golden Bay‐Secret Harbour, 2003‐2013 200,000 18,000 180,000 16,000 160,000 Estimated Resident Population Estimated Resident Population 20,000 • 14,000 12,000 10,000 8,000 6,000 4,000 2,000 Projected Population, City of Rockingham, 2003‐2026 140,000 120,000 100,000 80,000 60,000 40,000 20,000 0 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 0 2013 Source: ABS Regional Population Growth Cat No. 3218.0 (2014) 2003 2005 2007 2009 2011 2013 2015 2017 2019 2021 2023 2025 Source: ABS Regional Population Growth (2014), WAPC WA Tomorrow (2012) Community Facilities and Investment Business and Economic Activity The following outlines just a few major public and private investments proposed for Golden Bay and the surrounding region: Business activity is driven largely by the construction industry, over a third of all business in the Golden Bay region are construction related. Despite construction accounting for a large proportion of businesses in the region, businesses in other industries, such as professional services and financial services are steadily increasing in the region. There are very few large employing businesses in the region, where non-employing and small business makes up the vast majority; though there are large employers to the south and north of Golden Bay. Community Investment Projects – There has been significant community investment such as the $4.5 million redevelopment of the nearby Secret Harbour Surf Lifesaving Club and over $7 million enhancing Comet Bay College, the closest secondary school. Mandurah Aquatic & Recreation Centre Redevelopment – The $38 million redevelopment will revitalise the exiting ageing facilities to provide a modern, integrated sporting, aquatic and recreational facility that will meet the needs of the region’s growing community. Works began in April 2014 and are expected to be completed by early 2014. Challenger Institute of Technology Campus Expansion – Work is underway on the $6 million construction of the Challenger Institute’s new Peel Health and Community Services Training Centre, which is set for completion for the end of 2014. It will cater for a host of tertiary educational needs and is located 15 minutes’ drive south of Golden Bay. 600 Number of Registered Businesses Golden Bay Primary School – The new $13 million state-theart school facility is due for completion by the beginning of the 2015 school year. Businesses, by Employment Level, Singleton‐Golden Bay‐Secret Harbour Region 500 400 300 200 100 0 Non‐Employing 1‐4 Employees 5+ Employees Source: ABS Count of Australian Businesses Cat No. 8165.0 (2014) Perth Housing Market Trends The number of days taken to sell a home in Perth has declined 30% to 56 days, on average, over the past two years and therefore more existing home owners are marketing their homes for sale. This trend is likely to continue throughout 2014. RPS believes there are a number of strong fundamentals which will underpin the strength of the Perth property sector over the short and medium term such as population growth and tight new dwelling supply. 16,000 14,000 $400,000 Sales Volume 12,000 10,000 $300,000 8,000 $200,000 6,000 4,000 $100,000 2,000 $0 0 Mar-03 Mar-04 Mar-05 Mar-06 Mar-07 Mar-08 Mar-09 Mar-10 Mar-11 Mar-12 Mar-13 Mar-14 Volume House Price Unit Price Source: Landgate, RPS Perth Vacant Land Sales Volume and Median $300,000 5,000 4,500 $250,000 4,000 3,500 $200,000 3,000 $150,000 2,500 2,000 $100,000 Sales Volume Low levels of established products on the market drove capital growth as well as an increased appetite for new dwellings. Strong demand led to an undersupply of land as vacant land stock halved over the last 18 months. Median Price A drop in mortgage costs has encouraged strong first home buyer and investor activity over the last 18 months. This has led to strong demand for properties in the sub-$600,000 category; especially properties located near established employment centres. 18,000 $500,000 Median Price The Perth housing market has continued to strengthen since its 2011 low and has been driven by reduced mortgage costs and strong population growth. Perth House and Unit Sales Volumes and Medians $600,000 1,500 1,000 $50,000 500 $0 0 Mar‐03 Mar‐04 Mar‐05 Mar‐06 Mar‐07 Mar‐08 Mar‐09 Mar‐10 Mar‐11 Mar‐12 Mar‐13 Mar‐14 Volume Median Source: Landgate, RPS Golden Bay House Sales Volumes and Medians Golden Bay Housing Market Trends Despite the slowing in sales volume since the stellar 2013 year, the median house price rose by 15.1% to $412,000 through the year to March 2014 after a marginal increase of less than 1% in 2013. The housing stock in the suburb is dominated by detached housing, with a very small market for units and terrace houses. The affordability of houses and the community amenity aspects of Golden Bay provide a desirable location for young families and first-home owners. Investors will be also attracted to the area with relatively strong rents and affordable house prices allowing for many of the suburb’s housing stock to be positively geared at current mortgage rates. 70 $500,000 $400,000 50 $300,000 40 30 $200,000 Sales Volume Median Price 60 20 $100,000 $0 10 Mar-04 Mar-05 Mar-06 Mar-07 Mar-08 Mar-09 Mar-10 Mar-11 Mar-12 Mar-13 Mar-14 Volume House Price 0 Volume Average (10 year) Source: Landgate, RPS House Sales by Price Range, Golden Bay 18 16 14 Number of Sales The Golden Bay housing market experienced a strong 92% lift in sales volumes over the year to March 2013, as sales activity rose across metropolitan Perth. Over the year to March 2014, sales volume decreased by 29.3% to 53 sales, however, are still above the 10-year average of 50 sales. 80 $600,000 12 10 8 6 4 2 0 Less than $250,000 $250,000 to $350,000 Source: Landgate, RPS $350,000 to $450,000 $450,000 to $550,000 $550,000 to $650,000 More than $650,000 PO Box 465, Subiaco Western Australia 6904 Report Golden Bay Investor W rpsgroup.com.au July 2014 Rental Vacancy Rate Rental Yields and Overall Returns The rental vacancy rate for an area provides a strong indication of the market balance for residential rental properties. Vacancy rates across Perth have increased recently as population growth eased and many existing renters entered the property ownership market. Leases advertised in Perth more than doubled over the last year and the vacancy rate has lifted above what RPS considers a balanced market.The Golden Bay rental market has experienced a recent decline in vacant listings and the vacancy rate is 1% below the Perth average, indicating future strength in the investor market. The chart below compares Golden Bay capital and rental returns and median value to other surrounding suburbs in the southwestern coastal area. Golden Bay has experienced strong capital growth which is reflective of affordability, low interest rates and strong population growth – capital growth was superior to all other surrounding suburbs. The rental yield in the area is also strong and on par with surrounding suburbs, at around the 5% mark. Median Price, Capital Gain and Rental Return, Year to Mar 2014 18% 5.0% $600,000 16% Oversupplied Market 2.0% Balanced Rental Market Undersupplied Market 1.0% Mar‐08 Total Annual Return Vacancy Rate 3.0% 0.0% $500,000 14% 4.0% $400,000 12% 10% $300,000 8% 6% $200,000 4% $100,000 2% 0% Dec‐08 Sep‐09 Jun‐10 Mar‐11 Golden Bay Dec‐11 Sep‐12 Jun‐13 Mar‐14 Perth Metro Source: SQM (2014), RPS Median House Price Residential Rental Vacancy Rates $0 Golden Bay Capital Gain Singleton Secret Harbour Rental Yield Port Kennedy Median Price Source: Residex (2014), Landgate, RPS RPS Golden Bay Suburb Outlook The Golden Bay region has strong fundamentals which will likely lead to increased demand to live in the area and continued demand for homes for rental and ownership. The region is ideally located between the commercial centres of Mandurah and Rockingham which are expected to see an increase in amenity and community vibrancy as the population of surrounding areas increase and many private projects and public infrastructure come into fruition in the short to medium term. High levels of affordability compared to surrounding suburbs and access to new primary and secondary schools and community amenities will rank highly amongst young families. Golden Bay possesses the underlying fundamentals for future growth in the homebuyers market, investors will also be attracted by the healthy rental yields and capital growth prospects. About Economics at RPS Contact RPS is an international consultancy providing world-class local solutions in energy and resources, infrastructure, environment and urban growth. Our Economics team is well positioned to undertake comprehensive analysis of a range of business, community and government issues and projects. Our key areas of expertise include: WA Head Office Level 2, 38 Station Street SUBIACO WA 6008 • • • • • Urban Economics Socio-Economics Economic Development Regulatory Economics Corporate Strategy and Advice p. +61 8 9211 1111 w. www.rpsgroup.com.au Tim Connoley Technical Director Disclaimer: This profile has been prepared by RPS Australia East Ltd. Nothing in this profile represents financial advice. Data and associated analysis is current as at 1 July 2014.