PP10551/09/2011(028936)

13 April 2011

MALAYSIA EQUITY

Investment Research

Daily

Strategy

Chris Eng

+60 (3) 9207 7677

chris.eng@my.oskgroup.com

Penang

The Research Team

+60 (3) 9207 7688

Research2@my.oskgroup.com

No More “Kiam Siap”

With Penang appearing to benefit from greater local and foreign investments, we

made a visit to my home state to see if the famed “kiam siap” stereotype of the

typical island Penangite has changed. Visits to IJM Land, E&O and Hunza would

seem to indicate that Penangites today have a greater propensity to spend, which

will benefit these companies, which are in the midst of developing high end

property projects and a retail mall. While E&O and IJM Land are currently Not

Rated, we have a Buy call on Hunza and note that our top property sector pick, SP

Setia, is also exposed to the burgeoning Penang property market.

No longer “kiam siap”? Penang was in the news recently with the state receiving

the most investments in 2010 among all Malaysian states worth some RM12.2bn.

The PM has also indicated plans to make the state the preferred hub in the region

with some 10 infrastructure projects including expansion of the airport and port as

well as the 2nd Penang bridge. So we decided to pay a short visit to the island state to

see if these investments are changing the psyche of Penangites, who have long

been stereotyped as “kiam siap” or stingy. Based on our visits to IJM Land, E&O and

Hunza Properties, we found that there indeed appears to have been a small shift in

the spending patterns of Penangites.

More willing to buy high end properties. While E&O mentioned that sales at their

Seri Tanjung Pinang development were 50% foreign, IJM Land mentioned that 95%

of sales at their Light development were to locals with the biggest group from

Penang. Both these developments are premium residential projects with recent

launches having prices above RM700psf. The willingness of Penanites to purchase

these projects would seem to indicate that the island’s “old money” is finding new

avenues for investment.

More willing to open wallets for high end shopping too. Hunza’s retail mall

located in the Gurney Paragon, with 700,000 sq ft of retail space, aiims to be the

premier mall in Penang offering brands that are not yet available on the island.

Management believes that shift in shopping pattern gives it the confidence to invest

in the upper class retail mall.

Benefiting from less “kiam siap” Penangites. While our visit was too short and

limited in scope to confirm if there was indeed a broad change in the psyche of

Penangites, we can confirm that there are pockets of the population more willing to

splurge on luxury items and therefore the following companies with exposure in the

higher end property development market will be amongst the beneficiaries.

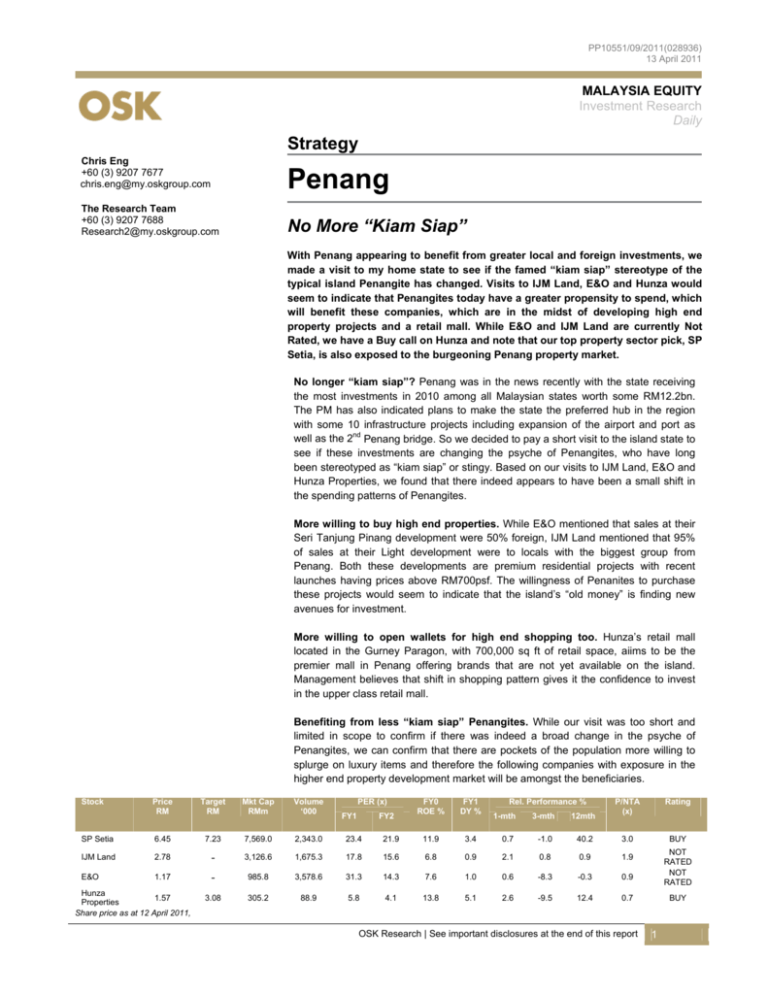

Stock

SP Setia

Price

RM

Target

RM

Mkt Cap

RMm

Volume

‘000

6.45

7.23

7,569.0

2,343.0

PER (x)

FY1

FY2

23.4

21.9

FY0

ROE %

FY1

DY %

11.9

3.4

Rel. Performance %

1-mth

3-mth

12mth

0.7

-1.0

40.2

P/NTA

(x)

3.0

IJM Land

2.78

-

3,126.6

1,675.3

17.8

15.6

6.8

0.9

2.1

0.8

0.9

1.9

E&O

1.17

-

985.8

3,578.6

31.3

14.3

7.6

1.0

0.6

-8.3

-0.3

0.9

3.08

305.2

88.9

5.8

4.1

13.8

5.1

2.6

-9.5

12.4

0.7

Hunza

1.57

Properties

Share price as at 12 April 2011,

OSK Research | See important disclosures at the end of this report

See important disclosures at the end of this publication

Rating

BUY

NOT

RATED

NOT

RATED

BUY

1

OSK Research

NO MORE “KIAM SIAP”?

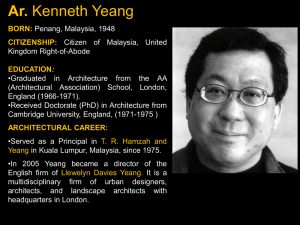

An evolution in Penang. “Kiam Siap” (pronounced kee-um see-yap) is a Hokkien word for stingy or tight

fisted. It has often been used to describe the residents of Penang island in the state of Pulau Pinang,

Malaysia. Given their largely immigrant background from China, India, Acheh and the Peninsular,

Penangites (residents of Penang) were generally stereotyped as being careful with their money, to the

extent of being stingy. With Penang being in the news recently with the state attracting the most investments

in 2010 to a tune of RM12.2bn and with the PM Datuk Seri Najib Tun Razak making Penang the preferred

hub in the region with 10 infrastructure projects such as the expansion of the airport, the port and the 2nd

Penang bridge, we felt that it was timely to see if all these investments have made a change to the psyche of

Penangites. For that we had a packed day trip to see:

Property developers E&O, IJM Land, Hunza Properties

Invest Penang / Penang Development Corporation (PDC)

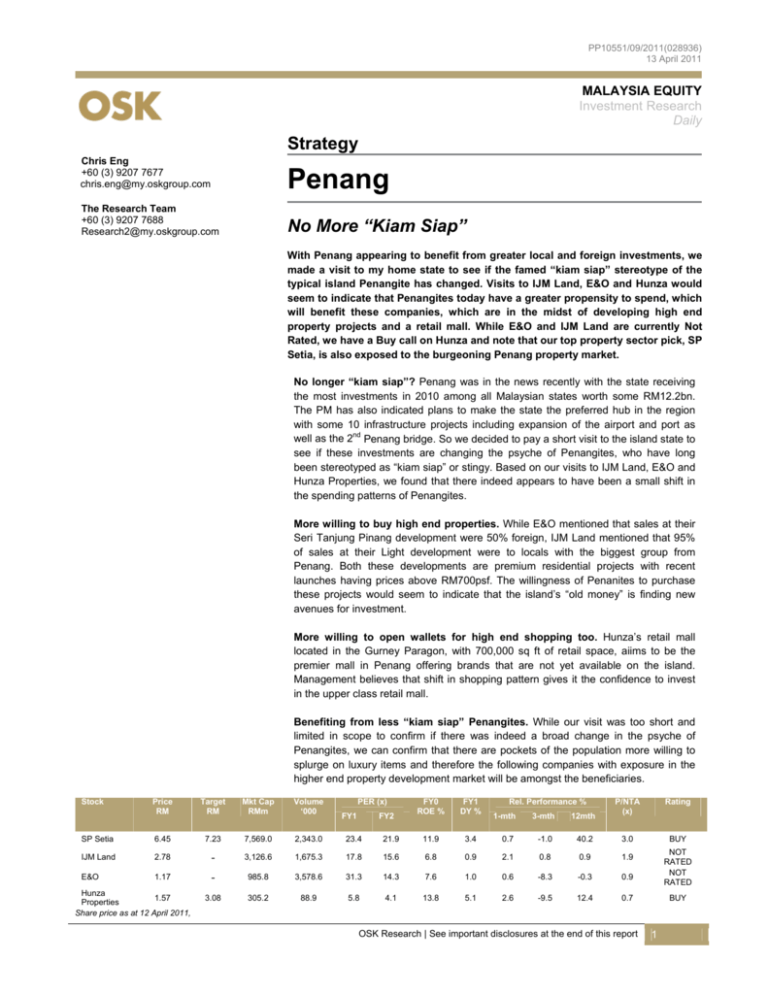

Figure 1: Penang attracting the most Investment in 2010 (RM)

14,000,000,000

12,000,000,000

10,000,000,000

8,000,000,000

6,000,000,000

4,000,000,000

2,000,000,000

0

Domestic Investment

Foreign Investment

Source: MIDA

Less “kiam siap” indicators. Speaking to the management of the property developers as well as the

representatives from PDC, we get the feeling that indeed there seems to have been an evolution of

Penangites’ psyche in that the tightfistedness would appear to have loosened somewhat. We base this view

on 3 developments:

Penangites are more willing to invest in high end landed properties

Penangites are more willing to shop in higher end retail outlets

Penangites will gradually include more residents from abroad

Penangites more willing to invest in high end landed properties. Our first stop was at IJM Land’s office

where we visited the sales gallery for their flagship project in Penang, the Light. Here, for the 152 acres

where the Gross Development Value (GDV) is an estimated RM6.5 – 6.8bn, IJM Land is reclaiming the land

needed to build an integrated waterfront living hub comprising residential, commercial and entertainment

components. The residential properties here comprise of high end condominiums as well as landed

properties. Since the launch of the Light, we understand that some 95% of purchases have been

Malaysians, a figure that also surprised IJM Land’s management. In fact for some of the launches,

management explained that potential buyers were willing to queue up to 4 days ahead of the launch in order

to secure units. With prices originally starting at RM320 per square foot (psf) for the first launch, prices have

since risen to touch over RM900 psf compared to an average of RM400-500 psf for Penang island. Even

when the company did not have an interest subsidy scheme, IJM Land noted that most of their buyers did

not have an issue with financing their purchases. As such, with Penangites comprising a large chunk of the

buyers of the Light, we can only conclude that the product, a premium products by any standard, is attractive

enough for buyers in Penang who certainly appear to have shrugged off any connotation of tight fistedness

in the buying of such properties. We understand that most of the launches are some 70 to 80% sold out with

those remaining mainly Bumiputera units.

OSK Research | See important disclosures at the end of this report

See important disclosures at the end of this publication

2

OSK Research

Figure 2: Location of The Light, Penang

Source: IJM Land

Figure 3: Masterplan of The Light, Penang

Source: IJM Land

Figure 5: View of the land being claimed for the Light

Source: OSK Research

OSK Research | See important disclosures at the end of this report

See important disclosures at the end of this publication

3

OSK Research

Figure 6: Scale model for the Light

Source: OSK Research

Penangites more willing to shop in higher end retail outlets. We next rushed over to meet the

management of Hunza Properties (Hunza) at Greenlane. There we were briefed on their flagship project the

Gurney Paragon which has a targeted 700,000 sq ft of retail space with departmental stores, supermarkets

and F&B outlets. Located close to Gurney Mall, it will have Tanjong Golden Village as its anchor Cineplex

and is still talking to premium departmental stores and supermarkets as other anchor tenants. Aside from the

retail mall, the Gurney Paragon will also have residential units and an office block. The target customers of

the Gurney Paragon are Penangites as well as local tourists who stay in Penang for 2 or more nights and

frequent the Gurney Drive area. They aim to bring in 30% of brands not yet in Penang but which are already

in existence in KL or Singapore. According to the Valiram Group which brought luxury brand Coach to First

Avenue in Penang, Penang is an underserved market with much potential for luxury brands. Hunza’s

management also highlighted that their positioning of the Paragon as a premium mall in Penang is due to

their view that younger Penangites will be more willing to pay for premium retail products and that

Penangites are not “kiam siap” but “looking for value”. Their view is that the Paragon will offer new forms of

value which will definitely be a hit with Penangites as well as other local Malaysian tourists. With the

Paragon being on schedule, they see Hunza gradually increasing its recurring revenue from retail operations

over the next few years.

Figure 7: Scale model view of the Gurney Paragon

Source: OSK Research

OSK Research | See important disclosures at the end of this report

See important disclosures at the end of this publication

4

OSK Research

Figure 8: Scale model view of the Gurney Paragon

Source: OSK Research

Penang residents will gradually include more foreigners. We then proceeded to E&O’s sales gallery for

Seri Tanjung Pinang, Penang Island’s largest seafront development. Consisting of up to 980 acres of

reclaimed land, thus far, Phase 1 of 240 acres has already been reclaimed and development is progressing

well with a GDV of RM3bn. Phase 2 to follow in the future has an estimated GDV of RM12bn. Seri Tanjung

Pinang is a comprehensive mixed development project consisting largely of high end landed and non-landed

residential properties with commercial and retail precints as well. It also includes residential parks, a marina

and the Penang Performing Arts Centre (PAC). The Seri Tanjung Pinang and its constituents appear to be

the epitome of luxury with its Quayside Seafront Resort Condominiums dubbed the “most complete luxury

seafront condominium in the region” featuring a resort themed water park for residents. Its terraces houses

set a new price benchmark of RM1.1m on average for Penang and its Martinique sea front villa fetched a

high of RM7m. Its Quayside condominiums touched a high of RM1200psf in terms of pricing. With such

levels of pricing, it was not surprising to hear that Seri Tanjung Pinang’s take up has been 50% local and

50% foreign unlike the Light which was 95% local. E&O has been aggressively marketing their project

overseas given its premium nature. While the fact that 50% of this project has been taken up by locals will

already indicate that Penangites and Malaysians are more willing to splurge, the continued attraction of

foreigners, especially those on the Malaysia My Second Home (MM2H) programme will mean that there

could be further growth in the Penang expat community. As such, this could further downplay th label of

Penangites being “kiam siap”.

Figure 9: Location of Seri Tanjong Pinang on the north east coast of Penang island

Source: E&O

OSK Research | See important disclosures at the end of this report

See important disclosures at the end of this publication

5

OSK Research

Figure 10: Eventual completed Seri Tanjung Pinang (artist rendition including Phase 2)

Source: E&O

Figure 11: Fittings that come with the Quayside condominiums

Source: OSK

THE WAY FORWARD

Plentiful wealth creation. We finished off our visit with a meeting at the PDC. There, the Chairman of

InvestPenang, Dato’ Lee Kah Choon explained the wealth effect in Penang. He highlighted the increase in

property prices in the town centre (from RM50-80,000 per shoplot prior to the repeal of the land act to

RM150,000 after the repeal to RM500,000 after the UNESCO heritage designation) as well as the increase

in flight connectivity to Penang (from 10 flights per week- Singapore to 11 flights per day), He alsopointed

out that Penang accounts for 2/3rds of medical tourism in Malaysia with its 7 private hospitals. With the

foreign investment and the many Multi National Corporations (MNCs) in Penang, we note that Penang

people were ‘making international money’.

Notable beneficiaries. Were we convinced that Penagnites were less “kiam siap”?. Given the brevity and

focused nature of our visit, we are unable to confirm if the wealth effect has indeed spread to the extent of

debunking the long-held stereotype. However, the projects that we visited certainly seemed to benefit or will

benefit from upcoming greater spending by locals, who are themselves reaping the benefits of rising

property prices and may well spend more on retail going forward. While not limited to the companies we

visited, undoubtedly the beneficiaries of the greater willingness to spend by Penangites will include IJM

Land, E&O and Hunza. The former 2 will continue to see good demand for their properties while the latter

will see its Gurney Paragon mall receive greater number of shoppers. We also take note that our Top Buy

call in the Property sector, SP Setia also has a property development on Penang which is perhaps catered

more to the mass market as opposed to the Light and Seri Tanjung Pinang although it too should benefit as

Penangites become more receptive to higher property prices.

OSK Research | See important disclosures at the end of this report

See important disclosures at the end of this publication

6

OSK Research

BENEFICIARIES OF LESS “KIAM SIAP” PENANGITES

Stock

SP Setia

Price

RM

Target

RM

Mkt Cap

RMm

Volume

‘000

6.45

7.23

7,569.0

2,343.0

PER (x)

FY1

FY2

23.4

21.9

FY0

ROE %

FY1

DY %

11.9

3.4

Rel. Performance %

1-mth

3-mth

12mth

0.7

-1.0

40.2

P/NTA

(x)

3.0

IJM Land

2.78

-

3,126.6

1,675.3

17.8

15.6

6.8

0.9

2.1

0.8

0.9

1.9

E&O

1.17

-

985.8

3,578.6

31.3

14.3

7.6

1.0

0.6

-8.3

-0.3

0.9

3.08

305.2

88.9

5.8

4.1

13.8

5.1

2.6

-9.5

12.4

0.7

Hunza

1.57

Properties

Share price as at 12 April 2011,

OSK Research | See important disclosures at the end of this report

See important disclosures at the end of this publication

Rating

BUY

NOT

RATED

NOT

RATED

BUY

7

OSK Research

OSK Research Guide to Investment Ratings

Buy: Share price may exceed 10% over the next 12 months

Trading Buy: Share price may exceed 15% over the next 3 months, however longer-term outlook remains uncertain

Neutral: Share price may fall within the range of +/- 10% over the next 12 months

Take Profit: Target price has been attained. Look to accumulate at lower levels

Sell: Share price may fall by more than 10% over the next 12 months

Not Rated: Stock is not within regular research coverage

All research is based on material compiled from data considered to be reliable at the time of writing. However, information and opinions expressed

will be subject to change at short notice, and no part of this report is to be construed as an offer or solicitation of an offer to transact any securities or

financial instruments whether referred to herein or otherwise. We do not accept any liability directly or indirectly that may arise from investment

decision-making based on this report. The company, its directors, officers, employees and/or connected persons may periodically hold an interest

and/or underwriting commitments in the securities mentioned.

Distribution in Singapore

This research report produced by OSK Research Sdn Bhd is distributed in Singapore only to “Institutional Investors”, “Expert Investors” or

“Accredited Investors” as defined in the Securities and Futures Act, CAP. 289 of Singapore. If you are not an “Institutional Investor”, “Expert Investor”

or “Accredited Investor”, this research report is not intended for you and you should disregard this research report in its entirety. In respect of any

matters arising from, or in connection with, this research report, you are to contact our Singapore Office, DMG & Partners Securities Pte Ltd

(“DMG”).

All Rights Reserved. No part of this publication may be used or re-produced without expressed permission from OSK Research.

Published and printed by :OSK RESEARCH SDN. BHD. (206591-V)

(A wholly-owned subsidiary of OSK Investment Bank Berhad)

Chris Eng

Kuala Lumpur

Malaysia Research Office

OSK Research Sdn. Bhd.

6th Floor, Plaza OSK

Jalan Ampang

50450 Kuala Lumpur

Malaysia

Tel : +(60) 3 9207 7688

Fax : +(60) 3 2175 3202

Hong Kong

Singapore

Hong Kong Office

OSK Securities

Hong Kong Ltd.

12th Floor,

World-Wide House

19 Des Voeux Road

Central, Hong Kong

Tel : +(852) 2525 1118

Fax : +(852) 2810 0908

Singapore Office

DMG & Partners

Securities Pte. Ltd.

20 Raffles Place

#22-01 Ocean Towers

Singapore 048620

Tel : +(65) 6533 1818

Fax : +(65) 6532 6211

Jakarta

Shanghai

Phnom Penh

PT OSK Nusadana

Securities Indonesia

Plaza CIMB Niaga,

14th Floor,

Jl. Jend. Sudirman Kav.25,

Jakarta Selatan 12920,

Indonesia.

Tel : (6221) 2598 6888

Fax : (6221) 2598 6777

Shanghai Office

OSK (China) Investment

Advisory Co. Ltd.

Room 6506, Plaza 66

No.1266, West Nan Jing Road

200040 Shanghai

China

Tel : +(8621) 6288 9611

Fax : +(8621) 6288 9633

OSK Indochina Securities Limited

No. 263, Ang Duong Street (St. 110),

Sangkat Wat Phnom, Khan Daun

Penh,

Phnom Penh, Cambodia.

Tel: (855) 2399 2833

Fax: (855) 2399 1822

OSK Research | See important disclosures at the end of this report

See important disclosures at the end of this publication

8