Mergers & Acquisitions in India

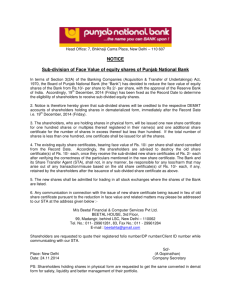

advertisement