An Economic Impact Analysis Of A Proposed Dakota Prairie

advertisement

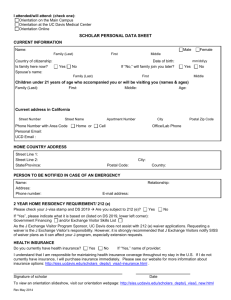

Proceedings of the South Dakota Academy of Science, Vol. 87 (2008) 279 AN ECONOMIC IMPACT ANALYSIS OF A PROPOSED DAKOTA PRAIRIE NATIONAL HERITAGE AREA Xiaobing Zhao The W. A. Franke College of Business Northern Arizona University Flagstaff, AZ 86011 Russell Stubbles Department of Horticulture, Forestry, Landscape and Parks South Dakota State University Brookings, SD 57007 ABSTRACT Although the United States National Park Service (USNPS 2008) has designated 37 National Heritage Areas, they are located mainly in the eastern U.S. Thus, the Dakota Prairie National Heritage Area (DPNHA) proposed for Brookings, Kingsbury, and Lake County in South Dakota has important significance for preserving Midwest culture and history. Although the cultural benefits of the DPNHA are evident, its economic benefits have not been examined and remain unclear. This study intends to fill this gap by investigating the economic impacts of the DPNHA. Money Generation Model version 1 (MGM1) developed by the USNPS (1990) was utilized to estimate sales benefits, tax benefits, and job benefits. Our results showed that the DPNHA could increase significantly the sales, taxes, and jobs in the three counties. Therefore, the DPNHA is also economically beneficial for the region. Keywords Money generation model, economic benefits, national heritage area INTRODUCTION According to the U.S. National Park Service (2008), a national heritage area (NHA) is a place where “natural, cultural, historic and recreational resources combine to form a cohesive, nationally-distinctive landscape arising from patterns of human activity shaped by geography”. Conservation and other activities in a NHA are managed by federal, state, and local governments and the private sector. Although the United States National Park Service (USNPS 2008) has designated 37 National Heritage Areas, they are located mainly in the eastern U.S. Thus, the Dakota Prairie National Heritage Area (DPNHA) proposed for Brook- 280 Proceedings of the South Dakota Academy of Science, Vol. 87 (2008) ings, Kingsbury, and Lake County in South Dakota has important significance for preserving Midwest culture and history. The theme for the DPNHA is the historical account of European settlement of the tall grass prairie. In addition to all existing historical and cultural attractions in this area, future features include the development of four new South Dakota historical prairie village parks, located between Brookings and DeSmet, along the corridor of Highway 14. The village parks will represent the time periods of the European settlement of 1880, 1890, 1900, and 1910. They could include restored farm buildings, antique farming equipment, artifacts, Wild West reenactments, pow-wows and theatrical performances depicting historical accounts, etc. Although the cultural benefits of the DPNHA are evident, its economic benefits have not been examined and remain unclear. This study intends to fill this gap by investigating the economic impacts of the DPNHA. Previous studies show that recreation and tourism activities arising from designated NHAs have significant impacts on regional economies. For instance, a number of economic impact studies have been done for Michigan’s Automobile National Heritage Area (Vander Stoep et al. 2004), Cane River National Heritage Area in Louisiana (Stynes and Sun 2004a), and Essex National Heritage Area in Massachusetts (Stynes and Sun 2004b). METHODS Economic impacts were measured as the changes in sales, tax, and jobs in the region resulting from spending by non-resident visitors, the federal government, and other parties. The economic estimates were produced using MGM1 as originally developed by Ken Hornback for USNPS (USNPS 1990). MGM1 generates quick and inexpensive estimates of the economic benefits of recreation visitor spending on local economies (Stynes 1997). Note that previous research also uses money generation model version 2 (MGM2) developed by Stynes and Propst (2008). It is an update of MGM1. Based on survey data, MGM2 provides more details on visitor spending categories. However, it is more costly and time-consuming (Stynes 1997). The MGM1 we use in our study provides the following (USNPS 1990): 1) visitor spending effects: the economic benefits to the local area resulting from expenditures by visitors who live outside the local area (i.e., non-local or non-resident tourists); 2) Federal Government spending effects: the economic benefits to the local area resulting from park-related Federal Government expenditure (for example, National Park Service expenditures for park supplies, services, construction projects, etc.); and 3) other spending effects: the economic benefits to the local area resulting from park-related expenditures by other non-local parties (for example, State expenditures for park access road; or capital expenditures to build a new marina). Proceedings of the South Dakota Academy of Science, Vol. 87 (2008) 281 To apply the MGM1, three types of economic benefits are considered (USNPS 1990): 1) sales benefits: consist of income to local area businesses or individuals for goods and services that these businesses or individuals provide as a result of expenditures by non-local visitors, Federal Government expenditures, and parkrelated expenditures by other non-local parties; 2) tax benefits: consist of local area sales tax and income tax revenues that result from expenditures by non-local visitors, Federal Government expenditures, and park-related expenditures by other non-local parties; and 3) job benefits: consist of jobs that are created in the local area as a result of expenditures by non-local visitors, Federal Government expenditures, and parkrelated expenditures by other non-local parties. RESULTS Our estimation results depend on our assumptions of the parameters in the model. We first present the base case in which we use the parameters that are commonly used in the literature (USNPS 1990). We then use Cases 1 to 5 to discuss the results when we allow the parameters to change within plausible ranges. Base Case Visitor Spending Effects To estimate the potential increase in sales induced by the DPNHA designation, we first use a deterministic trend model to project the visitor spending without the designation based on the historical data from Madden (2006), then we use the multiple 15% to estimate the induced sales. The use of the 15% multiple is based on evidence from existing National Heritage Areas (NHAs) such as Yuma Crossing NHA in Arizona and the Quinebaug & Shetucket Rivers NHA in Connecticut which suggest that the NHA designation can generally increase visitor revenues by about 15% per year (Dakota Prairie Heritage Area 2008). Specifically, we first estimate the following deterministic trend model with annual data from 1998 to 2005, Spendingt = a + b × t + et where Spendingt is the visitor spending in year t, a is the slope, b is the slope coefficient, et is the random disturbance term, and t = 1998, 1999, …, 2005. The historical data of visitor spending for the relevant three counties as well as the estimated trend line over 1998 to 2005 are shown in Figure 1. R2 is nearly 0.70, which suggests that our model is reliable enough for forecasting purposes. Based on the trend model, we project the visitor spending without the designation for years from 2010 to 2019. That is, the projected visitor spending in ^ ^ year τ without the designation is equal to a^ + b x τ, where a^ and b are the Ordinary Least Squares (OLS) estimates of a and b, and τ=2010, 2011,…, 2019. Then we 282 Proceedings of the South Dakota Academy of Science, Vol. 87 (2008) Visitor Spending 25,000,000 20,000,000 15,000,000 10,000,000 5,000,000 0 1998 1999 2000 2001 2002 2003 2004 2005 2 Year R = 0.6906 Figure 1. Visitor Spending, 1998-2005. multiply it by 0.15 to compute the direct increase in sales induced by the designation. In other words, the direct increase in sales induced by the designation is ^ equal to a^ + b x τ. Next we use a multiplier of two to compute the total increase in sales. Two is the average value for the multiplier used by many researchers (USNPS 1990). Therefore, the total increase in sales is equal to 2(1 + 0.15) ^ (a^ + b x τ) After that, we compute the increases in sales tax, income tax, and the total tax by using the sales tax rate of 4% (Madden 2006) and the income tax rate of 0%. Finally, we estimate the increase in jobs by assuming that every one million dollars can create 30 jobs, which is commonly used in literature (USNPS 1990). Table 1. Visitor Spending Benefits, 2010-2019. Year Visitor Spending without the Designation Direct Increase in Sales Total Increase in Sales Increase in Sales Tax Increase in Income Tax Total Increase in Tax Increase in Jobs 2010 20,104,538 3,015,681 6,031,361 241,254 0 241,254 181 2011 20,898,315 3,134,747 6,269,494 250,780 0 250,780 188 2012 21,692,092 3,253,814 6,507,627 260,305 0 260,305 195 2013 22,485,869 3,372,880 6,745,761 269,830 0 269,830 202 2014 23,279,646 3,491,947 6,983,894 279,356 0 279,356 210 2015 24,073,423 3,611,013 7,222,027 288,881 0 288,881 217 2016 24,867,199 3,730,080 7,460,160 298,406 0 298,406 224 2017 25,660,976 3,849,146 7,698,293 307,932 0 307,932 231 2018 26,454,753 3,968,213 7,936,426 317,457 0 317,457 238 2019 27,248,530 4,087,280 8,174,559 326,982 0 326,982 245 The results are shown in Table 1. The DPNHA is projected to increase the sales in the three counties by $6,031,361 in 2010 and $8,174,559 in 2019. It is Proceedings of the South Dakota Academy of Science, Vol. 87 (2008) 283 also projected to increase the tax by $241,254 in 2010 and $326,982 in 2019. It would also create 181 new jobs in 2010 and 245 in 2019. Federal Government Spending Effects We assume the federal government would invest $1 million per year from 2010 to 2019. Using the same parameters as in the last step, we project the increases in sales, tax, and jobs induced by the spending. The results are reported in Table 2. The DPNHA is projected to increase the sales in the three counties by $2 millions every year from 2010 to 2019. It is also projected to increase the tax by $80,000 per year from 2010 to 2019, and create 60 new jobs. Table 2. Federal Government Spending Effects, 2010 – 2019. Year Direct Total Increase Total Increase in Increase in Increase in in Income Increase in Increase in Sales Sales Sales Tax Tax Jobs Tax 2010 1,000,000 2,000,000 80,000 0 80,000 60 2011 1,000,000 2,000,000 80,000 0 80,000 60 2012 1,000,000 2,000,000 80,000 0 80,000 60 2013 1,000,000 2,000,000 80,000 0 80,000 60 2014 1,000,000 2,000,000 80,000 0 80,000 60 2015 1,000,000 2,000,000 80,000 0 80,000 60 2016 1,000,000 2,000,000 80,000 0 80,000 60 2017 1,000,000 2,000,000 80,000 0 80,000 60 2018 1,000,000 2,000,000 80,000 0 80,000 60 2019 1,000,000 2,000,000 80,000 0 80,000 60 Other Spending Effects We assume that the state government and other parties will not increase their spending for the DPNHA from 2010 to 2019. Using the same parameters, we can estimate the direct increase in sales, total increase in sales, increase in sales tax, increase in income tax, total increase in tax, and increase in jobs in each year from 2010 to 2019. They are all equal to zero. Combined Effects Combined visitor spending effects, federal government spending effects, and other spending effects are shown in Table 3. The DPNHA is projected to increase the sales in the three counties by $8.7 million in 2010 and about $11 million in 2019. It is also projected to increase the tax by $349,830 in 2010 and $435,558 in 2019. It would also create 262 new jobs in 2010 and 327 in 2019. 284 Proceedings of the South Dakota Academy of Science, Vol. 87 (2008) Table 3. Combined Effects of Visitor and Federal Government Spending, 2010 – 2019. Year Total Increase in Sales Increase in Sales Tax Increase in Income Tax Total Increase in Tax Increase in Jobs 2010 8,745,761 349,830 0 349,830 262 2011 8,983,894 359,356 0 359,356 270 2012 9,222,027 368,881 0 368,881 277 2013 9,460,160 378,406 0 378,406 284 2014 9,698,293 387,932 0 387,932 291 2015 9,936,426 397,457 0 397,457 298 2016 10,174,559 406,982 0 406,982 305 2017 10,412,692 416,508 0 416,508 312 2018 10,650,825 426,033 0 426,033 320 2019 10,888,958 435,558 0 435,558 327 Case 1 In the base case, we assume that visitor spending will increase by 15% per year. Although it is observed in some NHAs, there is no guarantee that this would also be precise for the proposed DPNHA. We therefore considered two alternative values: 10% and 20%. The results are presented in Tables 4 and 5. Table 4. Combined Effects of Visitor and Federal Government Spending: Visitor Spending Growth = 10%. Year Total Increase in Sales Increase in Sales Tax Increase in Income Tax Total Increase in Tax Increase in Jobs 2010 6,497,174 259,887 0 259,887 195 2011 6,655,929 266,237 0 266,237 200 2012 6,814,685 272,587 0 272,587 204 2013 6,973,440 278,938 0 278,938 209 2014 7,132,195 285,288 0 285,288 214 2015 7,290,951 291,638 0 291,638 219 2016 7,449,706 297,988 0 297,988 223 2017 7,608,461 304,338 0 304,338 228 2018 7,767,217 310,689 0 310,689 233 2019 7,925,972 317,039 0 317,039 238 Proceedings of the South Dakota Academy of Science, Vol. 87 (2008) 285 Table 5. Combined Effects of Visitor and Federal Government Spending: Visitor Spending Growth = 20%. Year Total Increase in Sales Increase in Sales Tax Increase in Income Tax Total Increase in Tax Increase in Jobs 2010 10,994,347 439,774 0 439,774 330 2011 11,311,858 452,474 0 452,474 339 2012 11,629,369 465,175 0 465,175 349 2013 11,946,880 477,875 0 477,875 358 2014 12,264,391 490,576 0 490,576 368 2015 12,581,901 503,276 0 503,276 377 2016 12,899,412 515,976 0 515,976 387 2017 13,216,923 528,677 0 528,677 397 2018 13,534,434 541,377 0 541,377 406 2019 13,851,945 554,078 0 554,078 416 With 10% annual visitor spending growth, the DPNHA is projected to increase sales in the three counties by about $6.5 million in 2010 and $7.9 million in 2019. It is projected to increase the tax by $259,887 in 2010 and $317,039 in 2019. It would create 195 new jobs in 2010 and 238 in 2019. With 20% annual visitor spending growth, the DPNHA is projected to increase sales in the three counties by about $11.0 million in 2010 and $13.9 million in 2019. It is projected to increase the tax by $439,774 in 2010 and $554,078 in 2019. It would create 330 new jobs in 2010 and 416 in 2019. Case 2 In the base case, we assume that the spending multiplier is two. Although it is commonly used by researchers, there is also no guarantee that this would be appropriate for the proposed DPNHA. We therefore consider two alternative values for this multiplier: 1.2 and 2.8. 286 Proceedings of the South Dakota Academy of Science, Vol. 87 (2008) Table 6. Combined Effects of Visitor and Federal Government Spending: Spending Multiplier = 1.2. Year Total ncrease in Sales Increase in Sales Tax Increase in Income Tax Total Increase in Tax Increase in Jobs 2010 5,247,456 209,898 0 209,898 157 2011 5,390,336 215,613 0 215,613 162 2012 5,533,216 221,329 0 221,329 166 2013 5,676,096 227,044 0 227,044 170 2014 5,818,976 232,759 0 232,759 175 2015 5,961,856 238,474 0 238,474 179 2016 6,104,735 244,189 0 244,189 183 2017 6,247,615 249,905 0 249,905 187 2018 6,390,495 255,620 0 255,620 192 2019 6,533,375 261,335 0 261,335 196 Table 7. Combined Effects of Visitor and Federal Government Spending: Spending Multiplier = 2.8. Year Total Increase in Sales Increase in Sales Tax Increase in Income Tax Total Increase in Tax Increase in Jobs 2010 12,244,065 489,763 0 489,763 367 2011 12,577,451 503,098 0 503,098 377 2012 12,910,837 516,433 0 516,433 387 2013 13,244,224 529,769 0 529,769 397 2014 13,577,610 543,104 0 543,104 407 2015 13,910,996 556,440 0 556,440 417 2016 14,244,383 569,775 0 569,775 427 2017 14,577,769 583,111 0 583,111 437 2018 14,911,155 596,446 0 596,446 447 2019 15,244,542 609,782 0 609,782 457 The results are presented in Tables 6 and 7. When the spending multiplier is 1.2, the DPNHA is projected to increase the sales in the three counties by about $5.2 million in 2010 and $6.5 million in 2019. It is projected to increase the tax by $209,898 in 2010 and $261,335 in 2019. It would create 157 new jobs in 2010 and 196 in 2019. When the spending multiplier increases to 2.8, the DPNHA is projected to increase sales in the three counties by about $12.2 million in 2010 and $13.6 million in 2019. It is projected to increase the tax by Proceedings of the South Dakota Academy of Science, Vol. 87 (2008) 287 $489,763 in 2010 and $609,782 in 2019. It would create 367 new jobs in 2010 and 457 in 2019. Case 3 In the base case, we assume that one million dollars can create 30 jobs. In Case 3, we consider two alternative values for this parameter: 20 and 40. The results are presented in Tables 8 and 9. Table 8. Combined Effects of Visitor and Federal Government Spending: One Million Dollars Create 20 Jobs. Year Total Increase in Sales Increase in Sales Tax Increase in Income Tax Total Increase in Tax Increase in Jobs 2010 8,745,761 349,830 0 349,830 175 2011 8,983,894 359,356 0 359,356 180 2012 9,222,027 368,881 0 368,881 184 2013 9,460,160 378,406 0 378,406 189 2014 9,698,293 387,932 0 387,932 194 2015 9,936,426 397,457 0 397,457 199 2016 10,174,559 406,982 0 406,982 203 2017 10,412,692 416,508 0 416,508 208 2018 10,650,825 426,033 0 426,033 213 2019 10,888,958 435,558 0 435,558 218 Table 9. Combined Effects of Visitor and Federal Government Spending: One Million Dollars Create 40 Jobs. Year Total Increase in Sales Increase in Sales Tax Increase in Income Tax Total Increase in Tax Increase in Jobs 2010 8,745,761 349,830 0 349,830 350 2011 8,983,894 359,356 0 359,356 359 2012 9,222,027 368,881 0 368,881 369 2013 9,460,160 378,406 0 378,406 378 2014 9,698,293 387,932 0 387,932 388 2015 9,936,426 397,457 0 397,457 397 2016 10,174,559 406,982 0 406,982 407 2017 10,412,692 416,508 0 416,508 417 2018 10,650,825 426,033 0 426,033 426 2019 10,888,958 435,558 0 435,558 436 288 Proceedings of the South Dakota Academy of Science, Vol. 87 (2008) If one million dollars create 20 jobs, the DPNHA would create only 175 new jobs in 2010 and 218 in 2019; if one million dollars create 40 jobs, the DPNHA would create 350 new jobs in 2010 and 436 in 2019. Increases in sales and increases in tax in 2010-2019 shown in Table 8 and 9 are the same as the results in the base case. In Cases 1 to 3, only one parameter is allowed to deviate from its base-case value. To gain more insights, we next examine the economic impacts of the DPNHA when all the parameters can deviate from their base-case values. To save space, we report only the results with the most conservative parameters (the worst case) and the least conservative parameters (the best case). Case 4: the Worst Case In the worst case, as shown in Table 10, the DPNHA still could increase sales in the three counties by about $4.0 million in 2010 and $4.8 million in 2019. It is projected to increase the tax by $155, 932 in 2010 and $190, 223 in 2019. It would create 78 new jobs in 2010 and 95 in 2019. Table 10. Combined Effects of Visitor and Federal Government Spending: Visitor Spending Growth = 10%, Spending Multiplier = 1.2, and One Million Dollars Create 20 Jobs. Year Total Increase in Sales Increase in Sales Tax Increase in Income Tax Total Increase in Tax Increase in Jobs 2010 3,898,304 155,932 0 155,932 78 2011 3,993,557 159,742 0 159,742 80 2012 4,088,811 163,552 0 163,552 82 2013 4,184,064 167,363 0 167,363 84 2014 4,279,317 171,173 0 171,173 86 2015 4,374,570 174,983 0 174,983 87 2016 4,469,824 178,793 0 178,793 89 2017 4,565,077 182,603 0 182,603 91 2018 4,660,330 186,413 0 186,413 93 2019 4,755,583 190,223 0 190,223 95 Case 5: the Best Case In the best case, as shown in Table 11, the DPNHA would increase sales in the three counties by about $15.9 million in 2010 and $19.4 million in 2019. It is projected to increase the tax by $615,683 in 2010 and $775,709in 2019. It would create 616 new jobs in 2010 and 776 in 2019! Proceedings of the South Dakota Academy of Science, Vol. 87 (2008) 289 Table 11. Combined Effects of Visitor and Federal Government Spending: Visitor Spending Growth = 20%, Spending Multiplier = 2.8, and One Million Dollars Create 40 Jobs Year Total Increase in Sales Increase in Sales Tax Increase in Income Tax Total Increase in Tax Increase in Jobs 2010 15,392,086 615,683 0 615,683 616 2011 15,836,601 633,464 0 633,464 633 2012 16,281,117 651,245 0 651,245 651 2013 16,725,632 669,025 0 669,025 669 2014 17,170,147 686,806 0 686,806 687 2015 17,614,662 704,586 0 704,586 705 2016 18,059,177 722,367 0 722,367 722 2017 18,503,692 740,148 0 740,148 740 2018 18,948,207 757,928 0 757,928 758 2019 19,392,722 775,709 0 775,709 776 DISCUSSION As a simple money generation model, the MGM1 developed by the USNPS (1990) captures the essential elements of an economic impact analysis. With sound judgment in choosing the parameters, the model can yield reasonable ballpark estimates of economic impacts at minimum cost. This approach, however, provides little details on spending categories or which sectors of the economy benefit from either direct or indirect and induced effects. The aggregate nature of the approach also makes it difficult to adjust recommended spending rates or multipliers to different applications (Stynes 1997). Nevertheless, it is emphasized that the MGM1 is intended to provide a fast and virtually zero cost estimate of the economic consequences of a park on the economy of the surrounding local area. Based on MGM1, visitor spending effects, Federal Government spending effects, and other spending effects were estimated. Within each type of effects, three categories of economic benefits were considered: sales benefits, tax benefits, and job benefits. The results from the base case showed that the DPNHA was projected to increase the sales in the three counties by $8.7 million in 2010 and about $11 million in 2019. It was also projected to increase the tax by $349,830 in 2010 and $435,558 in 2019. It would create 262 new jobs in 2010 and 327 in 2019. Although a number of assumptions were made about taxable income ratio, indirect and induced sales multiplier, and multiplier for jobs created per million dollars of total sales in order to simplify the economic benefit calculations in the base case, the robustness study in Cases 1 to 5 suggested that the DPNHA was economically beneficial for the region within the plausible ranges of the parameters. 290 Proceedings of the South Dakota Academy of Science, Vol. 87 (2008) We note that the money generation model is driven by visitor and park expenditure data; it does not consider economic benefits such as enhanced real estate values, improved recreational and cultural opportunities for local residents, improved community services, etc., that derive from the park. We intend to incorporate such analysis in future research. LITERATURE CITED Dakota Prairie Heritage Area. 2008. Frequently Asked Questions. http://dakotaprairienha.com/index_files/Page665.htm retrieved on July 15, 2008. Madden, M. K. 2006. Economic and Fiscal Impacts Associated with the Vacation Travel Industry in South Dakota: November 2004 through October 2005. The South Dakota Office of Tourism. 23 pp. Stynes, D. 1997. Economic impacts of tourism. Urbana, IL: University of Illinois, Cooperative Extension Service bulletin. 19 pp. Stynes, D., and D. Propst. 2008. Money Generation Model—Version 2. http:// web4.canr.msu.edu/mgm2/ retrieved on July 15, 2008. Stynes, D., and Y. Sun. 2004a. Cane River National Heritage Area: Visitor Characteristics and Economic Impacts. Department of Community, Agriculture, Recreation and Resource Studies, Michigan State University, East Lansing, MI. http://web4.canr.msu.edu/mgm2/ retrieved on August 1, 2004. Stynes, D., and Y. Sun. 2004b. Essex National Heritage Area; Visitor Characteristics and Economic Impacts. Department of Community, Agriculture, Recreation and Resource Studies, Michigan State University, East Lansing, MI. http://web4.canr.msu.edu/mgm2/ retrieved on August 1, 2004. USNPS (United States National Park Service). 1990. The Money Generation Model. Denver: Office of Social Science, Socio-Economic Studies Division. 25pp. USNPS (United States National Park Service). 2008. What is a National Heritage Area? http://www.nps.gov/history/heritageareas/FAQ/INDEX.HTM retrieved on June 5, 2008. Vander Stoep, G. A., D. J. Stynes and Y. Sun. 2004. Visitor Awareness and Economic Impacts of Motor Cities Hub Sites: Providing a Baseline for Michigan’s Automobile National Heritage Area. Department of Community, Agriculture, Recreation and Resource Studies, Michigan State University, East Lansing, MI. http://web4.canr.msu.edu/mgm2/ retrieved on August 1, 2004.